Table Of Content

How Bank Of America Monthly Maintenance Work?

Bank Of America's monthly service fee (also known as the maintenance fee) is the monthly amount that banks charge their clients for having a checking or savings account. The monthly service fee is usually tied to a specific account or, with some banks, the account package.

Many banks charge maintenance fees on checking accounts. In most cases, you get a checking account, debit card, and access to online and mobile banking applications. In return, you have to pay a service fee.

In this case, you do not have to make any payment. Instead, the bank will deduct the fee from your checking account by the end of the statement period.

Besides checking accounts, Bank Of America charges maintenance fees on savings accounts. However, the fees on savings accounts are considerably smaller than with checking accounts.

Finally, it is worth pointing out that most banks, including Bank Of America, offer to waive those monthly service fees from checking and savings accounts if their clients can meet specific requirements, something we will discuss in more detail below.

Bank of America Checking Account Monthly Fees

Like most major banks in the nation, Bank of America also charges monthly service fees on checking and savings accounts.

BofA Checking Account | Monthly Fee | Average Day Balance To Waive |

|---|---|---|

Safe Balance | $4.95 | $500 |

Advantage Plus | $12 | $1,500 |

Advantage Relationship

| $25 | $20,000 |

Bank of America offers its clients three types of personal accounts:

- Safe Balance – This represents the most basic checking account. The monthly fee here is $4.95. Students under 25 are exempted from paying the fee. You can pay bills and make payments; however, you cannot write checks with this account. To open the account, you need to make an opening deposit of $25 or more. You get a debit card and no fees if you withdraw your money using Bank of America ATMs. You can also access Bank of America’s online and mobile banking applications.

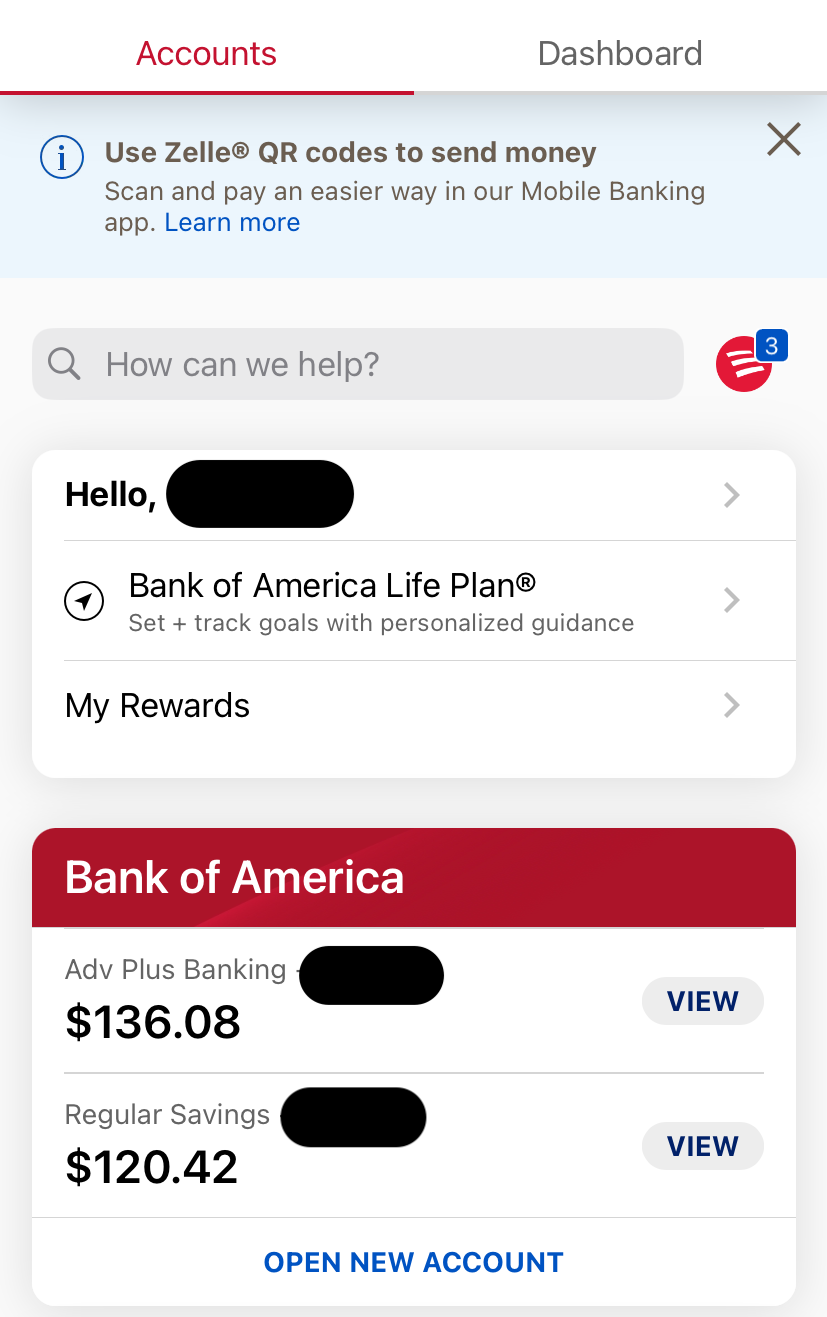

- Advantage Plus – With this account, you can write checks, pay bills, and make payments. The monthly fee here is higher, at $12. Here also, you get a debit card and do not have to pay any fees for withdrawing money from Bank of America ATMs. As with the previous account, you can also use online and mobile banking applications. To open this account, you must come up with $100 or more in opening deposit.

- Advantage Relationship – This is the most expensive checking account available, with a monthly service fee of $25. In return, you get all of the benefits mentioned with previous accounts; plus, if you choose this account, there will be no additional monthly fees with a savings account. Here you can earn some interest on your balance, but the rate is just 0.01%.

How's Bank of America Savings Account Fees?

Bank Of America Savings Account | Monthly Fee |

|---|---|

Advantage Savings Account | $8 |

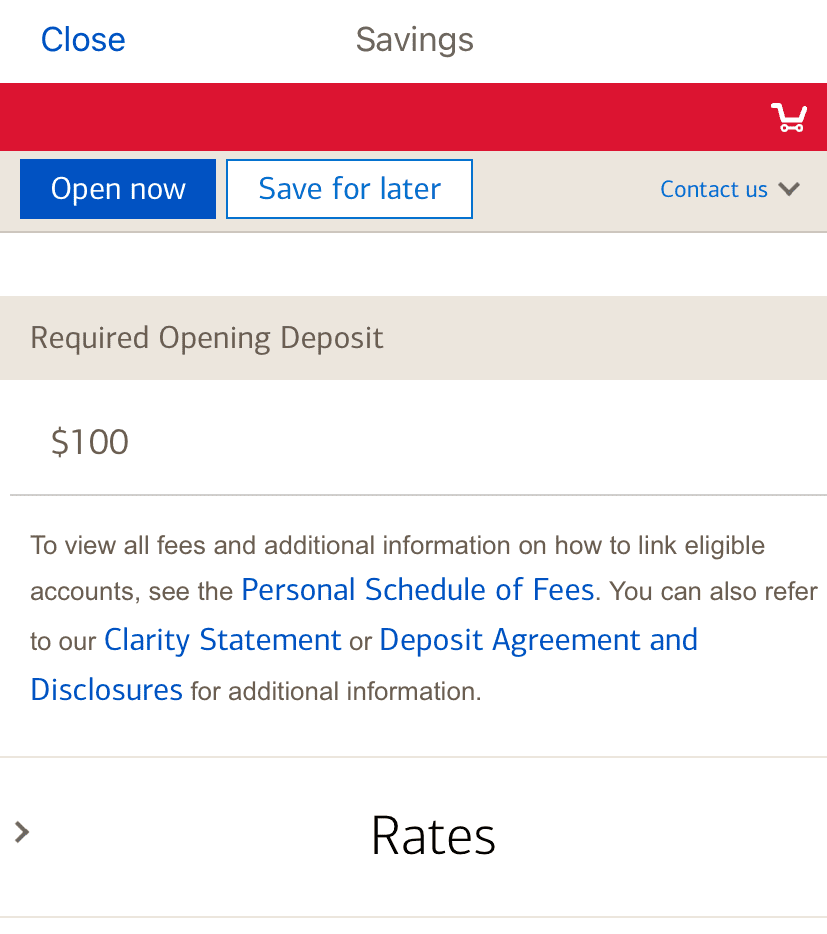

As things now stand, the Bank of America only offers one instant access savings account – Advantage Savings Account. In order to open this account, you have to come up with an initial deposit of $100 or more.

The account allows customers to withdraw funds up to 6 times a month without charging additional fees. However, you have to pay a $10 fee each time you exceed this limit and make more than six monthly withdrawals.

The monthly maintenance fee for the Advantage Savings Account is $8. However, the Bank of America’s website explains that this fee will not apply for six months after opening the account.

So, for example, if you open your saving account on April 15th, you do not have to pay any monthly service fees until October 15th. From that point onwards, the $8 fee will be deducted from your savings accounts unless you meet one of the requirements for waiving fees, something we will discuss below in greater detail.

However, as of April 2024, the interest rate is quite low compared to the best savings account interest rate.

How Are BOA Monthly Fees Compared to Other Banks?

Generally speaking, fees at Bank of America are mostly in line with fees charged by other major US banks, and even a bit higher than most of them. However, one thing to note here is that despite the latest reduction, the Bank of America still retains the overdraft fee, which some banks have already removed.

As for requirements for waiving fees, the conditions with Advantage Plus checking account are very similar to other major banks and offer clients an affordable way to get rid of those charges.

Bank/institution | Monthly Fee | |

|---|---|---|

| Bank of America Advantage Plus Checking | $12

can be waived by maintaining an account balance of $1,500, qualifying deposit of $250+ per month or enrol in Preferred Rewards

|

| Chase Total Checking® | $12

Can be waived if you maintain a $1,000 minimum daily balance, making direct deposits or Associated SnapDeposits of $500 or more per statement cycle, or holding $2,500 in combined deposit accounts with the same statement cycle date or having a Health Savings Account or investment account

|

| Citi Checking Account | $12

Can be waived if you make one qualifying direct deposit and one qualifying bill payment per statement period, maintain a combined balance of $1,500 per month across your eligible accounts or if you’re aged 62

|

| PNC Standard Checking | $7 – $25 per month

can be waived if you maintain $500+/$2,000/$5,000 direct deposit per month, $500+/$2,000/$5,000 monthly balance in savings or age 62+/$10,000 in all PNC consumer deposit accounts/$25,000 in all PNC consumer deposit accounts/

|

| U.S. Bank Checking | $6.95

Can be waived by maintaining an average account balance of $1,500, have $1,000+ in direct deposits per month or be aged 65+

|

| Wells Fargo Everyday Checking | $10

Related to Wells Fargo Everyday Checking. The fee can be waived if you maintain a minimum daily balance of $500 or receive at least $500 in qualifying direct deposits per month. The fee is also waived if you’re 17 to 24 and have a linked Wells Fargo Campus Debit Card or Campus ATM card linked to the checking account

|

When it comes to traditional banks, Bank of America's fees is higher than most banks. If you compare Bank Of America account fees to Chase, we can see they both charge the same fee. Also when comparing Bank of America with Wells Fargo, we can see the differences are minor – and they both offer multiple ways to waive it.

How to Avoid Bank of America Checking Account Fees?

One advantage of having the accounts mentioned above is waiving the monthly service fee. However, in each case, you have to meet one of the requirements:

Account | Minimum Balance To Waive Fees |

|---|---|

Safe Balance | $20,000 (all accounts including deposits) |

Advantage Plus | $1,500 on checking OR $20,000 (all accounts including deposits) |

Advantage Relationship

| $10,000 on checking OR $20,000 (all accounts including deposits) |

- SafeBalance – Here, you do not have to worry about service fees if you are under 18 or a student under 25. If this is not the case, you can still avoid maintenance fees if enrolled in the Preferred Rewards program. The program has several tiers, but the lowest Golden tier requires maintaining at least a $20,000 3-month combined balance across checking, savings, money market, and retirement accounts. The combined balance also includes CDs. So if you have joined this program, you no longer have to pay a $4.95 monthly fee.

- Advantage Plus – There are two ways for the bank to waive the $12 monthly service fee associated with this account. The first way is to enroll in the Preferred rewards program, as in the previous case, which will require maintaining at least a $20,000 combined balance for three months. The second way the bank will waive this fee is for you to make one qualifying deposit of $250 or maintain a minimum balance of $1,500 on this account.

- Advantage Relationship –The bank will waive a monthly fee if you maintain a combined balance of $10,000, including CDs, checking, savings, and retirement accounts. Like in previous cases, you can avoid paying fees if you have joined the Preferred Rewards program.

Here it is also worth noting that the Preferred Rewards program has several benefits besides waiving monthly fees. This includes a 25% bonus on credit card rewards, slightly higher interest rates on savings products and some discounts on home equity and auto loan interest rates.

Despite those upsides of the Preferred Rewards program, it is fair to say that maintaining a $1,500 balance on a checking account is considerably more accessible than coming up with $20,000.

How to Avoid Bank of America Savings Account Fees?

Bank of America offers five different ways to waive a savings account's fees is the complete list of those:

Bank Of America Savings Account | Minimum Daily Balance To Waive Fees |

|---|---|

Advantage Savings Account | $500 |

- Maintain minimum balance – Maintaining a minimum balance of $500 or more in the savings account during each statement period.

- Link to Advantage Relationship Account – If you own Advantage Relationship Account, you can link it to the savings account. In this case, you do not have to pay monthly service fees.

- Being a Preferred Rewards client – This is the same program; as explained above, you need to maintain $20,000 or more in combined balance for at least three months.

- Being under 18 – Underage clients do not pay any service fees, regardless of their status.

- Being a student and under 25 – If you are a student under 25, you do not have to pay any service fees.

How to Avoid Bank of America Overdraft Fees?

Before May 2022, the standard overdraft fee with Bank of America was $35. However, in May, the bank decided to reduce this fee to $10.

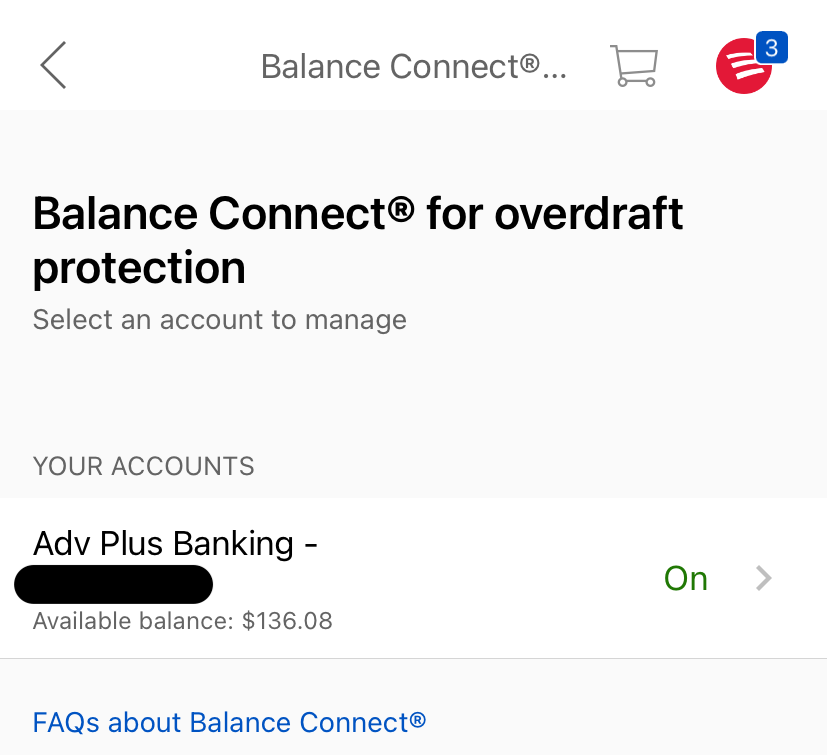

It is also worth mentioning that Bank of America balance connects for overdraft protection. This allows clients to link up to 5 other Bank of America accounts to their checking account. So if an individual makes a purchase or cash withdrawal that moves the balance into negative territory, then the balance will be automatically transferred from other accounts to avoid overdraft fees.

For example, suppose you have a $35 balance left in your checking account. You have a debit card which is linked to that account. You then made a $50 purchase in a shop.

So under normal circumstances, the transaction will be approved, but your balance will become -$15.00. As a result, you will be charged a $10 overdraft fee. So in total, you have to pay $25.

However, that $15 deficit will be filled with the balance connect function. For example, if you have $300 in your savings account, then $15 will be moved from your savings account to the checking account. As a result, $285 will remain in the savings account, while the balance in the checking account will be $0. So, in this case, it's good to know how overdraft fee work to avoid any overdraft fees.

How to Avoid Bank of America ATM Fees?

One of the main benefits of those three checking accounts that Bank of America offers to its clients is that, in all three cases, you do not have to pay any fees when withdrawing money from Bank of America ATMs.

On the other hand, if you withdraw money from a non-Bank of America ATM, you will be charged a $5 fee for each transaction. Here it is important to understand that this is the fee that Bank of America charges, not the owner of the ATM.

So, in this case, you will be charged additional fees by the bank, whose ATM, you have used to withdraw money. So the total amount of fee per transaction, in this case, will undoubtedly be higher than $5, but the exact amount will depend on the bank in question.

Some accounts at several banks, such as Citibank, do offer to refund ATM fees, even if a client uses another bank’s ATM. However, this benefit is not provided by Bank of America.

So the best way to avoid fees, in this case, is to only withdraw money from the ATMs that belong to Bank of America.

How is Bank of America's Monthly Fees Compared to Online Banks?

If you do not necessarily want to deal with brick-and-mortar banks and just want to avoid monthly service fees, then it has to be mentioned that many online banks offer better terms than Bank of America.

To avoid monthly fees with Bank of America, you have to come up with at least a $1,500 deposit. On the other hand, many online banks, like Amex bank or Capital One, do not have monthly maintenance fees, regardless of the balance.

While their set of financial products is sometimes smaller, high-interest rates on deposit products and low fees are some of the main benefits of online banking.

Does Bank of America Offer a Fee-Free Checking Account?

As of April 2024, Bank of America does not offer any accounts which do not have any monthly fees.

As we have discussed above, you either have to meet one of the requirements for the bank to waive fees or if that is not the case, then by the end of each statement period, the monthly fee will automatically be deducted from your checking or savings account.

Top Offers From Our Partners

FAQs

Bank of America has some notable advantages, such as offering overdraft protection to its clients and making its ATMs available to all its customers without fees.

In addition, Bank of America offers discounts on interest rates on some loans to those customers who join the Preferred Rewards program, as well as other benefits.

Despite those obvious advantages, the requirements to join this program are pretty strict for some customers, and interest rates on savings accounts are extremely low.

Bank of America qualifying direct deposits are regular income deposits, such as salaries, pensions, social security benefits, rents, and dividend payments.

Some banks require a certain amount of qualifying deposits to be made on a checking account during the statement period to waive monthly fees.

The daily balance represents an amount held at the checking, savings, or other types of accounts at the beginning or by the end of each day.

On the other hand, combined balance represents the total amount of money the client holds across the checking, savings, money market, and retirement accounts.

Here it is also worth noting that Bank of America includes CDs with combined balances, which is not the case with some other banks.

Bank of America offers a promotion bonus of $200 for new personal checking customers who open an account online.

To qualify for this deposit, customers should not have any Bank of America checking accounts. They should make a minimum deposit to open one of three checking accounts the bank currently offers.

Finally, customers must receive a direct deposit of $1,000 or more within the next 90 days. Once they meet those conditions, new clients will get their $100 cash bonus.

As things now stand in April 2024, the interest rates on Bank of America’s savings accounts are at 0.01% – 0.04%, which is very low. You can hardly earn any significant amount of interest at such rates.

In contrast, many other banks responded to rate hikes of the Federal Reserve by increasing rates on their deposit accounts to the 2.5% to 4% range. In sharp contrast, Bank of America has announced no intention to raise interest rates on savings products.

So if making most of your savings accounts is a top priority, then the Bank of America might not be the best choice.

While Bank of America isn't considered among the top issuers when it comes to credit cards, it offers multiple credit card selections. For example, the Bank of America® Customized Cash Rewards credit card that offers 3% cash back in the category of your choice: gas, online shopping, dining, travel, drug stores, or home improvement/furnishings, 2% cash back at grocery stores and wholesale clubs and 1% cash back on all other purchases. The 3% and 2% cash back available on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter (then 1%).

You may set up a direct deposit with Bank of America in a number of different ways. You must enter information about yourself and your account, regardless of the method you pick.