Table Of Content

What Are the Closed-End Funds?

A closed-end fund (CEF), or sometimes called closed-ended fund is a pooled investment that issues a fixed number of shares. The shares are not redeemable from the fund. The Securities and Exchange Commission (SEC) usually organizes it as a publicly-traded company.

It is similar to a mutual fund where investors create a collective fund and allow a portfolio manager to manage it. It raises the fixed amount of capital it needs through an Initial Public Offering (IPO). In the secondary offering, the fund is structured, listed and traded like a stock in the stock market.

There was a steady increase in the percentage of households who owned mutual funds, according to data from the Investment Company Institute.

Fixed Unit Captial

Closed-ended funds have a fixed unit capital. This means that they would be able to sell only a specific number of units. In open-ended funds, investors can come in and leave as they please. In a closed-end fund, investors cannot buy any unit after the New Fund Offer (NFO) period is over.

The scheme restricts new investors from coming in. It also disallows existing investors from exiting until the end of the term. Most companies though, provide a platform for investors to exit before the term. They do this by listing their close-ended schemes on a stock exchange.

Closed-End vs Open-End Fund

In an open-end fund, managers create new shares to meet the demands of investors. In a closed-end fund, investors can only buy shares from the market. Technically, mutual funds began with this design of actively managed pooled investments – before open-end funds morphed. US regulations require publicly sold CEFs to register under the Securities Act of 1933 and the Investment Company Act of 1940.

Investors can buy and sell closed-end funds on recognized stock exchanges. There are two important prices to consider when it comes to CEFs. The first is the price per share, which, the market dictates.

The other is the Net Asset Value (NAV) per share of the investments held by the fund. The market calculates it regularly; hence, they call it the underlying value. The two values are usually not the same. The price is at a discount when it is trading below the NAV. It is at a premium if it is above the NAV.

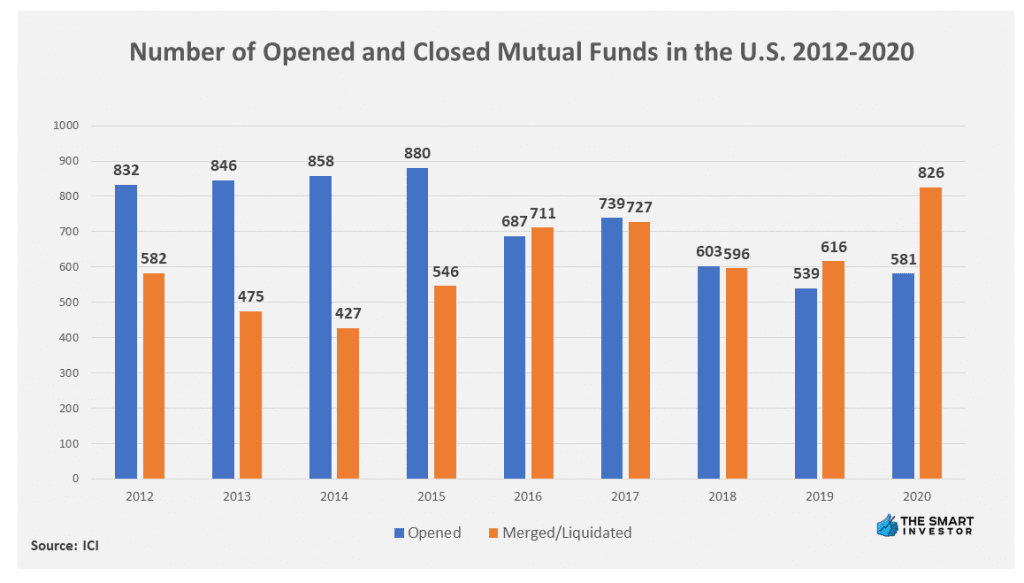

According to the ICI, there were more opened mutual funds than closed mutual funds in the period from 2012 to 2018, except in 2016. However, this trend changed in 2019 and 2020, where there were more closed mutual funds than opened mutual funds.

Price Fluctuations

When the market sees that the investment manager or the fund’s securities portfolio can produce superb returns, the price increases. In this case, the market gives rise to the premium. In cases where the market perceives a negative impact of certain circumstances, a discount may occur. These are things like anticipated future charges of the fund manager, liquidity anxiety, and high amounts of leverage. Even the lack of investor confidence in some or most of the underlying securities can bring the price down.

In the United States, the SEC recognizes three types of investment companies. The first two are mutual funds and unit investment trusts. The third is the closed-end fund, which the law considers as a closed-end company.

By the fund's nature, investors can buy and sell closed-end fund shares anytime during the trading hours. They can trade them at a premium or discount depending on the value of their underlying assets or NAV. Investors can check the Value Line Investment Survey, a study that tracks the performance of several closed-end funds.

Advantages Of Closed-End Funds

Closed-end funds tend to have a longer time period than open-end funds. Therefore, short-term downturns do not materially affect them. The closed-end fund can also trade at a premium or above their NAV. Open-end funds use their NAV to determine the price of their shares. In this case, closed-end funds have more profit potential.

The main advantages of a closed-end fund are:

- Regular Income or Cash Flow

Closed-end funds should provide regular cash flow to the investor.

This allows investors to have attractive, periodic distributions. All of these come from the fund’s total returns and from other sources as well. Fund managers can release regular distribution to investors in the form of cash. The investors can use the cash to pay for their expenses or use it to buy more shares in the market.

- Flexibility & Trading Liquidity

Investors who want to come in after the IPO cannot buy directly into the fund. Those who want to enter as well as those who want to exit must do so via the stock market. They can buy or shares stocks on the stock market similar to the process of buying and selling listed shares.

In this sense, all trading strategies related to stocks can apply to shares of a CEF. Investors can apply for market orders, limit orders, stop orders, short sales and margin buying in closed-end funds. Shares of a closed-end fund are open for dealing during any trading day. Traders update its price not just at the close of the market but throughout the day.

Similar to other instruments, the share prices of closed-end funds rise and fall every day. Any time, they may become worth more or worth less than the investor’s original purchase cost.

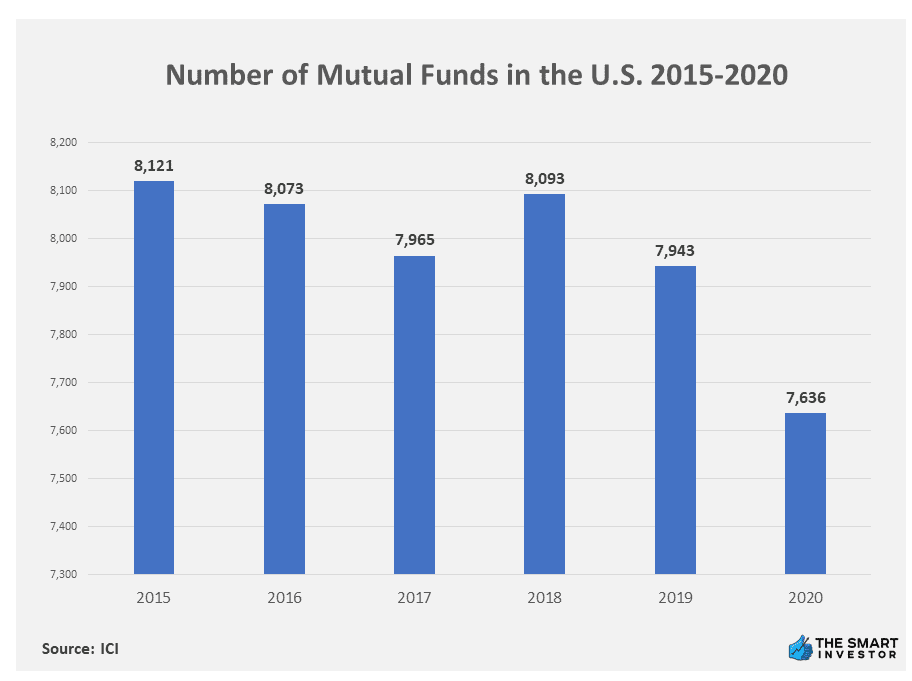

The number of mutual funds in the United States has declined over the years, with the figure falling from 8,121 in 2015 to 7,636 in 2020, based on data from ICI. This means about 485 mutual funds closed with the 7-year period. During the period from 2013 to 2020, the number of mutual funds only increased in 2018 by 128 up from 7,965 in 2017.

- Active Portfolio Manager

Investors will have the benefit of professional managers that look after the fund.

They also have access to specialized research materials done by able analysts. Fund managers strategically choose the correct securities that would fit into their portfolios. They always aim to provide a handsome steady cash flow that remains relatively constant through varied market conditions.

- Stable Asset Structure

Managers try to maintain a stable asset constitution of the fund and to keep it fully invested.

Since there is no pressure from investors to constantly invest or redeem the fund, they optimize the time period. They can take fuller advantage of longer-term and less liquid securities available in the market.

- Lower Operating Cost

Close-end funds have minimal marketing expenses and lower turnover. This is why they need fewer expenses to operate and manage.

However, as in stocks, investors must pay a brokerage fee to acquire or dispose of shares. Close-end funds have lower expenses internally but it has an impact to very active investors. If an investor trades frequently, the total fees he pays to brokers will significantly increase his operating cost.

- Leverage For Better Returns

Under certain conditions, managers may try to get a loan to boost the CEF’s returns.

This may result in bigger distributions for investors. This happens when the short-term loan interest is much lower than the long-term returns of the portfolio. Even if they deduct the borrowing costs, investors would stand to earn more than they would have without the loan.

Of course, borrowing brings greater risk.

If the interest rate comes close to the income rate of the underlying securities, it might jeopardize the distribution. It will diminish the positive returns to investors. Moreover, leveraged funds become more volatile with respect to their net asset value per common share. Clean close-end funds are relatively more stable. Leveraged funds may bring erratic distribution levels and/or market share prices.

Disadvantages Of Closed-End Funds

No investment is risk-free. Close-end funds also carry their own set of risks. Investors can be exposed to the following:

- Pricing risk

Like other instruments in the market, supply and demand affect the price of a closed-end fund. Seldom does a closed-end fund trade at its Net Asset Value.

More often, traders price them at a discount or premium. In doing so, their share prices remain volatile for the most part.

- Market Risk

Market prices for securities fluctuate daily and close-end funds are no exception.

The market has become more volatile than ever in the last few years. This is due to the uncertain economic situations, investors' insecurities and international security anxieties. Investors should take into consideration that all these might cause a market decline in the value of the CEF.

- Interest Risk

When interest rates rise, the prices of bonds and preferred securities normally go down – and rise when the rates fall. Bonds with longer maturities react even more significantly to these fluctuations.

If the closed-end fund has a sizable amount of bonds in its portfolio, this risk can affect it considerably.

- Credit Risk

Credit risk refers to the issuer's ability to pay the instrument's principal and interest as they become due.

For fixed-income closed-end funds, this risk is also present. Should the bonds in the portfolio fail to pay on time, it will affect the fund. Aside from disrupting the regular distribution, the net asset value and price could suffer.

- International Risk

International stocks and bonds carry additional risks. Factors like foreign company risk, market risk, foreign exchange risk, and correlation risk are all too real. These risks are even greater in emerging markets and economies. The securities are more volatile than US stocks because they face additional pressure in the market.

There is always the threat of a hostile economic, currency, political, social or regulatory direction of a foreign country. Their government may even resort to sequestrations, exorbitant taxes, asset restrictions, fiscal spending constraints or military control. They might even adopt a different legal or accounting standard that may be detrimental to the fund.

- Leverage Risk

As we've mentioned before, when fund managers borrow on behalf of the fund, there could be a leveraged risk.

When the loan interest rate catches up with the dividend rate, it lessens the amount dedicated to the investors. On top of this, the price of the shares of a leveraged fund can become very volatile. This would lead to an inconsistent distribution of wild market share prices.

- Currency Risk

When a fund invests in foreign securities or foreign interest rate swaps, it absorbs additional risks. Currency risk is simply the possible effect of a foreign currency's exchange rate on the value of the fund.

The risks of a closed-end fund will vary from fund-to-fund. Actually, the portfolio mix will determine the type of risks that a fund might have. Also, it is good to remember that prevailing market conditions directly affect closed-end fund share prices.