Rewards Plan

Welcome Bonus

Our Rating

0% Intro

Annual Fee

APR

- Redemption Options

- Transfer Points To Partners

- No Travel Rewards

- Low rewards Rate

Rewards Plan

unlimited 5X miles on hotels and rental cars booked through Capital One Travel and 1.25X miles on all other purchases

Welcome Bonus

Our Rating

PROS

- Redemption Options

- 0% Intro APR

CONS

- No Travel Rewards

- Low Rewards Rate

APR

19.99% - 29.99% variable

Annual Fee

$0

0% Intro

18 months on purchases and balance transfers

Credit Requirements

Good - Excellent

- Our Verdict

- FAQ

The Capital One VentureOne Rewards Credit Card may be a suitable option for those seeking a credit card without an annual fee and offering unlimited rewards on spending. Additionally, this card offers a welcome bonus, 0% introductory APR, and an extensive range of transfer partners, making it a compelling choice for those interested in travel rewards credit cards.

In terms of miles rewards, the card offers unlimited 5X miles on hotels and rental cars booked through Capital One Travel and 1.25X miles on all other purchases.

However, while the Capital One VentureOne Rewards Credit Card is a strong contender in the no-annual-fee category, it lacks extensive perks and bonus categories beyond Capital One Travel, has limited transfer partners based outside North America, lacks cell phone insurance, and has an uninspiring flat-rate rewards system.

Overall, for those who want to earn travel rewards without the burden of a hefty annual fee, the VentureOne stands out. However, if you prioritize luxury and premium features, you might want to explore other options with higher annual fees.

Does the card offer any travel insurance benefits?

While it lacks premium travel insurances, the card does provide some basic travel protections.

Can I transfer miles to other loyalty programs?

Yes, the VentureOne allows miles to be transferred to 18 airline and hotel partners.

What credit score is required for approval?

Applicants typically need a good to excellent credit score, ranging from 670 to 850.

Can I earn miles on everyday purchases beyond travel?

Yes, the card's unlimited flat rewards rate allows you to earn travel miles on all types of everyday spending.

What sets the VentureOne apart from the Venture Rewards card?

The VentureOne has no annual fee, whereas the Venture Rewards card offers higher rewards but comes with a $95 annual fee.

Are there restrictions on how I can redeem my miles?

The miles can be redeemed to cover any travel purchase at a value of 1 cent per mile.

In this Review

Estimating Your Rewards: A Practical Simulation

The following table showcases a rewards simulation highlighting the benefits of using the Capital One VentureOne Rewards Credit Card. It provides an approximate calculation of the rewards you could earn using the card for your expenses across various categories.

| |

|---|---|

Spend Per Category | Capital One VentureOne Rewards Credit Card |

$10,000 – U.S Supermarkets | 12,500 |

$3,000 – Restaurants

| 3,750 |

$5,000 – Airline | 6,250 |

$3,000 – Hotels | 15,000 |

$4,000 – Gas | 5,000 |

Estimated Annual Miles | 42,500 miles |

Pros and Cons

Just like any other credit card, the Capital One VentureOne Rewards has some advantages and disadvantages:

Pros | Cons |

|---|---|

Rewards And Welcome Bonus | No Special Travel Benefits |

Airlines And Hotels Transfer Partners | Low Rewards Rate |

Unlimited Miles With No Expiration | |

Redemption Flexibility | |

Protection |

- Rewards And Welcome Bonus

New VentureOne cardholders earn a signup bonus of 20,000 bonus miles once you spend $500 on purchases within the first 3 months from account opening.

In addition, cardholders accumulate unlimited 5X miles on hotels and rental cars booked through Capital One Travel and 1.25X miles on all other purchases.

- Airlines And Hotels Transfer Partners

With the Capital One VentureOne Rewards Credit Card, you get access to transferring your miles to over 15 airline and hotel partners. This is a great benefit since you can transfer points and book with the transfer partners.

For example, with Emirates Airline, you can transfer your miles at a ratio of 1:1.

- 0% Intro APR

The card offers one of the longest intro APR in the market – 18 months on purchases and balance transfers, the longest between Capital One cards.

- Unlimited Miles With No Expiration

There is no cap on earning rewards on spending with this credit card. Also, when your miles have no expiration date, you have the independence to decide how and when to redeem them.

- Redemption Flexibility

With Capital One VentureOne Rewards Credit Card Miles can be redeemed for a variety of rewards, including travel, cash back, gift cards, and more. For example, you can use your miles to book travel through Capital One's travel platform.

- No Special Travel Benefits

Unlike other no-annual-fee travel cards, such the Hilton Honors American Express Card or the American Airlines AAdvantage® MileUp® which offer specific hotel or airline benefits, this card is general and doesn't offer it.

Also, other premium travel card rewards such as TSA precheck reimbursement or annual travel credit are not available.

- Low Rewards Rate

The Rewards rate is quite low, even compared to other cards with no annual fee.

For example, with the Wells Fargo Autograph℠ Card, you can get 3X points on restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Also, earn 1X points on other purchases.

- Protection

Cardholders get protection services from Eno like Security Alerts, $0 Fraud Liability, Virtual Card Numbers, etc.

This can save you from any kind of fraudulent activity, and it also provides CreditWise with alerts when your TransUnion® or Experian® credit report changes.

Top Offers From Our Partners

Top Offers From Our Partners

Top Offers From Our Partners

How It Compared To Other Capital One Cards?

The Capital One VentureOne Rewards Credit Card, while a solid choice for entry-level travelers, has notable distinctions when compared to other Capital One cards. In contrast to its siblings, the Capital One Venture or Venture X Rewards, which carries an annual fee, the VentureOne stands out for its no-annual-fee structure. Hoever, these cards offer a more robust rewards rate and better travel perks.

Although the VentureOne doesn't feature in this analysis, the Capital One Savor Rewards Credit Card, geared towards dining and entertainment enthusiasts, and the Capital One Quicksilver Cash Rewards Credit Card, emphasizing simplicity with a flat 1.5% cash back on all purchases, represent alternative options with distinct focuses.

How It Compared To Other Travel Cards With No Annual Fee?

When evaluating the Capital One VentureOne Rewards Credit Card against other travel cards with no annual fee, the rewards ratio is lower – but it has other advantages, such as the welcome bonus or 0% intro.

Compared to the Bank of America Travel Rewards Credit Card or Discover it miles, the VentureOne boasts a lower flat-rate rewards system, earning 1.25 miles per dollar on all purchases compared to Bank of America or Discover's 1.5 miles per dollar.

Wells Fargo Autograph Card, another no-annual-fee travel card, boasts a broader range of bonus categories with 3X points on dining, gas stations, and travel. Contrasting with the Delta SkyMiles Blue American Express Car targetings Delta loyalists, the VentureOne offers more flexibility in earning and redeeming rewards on various travel expenses beyond airline-specific perks.

Is It The Right Card For You?

The Capital One VentureOne Rewards Credit Card is well-suited for beginners who desire a card without an annual fee. It is a suitable starting point for individuals who unfamiliar with how travel miles and points work.

Although the reward rate is relatively low, the card offers several transfer partners that one can take advantage of. Moreover, the card may be attractive to individuals who wish to earn rewards without the added burden of tracking rotating bonus categories or spending caps.

Furthermore, for individuals who are new to the credit card scene and are looking to establish their credit score, starting with a basic credit card is advisable. By using the card responsibly and making timely payments, one can effectively improve their credit score.

If you would like to access to better travel rewards with Capital One, you can consider the Venture Rewards card or Venture X card, which is the most premium travel card Capital One offers.

How To Maximize Card Benefits?

Here are some tips that will help you to maximize the benefits of VentureOne Rewards Credit Card:

-

Use 0% Intro APR

If you are about to make a big purchase and want to pay it overtime Capital One VentureOne Rewards Credit Card offers an intro APR for the first 18 months on purchases and balance transfers.

It may be a good option if you want to consolidate your debt into one credit card or use the new card for your next vacation.

-

Leverage Capital One Transfer Partners

There are more than 15 transfer partners to whom you can transfer your miles, but to whom should you transfer to maximise your redemption? So here is the list of some of the best return partners of the capital one:

- Turkish Airlines Miles&Smiles: This is a great option for domestic flights, with a value of around 1.4 cents per mile.

- Air France/KLM Flying Blue: If you want a great redemption option with your miles while travelling from the US to Europe, Flying Blue could be a great option.

- Air Canada Aeroplan: The value of this Air Canada Aeroplane is around 1.9 cents per point, so it's a great redemption option.

-

Use Your Card For All Your Purchases

As previously mentioned, there is no limit to the rewards that can be earned with this card. To fully benefit from it and maximize its advantages, it is recommended to use the card for all purchases. This will enable you to accumulate more miles that can be redeemed for rewards.

How To Apply?

It's easy and quick to apply for the VentureOne Card:

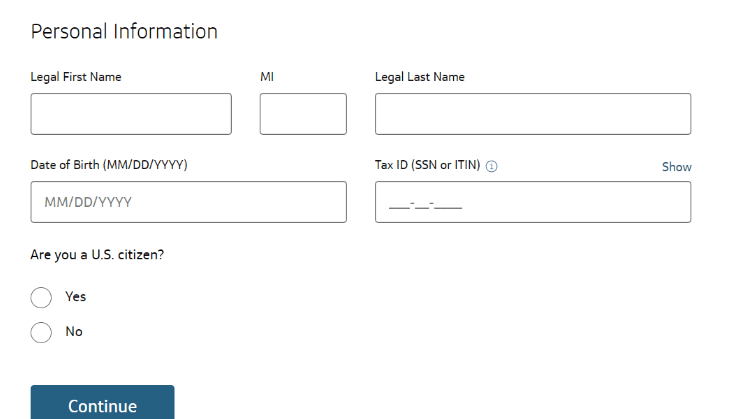

Step 1: Visit the Capital One VentureOne Credit Card page and click “Apply Now”.

Step 2: After you click on apply now, you will be directed to the pages where you have to fill out your personal information like name, email, occupation, etc.

Step 3: You will be shown a preview page to ensure that the information you entered is valid. Finally, make sure you read the key disclosure page to learn about your eligibility, fees, expenses, rates, and so on. Then, to finish the process, click “submit.”

FAQs

The redemption value of Capital One VentureOne Rewards miles is one cent per mile.

Yes, Capital One VentureOne Rewards miles can be transferred to various transfer partners such as airlines and hotels.

Yes, the Capital One VentureOne Rewards Credit Card can be used outside of the United States with no foreign transaction fees.

Yes, you can add an authorized user to your Capital One VentureOne Rewards Credit Card.

Compare Capital One VentureOne Card

The Venture card offers better travel perks and rewards ratio than the VentureOne, but lacks 0% intro APR. Here's our side-by-side comparison