Rewards Plan

Sign up Bonus

Our Rating

0% Intro

Annual Fee

APR

- United Club Membership

- IHG Platinum Status

- Airline Focused Rewards

- High Annual Fee

Rewards Plan

Sign up Bonus

0% Intro

PROS

- IHG Platinum Status

- United Club Membership

CONS

- Airline Focused Rewards

- High Annual Fee

APR

21.99% – 28.99% variable

Annual Fee

$525

0% Intro

N/A

Credit Requirements

Good - Excellent

- Our Verdict

- FAQ

The United Club℠ Infinite Card stands out among the best premium airline credit cards, targeting United's frequent flyers.

The card earns 4x miles on United Airlines purchases, 2x miles on all other travel purchases, dining and eligible delivery services and 1x miles on all other purchases, as well as a sign-up bonus of 80,000 bonus miles after you spend $5,000 on purchases in the first 3 months from account opening.

The card also provides various benefits, such as United Club membership, a Global Entry/TSA PreCheck fee credit, IHG Platinum status, and a $75 credit for IHG Hotels & Resorts purchases. Additional perks include two free checked bags, Premier Access, a 10% mileage discount on certain awards, and the ability to earn up to 4,000 Premier qualifying points per year.

While the card offers valuable travel protections and benefits, potential cardholders should carefully consider their travel habits and needs, especially given the high annual fee $525. Unless you frequently fly United and take advantage of the associated perks, there may be better options available.

What travel protections does the card offer?

The card provides trip cancellation/interruption insurance, baggage delay insurance, lost luggage reimbursement, trip delay reimbursement, purchase protection, and extended warranty protection.

What rental car privileges come with the United Club Infinite Card?

Primary cardholders can sign up for complimentary Avis President's Club membership, which includes upgrades and expedited rental service.

Is there a mileage discount for cardholders?

Yes, the primary cardholder can book economy Saver Awards on United flights within the continental U.S. and Canada for 10% fewer miles than the general publi

Are there any elite status-related perks with the United Club Infinite Card?

Yes, cardholders can earn up to 4,000 Premier qualifying points per calendar year, helping with elite status qualification.

Pros & Cons

Let’s take a closer look at the pros and cons of the United Club Infinite Card:

Pros | Cons |

|---|---|

United Club Membership | High Annual Fee |

IHG Rewards Platinum Elite | Airline Focused Rewards |

TSA PreCheck or Global Entry Fee Reimbursement | Unpredictable Award Redemption Rates |

No Foreign Transaction Fees | |

Trip Cancellation/Interruption Coverage | |

Free Check Bags |

- United Club Membership

The card includes a United Club membership, offering access to United Clubs and select Star Alliance lounges when flying United and its partners, a perk valued at up to $650 annually.

- IHG Rewards Platinum Elite

Cardholders receive complimentary IHG Platinum Elite status and a $75 statement credit for IHG Hotels & Resorts purchases.

- TSA PreCheck or Global Entry Fee Reimbursement

If you charge your TSA PreCheck or Global Entry fee to your card, you'll receive a $100 statement credit every four years as reimbursement.

- No Foreign Transaction Fees

If you use your card outside of the United States, you will not be charged any foreign transaction fees.

- Elite Status Benefits

customers can earn 500 PQP for every $12,000 you spend on purchases with your United Club Card (up to 8,000 PQP in a calendar year) that can be applied toward your Premier status qualification, up to the Premier 1K® level

- Trip Cancellation/Interruption Coverage

If your trip is canceled or cut short due to illness, severe weather, or other covered circumstances, you can receive reimbursement for pre-paid, non-refundable travel expenses of up to $10,000 per person and $20,000 per trip.

- Free Check Bags

The primary cardmember and a travel companion on the same reservation can receive their first and second standard bags checked for free. This represents savings of up to $320 per round trip.

- High Annual Fee

This a premium card and accordingly – the annual fee is high, $525.

- Airline Focused Rewards

While the card offers excellent returns on United purchases, its earning rates on other categories may be surpassed by general travel cards like the Chase Sapphire Reserve.

Also, some benefits, such as two free checked bags and Premier Access, may be less appealing for those who already hold United elite status.

- Unpredictable Award Redemption Rates

United no longer publishes an award chart, making it challenging to predict the exact redemption rates for MileagePlus miles.

Additional Perks

- Statement Credit for United Inflight Purchases: You can get 25% back when you buy food, drinks, WiFi and other onboard purchases with your United Club Infinite on United operated flights.

- Premier Access Travel Services: You can get preferential treatment at the airport including priority check in, boarding, security screening and baggage handling.

- Luxury Hotel & Resorts Collection: As with other Chase Travel cards, you can access the Luxury Hotel & Resorts Collection. This provides access to complimentary breakfasts, early check in, room upgrades and other amenities in over 1,000 luxury hotels and resorts around the world.

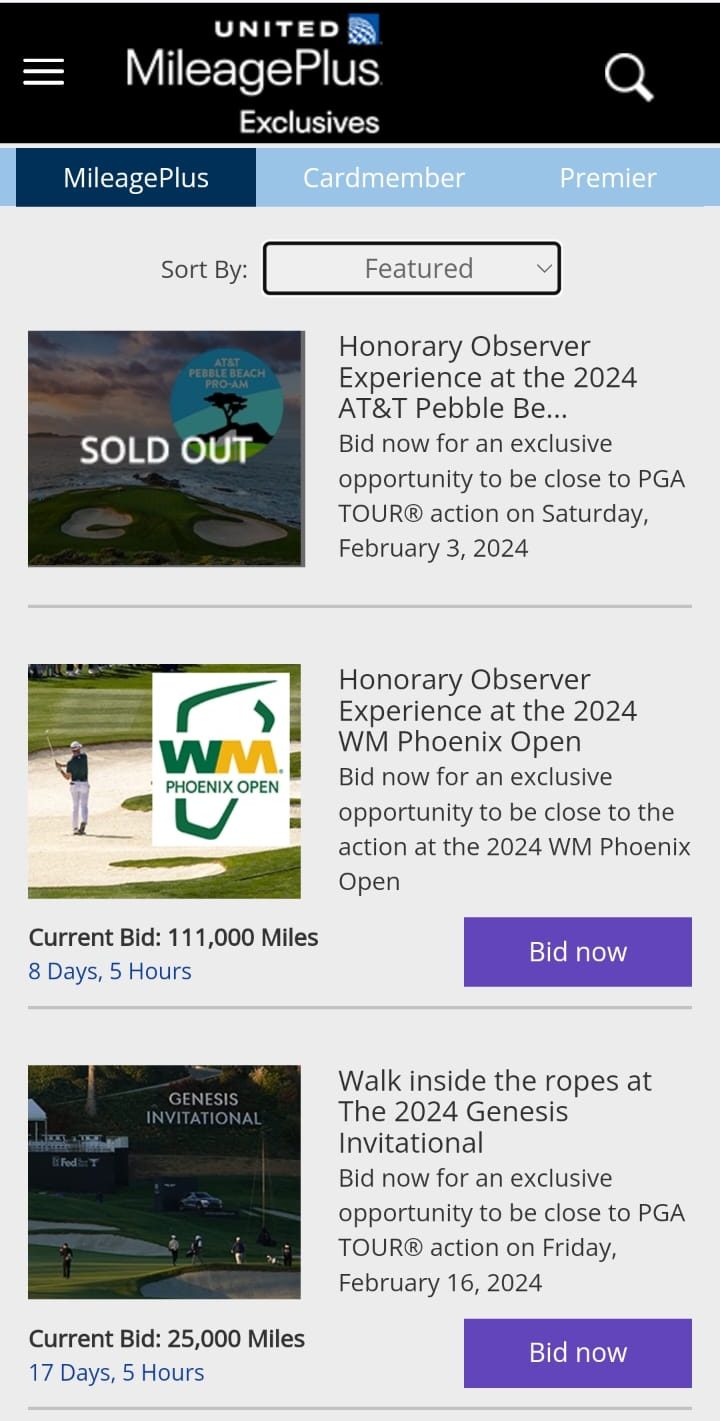

- Chase United Card Events: This allows you to purchase curated, private once in a lifetime experiences. These range from sporting events to celebrity meet and greets.

- Trip Delay Reimbursement: If your common carrier travel has a 12 hour plus delay, you’ll be covered for unreimbursed expenses such as meals and accommodation for up to $500 per ticket.

- Baggage Insurance: If your baggage is delayed by your passenger carrier for over six hours, you can get reimbursement for essential purchases up to $100 per day for three days. If your check or carry on baggage is lost or damaged by the carrier, you also have up to $3,000 per passenger coverage.

- Visa Infinite Concierge Service: This provides complimentary access to 24 hour concierge services to help you send gifts, find tickets to top events or make restaurant reservations.

- Auto Rental Collision Damage Waiver: If you charge the full rental cost to your card and decline the rental company collision insurance, you’ll enjoy primary coverage for collision damage or theft for most rental cars here and abroad.

- Purchase Protections: New purchases are covered for 120 days for up to $50,000 per year against theft or damage.

Top Offers From Our Partners

Top Offers From Our Partners

Top Offers From Our Partners

Simulate Your Rewards: How Much You Earn?

It's difficult to understand the actual reward potential without a scenario comparison.

While cardholders earn above-average rewards, the benefits are not as valuable. The true value of the card stems from the luxury perks they offer, such as global entry or TSA PreCheck, statement credit for in-flight purchases, trip delay reimbursement, and so on; more on this in the section that follows.

Remember that the figures should be adjusted to your regular spending categories, which may vary, so the exact calculation is dependent on your personal habits.

| |

|---|---|

Spend Per Category | United Club℠ Infinite |

$15,000 – U.S Supermarkets | 15,000 miles |

$5,000 – Restaurants

| 10,000 miles |

$5,000 – Airline | 20,000 miles |

$4,000 – Hotels | 8,000 miles |

$4,000 – Gas | 4,000 miles |

Total Miles/Points | 57,000 miles |

Estimated Redemption Value (Flights) | 1 mile = ~1.5 cents |

Estimated Annual Value | $855 |

Redemption Offers

The redemption options for the United Club Infinite Card primarily revolve around United MileagePlus miles. Cardholders can use these miles for:

Award Travel on United-operated Flights: Redeem miles for free or discounted flights on United Airlines, including economy, business, and first-class seats.

- Priority Boarding: Board United-operated flights with priority, along with your travel companions on the same reservation, ensuring you secure overhead bin space and settle into your seats comfortably.

Star Alliance Partner Flights: Use MileagePlus miles to book award travel on flights operated by other airlines within the Star Alliance network.

Upgrades: MileagePlus miles can be used to upgrade your seating class on eligible United flights.

Inflight Wi-Fi: Redeem miles to access in-flight Wi-Fi services during your United Airlines flights.

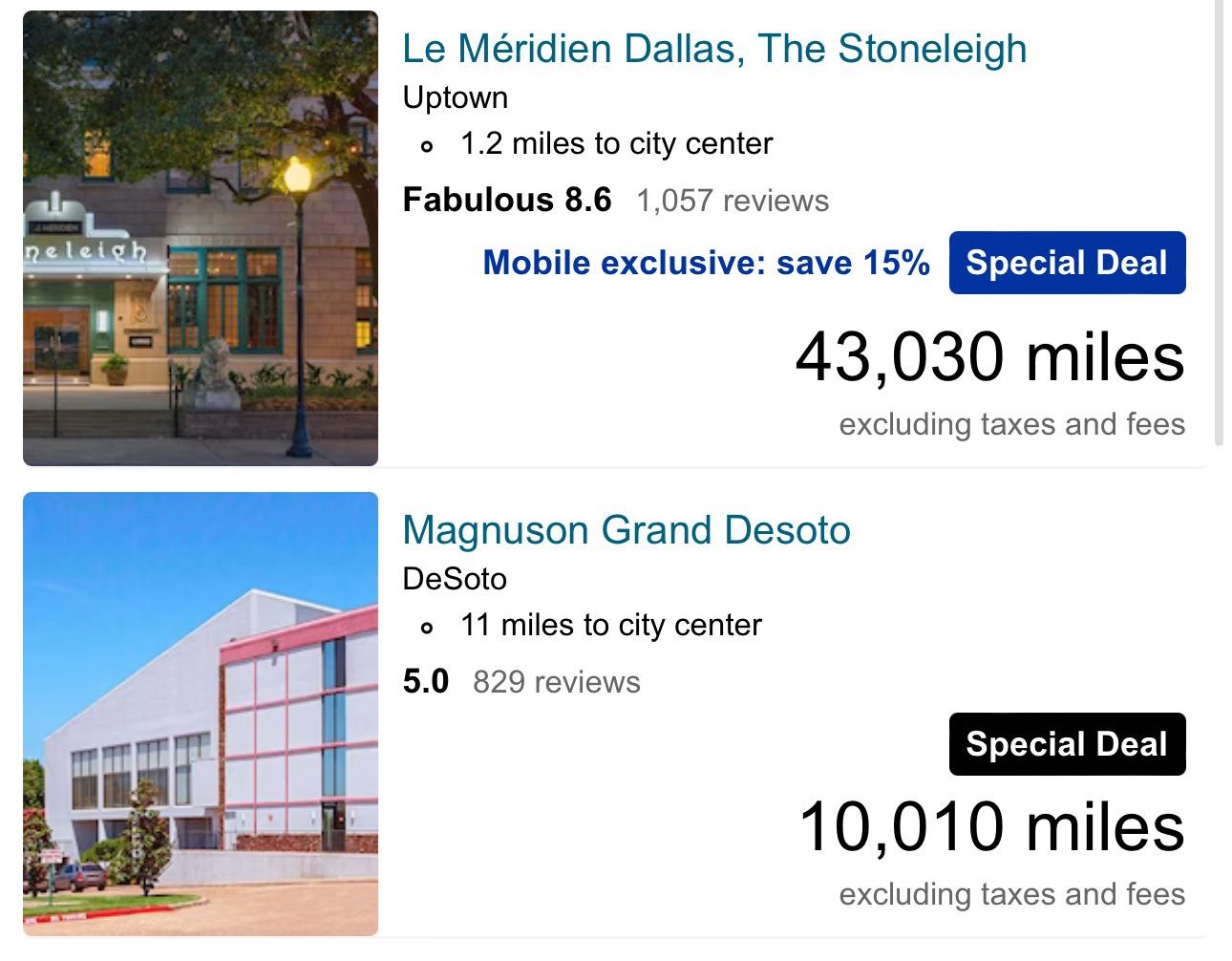

Hotel Stays: Use miles for booking hotel stays through United's partner hotels.

- Car Rentals: MileagePlus miles can be redeemed for car rentals with United's car rental partners.

Merchandise and Gift Cards: Use miles to purchase merchandise or gift cards through United's redemption platform.

Exclusive Events: Some credit card issuers, including United, occasionally offer unique experiences and events that cardholders can redeem miles for.

Top Offers From Our Partners

Top Offers From Our Partners

How to Maximize Benefits?

Because the redemption rate for United Club miles can vary greatly, if you want to maximize the benefits of this card, you should be prepared to conduct extensive research on your flight options.

If you simply book any flight, you may only receive a value of one cent per mile. However, if you do some research on your flight options, especially if your travel dates are flexible, you may be able to get a rate of two cents or more per mile.

If you want to maximize your United Club Infinite rewards, you must thoroughly research your United flight options. If you simply use the miles to book any trip, you might only get a 1 cent per mile rate. However, if you do your research and are flexible with your travel dates, you can get a much better redemption rate.

How It Compared To Other United Cards?

The United Club Infinite Card distinguishes itself from other United co-branded cards through its robust rewards structure and premium benefits.

The main competitor is the United Quest card. This is still a premium card but with a lower annual fee of $250, a decent rewards plan, and similar rewards such as free first and second checked bags, priority boarding and TSA Precheck reimbursement, $125 in statement credits for United purchases and great protections. However, it lacks premium benefits such as United Club membership (though it offers two United Club one-time passes every year), IHG Platinum elite status, or Visa Infinite benefits.

The United Explorer Card is another competitor, but this is a mid-level card with limited benefits. The rewards rate is lower, and perks are basic – free first-checked bags, priority boarding, and TSA Precheck reimbursement. However, compared to its annual fee – the variety of rewards is pretty good.

The last option is the United Gateway card. This is a no annual fee option with decent rewards – 2X per $1 spent on United® purchases, at gas stations and on local transit and commuting and 1X on all other purchases and almost no extra perks, besides an 0% intro APR which can be a good option for those who carry debt.

Bottom Line: When You Should Consider It?

- You want to increase your earnings: The United Club Infinite offers up to four miles per dollar, which is more than many other travel cards, but you can also earn two miles for dining and one mile for everything else. As a result, you can increase your mileage balance even if you are not a member of United.

- You Use WiFi While Flying: While Citi offers discounts on on-board purchases, the United Club card includes WiFi purchases in its offer, which could save you a lot of money if you fly frequently and use the on-board WiFi services.

- You're looking for the following premium travel benefits: The United Club Infinite card provides comprehensive insurance coverage, including trip interruption, baggage insurance, and trip delay coverage. So, if there are any unforeseen events that cause your trip to be delayed or disrupted, you can be reimbursed.

Compare The Alternatives

If you're looking for an airline credit card with premium travel rewards – there are some good alternatives you may want to explore:

|

|

| |

|---|---|---|---|

The Platinum Card® from American Express | Chase Sapphire Reserve® | Capital One Venture X Rewards | |

Annual Fee | $695. See Rates & Fees | $550 | $395 |

Rewards |

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. | 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

Welcome bonus |

80,000 points

80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership

|

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Foreign Transaction Fee | $0. See Rates & Fees | $0 | $0

|

Purchase APR | 21.24% – 29.24% APR Variable | 22.49%–29.49% variable | 19.99% – 29.99% (Variable) |

FAQ

United has over 30 airline partners, with which you can spend your miles. Of course, you will get preferential redemption rates if you choose a United operated flight, but it is still possible to use your miles with airlines including Lufthansa, SkyWest, Air Canada, Trans States, Aer Lingus, and GoJet.

Chase does not typically have pre approval for the United Club Infinite card. When you apply online, Chase will pull a hard credit search.

The United Club Infinite card does have auto rental collision insurance if you pay for the rental with your card and decline the car rental company’s optional coverage.

The United Club Infinite does have trip interruption/cancellation insurance that allows you to have pre paid, non refundable charges reimbursed. So, if your flight is canceled and you incur non reimbursed charges, you could recover them on your insurance.

The United Club Infinite card requires excellent credit. Your income will be used to determine your credit limit once approved.

The United Club Infinite miles have no expiry date.

The average redemption value for United Club miles is about two cents per mile, depending on your redemption method. This means that 10,000 miles could be worth $200 with the United Club Infinite.

Chase offers approved United Club Infinite customers a minimum credit limit of $5,000.

The United Club Infinite is heavily weighted towards United purchases, so if you’re not a frequent United flier, this is not the card for you.

Compare United Club Infinite Card

In this comparison, we will delve into the key features, benefits, and considerations of both the United Explorer and Infinite Card.

The United Infinite card offers luxury benefits that the Quest card doesn't, but for most consumers, it is not worth the higher annual fee.

These two are considered as one of the best exclusive airline cards out there. What are the differences between them and is it worth it?

United Club Infinite vs Delta SkyMiles® Reserve: Which Gives You More?

When it comes to premium travel cards, these two offer nice perks and benefits. But who is the winner between the two? Here's our analysis.

United Club Infinite vs AAdvantage Executive Elite Mastercard: Which Card Is Best?

The Infinite Card is tailored for frequent United flyers, while the Amex Platinum offers a more lucrative, comprehensive rewards program.

Top Offers From Our Partners

Top Offers From Our Partners

Top Offers From Our Partners

Review Airline Credit Cards

Delta SkyMiles Blue American Express