Table of Content

The Delta SkyMiles® Blue American Express Card and the Citi® / AAdvantage® Platinum Select® World Elite Mastercard® offer airline and travel rewards for Delta/American Airlines loyal customers, and for those who are flying frequently.

In this comparison, we review them side by side in order to understand which of them offer more – and which one can be the best fit for your needs. Let's start.

General Comparison

|

| |

|---|---|---|

Delta SkyMiles® Blue American Express | Citi® / AAdvantage® Platinum Select® | |

Annual Fee | $0. See Rates and Fees. | $99 (waived for the first 12 months)

|

Rewards | 2X miles for every dollar spent at restaurants worldwide and Delta purchases and 1X miles for every dollar spent on other eligible purchases. Terms Apply. | Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases. |

Welcome bonus | 10,000 bonus miles after you spend $1,000 in purchases on your new Card in your first 6 months | 50,000 American Airlines AAdvantage® bonus miles after $2,500 in purchases within the first 3 months of account opening |

0% Intro APR | N/A | None |

Foreign Transaction Fee | $0. See Rates and Fees. | $0 |

Purchase APR | 20.99%-29.99% Variable

| 21.24% – 29.99% (Variable) |

Read Review | Read Review |

Simulation: Which Card Gives More Rewards?

Without a scenario comparison, it's difficult to understand the actual reward potential. While both cards have decent rewards for travelers, potential cardholders should analyze it in order to understand which card gives you more.

However, keep in mind that the numbers should be adjusted to your regular spending categories, which may differ – so the exact calculation is dependent on your personal habits.

|

| |

|---|---|---|

Spend Per Category | Delta SkyMiles® Blue American Express | Citi® / AAdvantage® Platinum Select® |

$10,000 – U.S Supermarkets | 10,000 miles | 10,000 miles |

$4,000 – Restaurants

| 8,000 miles | 8,000 miles |

$4,000 – Airline | 8,000 miles | 8,000 miles |

$3,000 – Hotels | 3,000 miles | 3,000 miles |

$4,000 – Gas | 4,000 miles | 8,000 miles |

Total Miles/Points | 33,000 miles | 37,000 miles |

Estimated Redemption Value (Flights) | 1 mile = ~1.6 cents cent | 1 point = ~1.5 cent |

Estimated Annual Value | $528 | $555 |

Editorial Note: Terms apply to American Express benefits and offers. Enrollments may be required for select benefits. Visit americanexpress.com to learn more

Compare The Perks

Delta SkyMiles® Blue American Express

- 20% Back on In Flight Purchases: You’ll receive a statement credit for 20% of your purchases of food, beverages, and audio headsets on board Delta flights.

- No Foreign Transaction Fees: You can use your card outside of the U.S without incurring any foreign transaction fees.

- Pay with Miles Discount: Every five thousand miles you redeem using the Pay with Miles platform to book your Delta flights, you can receive up to $50 off the cost of your flights.

- Car Rental Damage and Loss Insurance: When you use your card to reserve and pay for the entire car rental, if you decline the rental company’s collision damage waiver, you’ll receive coverage through your car for theft of or damage to a rental vehicle in covered territories.

- Global Assist Hotline : When you’re more than 100 miles away from home, you can use the Global Assist Hotline for 24/7 emergency assistance or coordination service. This includes legal and medical referrals, missing luggage help, and emergency cash wires.

- American Express Experiences: This provides access to ticket presales and exclusive events.

Terms apply to American Express benefits and offers.

Citi® / AAdvantage® Platinum Select®

- American Airlines Flight Discount: After you spend $20,000+ on purchases during the year, on renewal you can enjoy a $125 flight discount.

- First Checked Bag Free: You and up to four travel companions on the same reservation can enjoy first checked bags free on domestic American Airlines flights.

- Preferred Boarding: On American Airlines flights, you can save time and enjoy preferred boarding status.

- Inflight Savings: You’ll receive 25% savings on beverage and food purchases on American Airlines flights when you use your card.

- Citi Entertainment: You can get access to purchase tickets to exclusive and popular events including sporting events, concerts, dining experiences and more.

Compare The Drawbacks

Of course, the Delta SkyMiles Blue and the AAdvantage Platinum Select, like all credit cards, have potential drawbacks that may influence whether they are a good fit for you.

So, to help you make a smart decision, we'll highlight potential drawbacks here.

Delta SkyMiles® Blue American Express

- No Free Checked Bags

While the card is an Amex credit card, unlike the AAdvantage Platinum Select card, you don’t get any free checked bags for you or your travel companions, which could end up costing you several hundred dollars on round trip flights.

- No Priority Boarding

One of the perks of an airline card is that you can enjoy preferential treatment at the airport, such as priority boarding. However, this is one of the few Delta cards that does not offer this feature.

Citi® / AAdvantage® Platinum Select®

- Annual Fee

While this card does offer more features compared to the Delta SkyMiles Blue, this does come at a cost and you will need to be prepared to pay a $99 annual fee after the first year.

- Limited Reward Options

While you can redeem your miles for hotel stays and car rentals, if you want to get the best redemption values, you are limited to American Airline flights.

Additionally, if you want to maximize your rewards, you are likely to need international destination flights, which means you won’t get the free checked bags perk.

Top Offers From Our Partners

Top Offers From Our Partners

Top Offers From Our Partners

Compare Redemption Options

As we touched on above, you’ll earn 2X miles for every dollar spent at restaurants worldwide and Delta purchases and 1X miles for every dollar spent on other eligible purchases. You can then use your SkyMiles for Delta flights, seat upgrades, experiences, merchandise or even gift cards.

You will need to enroll in the Delta SkyMiles program, which will allow you to redeem your accumulated miles via phone, on the website or using a Delta ticket counter. You can also transfer miles to Delta’s partners, which includes Hilton Honors, IHG, Radisson Rewards and Marriott Bonvoy, but you may incur a transfer fee.

You can enjoy similar redemption options with Citi AAdvantage rewards. You can use your miles to book travel to over 1,000 destinations globally. You have flexibility for your American Airlines awards or you could use your accumulated miles for Business and First Class upgrades, car rentals, hotel stays or vacation packages.

How to Maximize Cards Benefits?

If you want to make the best use of your AAdvantage Platinum Select , there are some tips:

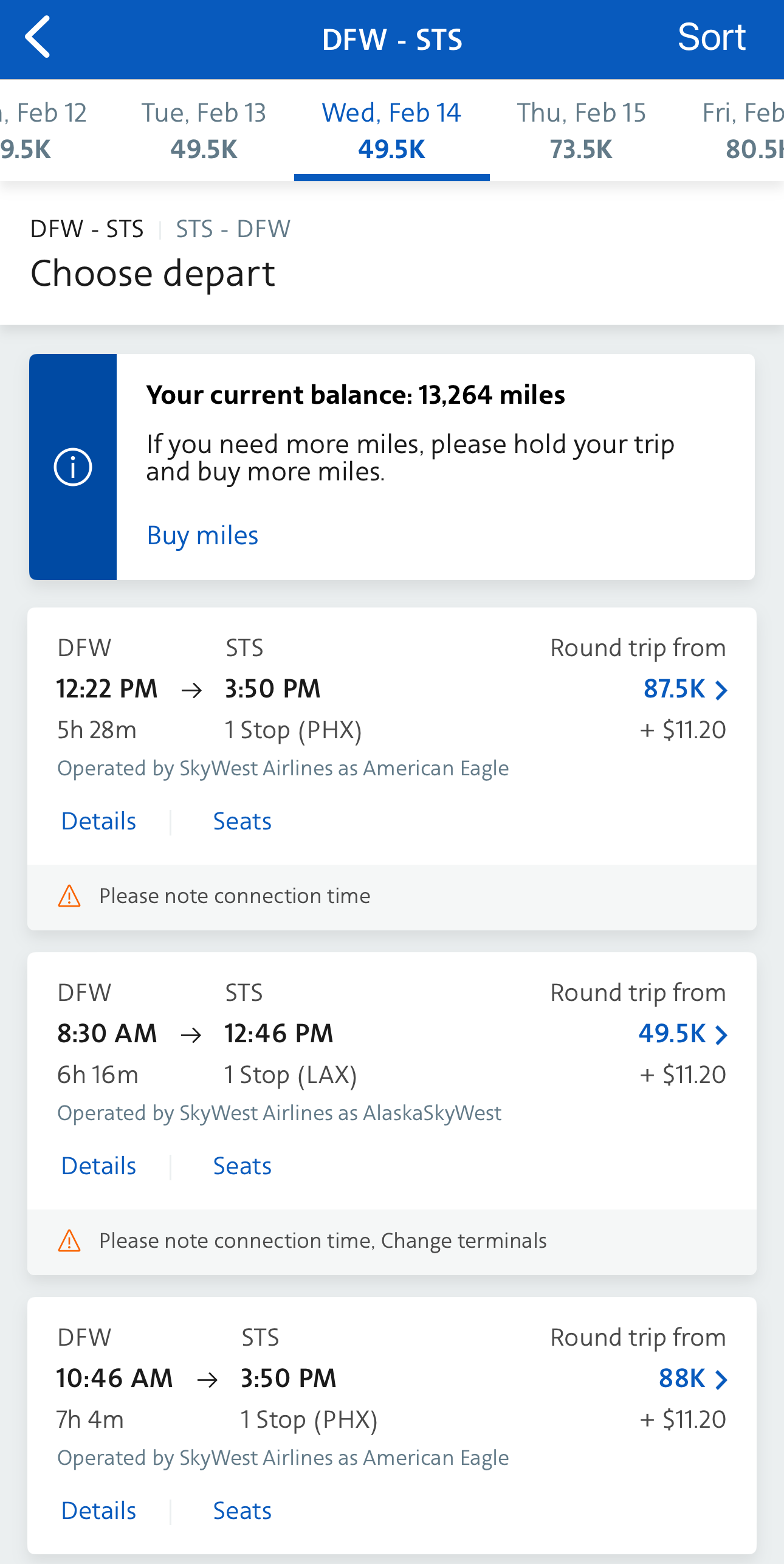

- Be Flexible: If you can be flexible about your travel dates and itinerary, and have the time and patience to research your options, there is the potential to save thousands of miles, particularly if you are planning on long international flights and premium seats.

- Research : There are different strategies for getting the most out of your AAdvantage miles, but they center around taking the time to fully research your flight options.

While the typical value for a mile is approximately 1.5 cents, it is possible to get a higher value with careful planning. Unfortunately, the reverse can also apply. If you simply book any flight, you could end up short changing yourself and only getting a value of less than one cent per mile.

If you want to maximize the value of your Delta SkyMiles, there are several things that you can do:

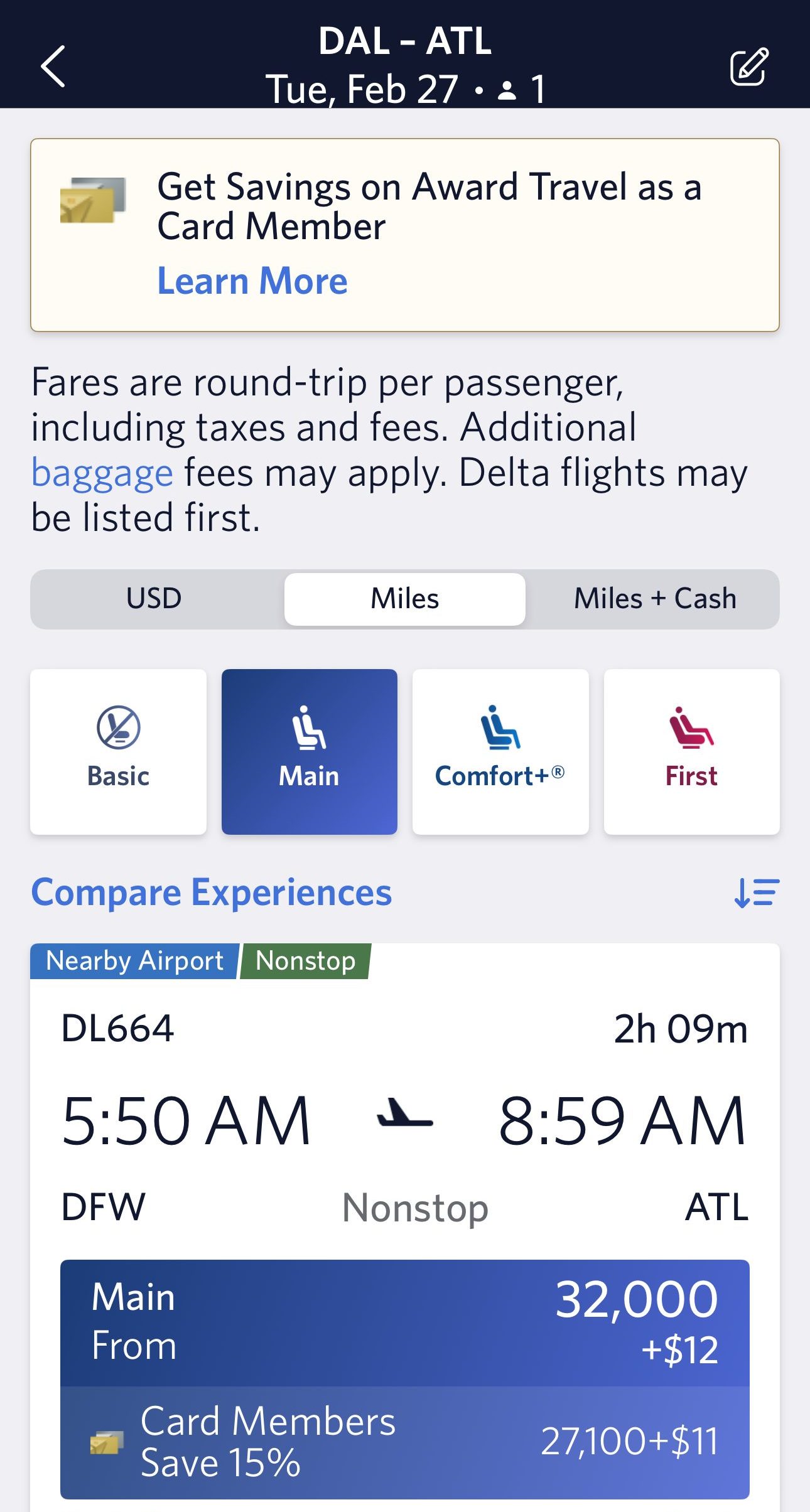

- Check the Price Calendar: Delta has a price calendar, where you can check up to five weeks of flights for their prices and miles. This will allow you to find the best deals, if you are able to have some flexibility about your travel dates. You could save thousands of miles if you are able to travel a day or two earlier or later.

- Watch Out for Flash Sales: Although Delta does have a dynamic pricing system, they are free to have sales at any time. So, even if you have no current plans to travel, it is worth regularly checking in to see if there are any flash deals.

- Try to Avoid Delta Hubs: While this may seem a little silly, you can actually get penalized when you fly from a Delta hub. Delta can take advantage of its loyal customers and will charge more from its major hubs. So, if you’re not in a great hurry, look at slightly longer flights that avoid Delta hubs and use neighboring airports and other airline hubs.

- Book Round Trips: Although a one way flight can provide some flexibility, it will cost you more SkyMIles. If you’re booking the same flights as one way trips, you could end up paying substantially more miles.

Customer Reviews: Which Card Wins?

Delta SkyMiles® Blue American Express

Satisfied customers report being pleased at how easy it is to qualify for the welcome bonus, as you only need to spend $500 within the first three months.

Negative reviews highlight that some people have difficulty qualifying for the card despite having a good to excellent score. Fortunately, you can use the American Express website to pre qualify and avoid impacting your credit with a hard pull.

Citi® / AAdvantage® Platinum Select®

Satisfied customers report that this is a card that does not require a lot of use to accumulate miles, as there is no annual fee to worry about.

Negative reviews are typically from longer term customers who have complaints that the benefits package for this card has been drastically reduced since 2019. Obviously, this will not be a factor for new customers, but it does highlight that it is worth comparing with other AAdvantage cards before you make a final decision.

Top Offers From Our Partners

Top Offers From Our Partners

When You Might Want the AAdvantage® Platinum?

The Citi® / AAdvantage® Platinum Select® is a solid choice if:

You Frequently Travel Domestically: When you’re flying on an American Airlines domestic flight, you and up to four travel companions get your first checked bag free, which could add up to serious savings.

You Want Airport Perks: As an AAdvantage Platinum Select World Elite cardholder, you’ll get preferred boarding status on American Airline flights.

You Want Flight Discounts: If accumulating miles for flights is not enough and you want further flight discounts, this could be the card for you. If you spend $20,000+ during the year, you’ll get a $125 flight discount on account renewal.

Why You Might Want the Delta SkyMiles® Blue?

The Delta SkyMiles® Blue American Express is a great option that could be good if:

You Don’t Want to Pay an Annual Fee: It is quite rare to find an airline card that does not have an annual fee. While this card may not offer a massive selection of benefits, you don’t need to offset an annual fee, so you can start enjoying immediate savings.

You Like to Eat Out: Most airline cards tend to heavily favor airline purchases, but this card allows you to earn the same rate of miles per dollar at restaurants including takeout and delivery. So, even if you’re not a frequent flier, you can still rack up those SkyMiles.

You Want Insurance Protections: This card not only offers purchase protection against damage or theft for 90 days after purchase, but you can also benefit from car rental damage and loss insurance simply by paying for the car rental with your card and declining the rental desk collision damage waiver.

Compare The Alternatives

If you're looking for an airline credit card with travel rewards – there are some good alternatives you may want to consider:

|

|

| |

|---|---|---|---|

United℠ Explorer Card | Delta SkyMiles® Gold American Express Card | Citi®/AAdvantage® Platinum Select® World Elite Mastercard® | |

Annual Fee | $95 ($0 first year) | $150, $0 intro first year. (See Rates and Fees.) | $99 (waived for the first 12 months)

|

Rewards |

1X – 2X

2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases

|

1X – 2X

2X miles on delta purchases, at restaurants worldwide (including take-out and delivery in the U.S) and at U.S. supermarkets, and 1x miles on all other eligible purchases

|

1X – 2X

Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

|

Welcome bonus |

50,000 miles

50,000 miles after you spend $3,000 on purchases in the first 3 months your account is open.

|

40,000 Miles

40,000 Bonus Miles after you spend $2,000 in purchases on your new Card in your first 6 months

|

50,000 Miles

50,000 American Airlines AAdvantage® bonus miles after $2,500 in purchases within the first 3 months of account opening

|

Foreign Transaction Fee | $0 | $0. See Rates and Fees. | $0 |

Purchase APR | 21.99% – 28.99% variable | 20.99%-29.99% Variable | 21.24% – 29.99% (Variable) |

Compare AAdvantage Platinum Select

We think that for most consumers, the no-annual-fee AAdvantage MileUp card may be a better option. When you may consider the Platinum Select?

The AAdvantage Platinum Select and the Southwest Premier card share many common features.

Here's where each card shines: AAdvantage Platinum Select vs. Southwest Rapid Rewards Premier

The Citi/AAdvantage Executive offers better cashback value and perks than the Platinum Select, but usually it doesn't worth the annual fee.

Citi/AAdvantage Executive World Elite vs. Citi/AAdvantage Platinum Select

While the AAdvantage Platinum Select and the United Explorer Card have many common features, the Explorer card is our winner. Here's why.

Citi/AAdvantage Platinum Select vs. United Explorer: How They Compare?

While the Citi/AAdvantage Platinum Select wins at cashback value, the Aviator Red World card offers better airline perks.

AAdvantage Aviator Red World Elite Mastercard vs AAdvantage Platinum Select

The Delta Gold and AAdvantage Platinum Select offer similar cashback value, but the Delta card is the winner due to its diverse travel perks.

Delta SkyMiles Gold vs. Citi/ AAdvantage Platinum Select: Which Card Wins?

While the airline perks are quite comparable, the JetBlue Plus Card emerges as the preferred choice thanks to higher cashback rates

Citi/ AAdvantage Platinum Select vs JetBlue Plus Card: Side By Side Comparison

Compare Delta SkyMiles Blue Card

The Delta SkyMiles Gold offers higher annual cashback and better perks than the Delta Blue card. But is it worth the annual fee? It depends.

Delta SkyMiles Blue vs Delta SkyMiles Gold: How They Compare?

Both JetBlue and Delta SkyMiles Blue offer basic airline benefits and no annual fee. We think the JetBlue card is a clear winner, here's why.

The JetBlue Card vs Delta SkyMiles Blue Amex: How They Compare?

The Delta SkyMiles Blue and United Gateway have similar cashback rates and airline perks. Where does each card shine? Here's our comparison.