Table Of Content

Maintain a good credit is not a simple task and sadly, many get caught up in the many myths about how to do it. You don’t have to chalk up a lot of credit card bills and definitely, you don’t need to fill your wallet with so many cards.

Your credit score, as private credit-monitoring companies compute it, reflect your ability to repay your debts. This is the rule: the more credit-worthy you are, the lower your finance charges get. Your ‘FICO’ score is direct to the point: the higher it is, the more you are like to swing a lower finance rate.

How's Your Credit Score Determined?

There are five main factors you have to remember when dealing with your credit score: payment history, credit indebtedness, time in file, the pursuit of new credit and credit use (mix of credit).

The bottom line is simply this: lenders are trying to figure out whether you can pay them back in a timely fashion if they decide to lend you some money.

Aside from the specific factors, there are three crucial things you should also know:

- Credit agencies work back only up to seven years into your credit history. Don’t worry about that missed payment 8 years ago because it won’t show up in the report, unless…

- You have filed for bankruptcy – they will go back ten years into your history.

- Student loans – if you’ve been delinquent, it will haunt you. This exception to the seven-year r le never drops off from your credit report. The only legitimate way to have t t speck removed is to pay the loan back in full.

Your history matters because it accounts for 35% of your credit score. If you’ve habitually paid all your bills, it’s an excellent indicator that you will pay your future bills.

When you’ve missed payments, they will be points against you, but they will not be so significant if they’re small and ages ago. So your best solution is to always p your bills on time.

1. Pay All Your Bills On Time

This is non-negotiable. The biggest factor in achieving a perfect credit score is your track record of paying your bills on time. Paying on time (or earlier) demonstrates to your lenders that you are trustworthy with future loans.

They may even give you a lower lending rate down the road. In practice, lenders would jockey each other for the business of customers with higher credit scores. This will give you better leverage to negotiate a more advantageous interest rate.

It would be good to know that if your payment pattern shows that late payment is the exception rather than the rule, lenders might not give it too much weight. Late payment tolerance depends on the lender in question, but many companies practice leniency.

If you’re late once every 12 to 24 months and explain to the lender, then make good on your payment, you can escape any negative repercussions.

2. Pay Attention to Your Credit Utilization Rates

The next important thing to manage is your credit utilization rates. Here’s how you check how good or bad you’re doing.

- Add up your aggregate available credit lines (include all the total amounts that lenders have given you the privilege to borrow).

- Add up the total amount of debts you incurred against these lines. Then divide the total credits you used over the total available lines of credits that you have and you’ll get your credit utilization rate.

- If it’s below 30% or even below 20%, give yourself a pat on the back. You’re doing a hell of a job looking good in the eyes of the three reporting credit agencies.

This chart created with Experian data shows that those with an average to good credit score have an average credit utilization ratio of the optimum 33%. This ratio drops significantly for those with very good and excellent scores.

At the other end of the scale, the chart shows that those with poor credit scores typically have a very high credit utilization ratio, with an average of 73%. This will be a massive factor in lending decisions for those in this group.

Credit bureaus are particularly conscious of cases with high credit utilization rates that breach the 30% threshold. It indicates that you don’t manage your money well enough or you’re already having difficulty repaying your debts.

If Possible, Ask For Credit Limit Increase

One factor that goes in your favor when it comes to the wise management of credit is a credit line increase.

Unless you can’t control your impulse to go shopping, a credit line increase boosts your aggregate credit lines and can drive down your utilization rate.

Conversely, decreasing your credit line could adversely affect your utilization rate. You will have a higher utilization rate, and the three reporting credit agencies would likely frown upon this.

3. Pay Off Debt

Paying off debt is crucial for improving your credit score as it demonstrates responsible financial management and reduces your overall debt burden.

When you pay off debt, it shows credit rating agencies that you are capable of meeting your financial obligations and are less of a risk to lenders. This positive behavior can help boost your creditworthiness and improve your credit score.

Credit rating agencies evaluate your creditworthiness by considering various factors, including your payment history, credit utilization, and debt-to-income ratio. When you pay off debt, it positively impacts these factors. Timely debt repayment reflects a reliable payment history, which is a significant aspect of your credit score.

Additionally, reducing your debt balances lowers your credit utilization ratio, indicating that you are not heavily reliant on credit and can manage your finances responsibly.

Lastly, paying off debt can lower your debt-to-income ratio, which compares your debt obligations to your income. A lower ratio suggests that you have sufficient income to manage your debt, making you a more attractive borrower to lenders.

4. Keep A Good Mix of Credit Accounts Counts

The third key is to make sure that you maintain a good mix of credit accounts at all times. Creditors want to see if you can pay on time, if you can manage your debts and if you can handle different types of credit accounts.

Here’s how it goes: credit agencies would look at your mix of installment loans (mortgage, car loan or student loan) and revolving credit (credit cards). If they see that you can handle a reasonable mix of debt obligations, they will most likely lend to you. Effectively, your FICO scores stand to benefit from this.

5. Don't Close Your Old Card If You Don't Have To

Your credit score should get a big hoist when you keep your good-standing accounts open for long periods.

Your lenders and credit reporting agencies determine your creditworthiness using the same thing as a road map: your credit history. Sure, you might say you have a perfect payment history, and today you can even get a credit card without a credit history.

But if that history is only six months long, lenders might still have second thoughts about giving their thumbs up to your account. So there’s not enough basis to quickly conclude your ability to meet your obligations. On the other hand, if your average good-standing account is ten years old and counting, that’s enough of a demonstration that you’re sensibly trustworthy.

Do not close, long-standing accounts even if you don’t use them often. Long-tenured accounts work wonders for your average credit history length–a factor affecting your credit scores. Be intentional about using your available lines of credit a couple of times yearly. This will keep them active and maintain your account in good standing.

6. Apply For New Cards Smartly

Finally, since the credit bureaus are watching how you manage multiple types of credit accounts, you want to be careful not to open too many accounts.

So, ask yourself first if you really need that new account. Is it really necessary in relation to your purchases? If you are buying a house or a car or paying for college or even just buying a new garden sprinkler system, opening a line of credit seems logical. These are large-money events so you may be in need of standby credit.

However, if you’re buying a new pair of earphones for $9.95 at your local sports shop, opening a new account to get 10% off might not be the best idea.

Move prudence when opening new accounts as you age because a new account can negatively impact your average length of credit history. It may also knock off a few points from your current FICO score due to the influx of hard credit inquiries.

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

7. Monitor Your Credit Report

Monitoring your credit report is essential for several reasons.

Firstly, it allows you to ensure the accuracy of the information being reported. Mistakes or errors on your credit report can negatively impact your credit score. By regularly reviewing your report, you can identify any inaccuracies and take the necessary steps to correct them. This ensures that your credit score is based on correct and up-to-date information.

Secondly, monitoring your credit report helps you detect any signs of fraudulent activity. Identity theft and unauthorized accounts can seriously damage your credit score and financial well-being. By monitoring your report, you can spot any suspicious activity early and take immediate action to mitigate potential damage.

Credit rating agencies rely on the information provided in your credit report to calculate your credit score. They assess factors such as payment history, credit utilization, length of credit history, and credit mix. By monitoring your credit report, you can proactively manage these factors and make improvements where necessary.

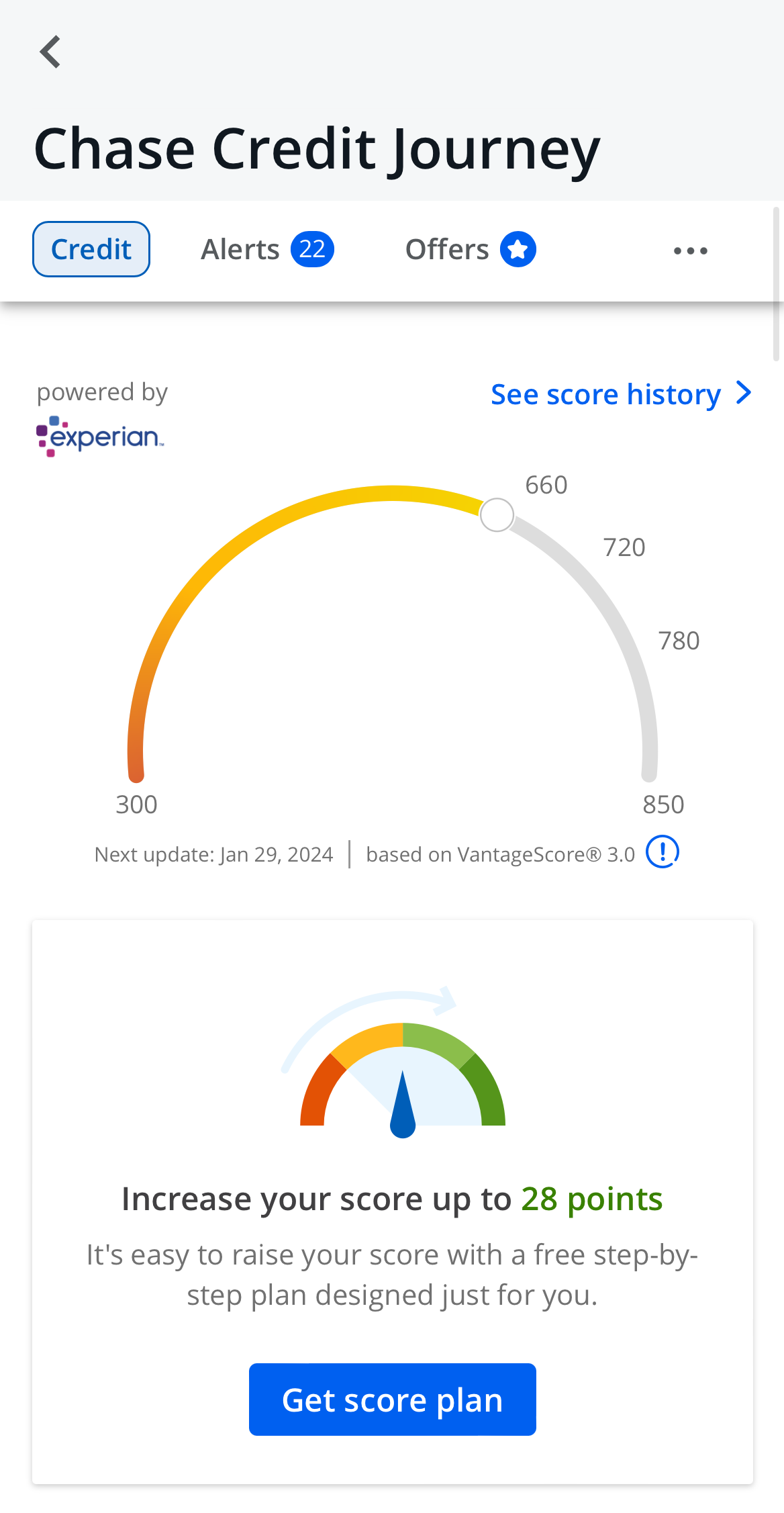

Most big banks provide a quick way to track and improve your score. Here's how it looks like with Chase credit journey:

8. Become An Authorized User

Being an authorized user on someone else's credit card can potentially improve your credit score in certain situations.

When you become an authorized user, the primary cardholder's credit card account activity may be reported on your credit report. If the primary cardholder has a long history of on-time payments and low credit utilization, their positive credit behavior can positively impact your credit score.

A study conducted by Credit Sesame revealed that individuals with fair credit scores experienced an improvement of approximately 11% in just three months after becoming an authorized user on another person's credit card.

The account's positive history, such as consistent payments and low balances, can contribute to building a strong payment history and lowering your credit utilization ratio. These factors are important components of a good credit score.

However, it's important to note that FICO and Vantagescore consider authorized user different, and the impact can vary between them. Additionally, if the primary cardholder has negative credit habits, such as late payments or high balances, it could potentially harm your credit score.

9. Stick To Good Financial Habits

Being patient and consistent while sticking to good financial habits is crucial for building and improving your credit score. Your credit score is a reflection of your creditworthiness and financial responsibility, and it plays a significant role in determining your access to loans, credit cards, and favorable interest rates.

Being patient means understanding that improving your credit score takes time. It's not an overnight process. It requires consistently practicing good financial habits, such as paying your bills on time, reducing debt, and managing credit responsibly.

By demonstrating responsible credit behavior over an extended period, you build a track record that credit rating agencies can evaluate.

Can You Achieve an Excellent Score?

There are actually two kinds of credit – installment credit and revolving debt. The first refers to big lump sums you borrowed and are slowly paying off such as student loans and home mortgage. The second is a debt you incur on a regular basis, a good example of which would be your credit card.

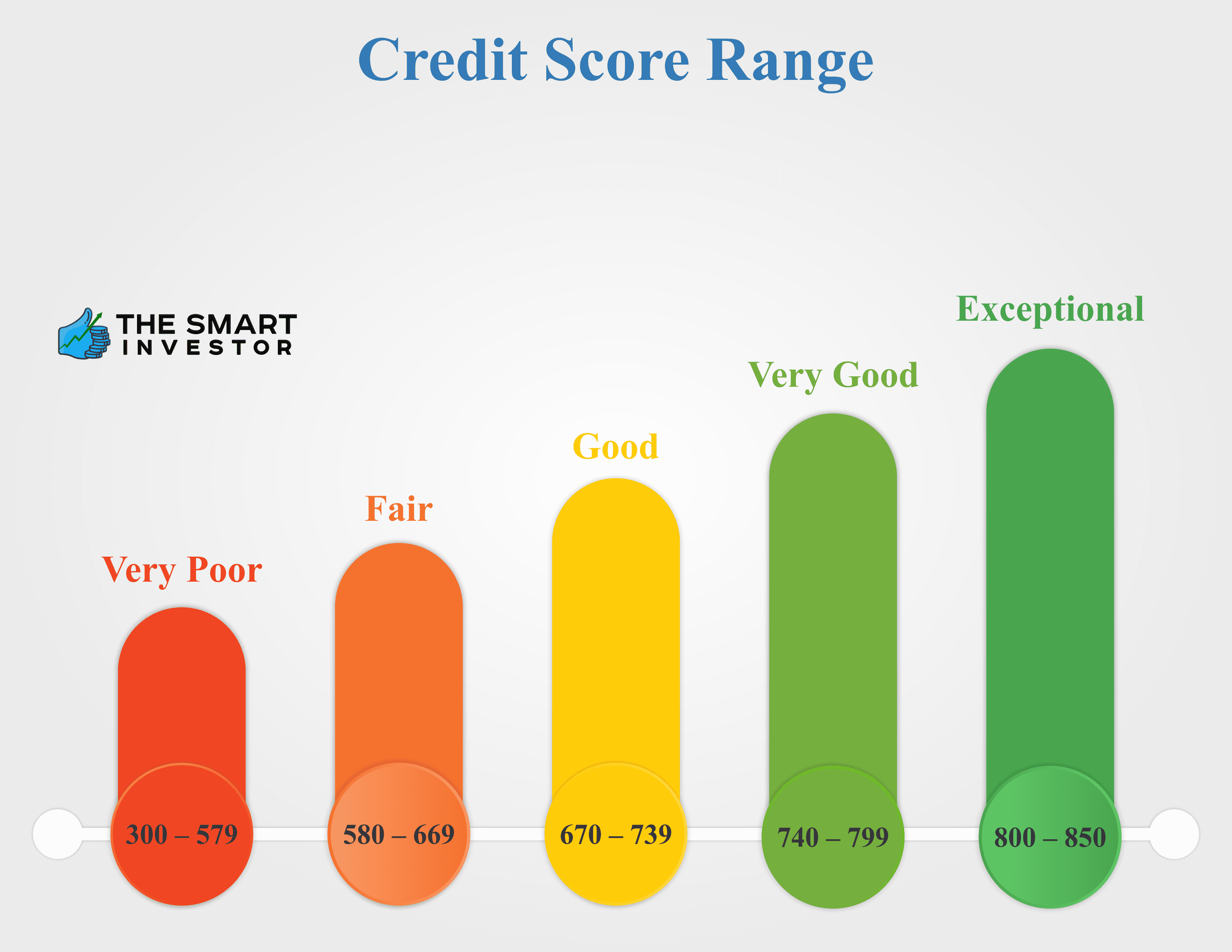

The FICO score scale carries 300 on the low and 850 on the high. You might be wondering: does anybody ever get a perfect score? Only 1.2% get a perfect credit score. Statistically, 1.2 out of 100 doesn’t exactly sound like an ideal ratio if you’re looking for perfection.

How Long Will It Take You to Boost Your Score Up?

The length of time it will take you to raise your score will likely depend on why your present score is what it is. If your score is low simply because you don’t have much credit history (maybe you’ve never used credit), you can raise your score in just a couple of months.

In case you’re debt-ridden, you can raise your score faster if you pay down most of your debts. It will take longer if you’ve somehow damaged your credit by missing payments or going through bankruptcy. A complete recovery on your credit score can take several years to bring it to your all-time high.

The bottom line is this: it’s challenging to find a quick and easy way to “repair” or “fix” your credit. The length of time it takes to rebuild your credit history will depend on the severity of the financial difficulties that influenced your credit history.

How Long Will My Negative Information Appear On The Credit Report?

Negative payment information (ex., Collections and late payments) will remain on the credit report for seven years. Other specific public record information, such as Chapter 7 bankruptcies and unpaid tax liens, will remain on the report for up to 10 years.

The impact of negative information tends to become less and less as the years go on. Serious delinquencies such as charge-offs or collections are harder to recover from compared to one or two missed payments. However, you can begin the process of improving your credit history as soon as possible and as quickly as possible in several ways.

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

FAQs

How long do negative items stay on my credit report?

Negative items, such as late payments or bankruptcies, can stay on your credit report for several years, typically seven years. However, their impact lessens over time as long as you maintain positive credit behavior.

Can student loans help improve my credit score?

Properly managing student loans and making timely payments can positively impact your credit score. It demonstrates responsible repayment behavior and contributes to a positive payment history.

Can credit counseling or debt management programs help raise my credit score?

Credit counseling or debt management programs can help you regain control of your finances but may not directly impact your credit score. However, by managing your debts responsibly, you can indirectly improve your creditworthiness over time.

How do late payments affect my credit score?

Late payments can significantly impact your credit score, as payment history is a crucial factor. A history of late payments can lower your score and signal potential risk to lenders.

How often should I check my credit report?

It's advisable to check your credit report at least 1-2 times a year from each of the major credit bureaus. However, if you want to improve your score, this is definitely ok to track your score every month to see how dod you imrpoved.