|

| |

|---|---|---|

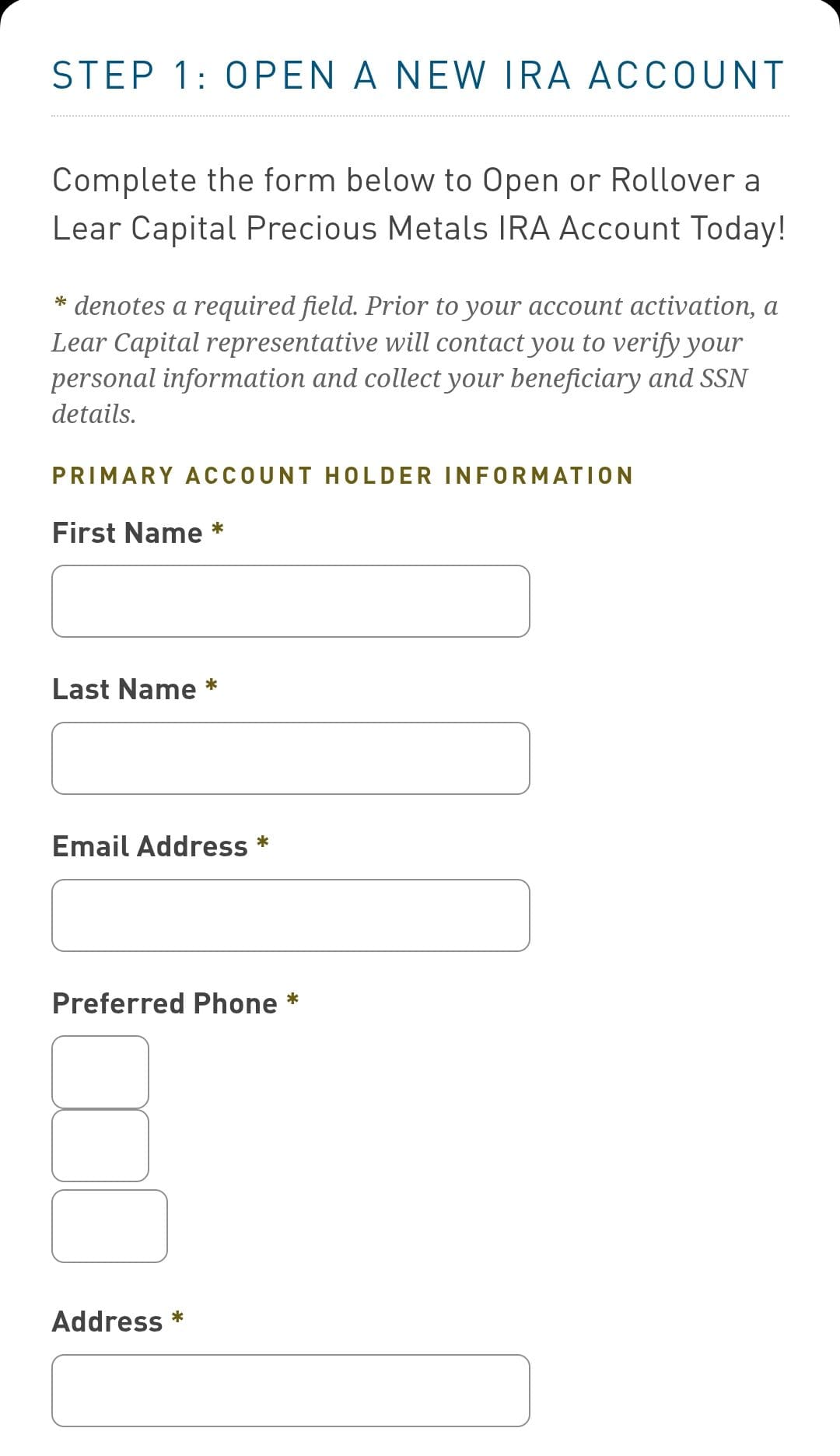

American Hartford Gold | Lear Capital | |

Min. Investment | $5,000 / $10,000

$5,000 for cash purchases / $10,000 for gold IRA | $5,000 / $10,000

$50,000 for cash purchases / $10,000 for gold IRA |

Established | 2015 | 1997 |

Storage Fees | $200 – $280 | $200

Also, there is an annual maintenance fee of $200. Estimated annual fee. |

Coin & Bar Selection | Bullion-focused, some collectibles | Bullion + numismatics, rare coins

|

Payment Methods | Wire, Check | Wire, Check, Credit Card

|

Pricing Transparency | Must call for pricing

| Real-time spot price updates |

Best For | Full-service IRA & buyback | Full-service IRA & direct purchase

|

Our Rating |

(4.6/5) |

(4.7/5) |

Read Review | Read Review |

American Hartford vs. Lear Capital: Customer Ratings

Lear Capital stands out as the top-rated dealer.

With higher review scores across Trustpilot, Consumer Affairs, and Google, it has consistently earned top marks from customers.

Platform | Rating |

|---|---|

Trustpilot

| 4.9 (2,561 reviews) |

Better Business Bureau (BBB) | A+ | Accredited Since 1997 |

Consumer Affairs | 5 (1,436 reviews) |

Google Reviews | 4.7 (404 reviews) |

While American Hartford Gold also receives high ratings, Lear Capital’s volume and consistency—especially its perfect 5.0 rating on Consumer Affairs—give it the edge.

Platform | Rating |

|---|---|

Trustpilot

| 4.7 (1,373 reviews) |

Better Business Bureau (BBB) | A+ | Accredited Since 2016 |

Consumer Affairs | 4.6 (891 reviews) |

AHG shines in customer service, but Lear Capital's long-standing reputation and broad customer satisfaction make it our pick here.

Comparing Direct Purchase Experience: Which Is Best?

Our preferred choice for direct gold and silver purchases is Lear Capital, mainly due to its wider product selection, payment flexibility, and live pricing tools.

Where they’re both strong:

Product Variety: Both companies offer gold, silver, platinum, and palladium coins and bars, with IRA-eligible and collectible options.

Free Insured Shipping: Each provides discreet, insured shipping on direct purchases within the U.S.

Buyback Support: Both offer assistance with buybacks, making liquidation easier.

Dedicated Account Specialists: Each buyer gets one-on-one support during the buying process.

Where American Hartford Gold stands out:

Lower Minimum: $5,000 minimum for direct purchases makes AHG more accessible.

No Buyback Fees: AHG’s guaranteed buyback includes no extra charges.

Promotional Offers: Eligible buyers can receive up to $15,000 in free silver.

Fee Waivers: Investors who buy in bulk (over $50K or $100K) get storage and setup fees waived for up to 3 years.

Where Lear Capital stands out:

Live Price Charts & Tools: Lear’s site provides real-time pricing and market resources for smarter decision-making.

Flexible Payment Methods: In addition to wires and checks, Lear accepts credit cards for smaller purchases.

Rare Coins Available: Offers numismatics and pre-1933 gold coins for collectors.

Mobile App Access: Lear offers a mobile app for investors to track prices and metals on the go.

Verdict: Both dealers are strong for direct purchases, but Lear Capital offers more flexible buying tools, easier access to live prices, and broader product types for both investors and collectors.

Which Is Better for a Gold or Silver IRA?

For precious metals IRA, both Americab Hartford Gold and Lear Capital offer great experience and features for long term investors.

Where they’re both strong:

IRA Rollovers Made Simple: Both companies walk you through the entire rollover process, from setup to funding.

IRS-Approved Storage: Metals are stored in secure, fully insured facilities like Delaware Depository.

Dedicated Support: Account specialists assist every step of the way, helping avoid penalties and delays.

Buyback Help: Both offer support for liquidation and converting metals back to cash.

Where American Hartford Gold stands out:

Lower IRA Minimum: AHG’s $10,000 minimum is more affordable than Lear’s $15,000.

No Buyback Fees: AHG guarantees a fee-free buyback process.

Promotional Incentives: Up to three years of IRA fees waived for large investments.

Brinks & Multiple Locations: AHG offers storage with both Brinks and Delaware Depository in various U.S. cities.

Where Lear Capital stands out:

Faster Setup: Lear Capital can set up an IRA within one business day—faster than most.

Transparent Fee Structure: Fees are clearly listed with tiered waivers depending on investment size.

Wider Selection for IRAs: Offers not only bullion but rare coins and more unique options.

Investor Tools & Mobile App: Resources like price charts, calculators, and app access make it easier to monitor performance.

Verdict: AHG is a solid IRA choice with strong support and fee waivers, while Lear Capital’s speed, transparency, and modern investor features give it a good fight.

Final Verdict: American Hartford vs. Lear Capital

Overall, our preferred choice is Lear Capital due to its higher ratings and direct purchases – but American Hartford Gold is still a great pick, especially if you're looking for low minimums and free silver promos.

- Ratings Winner: Lear Capital – Higher average scores across all major review sites.

- Best for Direct Purchase: Both.

- Best for IRAs: Lear Capital – Faster setup, transparent fees, and robust investor features.