APMEX

Storage Fees

Min. Investment

Our Rating

Established

- Overview

- Pros & Cons

- FAQ

Founded in 2000 in Oklahoma City, APMEX started as a small operation buying and selling precious metals on eBay. Over the years, it has grown into a billion-dollar business, serving investors and collectors across the U.S. and internationally.

What makes APMEX stand out is its massive inventory, offering everything from gold and silver bullion to rare coins and collectibles.

In addition to physical gold and silver, APMEX offers digital precious metals through OneGold, a platform developed in partnership with Sprott. Additional useful features include secure storage and Autoinvest.

However, while APMEX is well-known in the precious metals industry, its below-average customer reviews on most platforms raise concerns about its reputation and service quality.

- Huge Selection of Precious Metals

- Transparent Pricing

- Multiple Payment Options

- AutoInvest Feature

- Additional Features

- Low Customer Ratings

- 4% Fee for Certain Payments

- Minimum Sell Requirement for Buyback

- Higher Buyback Spreads

Does APMEX offer discounts for bulk purchases?

Yes, APMEX provides volume pricing discounts for bulk orders on many gold, silver, platinum, and palladium products. The more you buy, the lower the per-ounce cost.

Can I visit APMEX in person to buy metals?

No, APMEX is an online-only precious metals dealer with no physical storefront. All orders are shipped securely from their Oklahoma City headquarters.

How long does it take for APMEX to ship orders?

Most orders are processed within 1-3 business days, with QuickShip®-eligible orders shipping the next business day.

Can I buy fractional gold and silver from APMEX?

Yes, APMEX offers fractional gold coins (1/10 oz, 1/4 oz, etc.) and small silver bars and rounds, perfect for budget-conscious investors.

Products | Services | ||

|---|---|---|---|

Gold IRA Accounts | Transparent Pricing | ||

Silver IRA Accounts | Storage Options | ||

Direct Purchase | Free Shipping | ||

Buy Metals Online | International Shipping | ||

Physical Delivery | Mobile App | ||

Price Match Guarantee | Cryptocurrency Payment | ||

Buyback Guarantee | Live Chat |

APMEX Reputation: Not Among The Top Rated Platforms

While APMEX holds a strong presence in the precious metals industry, its below-average customer reviews on multiple platforms create doubts about its reputation and customer service:

Platform | Rating |

|---|---|

Trustpilot

| 1.7 (7,966 reviews) |

Better Business Bureau (BBB) | A+ | Accredited Since 2004 |

Consumer Affairs | 2.8 (290 reviews) |

Most competitors we reviewed have significantly higher ratings on both Trustpilot and Consumer Affairs.

Finding a trustworthy gold broker isn’t always easy, especially when there customer reviews are mixed.

APMEX Gold IRA: How Does It Work?

APMEX makes it easy for investors to set up a Gold IRA by offering a variety of IRA-eligible precious metals and working with trusted custodians.

Here’s what APMEX offers for Gold IRAs:

- Wide Selection of IRA-Eligible Metals – You can invest in gold, silver, platinum, and palladium that meet IRS purity standards. Popular options include gold bars (.995+ purity) and gold coins (.999+ purity, excluding U.S. Gold Eagles).

- Trusted IRA Custodians – APMEX partners with established custodians like Equity Institutional, GoldStar Trust, Entrust Group, and Strata Trust Company to help you set up and manage your account.

- Easy Rollover Process – Already have an existing IRA or 401(k)? APMEX helps roll over funds into a precious metals IRA without tax penalties.

- Secure Storage – Since you can’t store IRA metals at home, APMEX works with IRS-approved depositories, ensuring safe, insured storage.

With a Gold IRA, you can add physical gold to your retirement plan, helping to safeguard your wealth from market volatility.

Wide Selection: Coins, Bars & Rare Collectibles

APMEX is one of the largest precious metals dealers in the U.S., offering an extensive range of physical products to cater to both investors and collectors.

-

Gold Products

- Gold Bullion Coins – APMEX offers a variety of government-minted gold coins from around the world, including the American Gold Eagle, Canadian Gold Maple Leaf, South African Krugerrand, and Austrian Philharmonic.

- Gold Bars – Investors can choose from a wide selection of gold bars ranging from 1 gram to 1 kilogram, produced by trusted refineries such as PAMP Suisse, Valcambi, and the Royal Canadian Mint.

- Gold Rounds – Similar to coins but privately minted, gold rounds provide an alternative investment option with lower premiums over the spot price.

- Pre-1933 Gold Coins – Historic U.S. gold coins, such as the Saint-Gaudens Double Eagle and Liberty Head, appeal to both investors and numismatic collectors.

- Fractional Gold – Available in sizes below one ounce, fractional gold coins and bars offer a more affordable entry point into gold investing.

-

Silver Products

- Silver Bullion Coins – Popular options include the American Silver Eagle, Canadian Silver Maple Leaf, and British Silver Britannia, all backed by their respective governments.

- Silver Bars – Ranging from 1 ounce to 100 ounces, silver bars are ideal for bulk investment and come from reputable brands like Engelhard and Johnson Matthey.

- Silver Rounds – Private mints produce these rounds, often at lower premiums than government-minted coins, making them a cost-effective way to invest in silver.

- Junk Silver – Includes pre-1965 U.S. dimes, quarters, and half-dollars with 90% silver content, valued for their silver content rather than their face value.

- Collectible Silver Coins – Special editions, proof sets, and limited-mintage coins from world mints provide numismatic value beyond just silver content.

-

Platinum & Palladium Products

- Platinum/Palladium Coins – APMEX carries platinum coins such as the American Platinum Eagle and Canadian Platinum Maple Leaf, providing an alternative investment in precious metals.

- Platinum/Palladium Bars – These bars come in various sizes and are sourced from recognized mints like Credit Suisse and PAMP Suisse.

-

Numismatic & Rare Coins

- Certified Coins – Graded and authenticated by reputable services like NGC and PCGS, these coins hold collector value beyond metal content.

- World Coins – APMEX features an extensive selection of historic and modern coins from different countries, including European gold ducats and Chinese Pandas.

- Commemorative Coins – Specially issued coins that celebrate historical events, anniversaries, or famous figures, often in limited mintage.

-

Jewelry & Gifts

- Gold & Silver Jewelry – APMEX offers investment-grade jewelry, including chains, bracelets, and pendants crafted from pure gold and silver.

- Gifts & Collectibles – Customers can find unique gift items like silver bullion notes, themed coin sets, and holiday-themed precious metals.

Buying a physical can be a good alternative to a gold IRA.

APMEX Fees & Pricing

APMEX maintains transparent pricing, displaying all costs upfront on its website:

Fee | Cost |

|---|---|

Shipping Fee | $9.95 (Free for orders $199+) |

Storage Fees | About 0.55% annually |

Paypal/Credit Card/Crypto Fee | 4% |

Order Cancellation Fee | $35 + Market Loss Fee |

Overall, APMEX’s pricing is competitive, especially for large orders, but buyers should be mindful of payment method surcharges and storage fees.

APMEX Features For Gold Investors

As a leading player in the gold industry, APMEX offers a range of valuable and unique features for gold investors.

Here are the key ones to know:

APMEX AutoInvest

One of the biggest challenges with investing in physical precious metals is the lack of automation.

APMEX solves this with its AutoInvest feature, allowing customers to set up recurring purchases.

- Flexible Scheduling: Investors can schedule purchases weekly, biweekly, monthly, or quarterly.

- Diverse Product Selection: Works with gold, silver, platinum, and palladium, including IRA-eligible metals.

- Risk Reduction: AutoInvest helps reduce market timing risks by averaging out purchase costs over time.

This feature is especially useful for those who want to gradually accumulate precious metals without manually placing orders.

The Bullion Card – APMEX’s Rewards Credit Card

APMEX offers an industry-first rewards credit card, known as The Bullion Card, which allows users to earn precious metals as rewards instead of cash back or travel points.

- High Cashback Rates: 4% back in gold or silver on all APMEX purchases and 1% back on other everyday purchases.

- Bonus Rewards: 15,000 bonus points (worth about $150 in precious metals) after spending $1,500 in 90 days.

- 0% APR: Introductory 0% APR for the first six months, with no annual fee.

Unlike other rewards cards, where points devalue over time, gold and silver historically retain their value and even appreciate.

This makes The Bullion Card an attractive option for investors who frequently buy precious metals and want to accumulate wealth passively while making everyday purchases.

OneGold – Digital Precious Metals Ownership

APMEX, in partnership with Sprott, developed OneGold, a platform that allows investors to buy, sell, and store digital gold, silver, and platinum without physically handling metals.

- Secure Storage: Metals are stored in highly secure vaults, including Loomis International and Royal Canadian Mint.

- Lower Fees: Gold storage costs just 0.12% annually, significantly lower than traditional ETFs.

- Instant Liquidity: Investors can buy and sell at any time without holding physical metals.

- Mobile Access: Available through the OneGold mobile app, making trading simple and efficient.

OneGold bridges the gap between physical metal ownership and digital convenience, offering investors a way to hold precious metals without dealing with shipping or storage concerns.

For investors debating gold vs. Bitcoin as the best hedge against inflation, APMEX provides a reliable way to buy, store, and sell physical gold with transparent pricing.

Secure Storage with Citadel Depository

For those who don’t want to store gold and silver at home, APMEX offers secure storage through Citadel Global Depository Services, a subsidiary managed by Brink’s.

- Fully Insured: Storage is protected against theft, damage, or loss for added security.

- Low Storage Fees: Starting at 0.55% annually, making it a cost-effective alternative to ETFs.

- Free Storage Transfers: No shipping fees for APMEX orders over $500 stored directly in Citadel.

- Easy Access & Withdrawals: Customers can request delivery at any time.

- 24/7 Account Access: Online portfolio management with real-time valuation tools.

With Citadel, investors get the benefits of physical metal ownership without the security risks of home storage.

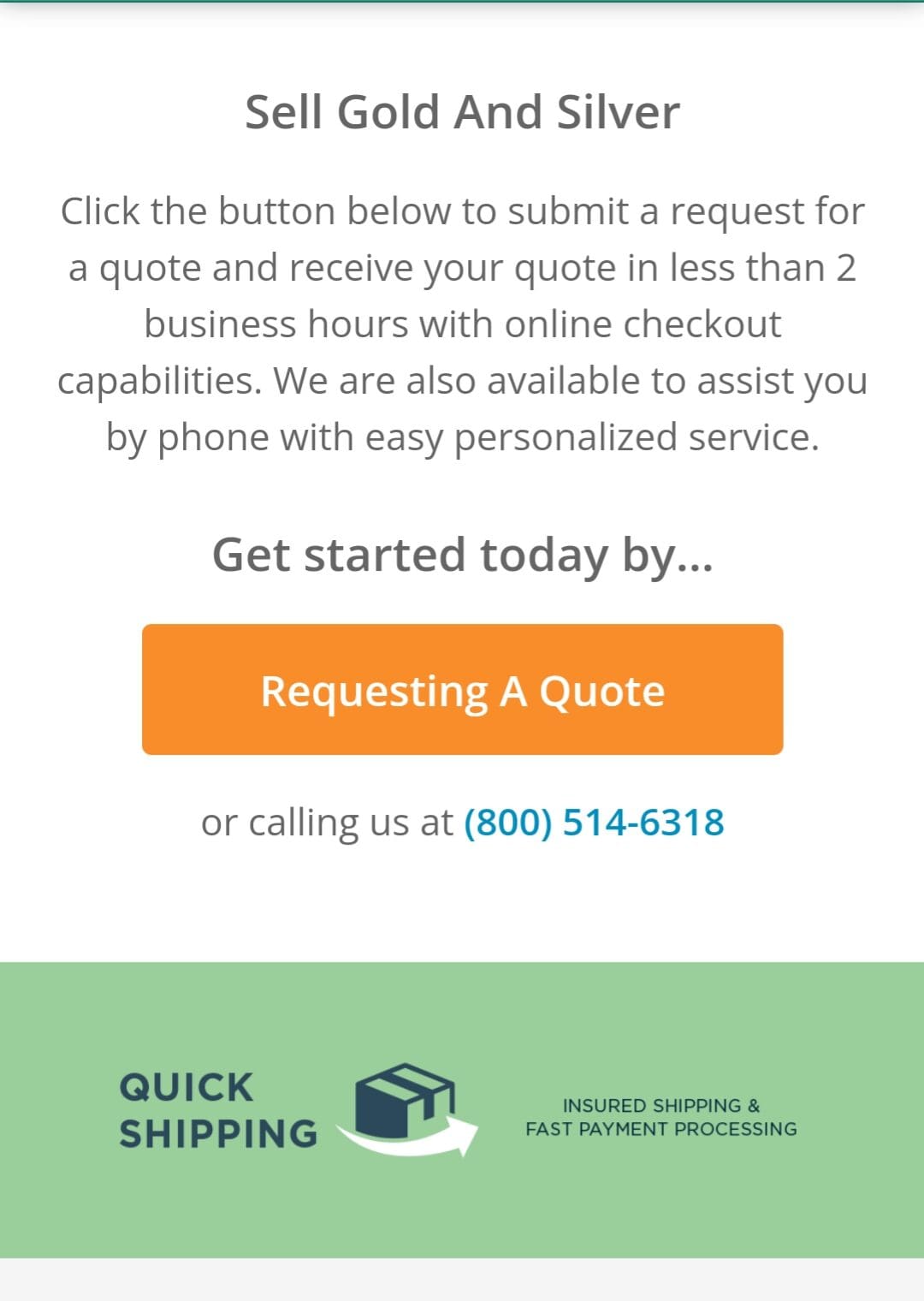

Buyback Program – Sell Your Gold & Silver Back to APMEX

APMEX’s Sell to Us program allows investors to quickly liquidate their metals at market-driven prices.

- Instant Quotes: Get an instant online price quote without calling customer service.

- Discounted Shipping: UPS offers reduced shipping costs for selling metals back.

- Guaranteed Buyback: Eligible metals qualify for APMEX’s guaranteed buyback program, ensuring liquidity.

- Same-Day Payment: Once received and verified, payments are processed the same day.

Even if you didn’t buy your gold from APMEX, their buyback program makes it one of the best places to sell your gold quickly and securely.

APMEX Club – Loyalty Rewards Program

APMEX rewards frequent buyers through APMEX Club, offering perks based on purchase history.

- Free Membership: Automatically activated after placing two orders or spending $5,000.

- Tiered Benefits: Four membership levels—Select, Premier, Elite, and VIP—with increasing rewards.

- Exclusive Perks: Enjoy early sale access, faster shipping, discounts, and personalized account management.

This program enhances the investing experience, making it more cost-effective and rewarding gold broker for loyal customers.

QuickShip® – Faster Order Processing

APMEX’s QuickShip® program ensures next-day processing for eligible orders, making delivery faster.

- Fast Order Fulfillment: Select products ship out the next business day after payment is processed.

- Eligible Payment Methods: Orders paid via debit card, credit card, or bank wire qualify for QuickShip®.

- Processing Guarantee: If APMEX fails to ship on time, customers receive a $10 credit.

For investors who want quick access to precious metals, QuickShip® helps reduce wait time

Multiple Payment Options, Including Cryptocurrency

APMEX provides various payment options, making it convenient for all investors.

- Traditional Payments: Accepts credit/debit cards, PayPal, bank wires, checks, and eChecks.

- Crypto Payments: Buy metals using Bitcoin, Ethereum, and Dogecoin via BitPay.

- Payment Discounts: 4% discount for check, eCheck, or wire payments, removing card processing fees.

With these flexible options, APMEX appeals to both traditional investors and crypto enthusiasts.

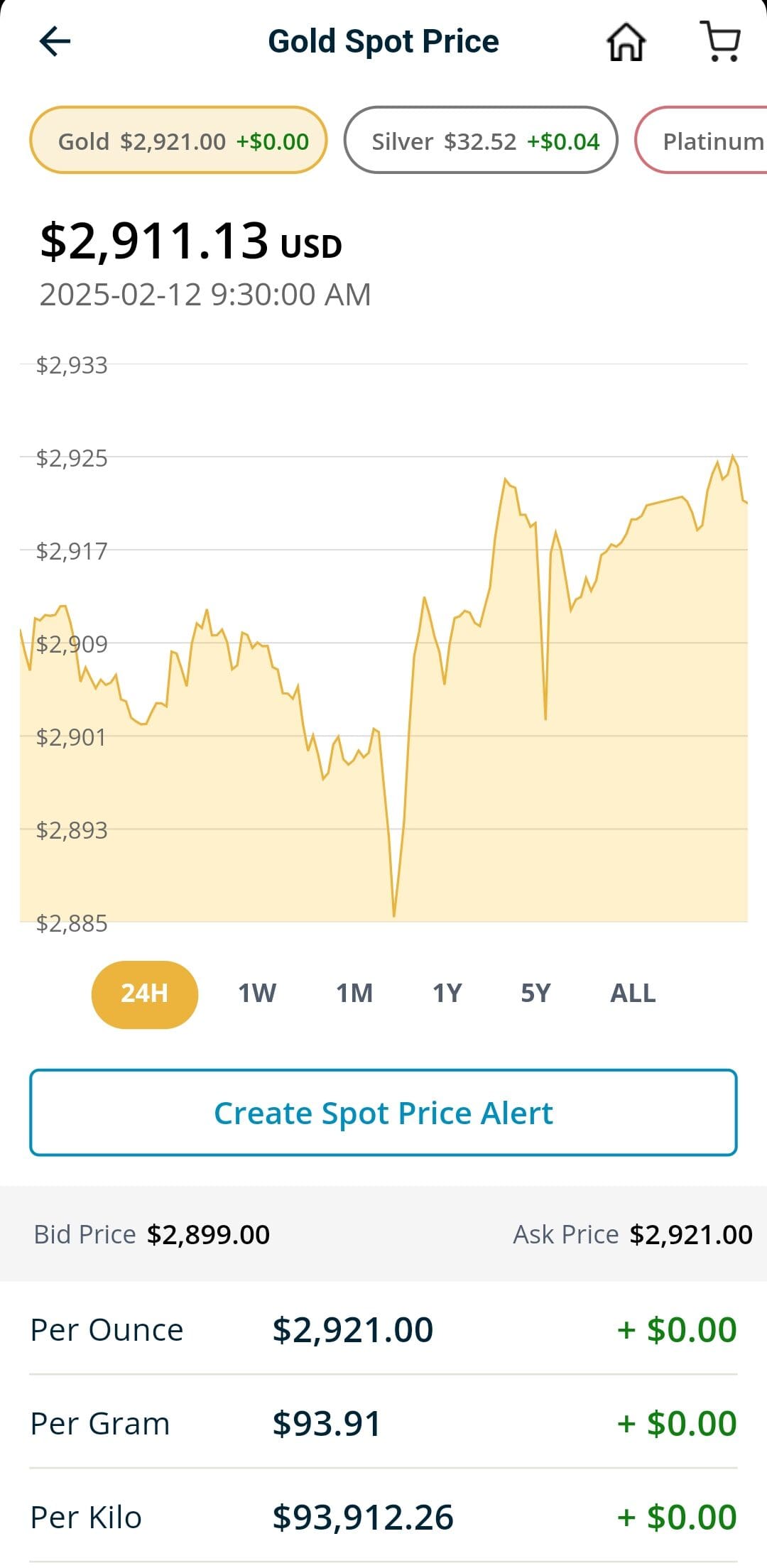

Precious Metals Portfolio Tool – Track Your Investments

APMEX’s Portfolio Tool helps investors manage and track their precious metal holdings.

- Comprehensive Tracking: Users can track both APMEX purchases and externally bought metals.

- Real-Time Valuation: Provides live updates on portfolio value based on spot prices.

- Price Alerts & Performance Analysis: Investors can set alerts and monitor gains/losses over time.

This tool simplifies portfolio management, ensuring that investors stay on top of their investments.

Customer Service

APMEX provides multiple customer support channels, including phone and email support. Live chat support is also available, which is excellent for users who need real-time support.

Contact Option | Details |

|---|---|

Phone Support | 800-375-9006 (Purchases/Gold IRA) | 800-492-9144 (OneGold) |

Email Support | service@apmex.com |

Live Chat | Available on the website |

Availability | Monday–Friday, 8 AM – 8 PM CST |

Website & App Experience

APMEX provides a smooth and user-friendly experience, making it easy for both beginners and experienced investors to navigate their website. The site is well-organized, with clear product categories and a straightforward checkout process.

The platform offers a mobile app for iOS and Android, allowing users to manage their portfolios, track market prices, and make purchases on the go.

Investors can also set up price alerts and restock notifications, ensuring they don’t miss key buying opportunities.

Educational resources, including market news, investment guides, and a learning center, help users make informed decisions.

Pros & Cons

APMEX stands out in several areas, but like any gold broker, it has both strengths and limitations. Here’s a closer look at what it does well and where it could improve.

- Huge Selection of Precious Metals

APMEX offers one of the largest inventories of gold, silver, platinum, and palladium, including bullion, coins, rounds, and rare collectibles.

- Transparent Pricing

APMEX lists all prices online, making it easy to compare products and track market fluctuations.

- Multiple Payment Options

You can pay with credit/debit cards, PayPal, bank wire, checks, eChecks, and even cryptocurrency via BitPay.

- AutoInvest Feature

APMEX makes it easy to schedule recurring purchases, helping investors build their portfolio over time without manually placing orders.

- Additional Features

Buyback program, OneGold, free shipping for $199+ orders, APMEX loyalty club and its Bullion credit card are just part of the additional features it offers.

- Low Customer Ratings

APMEX suffers from relatively low customer ratings across most platforms we've checked, such as TrustPilot and Consumer Affairs.

- 4% Fee for Certain Payments

Payments made via credit cards, PayPal, or cryptocurrency incur a 4% fee, making bank wire or check payments a better deal.

- Minimum Sell Requirement for Buyback

APMEX requires a minimum of $1,000 worth of metals to use its buyback program, which may not be ideal for small-scale investors.

- Higher Buyback Spreads

While APMEX offers a buyback program, some customers report that the prices offered are lower than expected compared to market rates.

Step-by-Step Guide to Buying Gold on APMEX

Whether you’re opening a Gold IRA or purchasing physical precious metals, APMEX provides a smooth investment experience. Here’s a detailed step-by-step guide to help you through the process.

-

Investing in a Gold IRA

If you’re looking to add gold to your retirement portfolio, APMEX makes it simple with its Gold IRA setup process. Here’s how it works:

Step 1: Open a Gold IRA Account

Start by choosing an IRS-approved custodian. APMEX works with companies like Equity Institutional, GoldStar Trust, and Strata Trust to help you set up an account. You’ll need to fill out an application and provide basic personal information.

Step 2: Fund Your Account

You can fund your IRA by rolling over an existing 401(k) or IRA, or by making a new contribution. The process is IRS-compliant, ensuring no tax penalties.

Step 3: Choose Your Gold

Once your account is funded, you can select from IRA-eligible gold products, such as gold bars (99.5%+ purity) and approved gold coins (except U.S. Gold Eagles).

Step 4: Secure Storage

IRS rules require that IRA gold be stored in an approved depository, such as Brink’s through Citadel Global Depository Services. APMEX helps arrange this storage.

Step 5: Manage & Monitor

You can track your IRA metals’ value online and sell or withdraw as needed.

-

Investing in Physical Gold with APMEX

If you want to own gold directly, APMEX offers a straightforward process to buy and store it.

Step 1: Browse & Choose Your Gold

Visit APMEX’s website or mobile app to explore their gold bars, coins, and rounds. You can filter by weight, mint, or price range to find the right investment.

Step 2: Place Your Order

Add items to your cart and complete the checkout process. APMEX accepts credit/debit cards, PayPal, bank wires, eChecks, and even cryptocurrency. Payments via wire or check receive a 4% discount.

Step 3: Secure Delivery or Storage

Once payment clears, your order is shipped securely. Orders over $199 qualify for free shipping, and eligible orders may qualify for QuickShip® next-day processing. If you prefer not to store gold at home, APMEX offers insured storage through Citadel, managed by Brink’s.

Step 4: Manage Your Holdings

Use APMEX’s portfolio tracking tools to monitor your investment and set up price alerts to buy or sell at the right time.

FAQ

Some transactions may require IRS reporting, especially large purchases or sales of certain metals. APMEX complies with all U.S. regulations but does not report routine purchases.

Yes, but cancellations incur a $35 cancellation fee plus any potential market loss, meaning you may pay more if metal prices drop after your order is locked in.

Yes, APMEX partners with Citadel Global Depository Services to provide fully insured, high-security storage for precious metals.

Yes, APMEX ships to over 30 countries, but international customers are responsible for any taxes, duties, and customs fees.

Review Gold Dealers For Direct Purchase & Gold IRA

How We Rated Gold & Silver Dealers: Review Methodology

At The Smart Investor, we evaluated gold brokers & dealers based on their overall value, pricing transparency, and investment options compared to other leading alternatives. Our hands-on testing focused on key factors that matter most to precious metals investors, including fees, security, product selection, and IRA investment options. Each broker was rated based on the following criteria:

- Pricing & Fees (15%): We prioritized brokers with transparent pricing, low markups on gold and silver, and fair premiums. Some platforms had hidden costs, including storage and liquidation fees.

- User Experience & Buying Process (20%): A smooth, intuitive, and secure buying process scored highest. Some brokers had complex procedures, slow transactions, or unclear order processing.

- Reputation & Ratings (10%): We factored in customer reviews, industry ratings, and regulatory compliance. Highly rated brokers had strong reputations for reliability, trustworthiness, and investor protection. Some had mixed reviews or unresolved complaints.

- Customer Support & Service (15%): We tested response times, availability, and helpfulness of support via phone, chat, and email. The best brokers provided knowledgeable assistance with fast, professional service, while others were slow or unresponsive

- Security & Storage Options (10%): We favored brokers offering secure vault storage, insured holdings, and direct delivery options. Some lacked proper security measures, increasing investment risks.

- IRA & Retirement Investment Options (20%): The best brokers offered Gold & Silver IRA accounts with IRS-approved metals, simple setup, and rollover assistance. Some lacked IRA services or charged high fees.

- Precious Metals Selection (10%): We rated brokers higher if they offered a wide range of gold and silver products, including bullion, coins, and bars. Some had limited selections, restricting investment choices.