Table Of Content

What Is an Investment Portfolio and Why Is It Important?

An investment portfolio is a collection of financial assets—such as stocks, bonds, mutual funds, real estate, or ETFs—owned by an individual or institution.

It represents the investor's strategy to grow wealth, manage risk, and meet specific financial goals like retirement, home ownership, or passive income.

Building a well-diversified portfolio is essential because it spreads risk across different asset types and markets.

For example, if tech stocks underperform, bond investments might help stabilize your overall returns.

Without a portfolio strategy, investors may fall into emotional or reactive decisions, which can lead to poor long-term results.

How to Build an Investment Portfolio: Step-by-Step

Before diving in, building a portfolio means aligning your financial goals with the right mix of assets, strategy, and risk tolerance.

Step 1: Define Your Financial Goals and Time Horizon

Start by identifying what you're investing for—retirement, a down payment, or your child’s education—and how long you have to achieve it.

For instance, someone saving for a home in 3 years will need more conservative investments than someone investing for retirement in 30 years.

Ask yourself:

How much do I need?

When do I need it?

Am I investing for growth, income, or capital preservation?

A 25-year-old aiming to retire at 60 can afford a more aggressive strategy, while a 58-year-old approaching retirement may prioritize stability. Your time horizon and goals shape every other decision in your portfolio.

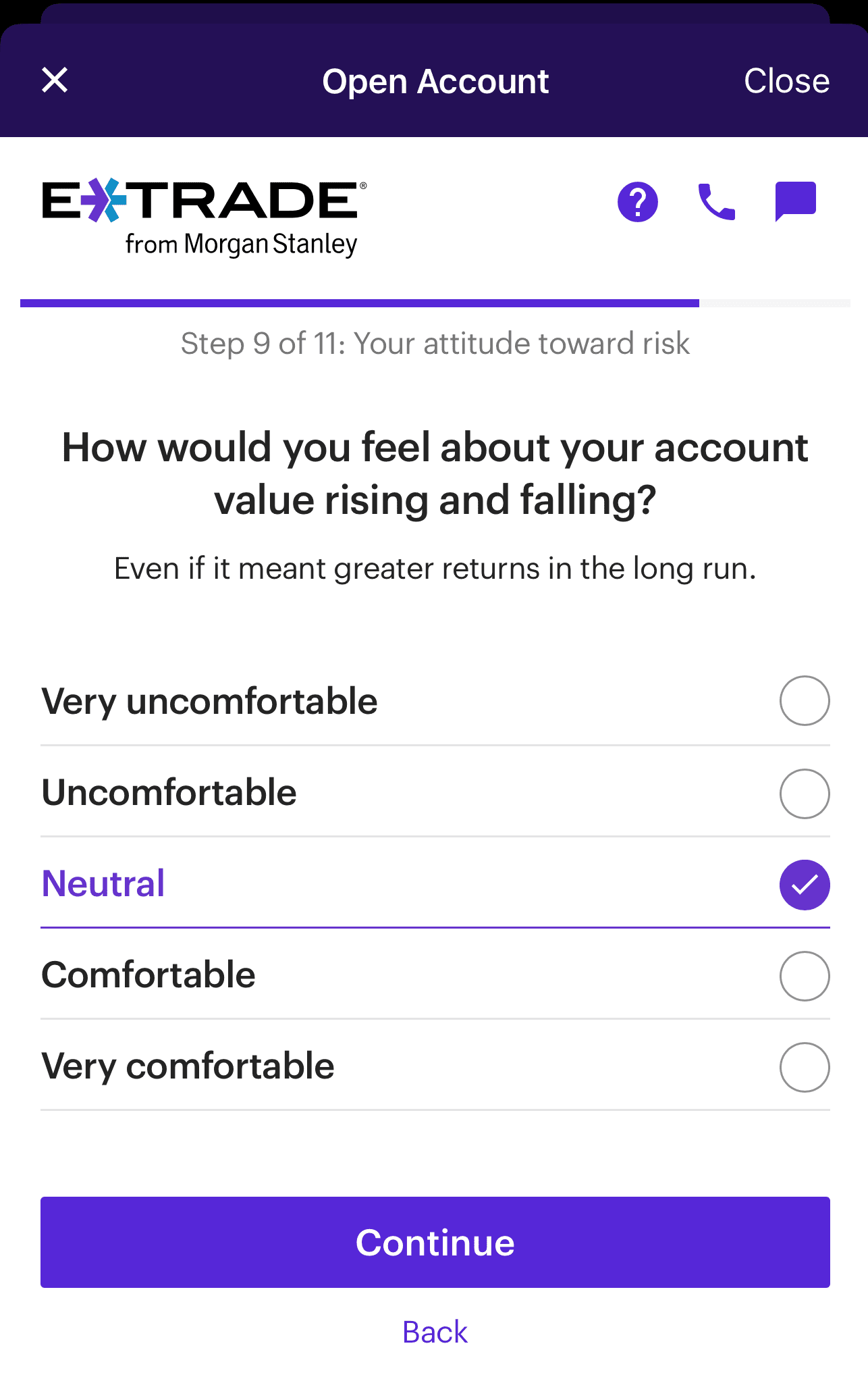

Step 2: Determine Your Risk Tolerance

Risk tolerance refers to how much volatility you're comfortable with. A risk-averse investor may prefer bonds or dividend-paying stocks, while an aggressive investor might lean toward tech growth stocks.

Use tools like Vanguard’s Investor Questionnaire to assess your profile. Consider:

Emotional comfort with market fluctuations

Past investing experience

How losses might affect your lifestyle or goals

For example, during the 2020 market crash, investors with high risk tolerance held their positions or even bought more, while others panic-sold. Understanding your own reactions helps you create a portfolio you can stick with during tough times.

Step 3: Choose an Asset Allocation Strategy

Asset allocation is the process of dividing your portfolio among asset classes—usually stocks, bonds, and cash. The right mix balances growth potential with risk based on your goals and risk tolerance.

Here are sample allocations:

Aggressive: 80% stocks, 15% bonds, 5% cash

Balanced: 60% stocks, 30% bonds, 10% cash

Conservative: 40% stocks, 50% bonds, 10% cash

For example, someone in their early 30s may go with an aggressive mix to maximize long-term growth. In contrast, a retiree may shift toward income-generating bonds.

According to FINRA, asset allocation is one of the most important decisions investors makeץ

Risk Profile | Stocks (%) | Bonds (%) | Cash (%) | Description |

|---|---|---|---|---|

Aggressive | 80 | 15 | 5 | High-growth potential, suitable for long-term investors |

Moderate | 60 | 30 | 10 | Balanced risk-return profile, ideal for mid-range goals |

Conservative | 40 | 50 | 10 | Emphasizes capital preservation and income for near-term financial goals |

Retiree/Income | 25 | 60 | 15 | Focuses on income and stability with minimal equity exposure |

Step 4: Select Specific Investments

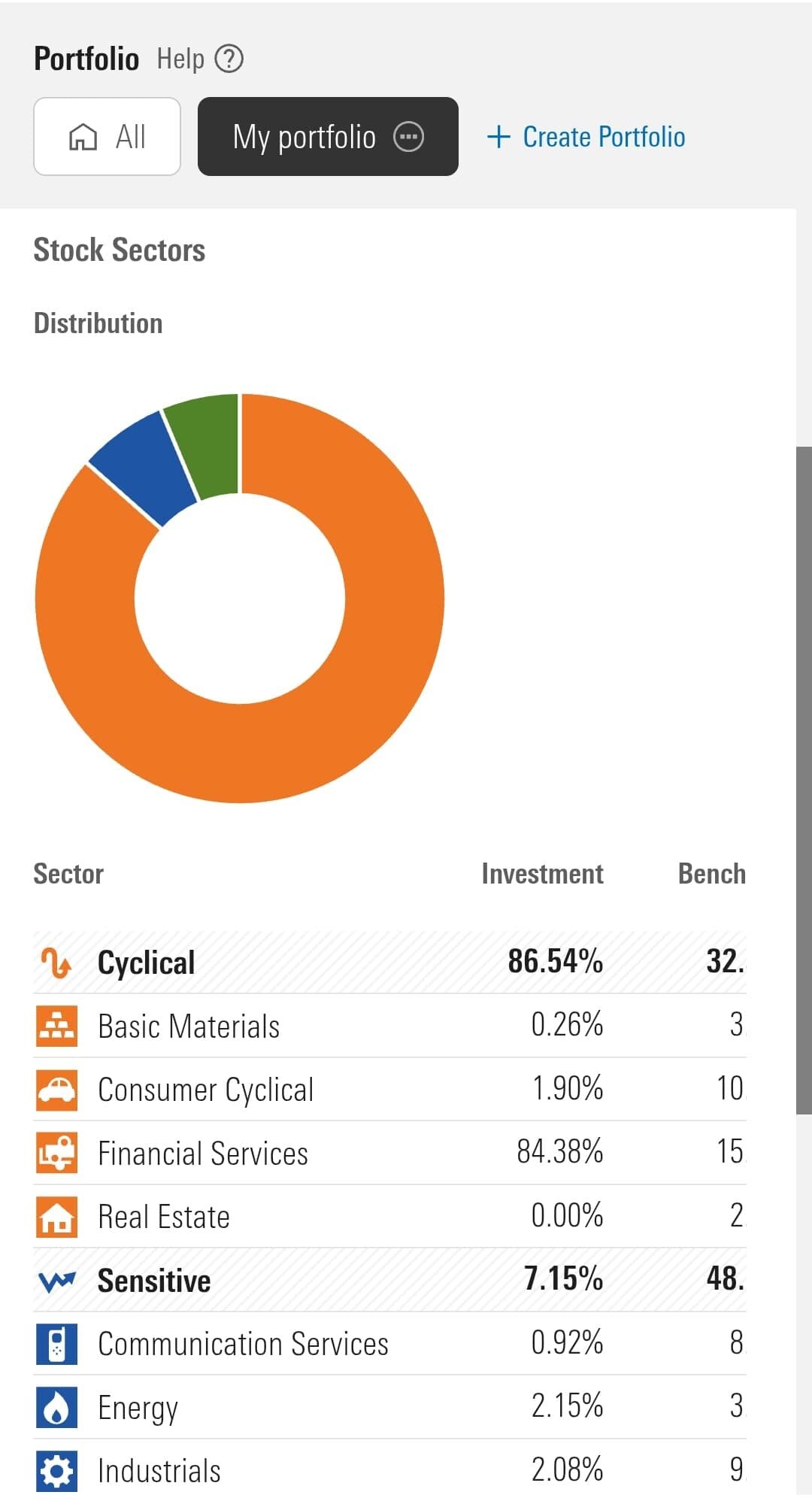

After setting your allocation, choose the actual investments—like index funds, ETFs, or individual securities—that fit each category.

Tips:

Use low-cost index funds or ETFs to gain broad exposure

Diversify across sectors (tech, healthcare, energy, etc.)

Don’t overlook international exposure or REITs for real estate.

For example, if your stock allocation is 60%, you might invest 40% in a total U.S. market ETF and 20% in an international ETF. This approach reduces reliance on a single market. Always review fund fees (expense ratios) before investing.

Step 5: Monitor and Rebalance Regularly

Markets fluctuate, so your portfolio’s allocation can drift over time. Rebalancing involves adjusting your holdings to return to your original target mix.

Rebalance when:

Your allocation is off by 5% or more

Annually or semi-annually, depending on market conditions

Major life events change your goals or risk tolerance

Say your aggressive 80/20 stock-bond mix becomes 88/12 after a strong stock rally. Rebalancing by selling stocks and buying bonds helps reduce future downside risk. Tools like robo-advisors or portfolio trackers can automate this process.

Tips for Building an Investment Portfolio

Creating a strong investment portfolio means combining discipline, diversification, and strategy—while tailoring each decision to your personal financial situation.

Focus on diversification: Don’t rely too heavily on one stock or sector. For example, instead of holding only tech stocks, spread your money across different industries or asset classes like healthcare, bonds, and international equities.

Start with low-cost index funds: Index funds and ETFs offer broad market exposure and usually come with lower fees, which means more of your money stays invested.

Automate your investing: Setting up automatic monthly contributions helps build your portfolio steadily and removes emotional decision-making from the process. A $200 monthly contribution can grow significantly over 20 years, even during market dips.

Review your portfolio after major life events: If you change jobs, buy a home, or have a child, your goals and risk tolerance may shift—requiring portfolio adjustments.

According to the SEC, regularly reviewing your goals and adjusting your portfolio is key to long-term investment success

How to Monitor and Adjust Your Portfolio Over Time

Maintaining an investment portfolio isn’t set-and-forget—it’s about staying on track as markets shift and your financial goals evolve.

Action Item | Frequency | Why It Matters |

|---|---|---|

Rebalance portfolio | Every 6–12 months | Keeps asset allocation aligned with goals and risk tolerance |

Review investment performance | Quarterly | Identifies lagging investments and areas for potential improvement |

Assess life changes | As needed | Updates strategy after major events like marriage, job change, or new goals |

Check fees and expenses | Annually | Reduces unnecessary costs and improves long-term growth |

-

Rebalance at Least Once a Year

Over time, your asset allocation can drift. For instance, a 60/40 portfolio could become 70/30 if stocks outperform, exposing you to more risk than intended.

-

Use Performance Benchmarks

Compare your funds against market indexes like the S&P 500 to determine whether they’re underperforming or worth keeping.

A consistently lagging mutual fund may be replaced with a better-performing ETF.

-

Adjust For Changing Goals

If you're 10 years from retirement instead of 30, it may be time to reduce risk by shifting into bonds or dividend stocks.

-

Track Expenses and Taxes

High-fee funds or tax-inefficient investments can erode gains. Using a tax-advantaged account like a Roth IRA can boost your net returns.

FAQ

Taxes can impact returns, especially in taxable accounts. Consider using tax-advantaged accounts like Roth IRAs and being aware of capital gains rules.

Active investing involves selecting specific stocks or timing the market, while passive investing uses index funds to track the market with lower fees. Passive is often better for long-term investors.

You can, but it increases your exposure to market volatility. A diversified portfolio that includes bonds, cash, or other assets is typically more balanced.

Adding funds regularly—like monthly or after each paycheck—can help grow your portfolio consistently. This approach also supports dollar-cost averaging.

An emergency fund should be separate from your investment portfolio. It helps you avoid selling assets during a downturn if you need quick cash.

Individual stocks offer control but come with higher risk. Funds like ETFs and mutual funds provide diversification, which can reduce risk for most investors.

You can invest in real estate through REITs (Real Estate Investment Trusts) without owning property directly. REITs provide exposure to the real estate market and pay dividends.

Taxable accounts require you to pay taxes on gains yearly, while tax-deferred accounts like 401(k)s or IRAs let your investments grow tax-free until withdrawal.

Yes, crypto can be a small part of a diversified portfolio. Limit exposure due to its high volatility, and use trusted platforms or crypto ETFs.