Table Of Content

When securing your crypto assets, choosing between a hot wallet and a cold wallet is essential. Each offers different levels of convenience, accessibility, and protection against online threats.

Hot Wallet vs. Cold Wallet: Key Differences

Understanding the difference between hot and cold wallets is key to safely storing and managing your crypto investments in any environment.

Feature | Hot Wallet | Cold Wallet |

|---|---|---|

Internet Connectivity | Always online | Offline (except when connected manually) |

Accessibility | Instant access, ideal for active use | Slower access, best for long-term storage |

Security Risk | Higher (due to online exposure) | Lower (not connected to internet) |

Cost | Free (most apps) | $50–$200+ for hardware wallets |

Ideal Use Case | Trading, DeFi, NFTs, daily transfers | HODLing, large balances, institutional use |

-

Internet Connectivity and Risk Exposure

Hot wallets are always connected to the internet, while cold wallets operate offline. This fundamental difference impacts everything from usability to security.

Hot Wallets Are Online-Based: They include mobile apps, browser extensions, and web wallets that allow instant access and quick transactions.

Cold Wallets Operate Offline: They store private keys in devices like hardware wallets or paper, isolating them from online threats.

Online Access Means Higher Risk: Because hot wallets are exposed to the internet, they’re more vulnerable to hacks, malware, or phishing attacks.

As a result, cold wallets are better suited for long-term storage and security-conscious users. But if you trade frequently, a hot wallet may offer needed flexibility.

-

Accessibility and Ease of Use

The way users interact with each type of wallet can affect daily crypto activities like trading, staking, or transferring funds.

Hot Wallets Are Convenient: They’re user-friendly, typically requiring just a few taps to send or receive crypto.

Cold Wallets Require Physical Access: You often need to plug in a USB device or scan QR codes, which can slow down access.

Cold Wallets Don’t Support Quick Swaps: Unlike many hot wallets, they aren’t connected to DeFi platforms or real-time exchanges.

Hot wallets offer convenience for users managing active portfolios. But if you're storing large amounts and don’t need daily access, cold wallets are a smarter choice.

-

Security Features and Backup Options

Wallets use different protection layers depending on how they are accessed and stored.

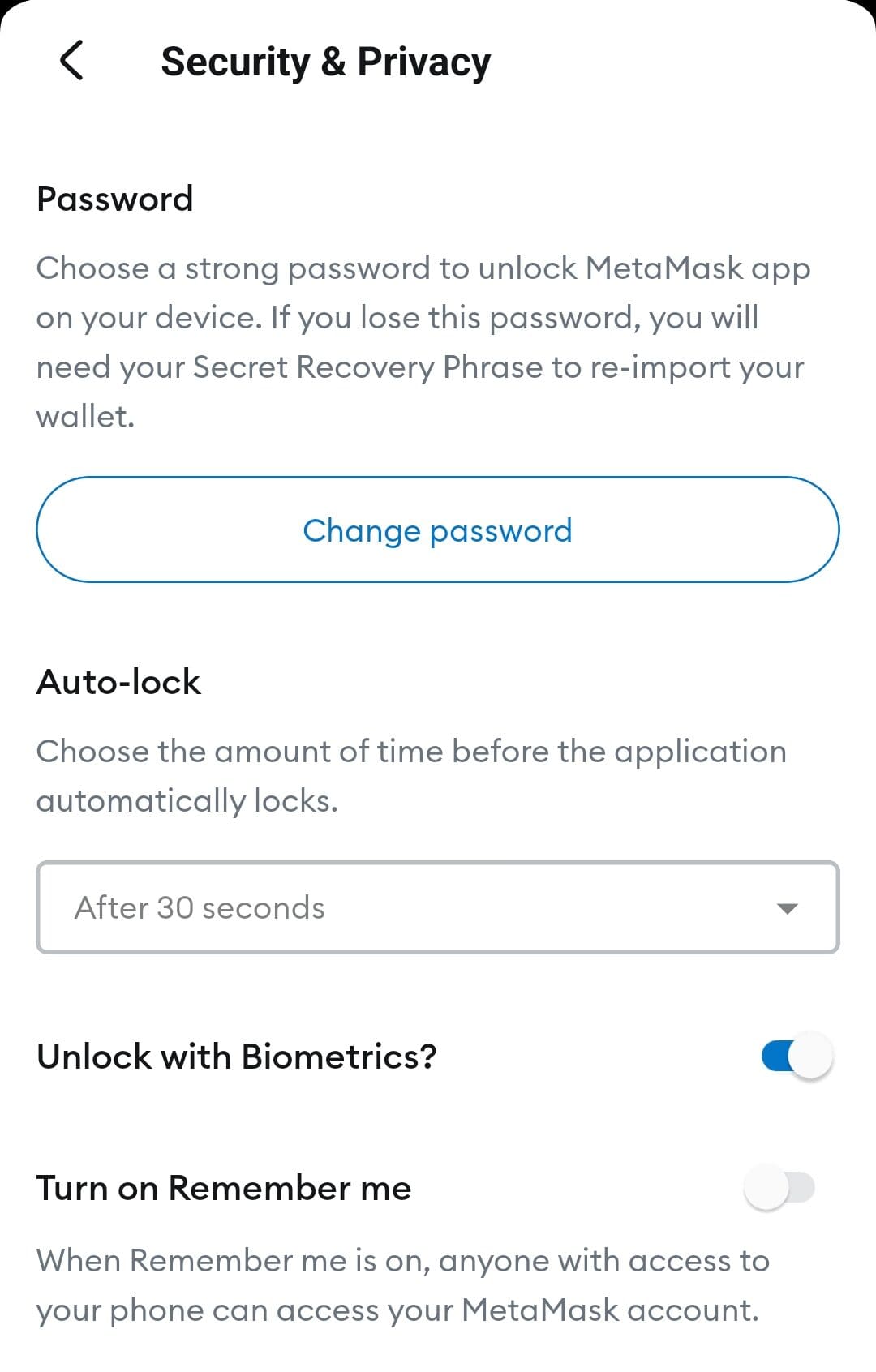

Hot Wallets Use PINs and 2FA: Platforms like MetaMask and Trust Wallet offer passcode protection, seed phrases, and biometric logins.

Cold Wallets Use Secure Chips and Isolation: Hardware wallets like Ledger or Trezor keep private keys encrypted and never expose them to the internet.

Backup Methods Vary: Hot wallets rely on cloud backups, while cold wallets require offline backups of seed phrases or physical devices.

Because cold wallets aren’t connected to any network, they minimize exposure to attacks. Still, both options require users to safeguard their backup phrases diligently.

-

Cost and Setup Requirements

The time and money needed to set up these wallets differ significantly.

Hot Wallets Are Free to Use: Most are downloadable apps that don’t require any additional equipment.

Cold Wallets Involve Upfront Costs: Hardware wallets typically cost between $50–$200, depending on the model and features.

Setup Time Is Longer for Cold Wallets: They involve installing firmware, writing down recovery phrases, and verifying device authenticity.

Although hot wallets are easy to get started with, investing in a cold wallet offers peace of mind for storing large or long-term holdings.

How to Transfer Funds Between Hot and Cold Wallets

Transferring crypto between hot and cold wallets ensures both accessibility and security, depending on your needs. Here’s how to move funds safely between the two.

Send Crypto from Cold to Hot for Trading: Use your cold wallet to generate a transaction and send it to your hot wallet address via the device’s companion app or interface.

Transfer from Hot to Cold for Long-Term Storage: Copy the receiving address from your cold wallet and use your hot wallet (like MetaMask or Trust Wallet) to initiate the transfer.

Double-Check Wallet Addresses: Always verify the destination address on both the software and the physical wallet to avoid phishing or clipboard malware.

Use Secure Internet and Avoid Public Wi-Fi: When interacting with wallets—especially hot ones—ensure your internet connection is private and secure to avoid interception.

Cold wallets often require manual approval before signing transactions, adding a layer of protection. For long-term savings, transferring assets to cold storage is a best practice.

When You May Want to Use a Hot Wallet

Hot wallets provide speed and convenience, making them ideal for active users who need instant access to their digital assets.

You Trade Frequently: Hot wallets are perfect if you're buying and selling crypto regularly on platforms like Uniswap or OpenSea.

You Use DeFi and NFTs: They seamlessly connect with decentralized apps and marketplaces, allowing you to stake tokens or mint NFTs.

You Make Daily or Weekly Transfers: Sending funds to friends, paying with crypto, or transferring to exchanges is faster with a hot wallet.

You Need to Monitor Holdings Actively: Hot wallets like Trust Wallet or MetaMask offer real-time portfolio tracking and token swaps.

Because hot wallets are connected to the internet, they allow instant access—but they’re better suited for small balances due to higher security risks.

Wallet Name | Type |

|---|---|

MetaMask | Hot |

Trust Wallet | Hot |

Trezor Model T | Cold |

Ledger Nano X | Cold |

Coinbase Wallet | Hot |

When You May Need a Cold Wallet

A cold wallet becomes essential when your crypto strategy focuses on long-term holding, high-value assets, or maximum security.

You Hold Large Crypto Balances: If you're storing significant amounts of Bitcoin, Ethereum, or stablecoins, a cold wallet protects your funds from online hacks and breaches.

You're Not Trading Frequently: When you're holding for the long haul (HODLing), there's no need for constant internet access—cold storage ensures peace of mind.

You Want to Minimize Risk Exposure: Cold wallets, like Ledger or Trezor, store your private keys offline, making them immune to phishing attacks, malware, and server-side exploits.

You're Managing Institutional or Family Funds: Organizations or individuals handling third-party or legacy crypto assets need the layered security that cold wallets provide to avoid costly mistakes or breaches.

Because cold wallets require physical confirmation for every transaction, they provide a much higher level of security than hot wallets—ideal for securing assets for years or transferring wealth securely.

FAQ

Yes, many investors use a hot wallet for active transactions and a cold wallet for long-term storage. This strategy combines flexibility with security.

Cold wallets are not connected to the internet, so they’re much harder to hack remotely. However, they can still be compromised through phishing or physical access.

If you have your recovery phrase, you can restore your wallet on a new device. Without it, your crypto is likely unrecoverable.

Hot wallets themselves are typically free to use, but you’ll still pay network fees for sending transactions, just like with cold wallets.

Most cold wallets don’t support direct staking, but you can transfer to a hot wallet for staking, then move funds back afterward.

Yes, but only for short-term use. For long-term NFT holding, consider a hardware wallet that supports NFTs, like Ledger with MetaMask.

Yes, most modern cold wallets like Ledger and Trezor support thousands of assets, including Bitcoin, Ethereum, and altcoins.

Not to store or hold crypto. You’ll only need internet access when you want to send crypto, which requires connecting the wallet.

The main risk is exposure to malware, phishing, or hacks. Therefore, always use strong passwords and enable two-factor authentication.

They’re convenient but vulnerable to malicious sites and extensions. Use reputable wallets like MetaMask and avoid unknown links.