Crypto.com Exchange

U.S. Status

Supported Coins

Our Rating

Spot Trading Fee

-

Overview

- FAQ

Crypto.com is a global cryptocurrency exchange offering +350 digital assets, making it one of the largest selections in the industry.

It provides a user-friendly mobile app, a separate web-based exchange, and additional services like a DeFi wallet, an NFT marketplace, and a Visa card with crypto cashback rewards.

The platform offers competitive trading fees, with discounts for users holding its native token, Cronos (CRO).

Users can trade with fiat currency (USD, EUR, GBP, etc.), and deposit funds via bank transfer or crypto. However, fees for credit and debit card purchases are high (up to 2.99%).

Security is a key focus, with measures like two-factor authentication (2FA), cold storage, and compliance with various global regulations.

Can I use Crypto.com Exchange without verifying my identity?

No, you must complete KYC verification to trade, deposit, or withdraw funds. Without verification, you can only browse the platform but not make transactions.

What happens if I lose access to my 2FA?

If you lose access to your two-factor authentication (2FA), you’ll need to go through Crypto.com’s account recovery process, which may take a few days. Always store your backup key safely when setting up 2FA.

Can I withdraw fiat currency from Crypto.com?

Yes, you can withdraw fiat via bank transfer (ACH, SEPA, or wire transfer). Processing times vary, but it usually takes 1-5 business days.

What happens if my withdrawal is delayed?

Crypto.com withdrawals may be delayed due to network congestion, security checks, or incomplete verification. If your funds don’t arrive within the expected time, contact Crypto.com support for assistance.

How do I reduce my trading fees on Crypto.com Exchange?

You can lower fees by increasing your 30-day trading volume or staking CRO tokens. High-volume traders and VIP members get the lowest fees.

Pros | Cons |

|---|---|

Wide Selection of Cryptocurrencies | Limited Access for U.S. Users |

Competitive Trading Fees | High Fees for Credit/Debit Card Purchases |

Strong Security & Compliance | Crypto Withdrawals Can Be Expensive |

Feature-Rich Ecosystem | No Staking for U.S. Users |

Seamless Mobile Experience | |

Institutional-Grade Storage & Trading |

Supported Cryptocurrencies & Assets

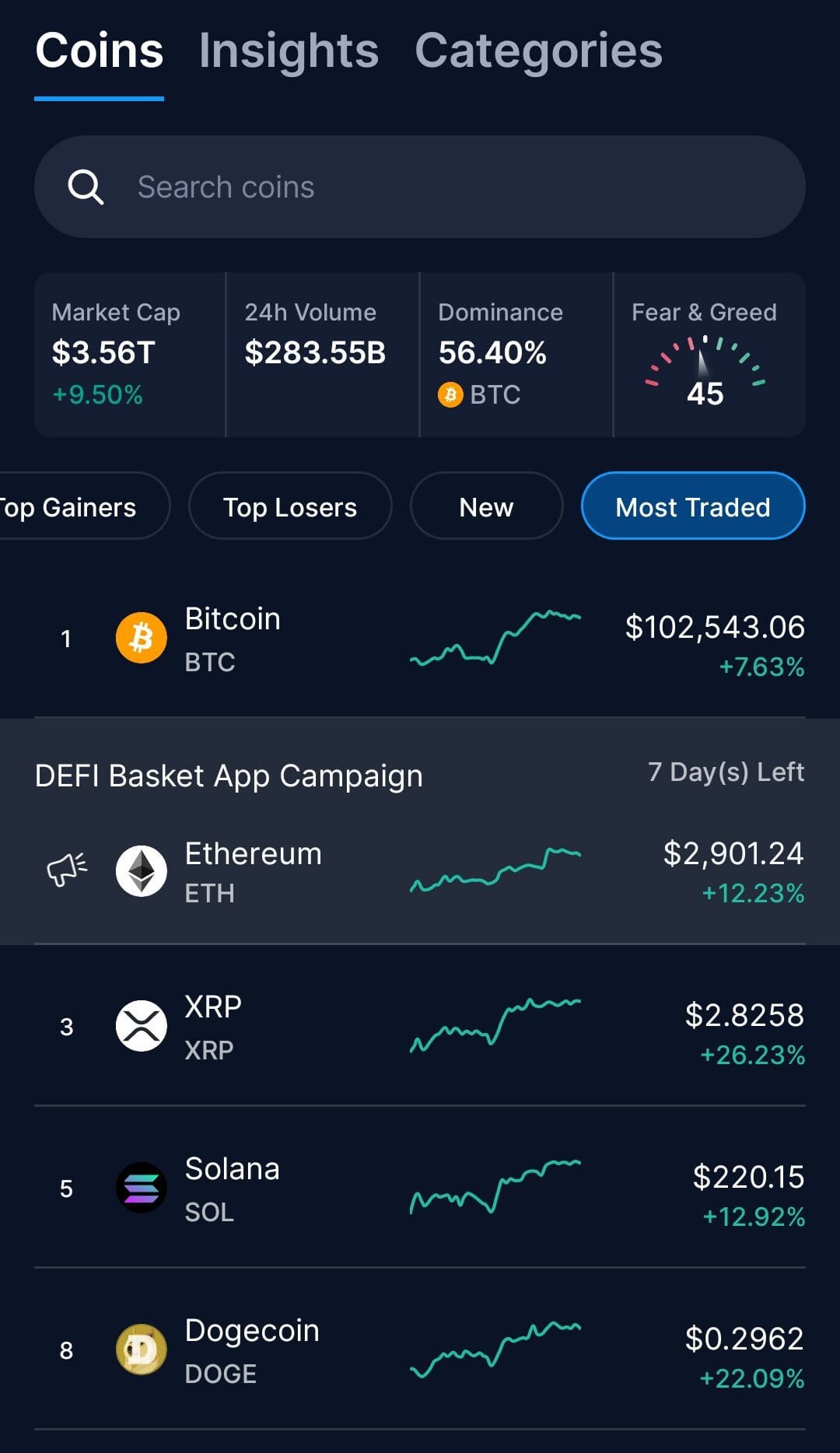

Crypto.com offers one of the largest selections of cryptocurrencies, with +350 digital assets available for trading.

This includes a mix of well-known cryptocurrencies, altcoins, stablecoins, and tokens, making it a versatile platform for investors of all levels.

The platform supports major cryptocurrencies like Bitcoin and Ethereum, as well as lesser-known and emerging coins.

It also includes several stablecoins such as USDC and USDT, which are pegged to fiat currencies and offer lower volatility.

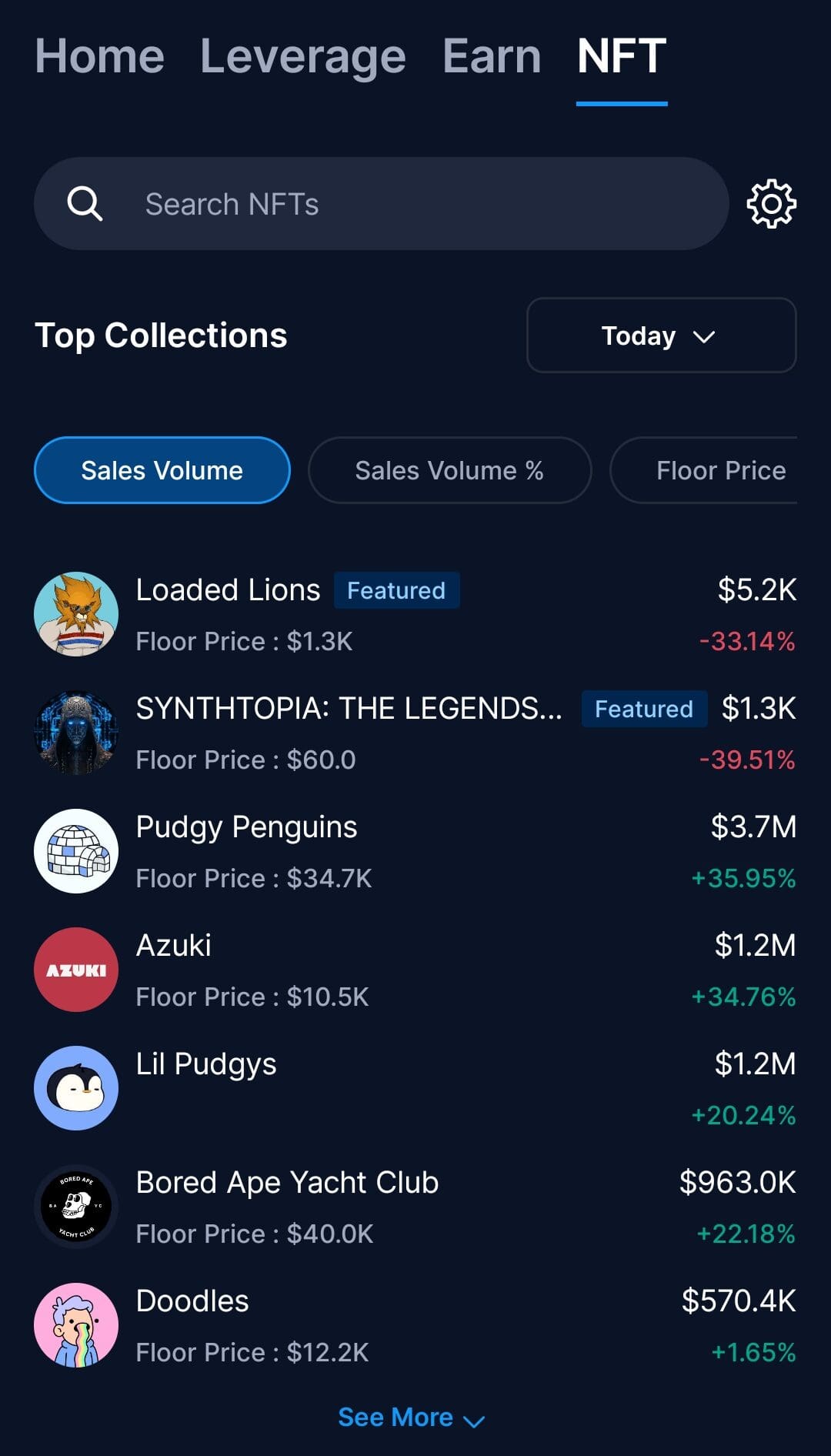

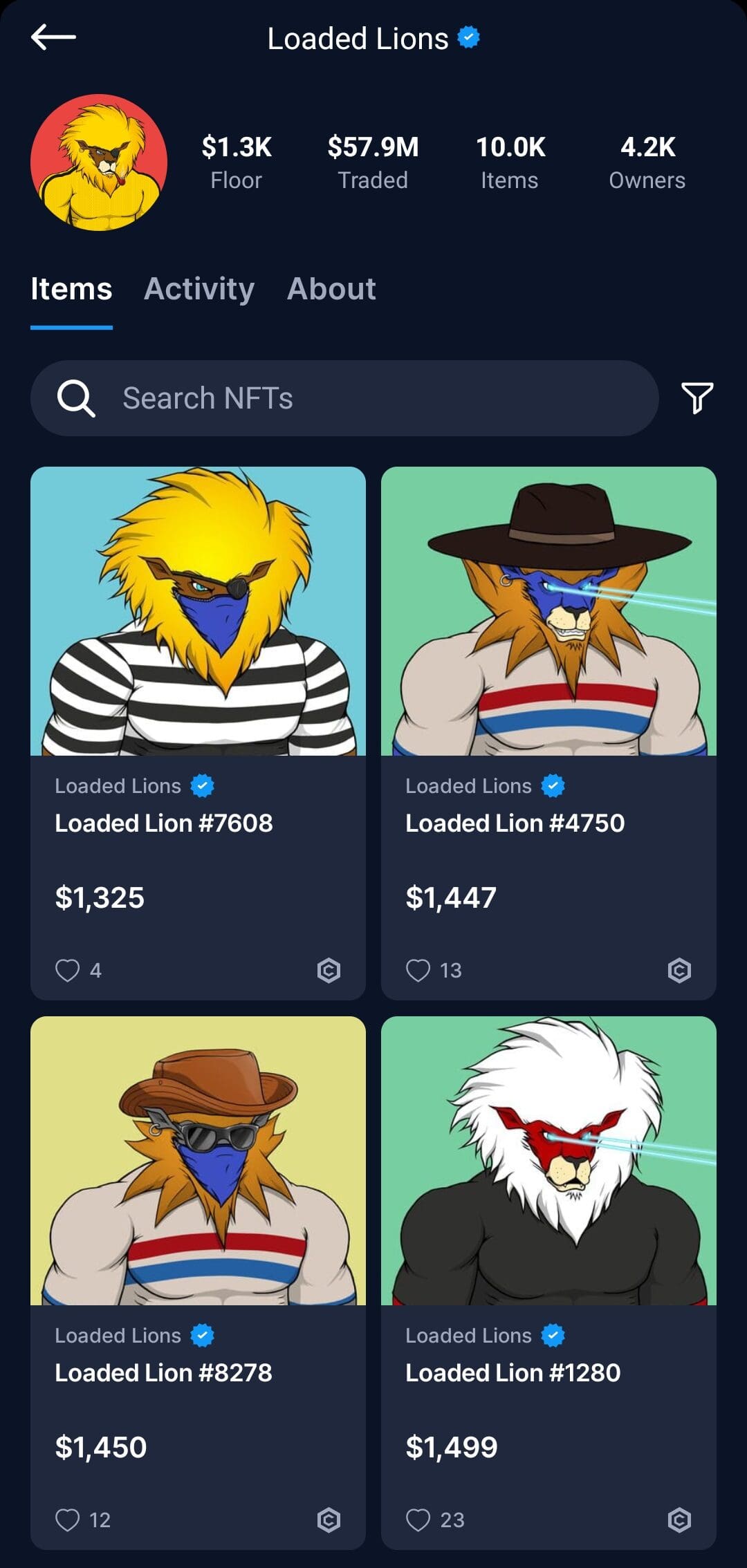

In addition to trading, Crypto.com provides access to NFTs (non-fungible tokens) through its dedicated NFT marketplace, where users can buy, sell, and trade unique digital collectibles.

With its extensive selection, Crypto.com is an excellent choice for traders looking to explore different crypto assets, including tokens, stablecoins, and NFTs.

Is Crypto.com Available In The US?

Yes, Crypto.com is available in the U.S., but with some limitations. Most U.S. users can access the Crypto.com App, which allows them to buy, sell, and manage crypto.

However, the Crypto.com Exchange (the web-based advanced trading platform) is only available to institutional investors in the U.S., meaning most retail traders cannot use it.

Additionally, Crypto.com is not available in New York due to state regulations.

Some services, like margin trading and staking, are also restricted for U.S. users. Despite these limitations, U.S. users can still use the Crypto.com Visa Card, earn rewards, and trade through the mobile app.

Main Features For Crypto Investors

Here are the key features that I found most appealing in Crypto.com:

-

Crypto.com Ease of Use & User Interface

Crypto.com is designed for both beginners and advanced traders, offering an intuitive interface that’s easy to navigate.

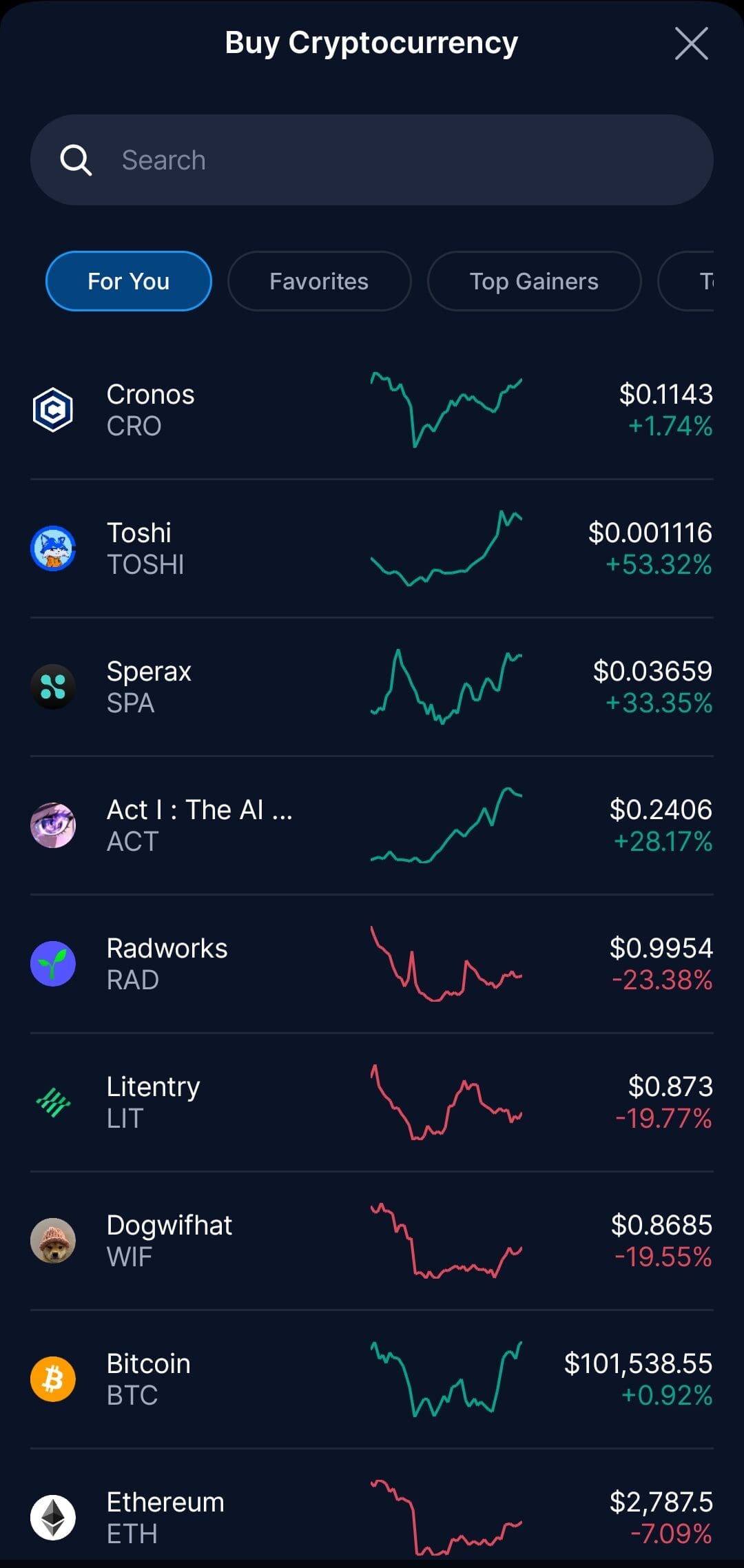

The mobile app is the primary trading platform for most users, providing access to buying, selling, and tracking +350 cryptocurrencies. The app has a clean, user-friendly layout that simplifies crypto transactions and portfolio management.

For desktop users, the Crypto.com Exchange offers a more advanced trading experience with charting tools, multiple order types, and API integration for automated trading.

However, the web platform is only available to institutional investors in the U.S., limiting access for retail traders.

The platform supports real-time market data, price alerts, and trading bots, making it a good choice for active traders.

-

How Secure is Crypto.com? A Deep Dive into Its Safety Features

While no exchange is risk-free, Crypto.com’s strong compliance and security features make it one of the safer options in the crypto space.

Crypto.com implemented multi-layered protection to keep user funds and data safe. It employs encryption, two-factor authentication (2FA), and withdrawal whitelisting to prevent unauthorized access.

100% of customer funds are stored in cold wallets, reducing exposure to hacks, and it also offers the Account Protection Program (APP), which insures funds in case of unauthorized withdrawals.

In 2022, Crypto.com reimbursed users after a $35 million hack and strengthened its security measures.

-

How to Deposit & Withdraw Funds on Crypto.com

Crypto.com supports multiple deposit and withdrawal methods, making it easy for users to fund their accounts.

You can deposit fiat currency (USD, EUR, GBP, etc.) via bank transfer or use a credit/debit card (with a 2.99% fee). Crypto deposits are also available, supporting Bitcoin, Ethereum, and 350+ other assets.

Withdrawals vary based on method. Fiat withdrawals via bank transfer can take 1-5 business days, while crypto withdrawals depend on network congestion.

Crypto withdrawal fees apply, with Bitcoin withdrawals costing 0.0006 BTC (around $20-$30, depending on market rates).

For cost-effective transactions, Crypto.com recommends using ACH or SEPA bank transfers instead of cards.

The platform also has a “Withdraw to App” feature, which allows free transfers between the Crypto.com Exchange and the Crypto.com App.

-

Crypto.com & the Future of Web3: NFTs, DeFi, and Beyond

With its easy-to-use NFT marketplace and strong Web3 integrations, Crypto.com is positioning itself as a leader in the next phase of the digital economy.

Crypto.com offering an NFT marketplace, blockchain gaming integrations, and DeFi wallet support. The Crypto.com NFT platform allows users to create, buy, and sell digital collectibles, supporting artists, brands, and collectors.

Beyond NFTs, Crypto.com is investing in Web3 infrastructure, including support for decentralized applications (dApps), staking, and DeFi services.

Its non-custodial Onchain Wallet gives users full control over their assets, enabling direct interaction with decentralized finance platforms.

The exchange’s Cronos (CRO) blockchain plays a major role in Web3 adoption, allowing developers to build smart contracts and NFT projects.

Crypto.com also collaborates with gaming and metaverse projects, bringing new blockchain-based experiences to users.

-

Crypto.com Fees Explained: Competitive With Catches

Crypto.com offers a tiered fee structure based on 30-day trading volume. Users who stake CRO tokens receive additional fee discounts.

Spot Trading Fees | Future Trading Fees |

|---|---|

0.075%

For both maker and taker orders. The more you trade, the lower the fees – can decrease to as low as 0% – 0.050%. Holding and staking CRO tokens, Crypto.com native token, unlocks additional fee discounts. | 0.04% – 0.06%

0.06% for taker trades and 0.04% for maker trades. Holding and staking CRO tokens, Crypto.com native token, unlocks additional fee discounts.

|

Deposit fees:

- Fiat deposits via ACH or SEPA: Free

- Credit/Debit card deposits: Up to 2.99%

Withdrawal fees:

- Crypto withdrawals vary by asset. Bitcoin withdrawals, for example, cost 0.0006 BTC (~$20-$30).

- Fiat withdrawals via bank transfer take 1-5 business days and may include small processing fees

-

Crypto.com Customer Support: A Look at Its Reputation & Review

Crypto.com offers customer support via live chat and email, but does not provide phone support.

While the platform has expanded its support team, many users report slow response times, especially for account-related issues.

The platform has a 1.5-star rating on Trustpilot, with common complaints about locked accounts, slow withdrawals, and unresponsive support.

-

Crypto.com Supercharger: Earn Free Crypto with Staking

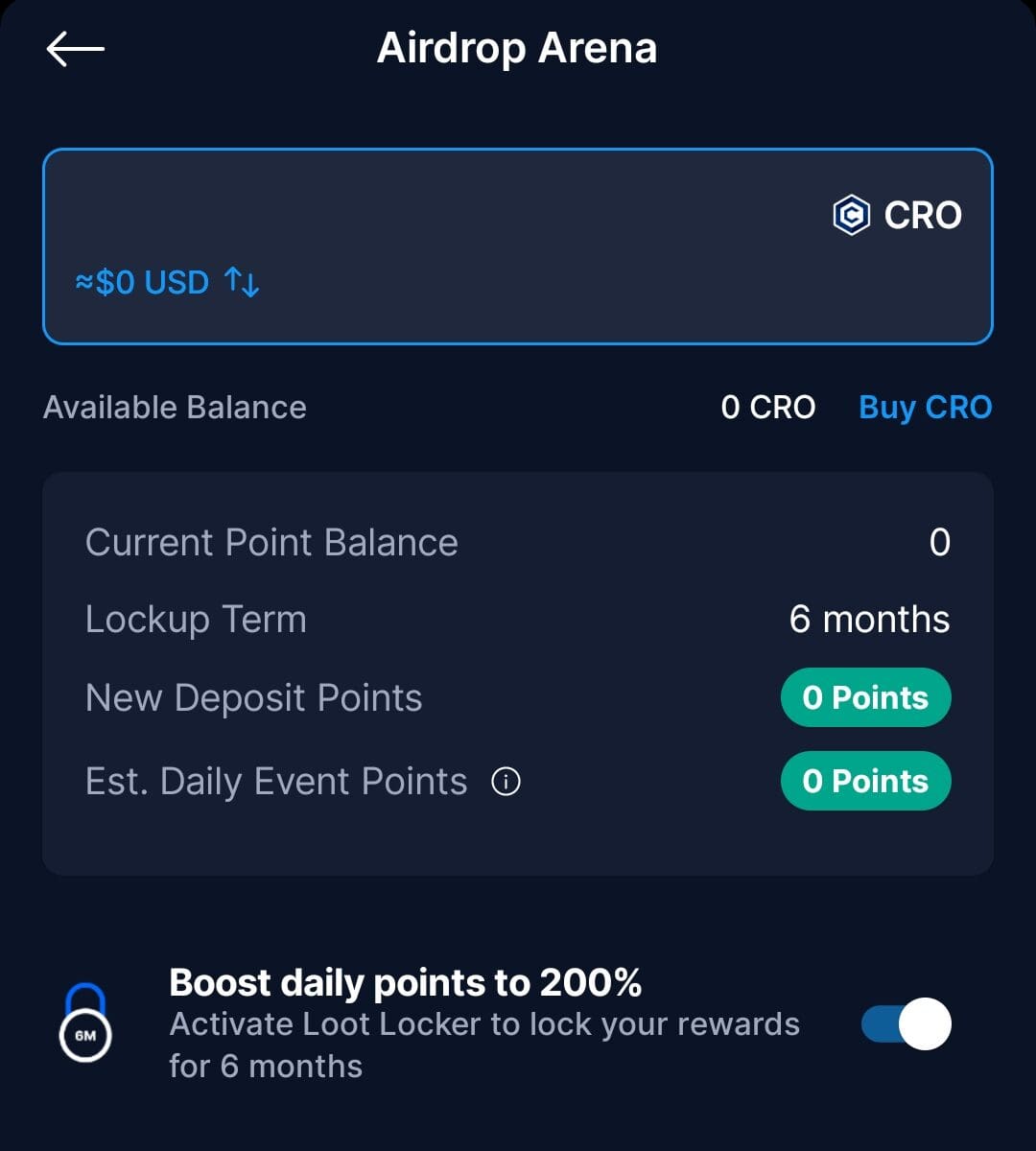

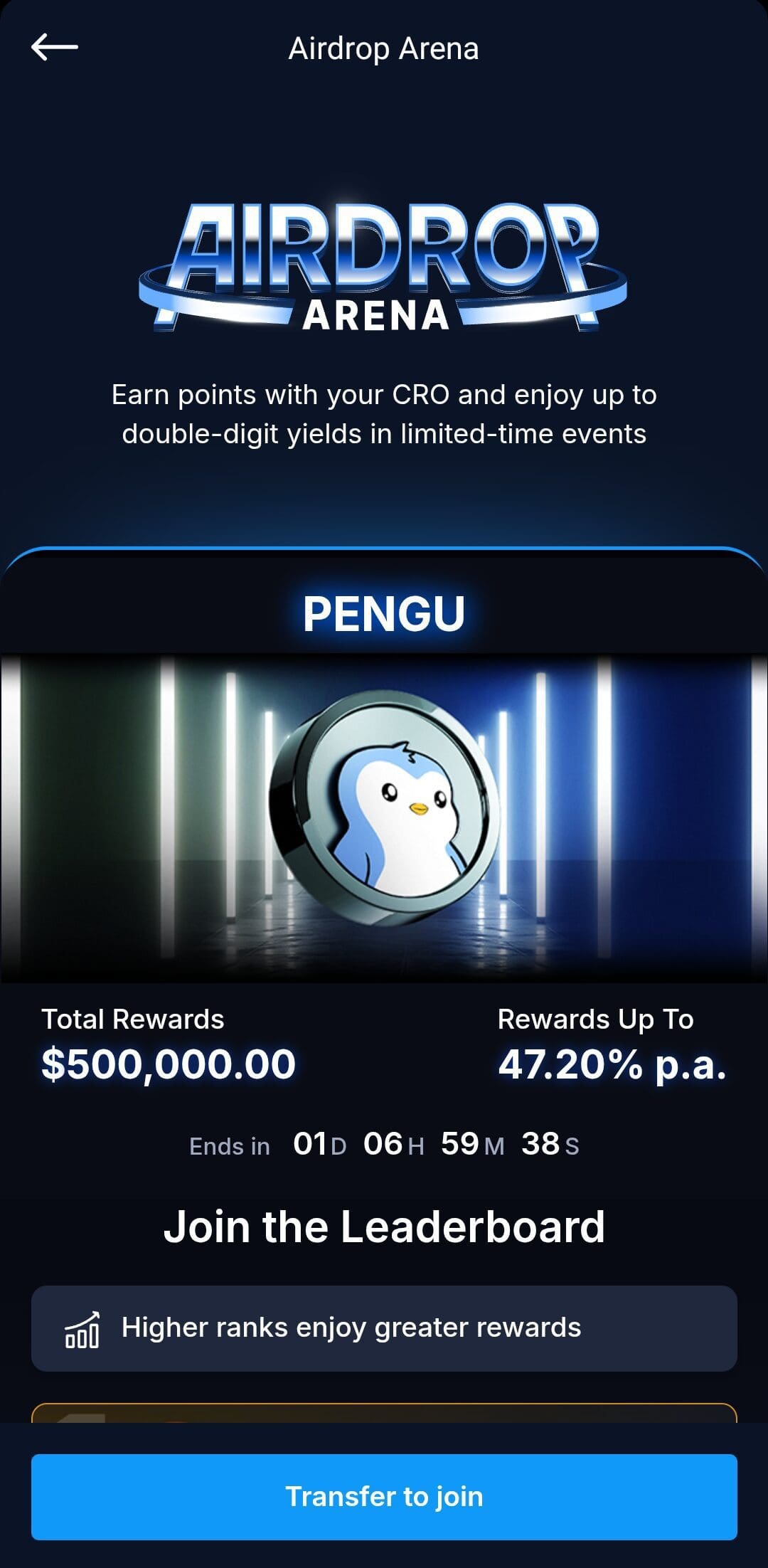

Supercharger is a unique rewards program on Crypto.com that lets users earn free cryptocurrency by staking Cronos (CRO).

It works like an airdrop lottery, where users deposit CRO into a pool and receive rewards in various cryptocurrencies, including Bitcoin and Ethereum.

Here’s how it works:

- Charging Period (10-45 days): Stake CRO anytime during this period. The more CRO you stake, the higher your rewards.

- Rewards Period: After the charging period, you receive daily payouts in the featured token over a set period.

Unlike traditional staking, you can withdraw your CRO at any time, making Supercharger a flexible and low-risk way to earn crypto rewards.

If you leave your CRO staked, it automatically rolls over to the next event.

-

Crypto.com Trading Arena: Compete & Win Prizes

The Crypto.com Trading Arena is a competitive feature that allows users to participate in trading competitions for a chance to win cash prizes, crypto rewards, and exclusive perks.

These competitions test traders’ skills by ranking them based on trading volume, profit percentages, or other criteria.

How it works:

- Register for a competition through the Trading Arena.

- Trade specific crypto pairs within the event timeframe.

- Climb the leaderboard—the more you trade, the better your ranking.

Prizes can include cash rewards, discounted trading fees, and VIP perks. There are also lucky draws and giveaways, meaning even casual traders have a chance to win.

This feature is great for active traders who want an extra incentive to trade while competing against others.

-

Crypto.com DCA Bot: Automate Your Crypto Investments

Crypto.com offers a Dollar-Cost Averaging (DCA) Trading Bot, designed to automate your crypto investments and reduce the impact of market volatility.

Instead of manually buying at unpredictable prices, the bot automatically purchases crypto at set intervals—daily, weekly, or monthly.

How it works:

- Choose a cryptocurrency you want to buy (e.g., Bitcoin, Ethereum).

- Set the amount and frequency (e.g., $50 in BTC every week).

- The bot automatically buys at regular intervals, helping you average out price fluctuations over time.

This is a great tool for long-term investors, as it removes emotional decision-making and ensures consistent crypto accumulation. Best of all, the DCA bot is free to use with no extra fees!

-

Futures & Margin Trading (Not Available For U.S. Retail Users)

Crypto.com offers Futures and Margin Trading for users looking to trade with leverage, allowing them to increase their buying power.

With margin trading, traders can borrow funds to open larger positions, amplifying both potential profits and risks. Crypto.com offers up to 10x leverage on over 100 trading pairs.

Futures trading allows users to speculate on price movements without owning the underlying crypto.

Crypto.com offers perpetual contracts, meaning traders can hold positions indefinitely. These contracts are settled in USDT or other stablecoins.

-

Crypto.com OTC Trading: Large Trades, Low Fees

Crypto.com’s Over-the-Counter (OTC) trading is designed for users making large crypto transactions.

This feature allows high-net-worth individuals and institutional investors to buy and sell crypto directly with reduced price slippage and lower fees compared to regular exchange orders.

OTC trading is ideal for transactions starting at $50,000 or more, as large trades on the open market can affect prices and create volatility.

Instead of placing multiple small orders, users can execute one large transaction at a pre-negotiated price.

When Crypto.com May Be a Good Choice? When Not?

Like any financial product, Crypto.com may not be the best option for everyone.

Below are the types of users who may benefit from using Crypto.com and those who might want to look elsewhere:

When Crypto.com May Be a Good Choice | Who Should Look Elsewhere |

|---|---|

Mobile-First Crypto Traders | U.S. Traders Wanting Desktop Access |

Users Looking for a Large Crypto Selection | Users Who Need Strong Customer Support |

Those Who Want Crypto Rewards & Perks | Those Looking for the Lowest Fees |

Active & Competitive Traders | Traders Who Rely on Staking |

DeFi & Web3 Enthusiasts |

4 Simple Steps to Set Up the Crypto.com Account

Let's see the main steps when setting up an account with Crypto.com:

-

1. Sign Up on Crypto.com Exchange

To get started, go to Crypto.com’s official website or download the Crypto.com Exchange app.

Click on “Sign Up” and enter your email address, create a strong password, and confirm your registration.

You’ll receive an email verification link—click it to activate your account.

Our tips:

🔹 Always download the app or access the site from official sources to avoid phishing scams.

🔹 Choose a strong, unique password to secure your account

🔹 If you don’t see the verification email, check your spam folder or request a new link.

-

2. Complete Identity Verification (KYC)

Crypto.com requires Know Your Customer (KYC) verification before you can trade, deposit, or withdraw funds.

You'll need to provide your full name, date of birth, country, and a government-issued ID (passport, driver’s license, or national ID).

Our tips:

🔹 Use a clear, well-lit photo of your ID to avoid rejection.

🔹 Ensure that your name and details match exactly with your submitted documents.

🔹 The verification process can take a few minutes to a few hours, but delays may occur during high-traffic periods.

-

3. Secure Your Account with 2FA

Once verified, enable Two-Factor Authentication (2FA) for added security. Crypto.com supports Google Authenticator or SMS-based 2FA for logging in, making withdrawals, and performing sensitive actions.

Our tips:

🔹 Write down or store your backup key safely in case you lose access to your 2FA app.

🔹 Avoid using SMS 2FA alone, as SIM-swapping scams are a known risk.

🔹Crypto.com also offers withdrawal whitelisting, which only allows withdrawals to pre-approved addresses for extra security.

-

4. Deposit Funds & Start Trading

Now, you can fund your account using fiat (bank transfer, credit/debit card) or crypto deposits.

Fiat deposits are available via ACH, SEPA, or wire transfers, while crypto deposits require sending funds from an external wallet.

Our tips:

🔹 Bank transfers are fee-free, but they may take 1-5 business days to process.

🔹 Credit/debit card deposits have a 2.99% fee—consider using ACH transfers to save money.

🔹 Always double-check the deposit address when transferring crypto, as sending funds to the wrong address is irreversible.

🔹 Once your funds are available, you can start trading, exploring DeFi features, or staking CRO for rewards.

FAQ

No, the Crypto.com Exchange is a separate platform designed for advanced trading, while the Crypto.com App is mainly for buying, selling, and managing crypto. However, you can connect both to transfer funds between them.

To link both accounts, log in to the Crypto.com App, go to Settings > Crypto.com Exchange, and follow the instructions. Once linked, you can move funds easily between the two platforms.

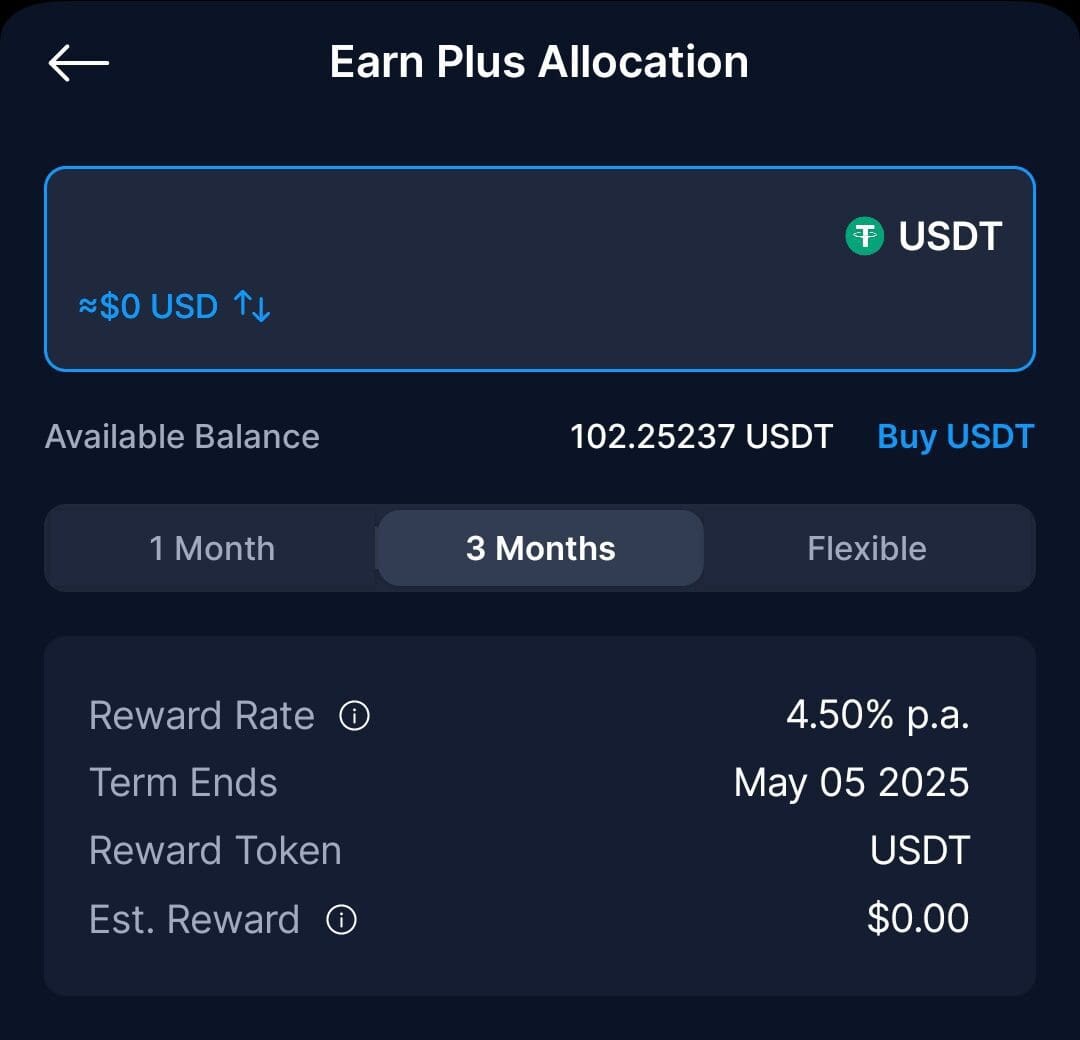

Yes! Crypto.com offers Crypto Earn, where you can deposit and earn interest on certain assets. However, staking is no longer available for U.S. customers.

Yes, Crypto.com uses cold storage, 2FA, withdrawal whitelisting, and compliance measures to protect user funds. It was hacked in 2022, but affected users were fully reimbursed, and security was strengthened.

Cronos (CRO) is Crypto.com’s native token. Holding CRO gives you trading fee discounts, staking rewards, and cashback benefits on the Crypto.com Visa Card.

If you have problems with your account, try reaching out to Crypto.com support via live chat or email. However, support response times can be slow, so be patient.

Review Crypto Exchanges

How We Rated Crypto Exchanges: Review Methodology

At The Smart Investor, we evaluated crypto exchanges based on their overall value, security, and trading experience compared to other leading alternatives. Our hands-on testing focused on key factors that matter most to traders and investors, including fees, security, liquidity, and available assets. Each exchange was rated based on the following criteria:

- Fees & Costs (15%): We prioritized exchanges with low trading fees, competitive spreads, and transparent pricing. Some platforms had hidden withdrawal fees or costly trading structures.

- User Experience & Interface (15%): A fast, intuitive, and well-designed platform scored highest. Some exchanges felt clunky or slow, impacting trade execution and overall experience.

- Security & Regulation (20%): We favored exchanges with strong encryption, two-factor authentication (2FA), cold storage, and regulatory compliance. Some lacked proper security, making them high-risk.

- Trading Tools & Features (30%): The best exchanges offered advanced charting, real-time market data, order types (limit, stop-loss), and automation tools. Some lacked depth, limiting professional traders.

- Supported Cryptocurrencies (10%): We rated exchanges higher if they supported a broad range of cryptocurrencies, including major coins, altcoins, and stablecoins. Some had limited selections, restricting options.

- Liquidity & Execution Speed (5%): Exchanges with high liquidity, deep order books, and fast execution times scored highest. Lower-rated platforms had frequent slippage or delays.

- Additional Features (5%): We favored exchanges with staking, lending, fiat on-ramps, NFT marketplaces, and DeFi integration. Some lacked these extras, making them less versatile.