| ||

|---|---|---|

eToro | Robinhood | |

Supported Coins | +25 | +20 |

Spot Trading Fees | 1% | $0 |

Future Trading Fees | $3–$5 per action | N/A |

Our Rating |

(4.4/5) |

(4.4/5) |

Read Review | Read Review |

eToro vs. Robinhood: Compare The Best Features

When choosing a crypto platform, it’s important to find one that matches your needs for ease of use, trading features, and crypto access.

Let’s compare eToro and Robinhood side by side, with real examples and clear takeaways.

-

Ease of Use & Mobile App Experience

eToro focuses on simplicity, offering an intuitive web and mobile experience ideal for beginners. With CopyTrader, you can easily copy top investors or start with a $100,000 virtual account.

Robinhood, however, shines with its fast, sleek app that supports 24-hour stock trading and real-time customizable charts.

Overall, Robinhood offers a slightly superior mobile and real-time trading experience for active traders.

-

Cryptocurrency Selection

eToro provides access to +25 cryptocurrencies globally, but U.S. users can only trade Bitcoin, Ethereum, and Bitcoin Cash, limiting options.

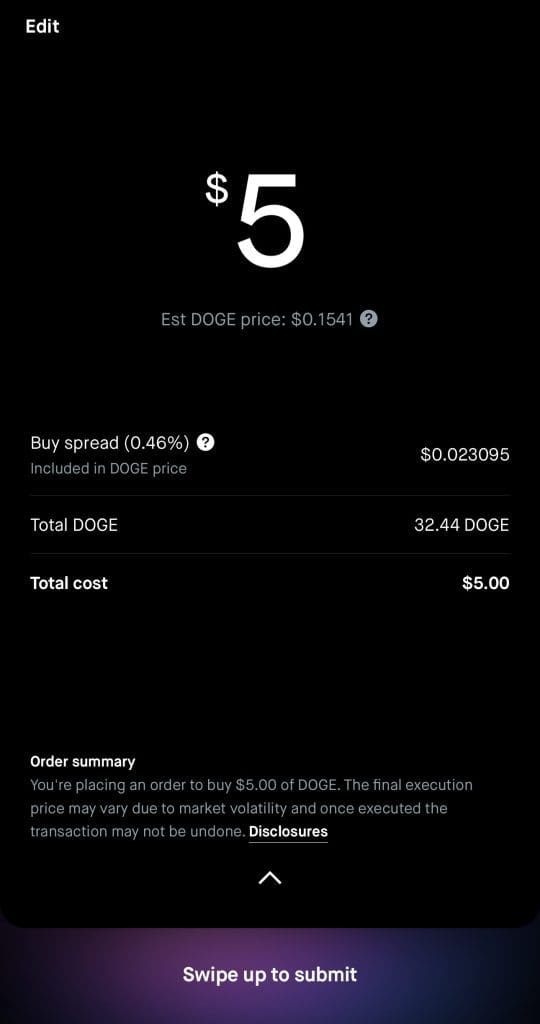

Robinhood, on the other hand, allows U.S. investors to trade +20 popular cryptocurrencies like Bitcoin, Ethereum, and Dogecoin without fees, plus supports recurring buys.

-

Trading Crypto Features & Experience

eToro targets beginner and intermediate investors, offering Smart Portfolios managed by experts and CopyTrader for easy portfolio mirroring. However, it lacks deep technical analysis tools.

Robinhood, by contrast, offers users advanced charting with technical indicators like RSI and MACD, as well as access to IPOs, 24-hour stock trading, and a Robinhood Gold membership that includes Morningstar insights.

Overall, Robinhood wins for more advanced trading tools and features that support active and technical traders.

-

Staking Options and Rewards

eToro offers a diverse range of staking options, including Cardano (ADA), Solana (SOL), Ethereum (ETH), Near Protocol (NEAR), Polygon (POL), Tron (TRX), Polkadot (DOT), and Cosmos (ATOM) .

Users can earn passive income by holding these assets, with rewards automatically credited to their accounts.

Robinhood, on the other hand, provides staking for Solana (SOL) and Ethereum (ETH) . While both platforms offer staking rewards, none of the, are available for U.S. investors.

-

DApps and Web3 Integration

Robinhood edges out eToro by offering basic Web3 interaction through crypto wallet transfers.

eToro does not offer DApps or Web3 connectivity; it's primarily focused on traditional asset trading and social investing.

Robinhood recently expanded crypto functionality, allowing users to send crypto to external wallets, enabling access to decentralized apps outside the platform.

For example, you can transfer Ethereum from Robinhood to a Web3 wallet for DeFi use.

-

Wallet Options

eToro provides the eToro Money crypto wallet, allowing users to store, send, and receive various cryptocurrencies securely .

Robinhood offers a self-custody wallet, granting users full control over their private keys and enabling transfers across multiple blockchain networks, including Ethereum, Solana, and Polygon .

-

Trading Bots and Automation

eToro does not natively support trading bots. However, users can explore third-party solutions like Stoic AI and Cindicator for automated trading strategies .

On the other hand, Robinhood does not officially support trading bots.

Nevertheless, developers have created custom bots using platforms like TradersPost and GitHub repositories to automate trading on Robinhood .

Which Investors May Prefer eToro?

eToro is best suited for beginner, passive, and global investors looking for diverse assets and social trading features:

Beginner Investors: eToro’s easy-to-use interface and social trading features like CopyTrader make it ideal for beginners. You can copy top traders with just a click, making it easy to get started.

Long-Term Investors: eToro offers access to traditional assets like stocks and ETFs alongside cryptocurrencies, making it great for long-term portfolio management. The Smart Portfolios feature offers diversification without individual asset picking.

Passive Investors: eToro’s Smart Portfolios allow hands-off investing in themed, pre-built portfolios. It's ideal for investors investing in sectors like renewable energy or top-performing cryptocurrencies without active management.

Crypto Enthusiasts (Global): eToro supports a wide range of cryptocurrencies and staking options, making it appealing for those wanting exposure to various digital assets.

Which Investors May Prefer Robinhood Crypto?

Robinhood excels for mobile-first, low-cost, and beginner crypto traders looking for simplicity and easy access to the market.

Mobile-First Investors: Robinhood’s sleek mobile app offers commission-free trading and easy access to crypto markets. It’s perfect for investors who prefer to trade on the go.

Crypto Newcomers: Robinhood’s simple, no-fee structure and limited selection of popular cryptocurrencies appeal to new crypto investors who want to get started with minimal barriers.

Low-Cost Traders: With commission-free crypto trading, Robinhood appeals to those who want to trade without worrying about transaction fees, which makes it especially attractive for frequent traders.

Frequent Crypto Traders: Robinhood allows users to set up recurring buys for crypto, making it easy for traders to automate their investments. It's great for those looking to add dollar-cost averages to their positions.

Bottom Line

eToro is a strong choice for beginner and passive investors who seek a range of assets, social trading features, and the option to copy experienced traders.

Robinhood stands out for its simplicity, low-cost trading, and mobile-first approach, making it perfect for newcomers to crypto and active traders who value commission-free transactions and automated investment features.

Both platforms serve different types of investors with unique needs.