Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

E*TRADE | Robinhood | |

Monthly Fee | 0% – 0.35%

0% on stocks and ETFs in self directed brokrage, 0.35% for Core Portfolio Robo Advisor

| $0 – $6.99

$0 for basic account, $6.99 for Robinhood Gold |

Account Types | Brokerage, Retirement | Brokerage, Retirement, Crypto |

Savings APY | 3.75%

| 3.75%

|

Minimum Deposit | $0 | $0 |

Best For | Beginners, Traders, Robo Advisor | Active Traders, Tech Savvy Investors |

Read Review | Read Review |

E*TRADE vs Robinhood: Compare Investing Features

While Robinhood simplifies trading with a focus on cost-efficiency and ease of use, making it ideal for new investors, E*TRADE offers a more robust and versatile trading environment suitable for a broader range of investment strategies.

Robinhood | E*TRADE | |

|---|---|---|

Investing Options | Over 5,000 securities, most U.S. stocks and ETFs listed on U.S. exchanges | Full Access To Almost Any Asset |

Investing Types | Stocks, Options, Futures, ETFs, Crypto, Margin, Fractional Shares | Stocks, Options, Futures, ETFs, Bonds, Mutual Funds |

Automated Investing | No | Yes |

Paper Trading | No | Yes |

Tax Loss Harvesting | No | Yes |

IPO Access | Yes | Yes |

Robinhood offers innovative features like fractional shares and 24-hour trading on select securities.

Its premium membership, Robinhood Gold, includes benefits like higher instant deposits, margin trading with competitive rates, and access to advanced research.

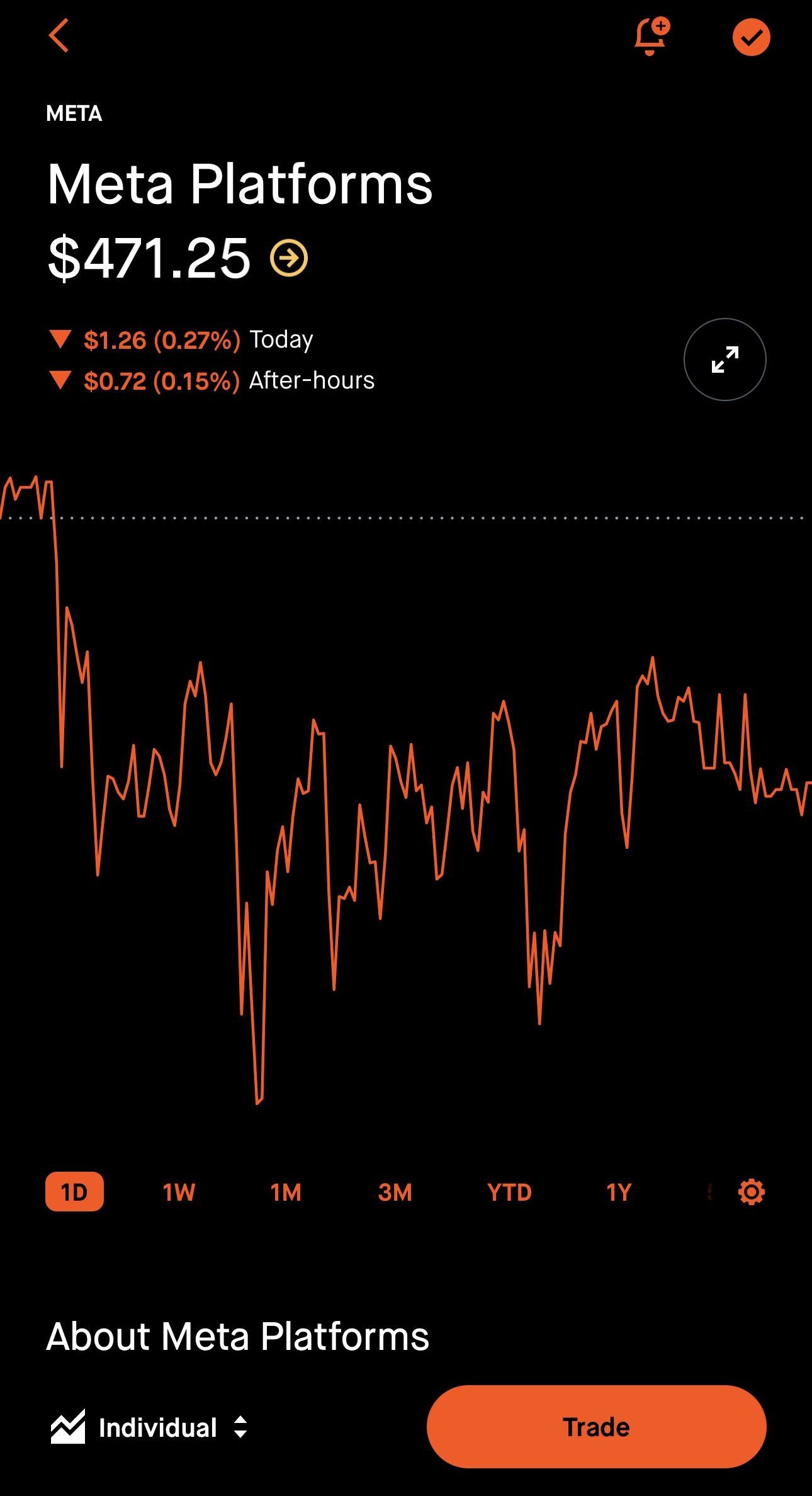

ETRADE stands out for its comprehensive trading tools and extensive investment options, attracting both novice and experienced investors.

The platform offers a wide range of assets, including stocks, bonds, ETFs, mutual funds, and options.

-

Self Investing And Trading Options

E*TRADE excels with its extensive range of investment options and robust research tools, appealing to investors who prefer a more traditional and comprehensive trading platform.

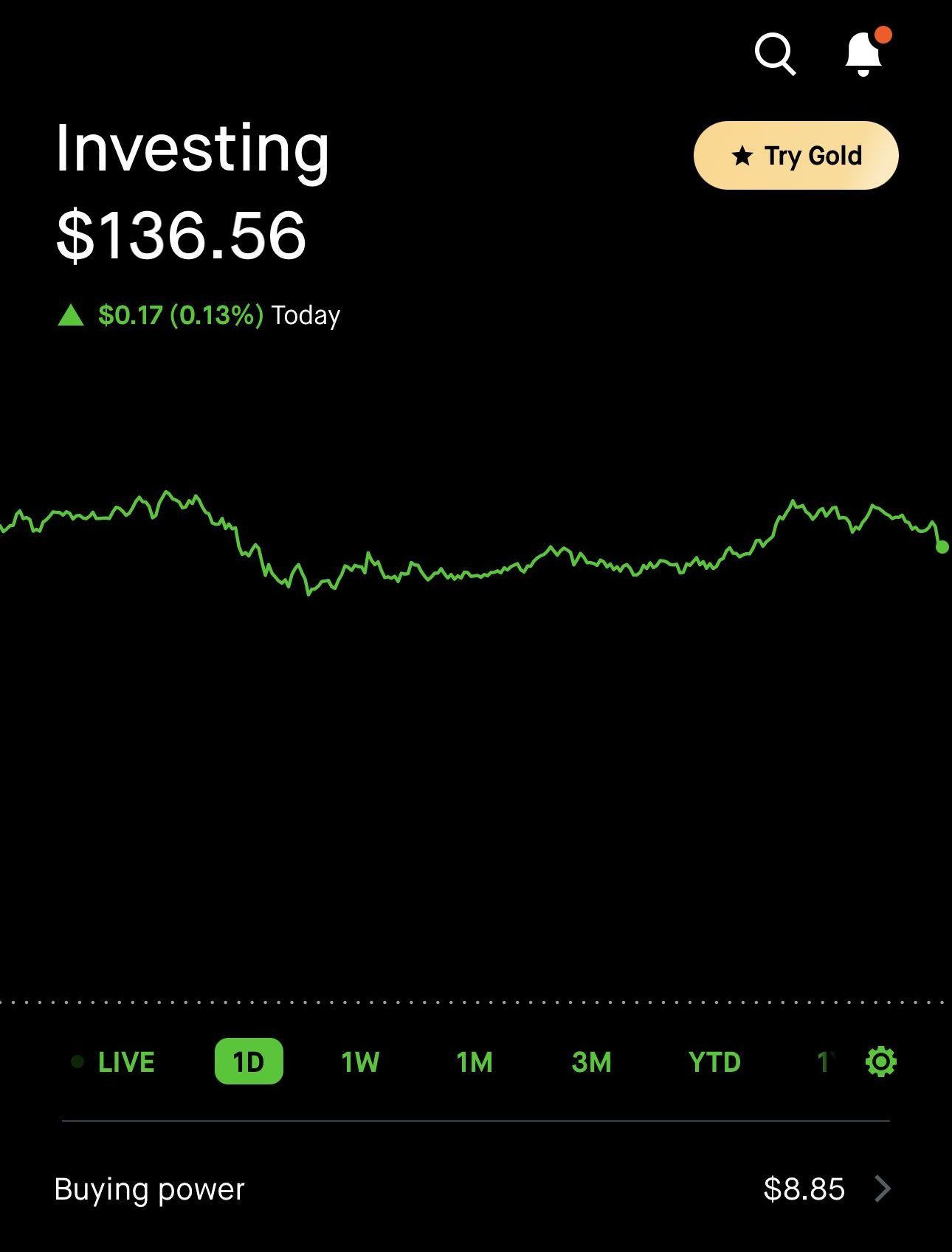

Robinhood, with its fractional shares, intuitive mobile app, and 24-hour trading, is ideal for investors who value simplicity and round-the-clock trading capabilities.

The platform’s strong web and desktop interfaces are well-suited for self-directed investors, featuring advanced research tools, portfolio rebalancing, and detailed earning reports.

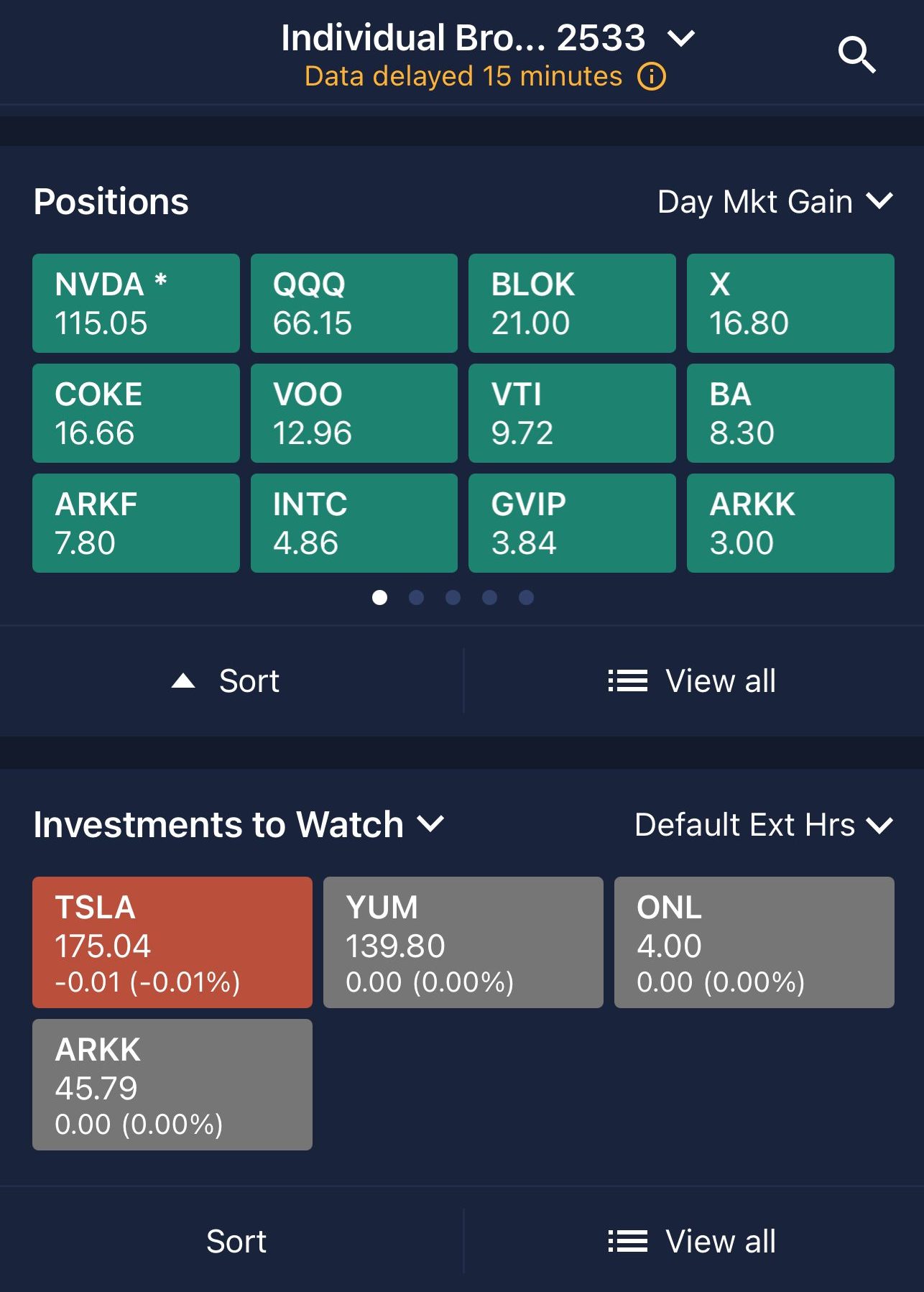

Traders and investors can track portfolio movers and manage watchlists effectively.

Robinhood, on the other hand, offers fractional shares, enabling investors to buy smaller portions of stocks and ETFs.

Advanced charting options and technical analysis tools are available, along with custom pricing and technical analysis alerts. A standout feature is its 24-hour market trading on certain stocks, offering more flexibility.

-

Retirement Accounts

When it comes to retirement options, Etrade is the winner when it comes to diversity and options for retirement plans. However, Robinhood wins when it comes to extra benefits.

E*TRADE offers diverse retirement accounts including Roth and Traditional IRAs, Rollover IRAs, Inherited IRAs, Complete IRAs for those over 59½, and IRAs for minors. Additionally, E*TRADE features the Complete IRA, specifically designed for investors over 59½ years old.

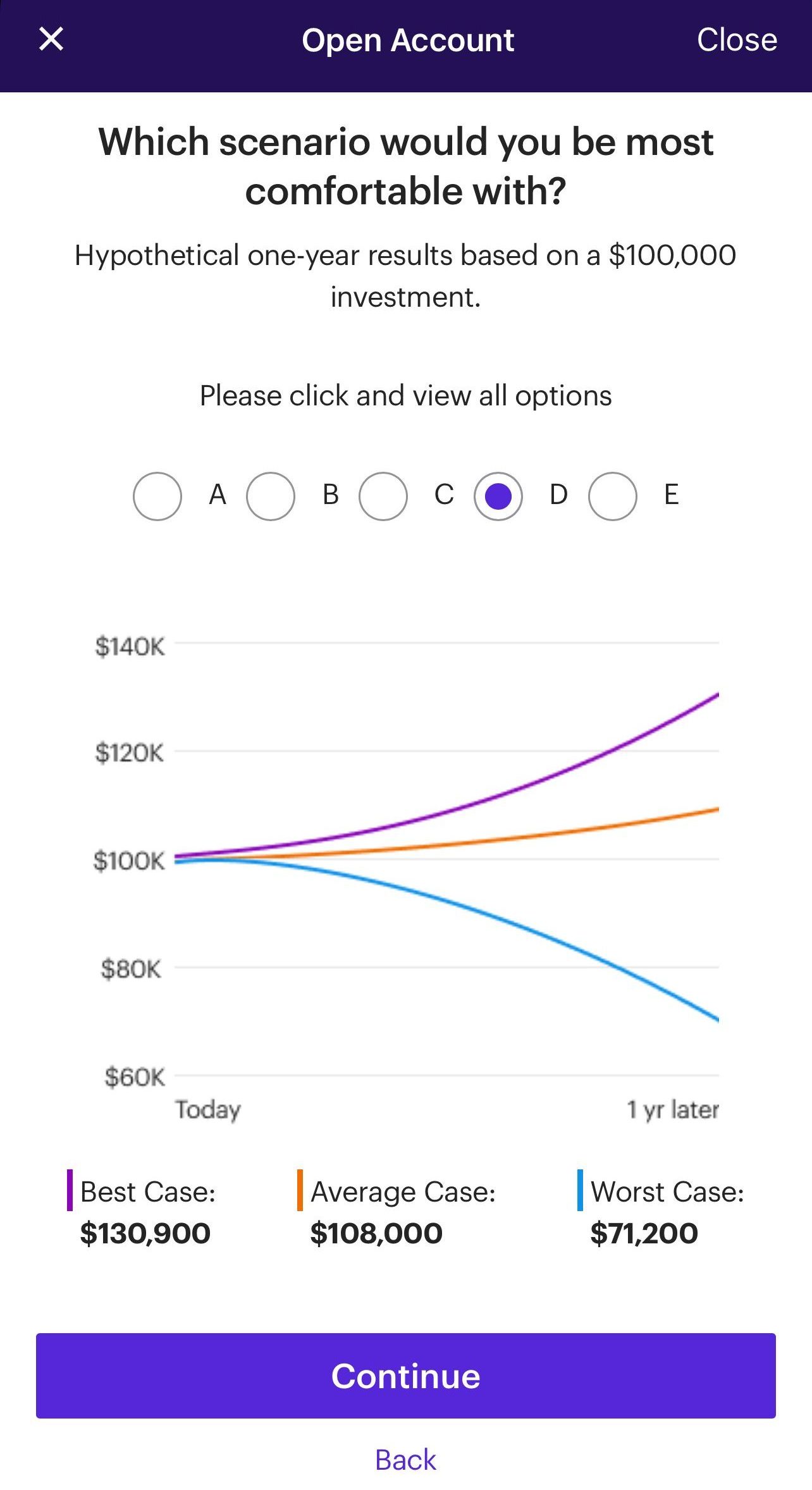

When opening ana account, you can set even get hypothetical one year results based on investment:

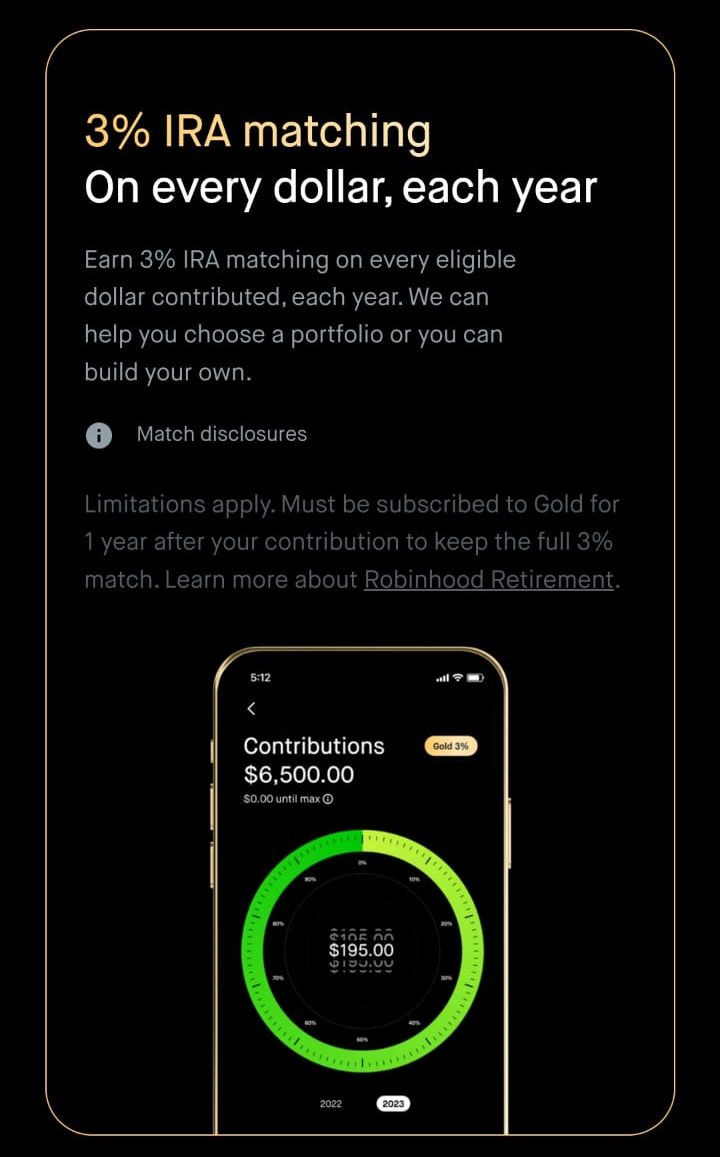

With Robinhood, you can choose from a Traditional, Roth, or Rollover IRA. Moreover, even with the basic free Robinhood tier, you can receive a 1% match on qualified IRA deposits.

If you subscribe to Robinhood Gold, you can benefit from a 3% IRA match, allowing you to earn 3% on every eligible dollar contributed to your IRA each year.

-

Fees

Robinhood wins when it comes to fees.

ETRADE offers $0 commissions on online stock, ETF, and mutual fund trades, with options contracts costing $0.65 per contract (reduced to $0.50 with higher trading volume). OTC stock trades cost $6.95, reduced to $4.95 with frequent trading.

Robinhood stands out for its low-cost structure, offering commission-free trading on stocks, ETFs, and options and there are no account minimums or inactivity fees.

-

Cash Management And Savings Rates

When it comes to banking options, Etrade wins as it offers checking accounts with various money management features. However, Robinhood Gold customers can earn higher savings rates.

Etrade Premium Savings | Robinhood | |

|---|---|---|

Savings APY | 3.75%

| 3.75%

|

ETRADE provides a comprehensive cash management service through its ETRADE Max-Rate Checking and Premium Savings accounts with competitive savings rate.

Managed by Morgan Stanley Private Bank, E*TRADE offers two checking accounts: Max-Rate Checking and Standard Checking.

Both provide unlimited online wire transfers, money transfers, mobile check deposits, and nationwide ATM fee refunds. They feature Coverdraft Protection and integrated account views

Unlike Etrade, Robinhood lacks checking account features but do offer a high savings rate of 3.75% and rewards credit card that is exclusive for Gold members.

There is 5% cash back if I book travel using the Robinhood travel portal and 3% on all other purchases.

It also includes a number of insurance coverages including trip interruption, auto rental collision, travel and emergency assistance and roadside dispatch.

Etrade: Which Features Are Unique?

Here are some of the features that investors can find only with Etrade:

-

Automated Investing

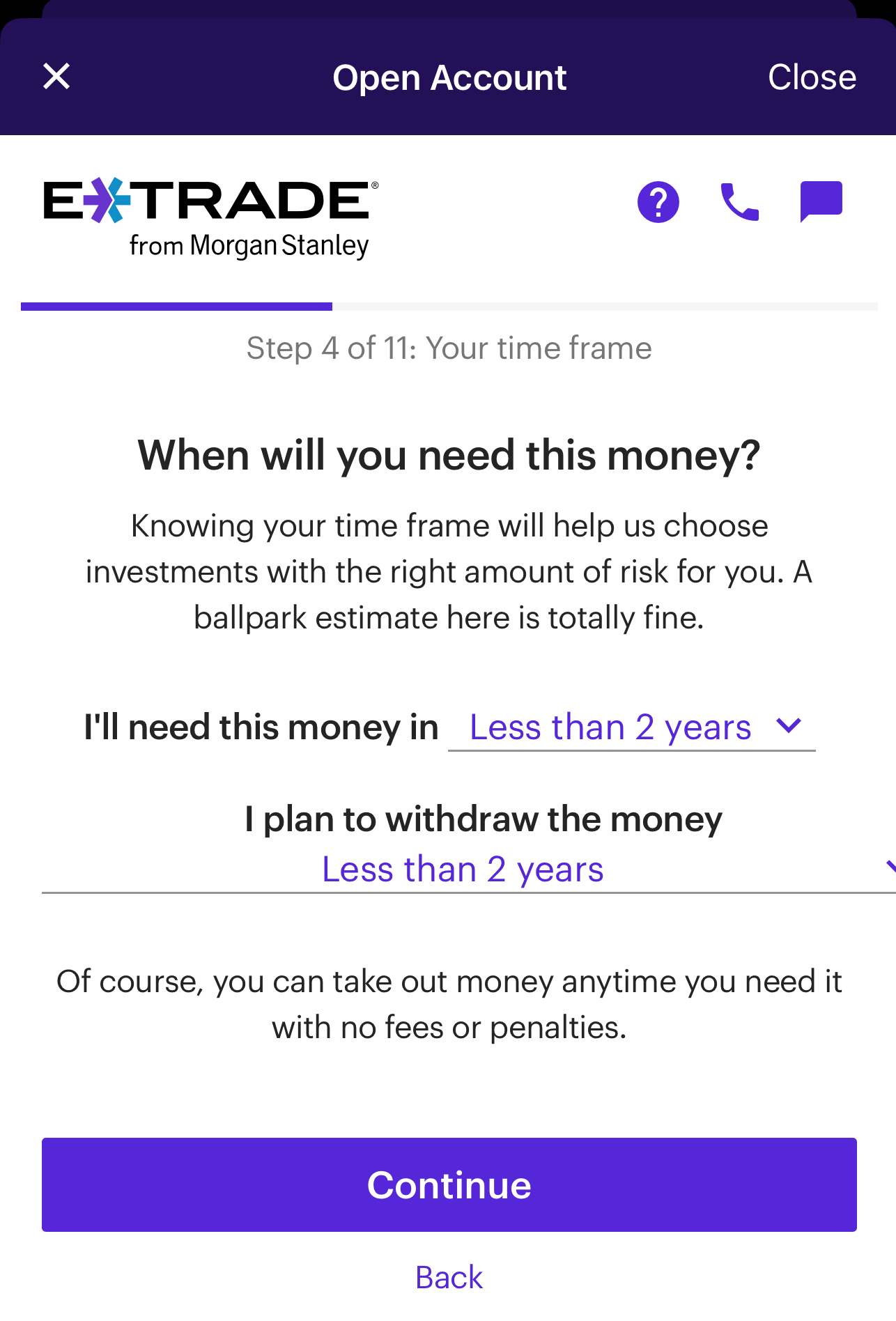

E*TRADE Core Portfolios is an automated investing service designed to simplify portfolio management through a robo-advisor.

It starts with an investor completing a questionnaire to determine their risk tolerance, investment goals, and time horizon.

Based on the responses, Core Portfolios constructs a diversified portfolio primarily composed of ETFs tailored to the investor’s profile.

One of the key features of Core Portfolios is automatic rebalancing. As market conditions change, the portfolio is adjusted to maintain the target asset allocation, ensuring that the investment strategy remains aligned with the investor's goals.

ETRADE also offers tax loss harvesting for clients using Core Portfolios. The annual advisory fee of 0.30%.

Robinhood: Which Features Are Unique?

Here are some of the features that investors can find only with Robinhood:

-

Crypto Trading

Robinhood Crypto allows users to buy, sell, and store a variety of cryptocurrencies directly through the Robinhood app.

Investors can trade popular cryptocurrencies such as Bitcoin, Ethereum, Dogecoin, and several others.. Unlike traditional crypto exchanges, Robinhood does not charge commission fees for crypto trades.

However, it's important to note that as of now, Robinhood Crypto does not support transferring cryptocurrencies to external wallets, limiting the ability to use crypto outside the Robinhood platform.

-

Custom Alerts

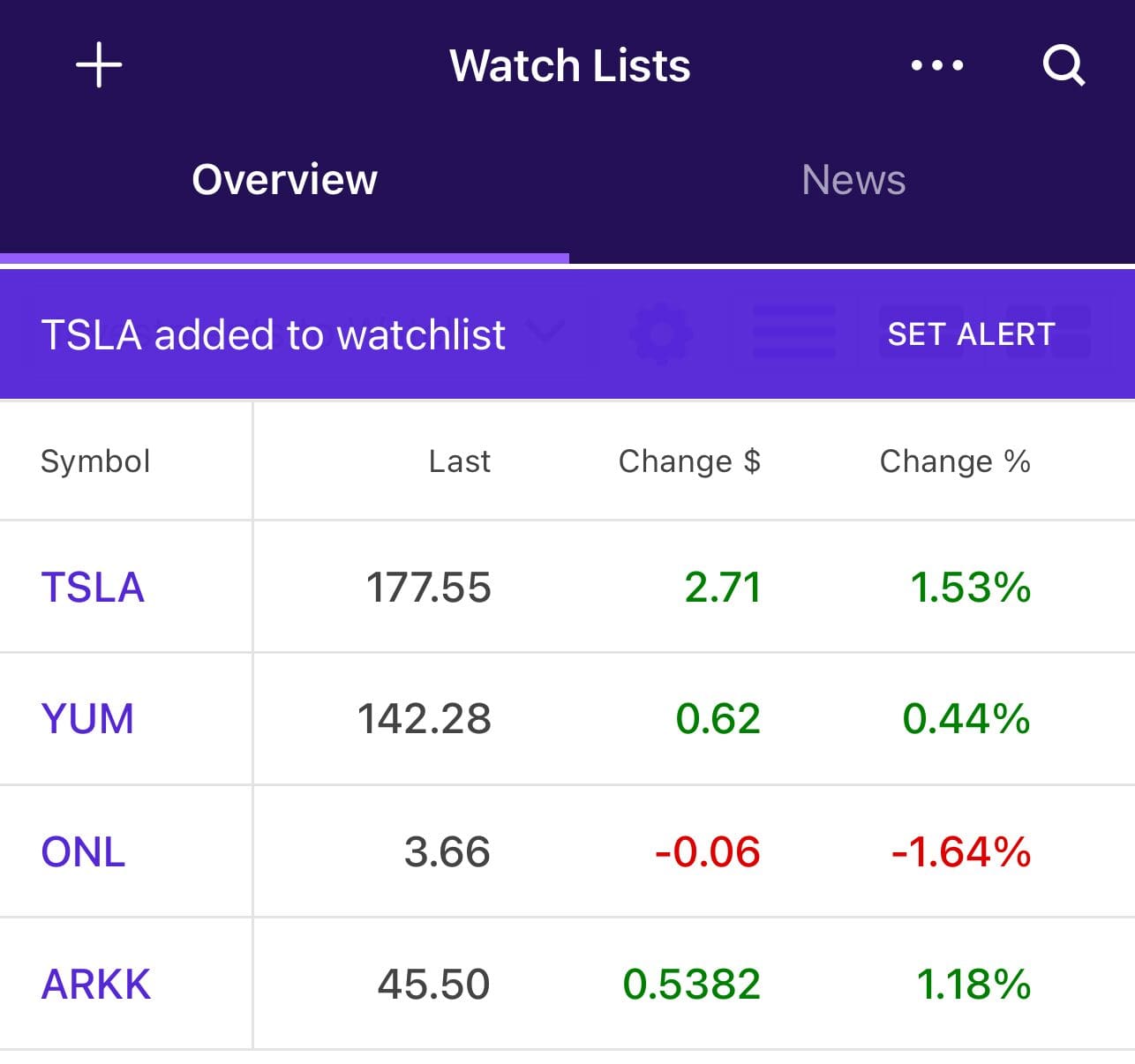

Another feature we found helpful on Robinhood is the custom alerts. These alerts let you set price targets and then walk away from the app. If there are any price changes, you get a notification so you can check and take action.

The real value is with technical analysis. Robinhood supports alerts for technical indicators like moving averages, relative strength index (RSI), or Bollinger Bands.

By setting these alerts, you get notified when specific market conditions are met, helping you stay on top of market trends and signals.

Bottom Line

Robinhood is best for those who want a simple, low-cost platform for various trading needs, including Crypto.

However, Etrade may be better if you need a more comprehensive platform with advanced tools, diverse investment options, and great banking options.

Compare Robinhood Side By Side

Schwab offers more options for investors, including robo advisors and wealth management, while Robinhood is best for beginners and traders.

Schwab vs. Robinhood: Which Brokerage is Right for You?

Vanguard offers more options for investors, including retirement, robo advisors, and wealth management, while Robinhood is best for traders.

Merrill Edge is best for long-term investments, including retirement, while Robinhood is perfect for active traders who value simplicity.

Merrill Edge vs. Robinhood: Compare Brokerage Account Options

JP Morgan wins when it comes to fundamental investing tools, but Robinhood is better for technical analysis and trading. Here's why:

J.P. Morgan Self-Directed Investing vs. Robinhood : Compare Brokerage Accounts

Fidelity is our winner for diversified long-term investing, while Robinhood shines in cost-effective options for active traders and beginners.

Robinhood is an excellent choice for beginner and casual investors, but IBKR is better suited for experienced investors and advanced traders.

Interactive Brokers vs. Robinhood: Compare Brokerage Account Options

Robinhood is best for traders looking for easy, cost-free trading, while Stash is great for beginner investors who need a financial management tool

While Robinhood caters to traders and advanced investors, Acorns focuses on automated investing and banking. Here's our full comparison.

Webull is better suited for experienced traders needing advanced tools, whereas Robinhood caters to beginners and those who prefer simplicity.

Compare E-Trade Side By Side

Schwab is our pick for long-term investors, wealth management, or retirement. E-Trade may be better for traders and cash management.

Vanguard is our pick for long-term investors, wealth management, or retirement, while E-Trade may be better for traders active investors

Robinhood is best for low-cost platform for various trading needs, including Crypto. Etrade is better for one stop shop, including banking.

ETRADE is best for a comprehensive array of investment options, while Webull app design and charting is one of the most appealing we've seen