If you're looking to do some stock research without spending a dime, there are plenty of free stock research websites and tools that give you all the info you need to make smart decisions.

Let’s explore the top free options available for your everyday investing needs.

Stock Analysis

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Platform Screenshots

We included Stock Analysis in our list of free stock research tools for investors because it provides essential financial data, earnings reports, and valuation metrics without a subscription.

Investors can access company financials, historical stock data, and basic screening tools to support their research. The platform's intuitive interface makes it easy to analyze stocks, track trends, and compare financials.

Besides Free Stock Research Tools, Stock Analysis also provides detailed financial statements, earnings reports, valuation metrics, and stock screening features.

Its intuitive interface and fundamental analysis focus make it a great choice for investors seeking data-driven insights and long-term stock evaluation.

- Stock screener

- ETF screener

- Stock analysis tools

- Technical charting

- Watchlist tracking

- IPO tracking

- Stock comparison

- Stock market news

- Earnings calendar

- Trending stocks

- ETF provider insights

- Financial statement analysis

MarketBeat

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Platform Screenshots

MarketBeat stands out as a solid free stock research tool for investors, offering analyst ratings, real-time stock quotes, insider trading activity, and financial data – all presented in an easy-to-use interface with clear, visually appealing charts and stock comparisons.

MarketBeat’s premium plans expand on this, adding features like MarketRank™ stock rankings, real-time news updates, and in-depth stock analysis.

Whether you're a beginner or a seasoned investor, MarketBeat’s intuitive design and insightful tools make it a valuable addition to any investor’s research toolkit.

- Stock research reports

- Analyst forecast ratings

- Dividend and earnings data

- Insider trade tracking

- Short interest insights

- Options chain analysis

- Stock comparison tool

- Market calendars

- Portfolio tracking

- Stock market heatmaps

- Trending stocks data

- MarketBeat mobile app

Zacks

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Platform Screenshots

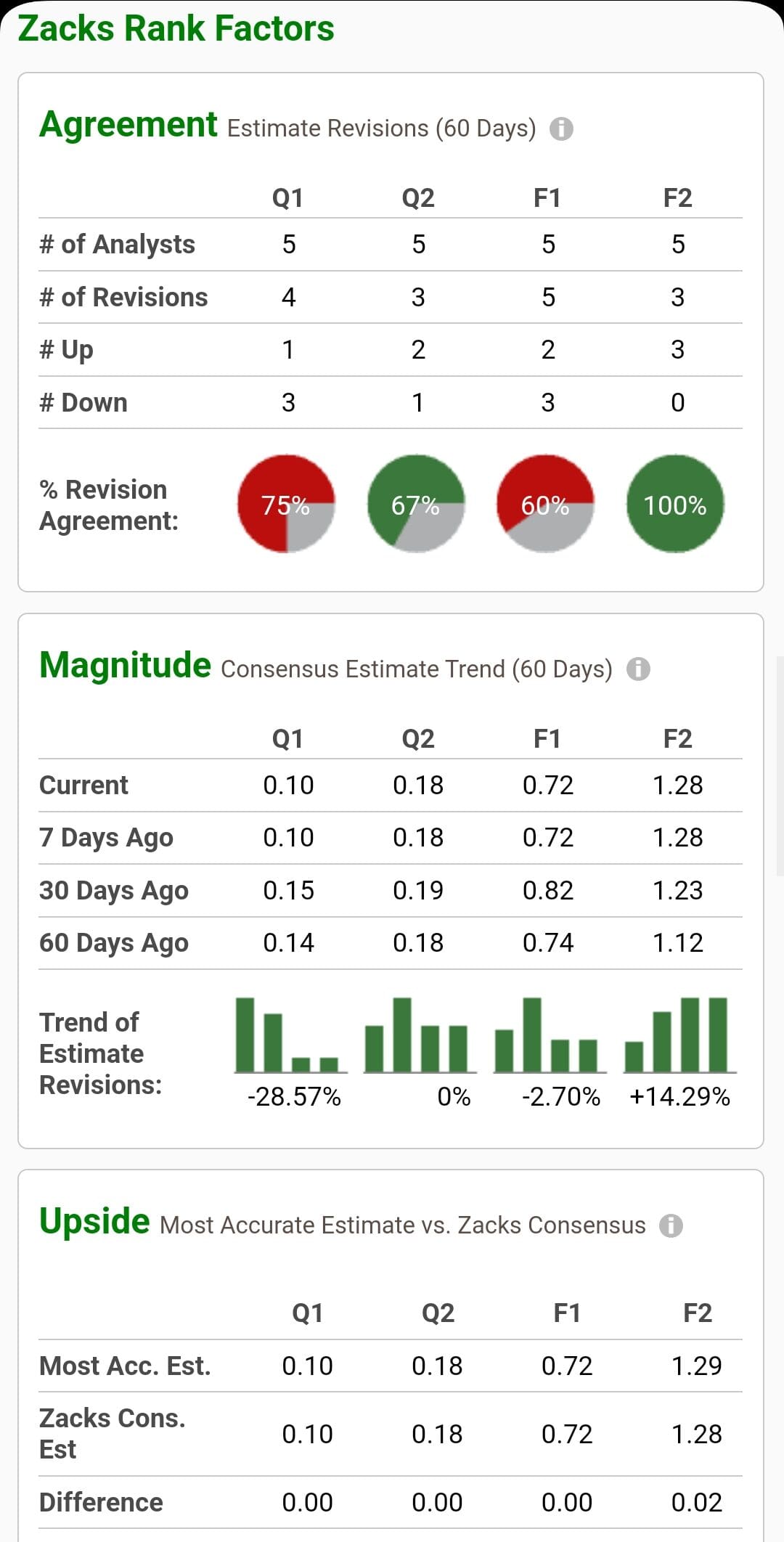

Zacks’ free stock research tools provide investors with market insights, basic stock rankings, and fundamental data to help them make informed investment decisions.

The Zacks Rank system, which evaluates stocks based on earnings momentum, is a standout feature, offering a quick way to assess potential winners and losers.

We included Zacks because it delivers trusted stock research for free, making it a great option for investors who need reliable rankings and market analysis without paying for premium services.

However, the free version lacks in-depth research reports, full stock rankings, and advanced screening tools.

- Zacks Rank Stock Ratings

- Stock Screener & Filters

- ETF & Mutual Fund Screener

- Style Scores (Value/Growth)

- Basic Stock Charting Tools

- Portfolio Tracker & Alerts

- Profit from the Pros Newsletter

- Industry Rank & Market Trends

- Stock Forecasts & Price Targets

- Dividend Stock Research

- Economic & Earnings Calendar

- Bull & Bear of the Day

Yahoo Finance

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Platform Screenshots

The Yahoo Finance Free Stock Research Tools provide investors with real-time quotes, financial news, company fundamentals reports, stock charts, and a stock screener to analyze market trends.

We included it in our list because it offers a user-friendly experience, easy access to company financials, earnings reports, and fundamental data.

Premium plans unlock Morningstar stock ratings, Argus Research picks, fair value analysis, and insider trading insights, making it an even more powerful research tool.

- Basic stock & ETF screener

- Real-time stock quotes & news

- Follow stocks, ETFs, and crypto

- Basic technical analysis tools

- Custom watchlists & alerts

- Link brokerage portfolios

- Join investor conversations

- Company profiles & key statistics

- Earnings & economic event calendar

- Top movers & trending stocks

- Cryptocurrency market tracker

- Stock market heat maps

Simply Wall St

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Platform Screenshots

Simply Wall St makes stock research simple with its easy-to-read visuals and fundamental analysis.

The free version gives investors access to stock reports, portfolio tracking for one portfolio, and community insights, making it a great tool for beginners.

Besides this, Simply Wall St also provides intuitive portfolio tracking, in-depth stock analysis, and a unique visual approach with its Snowflake analysis.

Investors can access fundamental insights, stock screeners with alerts, and curated investment ideas, making it a powerful tool for long-term, data-driven stock research and decision-making.

- Portfolio tracking & analysis

- Stock screener filters

- Fundamental stock analysis

- Company reports insights

- Stock comparison tool

- Investing ideas & trends

- Watchlist & valuation tracking

- Dividend tracking insights

- Community stock narratives

- Earnings & financial health

- Sector & industry filtering

Investing.com

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Platform Screenshots

Investing.com’s Free Stock Research Tools offer a solid foundation for investors looking to analyze stocks, track market trends, and review fundamental data.

The platform provides real-time quotes, financial news, earnings reports, and interactive charts to help investors make informed decisions.

We included it in our list because it’s user-friendly, covers global markets, and aggregates key financial data in one place.

However, the free version lacks in-depth analyst reports, advanced financial models, and historical data beyond a few years, which limits deep stock analysis.

- Stock Screener

- Stock Analyst Ratings

- Real-Time Market Data

- Interactive Financial Charts

- Technical Analysis Summary

- Company Financials Data

- Portfolio Management

- Financial News & Analysis

- Economic Calendar

- Alerts & Notifications

- Currency Converter

- Basic Fundamental Data

Seeking Alpha

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Platform Screenshots

Seeking Alpha’s Basic plan is a free entry-level option for investors looking for market news, stock analysis, and general financial insights.

It provides access to articles from contributors, earnings reports, limited stock ratings, and a stock screener, making it a useful starting point for those researching stocks and ETFs.

The platform is well-known for its investor-driven content, where analysts, traders, and financial experts share stock ideas, market trends, and industry insights.

However, the basic plan does have several limitations. Real-time stock prices are not included, as well as advanced technical analysis tools or stock advisory options.

- Stock market news & analysis

- Stock screener for research

- Delayed stock prices

- Stock charts & tracking

- Fundamental analysis tools

- Watchlist & portfolio tracking

- Dividend stock data

- Earnings reports & transcripts

- Earnings calendar access

- Market overview & trends

- SEC filings & press releases

- Macro & economic news

Must-Have Features in a Free Stock Research Website

For beginners, a good stock research website should provide essential tools and data to help make informed investment decisions. Here are the must-have features to look for:

Real-Time Stock Quotes – Live price updates ensure you’re not relying on outdated information when analyzing stocks.

Fundamental Data & Financial Statements – Access to key metrics like revenue, earnings, P/E ratio, and balance sheets helps evaluate a company's health.

Stock Charts & Technical Analysis – Basic charting tools with indicators like moving averages and RSI assist in spotting trends.

Stock Screeners – Customizable filters to find stocks based on market cap, valuation, dividend yield, or growth potential.

Analyst Ratings & Price Targets – Insights from Wall Street analysts give an idea of market sentiment around a stock.

Market News & Sentiment Analysis – Real-time news feeds and sentiment tracking help investors stay updated on key events impacting stocks.

Earnings Calendar & Key Events – A schedule of earnings reports, dividends, and economic events aids in planning investment decisions.

Portfolio Tracking – Tools to track your holdings, monitor performance, and set alerts for price changes or news.

ETF & Index Insights – Access to data on ETFs and major indices for diversified investing strategies.

Community Discussions & Forums – Social sentiment from investor communities (e.g., Reddit, X) can offer additional perspectives.

A well-rounded stock research website should combine these features to provide a complete picture of a stock’s potential.

6 Things Investors Can Do with a Free Stock Research Website

Free stock research websites provide powerful tools for investors to analyze and track stocks without paying for expensive platforms.

Here are 6 key things investors can do using these websites:

-

Check Real-Time Stock Prices

Investors can monitor live stock prices and historical performance to track market movements.

Websites like Yahoo Finance and investing.com provide up-to-date price charts, allowing investors to make timely decisions based on market trends.

-

Analyze Financial Statements

Understanding a company’s financial health is crucial for making informed investment decisions.

Free platforms like MarketWatch and Morningstar offer access to financial statements, including income statements, balance sheets, and cash flow reports.

Investors can check key metrics such as revenue, profit margins, and debt levels before investing.

-

Use Stock Screeners to Find Opportunities

Stock screeners help investors filter stocks based on specific criteria such as P/E ratio, dividend yield, and market capitalization.

Finviz and stockanalysis.com offer an advanced stock screener that allows investors to find undervalued stocks or high-growth opportunities based on their strategy.

-

Track Analyst Ratings and Forecasts

Websites like Zacks Investment Research and TipRanks provide analyst recommendations, price targets, and earnings forecasts.

Investors can use this data to gauge market sentiment and determine whether a stock has strong growth potential or faces potential risks.

-

Compare Stocks and Sectors

Investors can compare multiple stocks within the same industry to determine the best investment options.

For example, using Yahoo Finance, an investor can compare Tesla (TSLA), Ford (F), and General Motors (GM) based on revenue, valuation, and performance charts to decide which auto stock is the best pick.

-

Manage and Track a Portfolio

Many free stock research websites allow users to create a virtual portfolio to track investments in real time.

MarketBeat and TradingView enable investors to monitor stock performance, set alerts, and analyze portfolio diversification, helping them manage their investments effectively.

How to Analyze a Stock Using Free Tools: A Step-by-Step Guide

Using free stock research websites, investors can analyze stocks effectively without paying for premium tools. Here’s a simple fivr-step process with examples:

-

Step 1: Check Basic Stock Information & Price Trends

Start by looking at the stock’s price history, market cap, and recent performance. Websites like Yahoo Finance or Investing.com provide interactive stock charts.

For example, if researching Apple (AAPL), you can see its historical performance, 52-week high/low, and trading volume to assess price trends.

-

Step 2: Analyze the Company’s Financials

Review the income statement, balance sheet, and cash flow statement to understand profitability and financial stability. Morningstar or MarketWatch provide access to key financial metrics.

For example, when evaluating American Express (AXP), check its revenue growth, profit margins, and debt levels to determine financial health.

-

Step 3: Compare with Competitors & Industry Trends

Use stock comparison tools on Yahoo Finance or Finviz to see how the stock stacks up against competitors.

If researching Microsoft (MSFT), compare it with Google (GOOGL) and Amazon (AMZN) on valuation ratios like P/E ratio and revenue growth to assess its relative position in the tech industry.

-

Step 4: Review Market Sentiment & Analyst Ratings

Check analyst recommendations on Zacks Investment Research or TipRanks to see if experts rate the stock as a “Buy” or “Sell.”

Also, news sentiments can be scanned on CNBC or StockTwits to identify potential risks or catalysts.

For instance, if Nvidia (NVDA) gets strong analyst upgrades, it may indicate growth potential.

-

Step 5: Decide Whether to Invest or Pass

- If the stock meets your criteria (strong financials, industry leadership, positive analyst sentiment), consider adding it to your watchlist or buying shares.

- If red flags appear (declining revenue, excessive debt, poor industry outlook), it might be best to pass or wait for a better opportunity.

Hidden Limitations of Free Stock Research Websites

While free stock research websites offer valuable tools for investors, they come with certain limitations that can impact decision-making. Here are some key drawbacks to be aware of:

Delayed Data & Limited Real-Time Access – Many free platforms provide stock prices with a delay, making them less reliable for active traders who need real-time updates.

Limited Depth of Financial Data – While basic financial statements are available, deeper insights like segment breakdowns, in-depth valuation models, and historical financial trends are often behind a paywall.

Restricted Analyst Ratings & Forecasts – Free websites may show a limited number of analyst ratings, while detailed forecasts, earnings projections, and target price breakdowns require a premium subscription.

Basic Stock Screeners – Free stock screeners may lack advanced filters, such as specific fundamental and technical indicators, making it harder to refine investment searches.

Advertisements & Biased Content – Many free platforms rely on ads and sponsored content, which can sometimes promote certain stocks or services with a biased perspective.

No Custom Alerts & Portfolio Analysis – Features like personalized alerts, backtesting strategies, and in-depth portfolio analysis are often missing or restricted in free versions.

Understanding these limitations helps investors supplement free resources with additional research before making investment decisions.

FAQ

Yes, websites like Yahoo Finance, Morningstar, and MarketWatch allow access to income statements, balance sheets, and cash flow reports for most publicly traded companies.

Free websites provide basic analyst ratings, but they often lack detailed reports and consensus breakdowns found in premium services like TipRanks or Seeking Alpha Pro.

Most free tools, like Yahoo Finance and Investing.com, provide ETF and index performance data, but they may not offer detailed holdings analysis.

Some free tools, like TradingView and Yahoo Finance, allow users to set up basic price alerts, but more advanced alerts often require a paid plan.

Beginners should use a combination of free tools for financial analysis (Yahoo Finance), screening (Finviz), charting (TradingView), and news tracking (Benzinga) to get a well-rounded view before making investment decisions.