|

| |

|---|---|---|

Goldco | Silver Gold Bull | |

Min. Investment | $15,000 / $25,000

$15,000 for cash purchases / $25,000 for gold IRA | $0 |

Established | 2006 | 2009 |

Storage Fees | $100 – $150

Non-Segregated: $100 | Segregated: $150 per year . Estimated annual fee. | $225 – $275

$225 for Pooled Storage, $275 for Segregated Storage . Estimated annual fee. |

Coin & Bar Selection | Limited, IRA-focused | Wide, includes collectibles & numismatics

|

Payment Methods | Bank wire, check, credit card | Credit card, PayPal, wire, crypto |

Pricing Transparency | No, must contact for pricing

| Yes, live pricing on website

|

Best For | IRA-focused investors | Direct buyers seeking variety |

Our Rating |

(4.7/5) |

(4.5/5) |

Read Review | Read Review |

Silver Gold Bull vs. Goldco: Who Has the Better Reputation?

Our preferred choice for reputation is Goldco, thanks to its larger volume of positive reviews across multiple platforms and better online engagement.

Both companies are highly rated, with Goldco receiving an A+ BBB rating and strong feedback on Trustpilot and Consumer Affairs.

[elementor-template id=”203484″]

However, Silver Gold Bull has more total reviews and a consistent 4.8 Trustpilot score across over 4,000 reviews:

[elementor-template id=”203485″]

Where to Buy Gold: Silver Gold Bull vs. Goldco

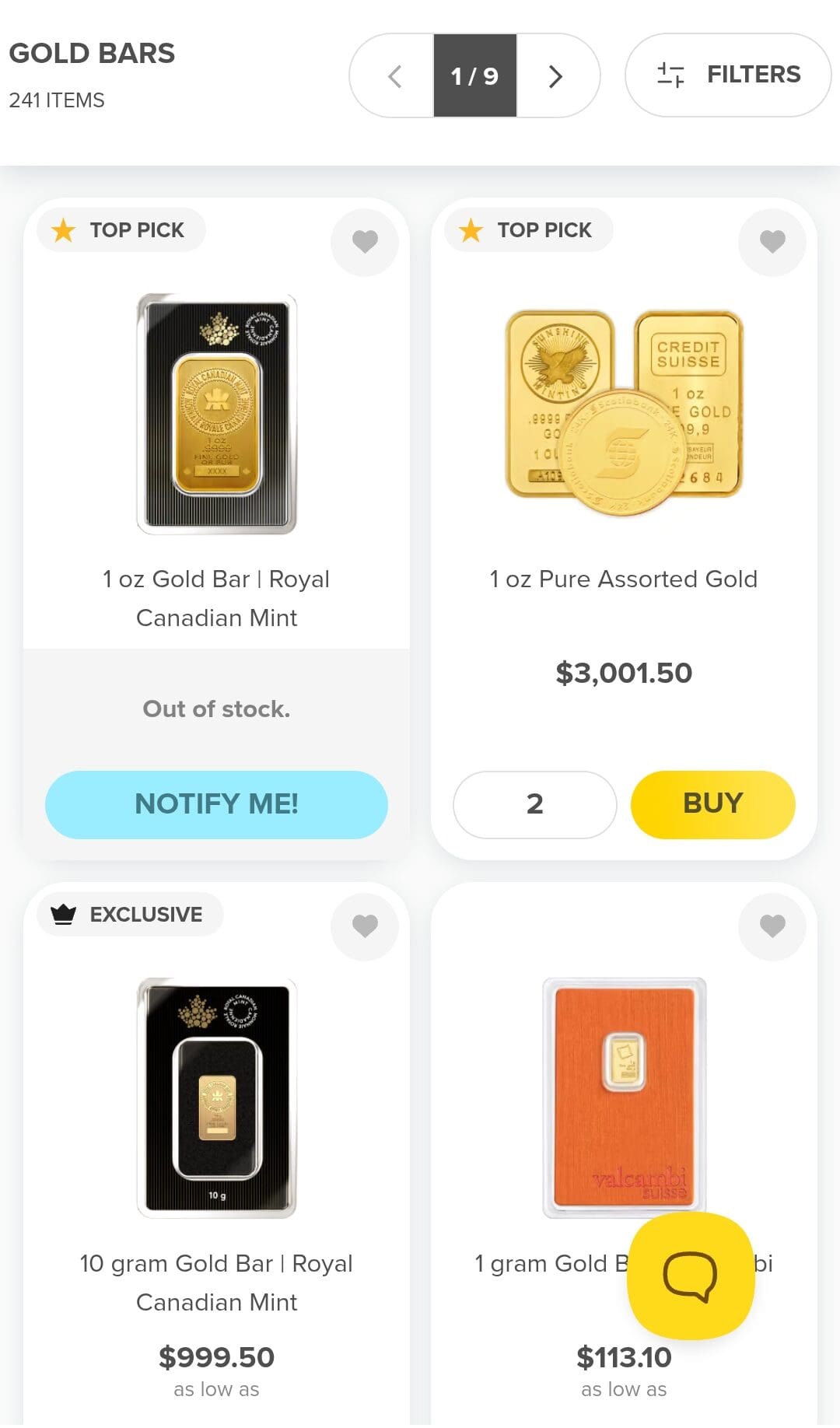

Our top pick for direct precious metal purchases is Silver Gold Bull due to its wider product range, price match guarantee, flexible payment methods, and great website experience.

Both Goldco and Silver Gold Bull offer strong options for purchasing physical gold and silver, including IRS-approved bars and coins. They also provide secure storage options and buyback programs that reflect current market value.

Where they’re both strong:

Product selection: Both offer popular IRA-approved coins like American Eagles and Canadian Maple Leafs.

Buyback program: Each provides competitive market-based buybacks, even for metals not originally purchased through them.

Secure shipping: Orders are shipped with insurance and tracking, ensuring safe delivery.

Payment options: Credit cards and bank wires are standard; Silver Gold Bull also accepts PayPal and crypto.

Where Silver Gold Bull stands out:

Wider selection: In addition to gold and silver, it offers platinum, palladium, numismatics, and jewelry.

Payment flexibility: Accepts PayPal, e-checks, and crypto for greater convenience.

Price Match Guarantee: You can get the best deal by matching competitors’ prices, including shipping and insurance.

Military discount: Unique benefit for active duty and veterans.

Where Goldco falls short:

Product scope: Limited to gold and silver only—no platinum or palladium.

Higher minimums: Requires at least $15,000 for direct purchases.

Website info gaps: Exact pricing often requires a phone consultation.

If you're seeking a wider selection and more flexibility when buying physical metals, Silver Gold Bull is the better option overall.

IRA Investing: Goldco vs Silver Gold Bull

Our preferred choice for precious metals IRAs is Goldco, due to its specialized focus, strong customer ratings, and comprehensive rollover and educational support.

Both Goldco and Silver Gold Bull offer Gold IRA services, helping customers transfer or roll over retirement accounts into precious metal-backed IRAs. However, there are meaningful differences in focus and experience.

Where they’re both strong:

IRA-approved metals: Both dealers offer IRS-compliant coins and bars.

Storage options: Clients can choose between segregated and non-segregated storage at approved depositories.

Custodian partnerships: Each works with reputable third-party custodians.

Where Goldco excels:

Specialization: Goldco’s core business is retirement-focused investing, not just product sales.

Rollover support: Dedicated account reps assist with transfers from IRAs, 401(k)s, 403(b)s, and TSPs.

Educational resources: Offers free guides, personal consultations, and article libraries focused on retirement investing.

Transparent fees: Lists setup ($50), maintenance ($80), and storage ($100–$150) clearly for IRA investors.

Buyback guarantee: Investors can sell metals back at the highest market price after 3 years.

Where Silver Gold Bull is limited:

IRA is secondary: Their main focus is direct sales, not IRAs.

Limited transparency: Investors may need to contact customer service to learn specific fees.

Storage flexibility: Only partners with select custodians like Equity Trust, limiting international storage options.

While both are capable, Goldco’s experience, transparency, and dedication to long-term retirement planning make it the more secure and supportive IRA partner.

Final Verdict: Silver Gold Bull vs. Goldco

We recommend Silver Gold Bull for investors buying physical metals directly due to its variety and payment flexibility.

For retirement investors, Goldco is our preferred IRA partner for its specialization, experience, and strong customer support.

- Ratings: Goldco – More reviews, consistent ratings, many platforms.

- Direct Purchase: Silver Gold Bull – Wider product range, payment methods, and pricing benefits.

- IRA: Goldco – Specialized services, educational support, and clear fee structure.