GuruFocus (Free Plan)

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Pros & Cons

The GuruFocus Free Plan is a stock research platform designed for investors who focus on fundamental analysis and long-term value investing.

This is one of the most comprehensive platforms available, with many features and options for investors.

It provides access to historical financial data, valuation metrics, and guru trading insights, helping users analyze companies based on key financial health indicators.

The platform’s All-in-One Screener allows users to filter stocks based on market cap, valuation ratios, and profitability metrics, while the Insider Trading Tracker reveals CEO and CFO stock transactions.

Despite these features, the free plan comes with notable limitations. Guru Trades are not available, most customization options for screeners are restricted, and key stock data such as valuation metrics are only available with a paid subscription.

- All-in-One Stock Screener

- GuruFocus Predefined Screens

- Historical Financial Data

- Stock Valuation Metrics

- Insider Trading Tracker

- Guru Holdings & Trades

- Model Portfolio Strategies

- Stock Comparison Tool

- Charting & Technical Analysis

- Discussion Board & Community

- Earnings Call Transcripts

- ETF & Fund Data

- Comprehensive stock research tools

- Strong fundamental analysis focus

- Guru trading insights available

- Valuation metrics & data access

- Sector & market comparison tools

- Limited free plan features

- No portfolio tracking tools

- Lacks real-time stock data

- Weak technical analysis support

- User interface could improve

How To Research Stocks With GuruFocus?

We tested GuruFocus's stock research tools, exploring its screeners, valuation metrics, and financial data:

-

GuruFocus Stock Screeners: How Effective Is It?

The Screeners on GuruFocus provide investors with powerful tools to filter and identify stocks based on key financial metrics, valuation models, and investment strategies.

With customizable criteria and predefined screens, users can discover high-quality stocks, value opportunities, and guru-held investments.

However, the screeners are unavailable for the free plan, only for the Gurufocus premium plan.

Here are the main screeners:

- All-In-One Screener: The All-In-One Screener allows investors to filter stocks based on various fundamental and technical metrics.

- Guru screener: The GuruFocus Screener offers a range of predefined screening tools designed. For example,The Ben Graham Lost Formula screener identifies undervalued stocks based on low PE ratios and strong equity-to-asset ratios.

- Value screneer: The Value Screens on GuruFocus are designed for investors following value investing principles, providing curated lists of stocks that meet specific valuation criteria.

-

Stock Analysis With GuruFocus: Worth It?

GuruFocus provides investors with a comprehensive overview of a company's financial health, valuation, and performance.

If you search for a stock, you can easily see key metrics such as price-to-earnings ratios, profitability measures, and growth rates, helping users assess a stock's fundamental strength.

For example, here we checked JPM financials:

Investors can access historical financials, industry comparisons, earnings and more parameters. Proprietary scoring models like the GF Score, which evaluates stocks based on factors like growth, value, and momentum.

The feature also highlights risk indicators, including financial distress signals and potential red flags, offering a deeper perspective on a company's stability.

The platform also integrates insider trading data and institutional holdings, allowing investors to see who is buying or selling shares.

However, the free plan has limitations, such as restricted access to premium valuation tools, limited data history, and fewer advanced screening options.

-

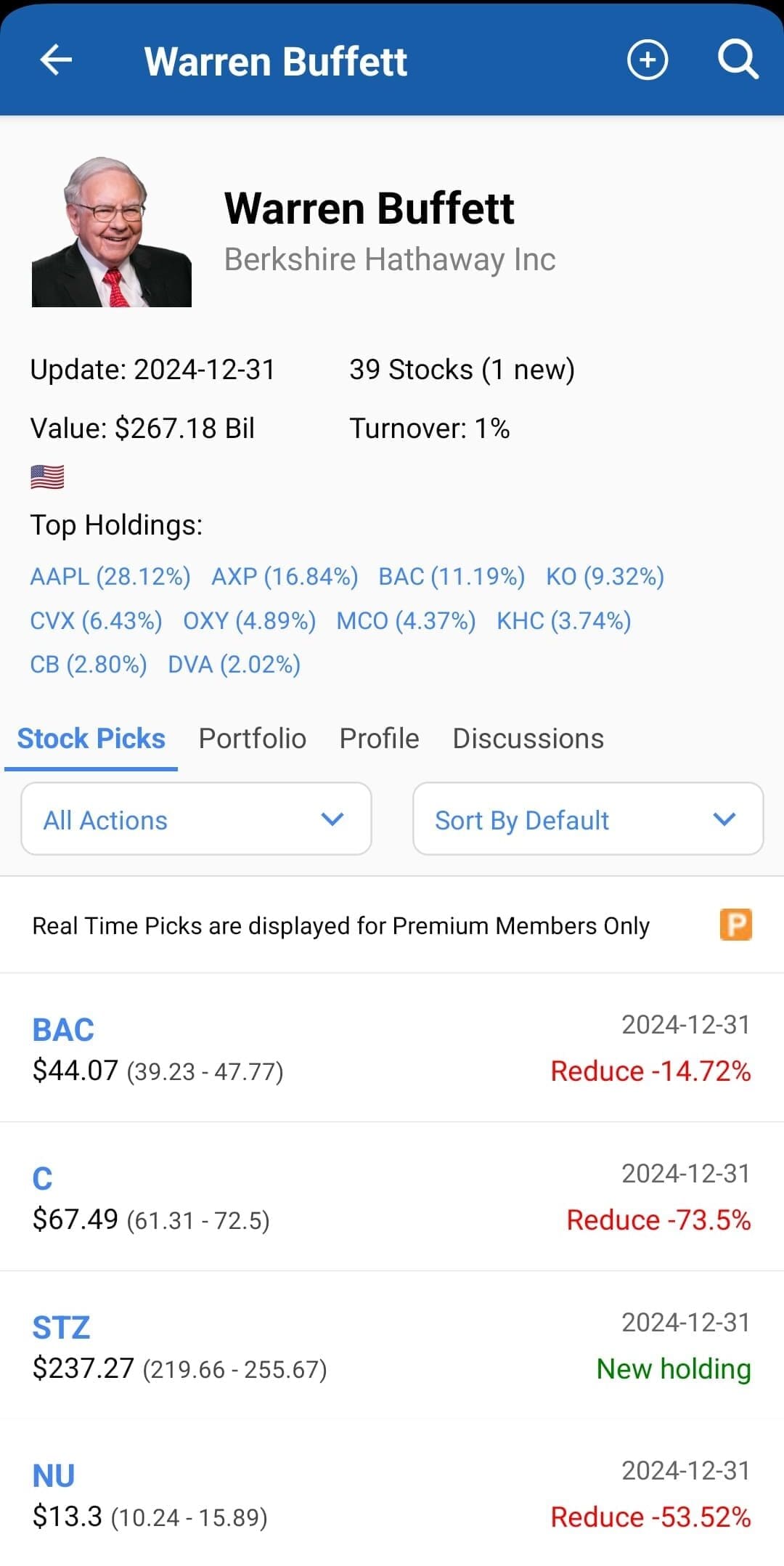

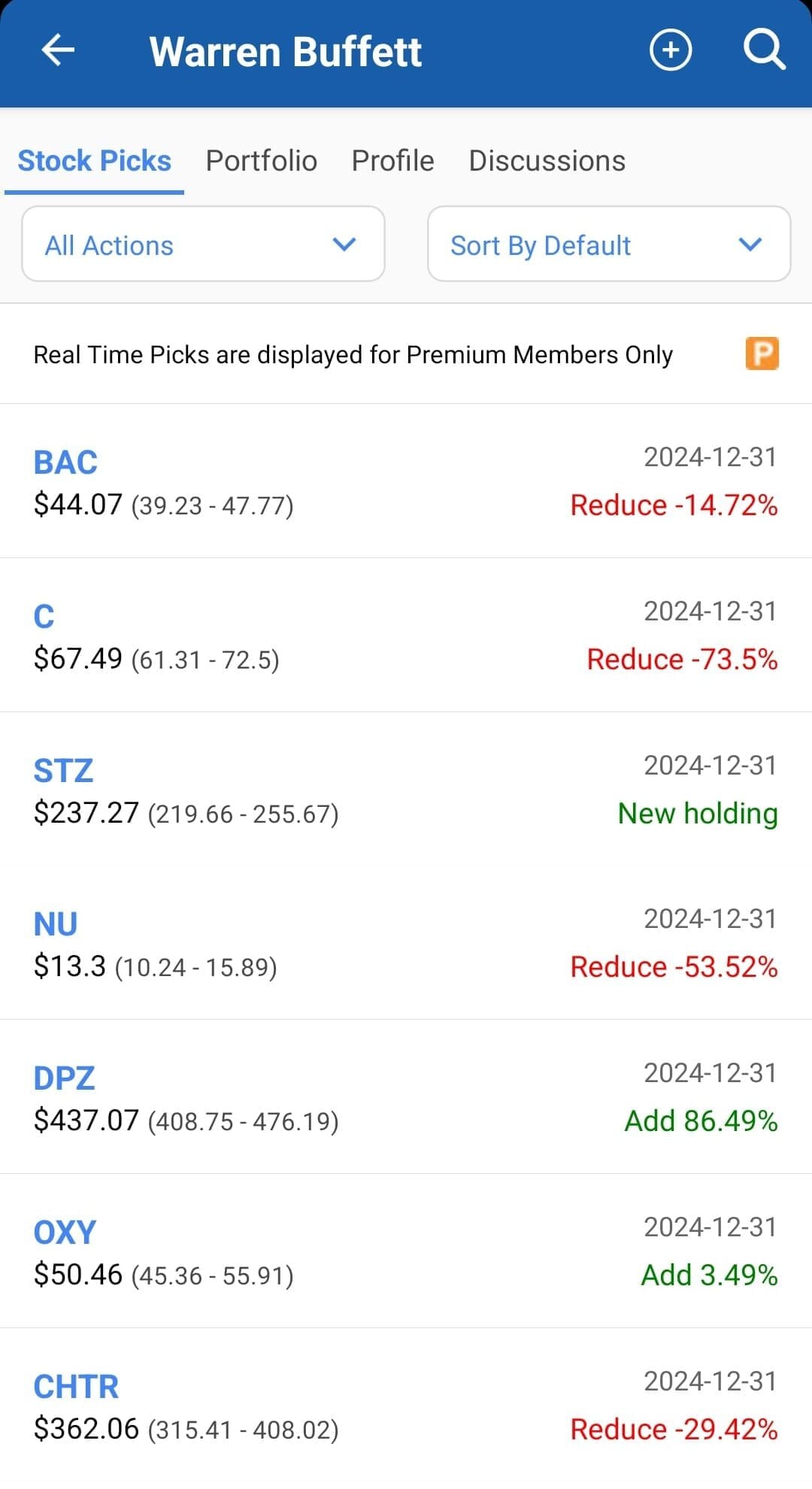

Explore Guru Lists

The Guru Lists provides investors with insights into the portfolios and strategies of top professional investors, or “gurus.”

It tracks their latest stock picks, holdings, and investment philosophies based on SEC filings, including 13F reports.

Investors can explore profiles of well-known figures like Bill Ackman, Warren Buffett, and others, gaining access to their top holdings, sector allocations, and historical portfolio changes.

The feature highlights recent trades, portfolio turnover, and key metrics such as position weighting and trade impact.

Users can analyze investment patterns, compare guru strategies, and see which stocks are most commonly held by top investors.

Additionally, it includes detailed company breakdowns, offering insight into which stocks gurus are buying, reducing, or holding steady.

Hidden Features Of GuruFocus You Should Know

We explored lesser-known tools like ETF data, model portfolio and news that can enhance your research:

-

Model Portfolios

The Model Portfolios offers investors pre-constructed portfolios based on various investment strategies, helping them analyze how different stock-picking methods perform over time.

These portfolios are built using specific criteria, such as value investing, guru strategies, and insider trading patterns. For example:

- The Value Strategies portfolios include top undervalued and predictable companies, historical low price-to-sales and price-to-book ratio stocks, and Buffett-Munger style picks.

- The GF Score Strategies rank companies based on the proprietary GuruFocus Score, highlighting stocks with strong fundamentals.

- The Guru Strategies feature tracks portfolios created from guru consensus picks, most broadly held stocks, and guru bargain opportunities.

- Insider Strategies identify top stocks based on CEO, CFO, and insider purchases or sales.

Additionally, sector and geographic trends are incorporated, allowing users to explore stocks within specific industries or regions.

-

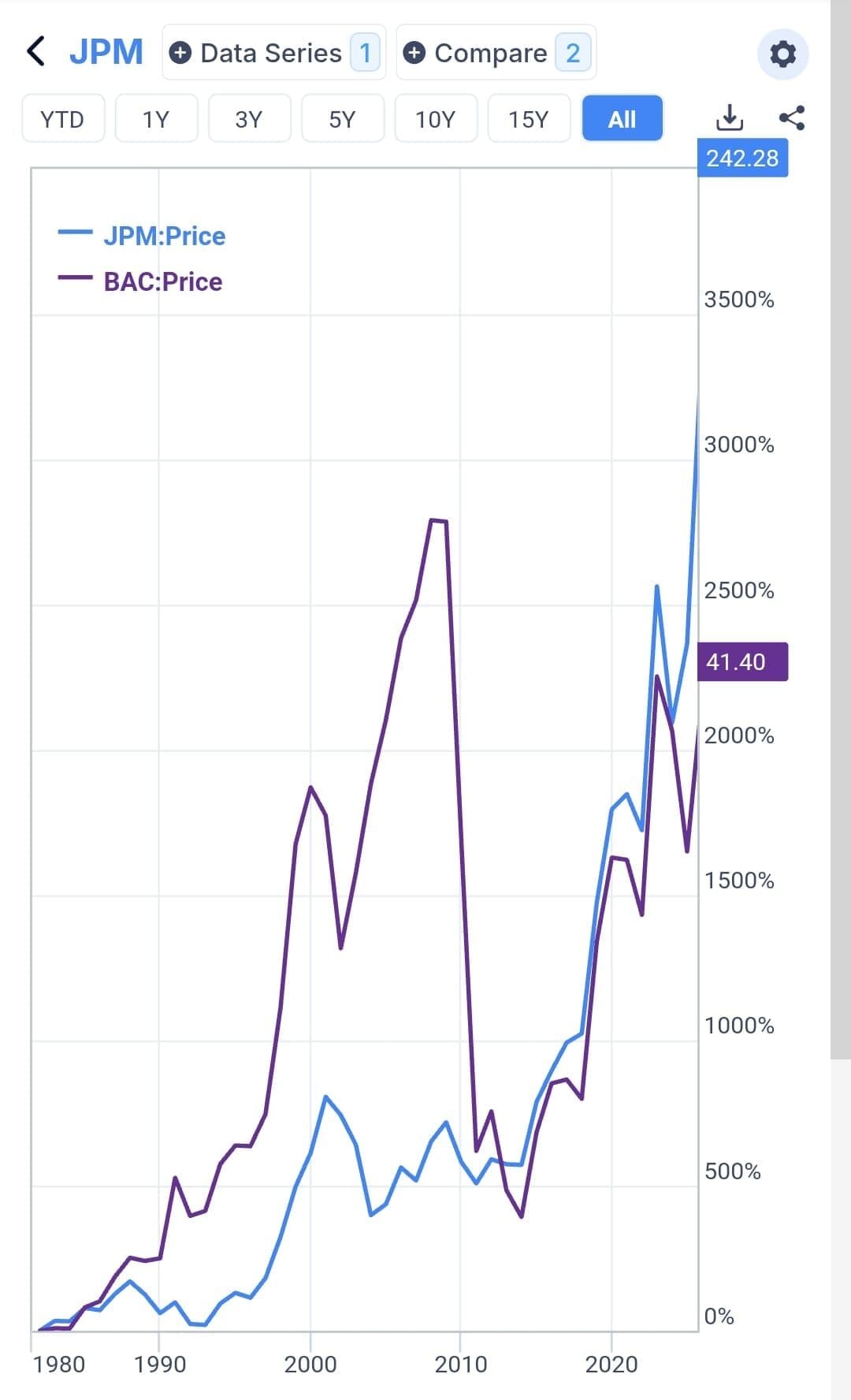

Stock Comparison

The Stock Comparison allows investors to analyze multiple stocks side by side using a variety of financial, valuation, and performance metrics.

Users can compare individual stocks of their choice or select from predefined categories such as clean energy, cloud computing, EV stocks, and FAANG stocks.

We compared JPM and BAC performance:

The tool provides key insights through Stock Table Performance, which highlights fundamental financial data.

The platform also offers various growth and profitability metrics, allowing users to compare companies based on earnings growth, return on invested capital, and financial stability indicators.

However, the free plan has limitations, such as restricted access to detailed valuation charts and advanced financial metrics.

-

Charting and Technical Analysis

GuruFocus charts allow investors to visualize stock performance with customizable, interactive charts.

Users can analyze historical price movements over multiple timeframes, from short-term trends to multi-decade perspectives.

The platform provides essential technical indicators, including moving averages, price-to-earnings ratios, and valuation metrics such as GF Value, helping investors assess whether a stock is over- or under-valued.

The charting tool also integrates financial data, allowing users to overlay key fundamentals like revenue, net income, and balance sheet metrics to identify correlations between price movements and company performance.

The layout is intuitive, making it accessible for both technical traders and long-term investors looking for data-driven insights.

However, the free plan has limitations, including restricted access to premium indicators, limited historical data for some metrics, and fewer customization options.

-

Insiders Tracking

With Insiders, investors can find insights into stock transactions by corporate executives and politicians, gain insights into potential driven market movements:

-

Insider Trading Tracker

The GuruFocus Insider Trading Tracker provides real-time insights into corporate insider transactions, helping investors analyze the buying and selling patterns of executives.

It highlights key trades by CEOs and CFOs, offering a window into leadership confidence.

The tool also tracks broader insider trends, including clusters of executives buying shares simultaneously, which can indicate strong internal sentiment.

-

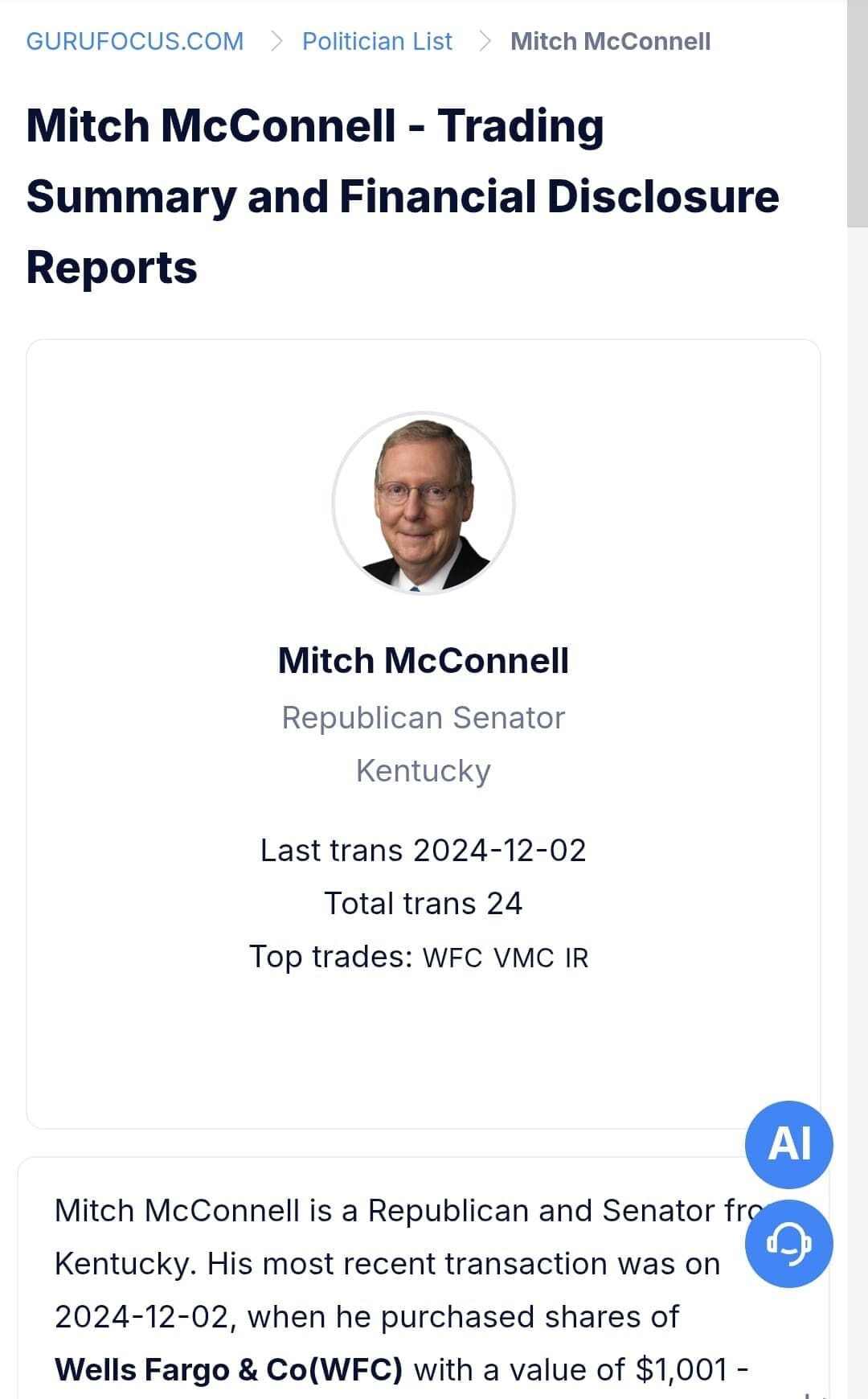

Politician Trading Tracker

This tracker monitors stock trades made by U.S. politicians, offering transparency into their investment decisions.

It provides real-time updates, a comprehensive list of political figures, and focused tracking on high-profile names such as Nancy Pelosi, Mitch McConnell, and Tommy Tuberville.

-

News

GuruFocus provides investors with a curated selection of market updates, expert insights, and company-specific reports.

It covers a broad range of financial topics, including stock market news, earnings reports, and insider transactions, giving users a well-rounded view of key developments.

The platform also delivers sector-specific news, including updates on software, biotechnology, hardware, banking, and metals & mining stocks.

These sections helps users stay informed with timely updates, making it a valuable tool for market research and investment decisions.

-

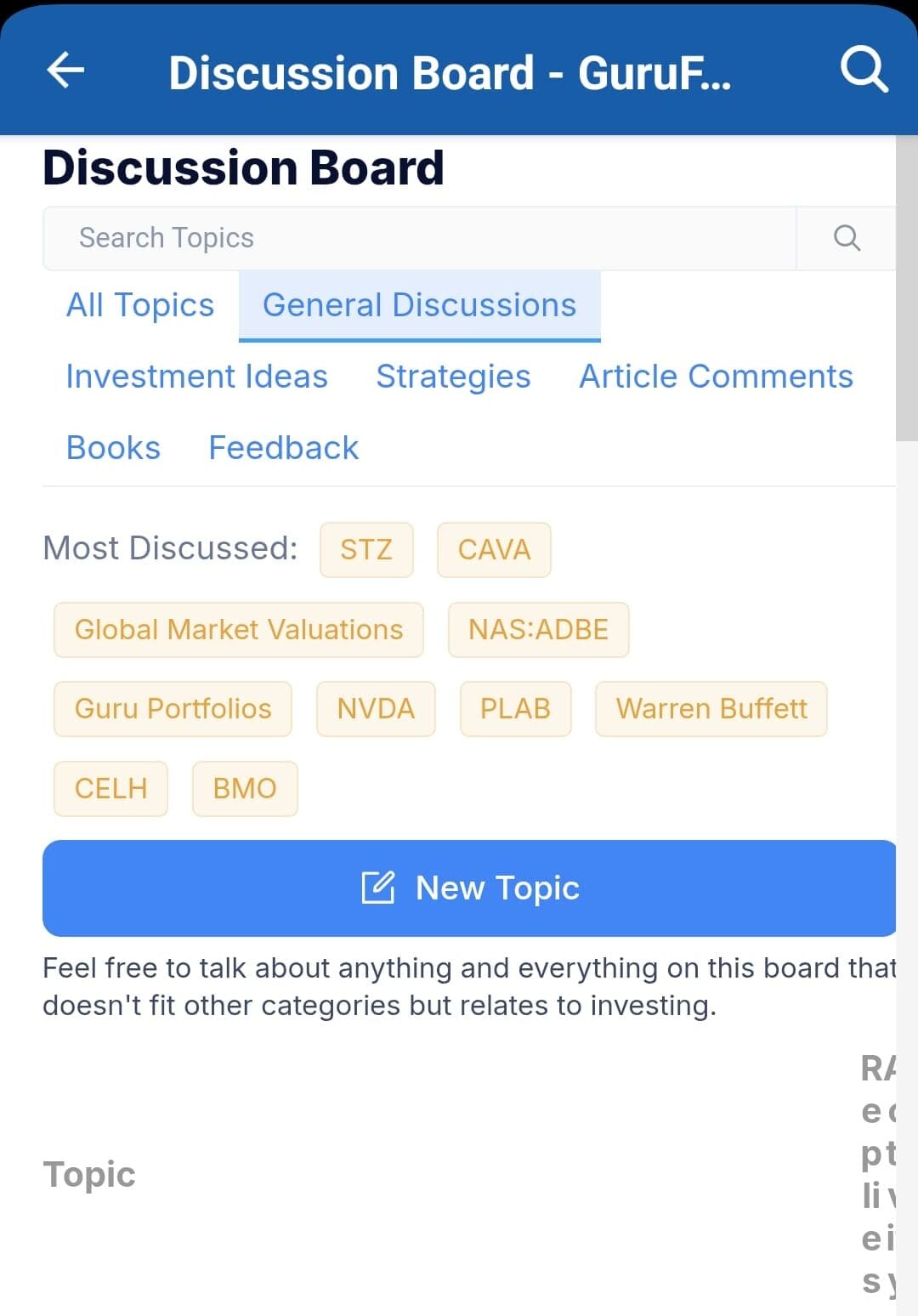

Discussion Board Search Topics

The Discussion Board on GuruFocus is a platform where investors can engage in conversations about stocks, market trends, and investment strategies.

It allows users to ask questions, share insights, and discuss financial topics with other community members.

Investors can exchange views on specific companies, valuation methods, and trading strategies, fostering collaborative learning.

The board also features discussions on guru trades, financial analysis, and macroeconomic trends, providing diverse perspectives from experienced investors.

Additional Features & Tools

The GuruFocus Free Plan provides a variety of tools and we couldn't cover all of them. Here are some additional, useful features it offers:

- ETF & Fund Data: Provides details on exchange-traded funds (ETFs) and mutual funds, including holdings, performance, and sector allocations.

- Alerts & Watchlists: Enables users to set up watchlists and receive alerts for price changes, news updates, and insider transactions.

- Economic Data: Includes key macroeconomic indicators such as GDP growth, interest rates, and inflation, helping investors understand broader market conditions.

- DCF Calculator: Allows users to perform basic discounted cash flow (DCF) valuation estimates to determine whether a stock is overvalued or undervalued.

- Dividend Data: Displays dividend yield, payout ratios, and dividend growth trends, helping income investors evaluate potential dividend-paying stocks.

- Earnings Calendar: Tracks upcoming earnings reports for companies, helping investors stay updated on potential market-moving announcements.

- Q&A with Gurus: Provides insights from top investors through interviews and discussions, helping users understand expert perspectives on market trends and investment strategies.

- Podcast: Features discussions on stock market trends, investing strategies, and insights from financial experts, offering an alternative way to stay informed.

- Earnings Call Transcripts: Gives access to company earnings call transcripts, allowing investors to analyze management commentary and business outlooks.

- Submit Article: Allows users to contribute articles on investing topics, stock analysis, and market trends, fostering community engagement and knowledge sharing.

- US Market Valuation: Tracks valuation metrics for the U.S. stock market, including aggregate price-to-earnings ratios and historical trends to assess overall market conditions.

- Global Market Valuation: Provides insights into valuation metrics across international markets, helping investors compare market conditions worldwide.

- Economic Indicators: Displays key macroeconomic data, such as interest rates, unemployment, and inflation, offering insights into broader economic trends affecting the stock market.

Key Drawbacks Of GuruFocus Free Plan

The GuruFocus Free Plan offers a solid foundation for stock research, but it has several limitations compared to its premium versions and competing platforms:

-

User Interface & Experience Could Be Improved

While GuruFocus provides a wealth of stock data, its UI (User Interface) and UX (User Experience) could be more intuitive and user-friendly.

The platform feels data-heavy, which can overwhelm beginners who prefer a more streamlined layout. Navigation between different features isn’t always seamless, and some tools require multiple steps to access.

-

No Advanced Technical Analysis Features

GuruFocus primarily focuses on fundamental analysis, leaving out many essential technical analysis tools that traders rely on.

Competing platforms like TradingView provide a much richer set of technical tools, including real-time pattern recognition and customizable charting.

-

No Portfolio Analysis & Tracking Features

One major drawback of the GuruFocus Free Plan is the lack of portfolio tracking and performance analysis tools.

While the platform provides insights into guru and insider portfolios, users cannot track their own investments or analyze portfolio allocation, returns, or risk metrics.

-

Free Plan Limitations

One major drawback of the free plan is the lack of real-time stock prices, insider trading updates, and guru trades.

Also, the DCF (Discounted Cash Flow) calculator, valuation models, and financial ratios are often restricted for free users

Lastly,free users cannot download financial statements, screeners, or guru portfolio holdings, making it difficult to analyze data offline.

Who Should Use GuruFocus?

The GuruFocus Free Plan is best suited for investors who focus on long-term strategies and fundamental analysis:

- Long-Term Value Investors: Those who follow Warren Buffett’s approach, looking for undervalued stocks with strong financials, will benefit from GuruFocus’s valuation models, stock screeners, and guru insights.

- Fundamental Analysts: Investors who prefer deep dives into financial statements, profitability metrics, and company health will appreciate the extensive financial data and historical trends available.

- Guru Followers: Investors who like to mirror the stock picks of top fund managers and hedge funds can explore guru trades and holdings.

- Sector-Focused Investors: Users interested in specific industries, like clean energy or technology, can explore sector-based stock comparisons and market valuation tools.

Who Should Avoid GuruFocus?

The GuruFocus Free Plan isn’t ideal for every type of investor or trader. Here’s who might not be a good fit:

- Options & Futures Traders: The platform focuses on stocks and fundamental analysis, offering little support for options strategies, futures trading, or complex derivatives.

- Technical Analysts: Traders who use indicators like Bollinger Bands, Fibonacci levels, and RSI will find GuruFocus’s charting tools too basic compared to platforms like TradingView.

- High-Frequency Traders: Investors who need millisecond-level data, direct market access, and algorithmic trading capabilities won’t find the necessary tools here.

- Portfolio Trackers: Those looking for a platform to manage and analyze their investments over time won’t have access to personal portfolio tracking or performance metrics.

FAQ

Yes, but it comes with limitations. Users can access basic stock data, historical financials, and some valuation metrics, but many advanced tools and real-time data require a premium subscription.

No, free users cannot set up custom alerts for stock price movements, earnings releases, or insider transactions. This feature is only available for premium subscribers.

Free users have access to the All-in-One Screener but are limited in the number of filters they can apply. More advanced filtering options require a premium upgrade.

Yes, but with restrictions. The platform covers global markets, but free users get limited access to detailed financials, valuation metrics, and guru holdings for non-U.S. stocks.

While the website is accessible on mobile browsers, there is no dedicated mobile app, making navigation and usability less seamless for mobile users.

The platform provides some ETF and mutual fund data, but its focus is primarily on individual stock analysis, with limited fund comparison tools.

No, the free plan does not offer backtesting capabilities.

Review Free Stock Analysis Tools

Investment Analysis & Research Tools : Review Methodology

At The Smart Investor, we evaluated free investment research platforms based on the quality and depth of their features compared to other free alternatives. Each platform was rated based on the following criteria:

- Fundamental Analysis Tools (25%): We assessed the availability of key financial data, including income statements, balance sheets, cash flow, valuation metrics, and analyst estimates. Platforms with more in-depth historical data, forward-looking projections, and research reports scored higher.

- Technical Analysis Features (20%): We examined the variety and quality of technical indicators, charting tools, and real-time price data. Platforms that offered customizable interactive charts, trend analysis, and multiple timeframes received better ratings.

- Stock Screener & Free Filters (15%): A strong stock screener is crucial for research, so we rated platforms based on the number and depth of filtering options. Higher scores were given to platforms that allowed customized searches using fundamental, technical, and sector-based criteria.

- Portfolio Tracking & Alerts (15%): We reviewed the ability to track multiple portfolios, set up watchlists, and receive alerts on stock movements. Platforms offering real-time updates, dividend tracking, and personalized notifications ranked higher.

- Ease of Use & User Experience (15%): Platforms were rated on their design, navigation, and accessibility across devices. Those with intuitive layouts, easy-to-read data, and smooth user experiences received better scores.

- Additional Perks & Limitations (5%): We considered unique tools, premium research access, and potential feature restrictions. Platforms with added perks like AI analysis or fewer paywalls scored higher, while those with aggressive ads or major limitations were rated lower.

- Community & Social Features (5%): Platforms with investor discussion forums, sentiment tracking, or social trading features were rated higher. Those lacking community-driven insights or engagement tools scored lower.