Table Of Content

Buying penny stocks can be appealing because of their low price and high growth potential, but they also come with significant risk.

These stocks typically trade for under $5 and are often issued by smaller or distressed companies. Therefore, it’s important to understand how to invest in them wisely.

Ways to Invest in Penny Stocks

How you invest in penny stocks depends on your risk tolerance, trading experience, and how much time you want to spend researching.

Below are the most common ways investors get started:

-

Buy Individual Penny Stocks Through an Online Brokerage

If you want hands-on control and are comfortable with higher volatility, buying individual penny stocks directly through a brokerage platform is one way to go.

This method gives you full control over what companies you invest in, which is ideal if you're actively researching small-cap or micro-cap firms.

-

Invest Through Penny Stock ETFs or Mutual Funds

Because researching each low-priced company is time-consuming and risky, some investors prefer gaining exposure through diversified ETFs or funds that include micro-cap or small-cap stocks.

For instance, the iShares Micro-Cap ETF (IWC) and Invesco S&P SmallCap Value with Momentum ETF (XSVM) hold many small companies, including some penny stocks, giving you access to broader growth potential with less risk from any single firm.

This is a better choice if you want exposure to small-cap growth but don’t have the time or expertise to vet each company yourself.

Feature | Individual Penny Stocks | Penny Stock ETFs/Funds |

|---|---|---|

Diversification | Low – concentrated in few companies | High – spread across many companies |

Risk | High – individual company risk | Lower – risk shared across fund holdings |

Research Required | High – analyze each stock individually | Low – managed by fund professionals |

Liquidity | Often low, especially on OTC markets | Higher – ETFs trade like regular stocks |

Ideal For | Active, speculative investors | Passive investors seeking small-cap exposure |

How to Buy Penny Stocks Through a Brokerage

Investing in penny stocks directly through a brokerage offers control—but also comes with extra risks and requires careful due diligence. Here’s how to approach it:

Step 1: Choose a Brokerage That Supports Penny Stock Trading

Not all platforms offer access to the over-the-counter (OTC) markets where most penny stocks are traded. Therefore, you’ll want a brokerage that allows OTC trading and provides solid research tools.

Popular choices include Fidelity, Charles Schwab, and Interactive Brokers.

For example, if you want to trade a stock listed on the OTCQB market, Interactive Brokers can provide access with real-time data and low trading fees.

Also, make sure the platform discloses all commissions, as penny stock trades sometimes come with higher costs.

Broker | Annual Fees | Best For |

|---|---|---|

E-Trade | 0% – 0.35%

0% on stocks and ETFs in self directed brokrage, 0.35% for Core Portfolio Robo Advisor

| Options & Futures Trading |

Interactive Brokers | 0% – 0.75%

$0 online commission on U.S. listed stocks and ETFs, Options: $0.15 – $0.65 per-contract, Futures: $0.25 – $0.85 per-contract. For Interactive Advisors: asset-based management fees of 0.10% to 0.75% | Professional Trading Tools |

Fidelity | 0% – 1.04%

Fidelity Go® Robo advisor: $0: under $25,000, 0.35%/yr: $25,000 and above

Fidelity® Wealth Management dedicated advisor: 0.50%–1.50%

Fidelity Private Wealth Management® advisor-led team: 0.20%–1.04%

| Retirement Account Investing |

Vanguard | Up to 0.30%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Vanguard Digital Advisor – 0.015%, Vanguard Personal Advisor: 0.03%, Vanguard Personal Advisor Select: up to 0.03%, Vanguard Wealth Management: up to 0.03% | Low-Cost ETF Investors |

J.P. Morgan Self Investing | $0

$0 online commission on U.S. listed stocks and ETFs and $0.65 per-contract | Chase Bank Customers |

Charles Schwab | Up to 0.80%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Schwab Intelligent Portfolio – 0%, Schwab Intelligent Portfolios Premium – One-time planning fee: $300 + Monthly advisory fee: $30, Schwab Wealth Advisory: up to 0.80% | Advanced Trading Tools |

Merrill Edge | 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor | Bank of America Clients |

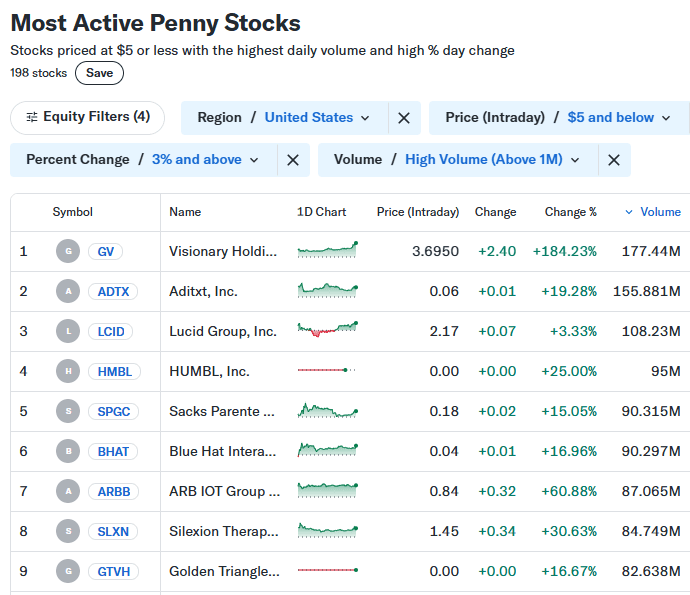

Step 2: Use Screeners to Identify Potential Stocks

Most brokerages offer stock screening tools that let you filter by price, market cap, sector, and exchange. There are also great penny stock screeners online.

For instance, you might look for healthcare companies trading under $2 with strong recent volume, or tech startups with quarterly revenue growth. This is essential because it helps you avoid deadweight stocks with no trading activity.

As a result, you can focus your attention on stocks that at least show some movement or growth potential.

Step 3: Research Before You Buy

Because penny stocks are prone to scams and volatility, you should deeply research each company before buying.

Look into the company’s:

Financial statements (if available)

Management team and history

Recent press releases or product developments

Filter by trading volume and price chart trends

For example, a stock trading at $1.50 with rapidly increasing volume due to a recent contract win may be a better prospect than a stagnant $0.10 stock with no public filings for two years.

Step 4: Place a Limit Order, Not a Market Order

Because penny stocks often have low liquidity, placing a market order is risky. Instead, use a limit order to control the price you pay.

Let’s say a stock trades at $0.88, and you want to buy 1,000 shares. If you use a market order, your buy might cost $0.95 or even higher. But with a limit order, you can set your maximum purchase price—helping protect you from sudden price spikes.

Also, be aware that some brokers may limit how much you can invest in OTC stocks or require additional agreements.

Key Tips Before You Invest in Penny Stocks

To improve your chances of success, keep these best practices in mind:

Avoid stocks with little or no trading volume – Illiquid stocks are harder to sell later and more prone to wild price swings.

Watch out for pump-and-dump schemes – If a stock is heavily promoted online without clear fundamentals, it’s likely a red flag.

Start small – Because penny stocks are highly risky, consider starting with a small portion of your portfolio.

Use stop-loss orders – Set a price where you’ll automatically sell to protect yourself from large losses.

FAQ

Penny stocks are highly volatile and often lack transparency, which makes them susceptible to large price swings and fraud. Because they trade on less-regulated markets, reliable financial data may be limited.

Some brokerages allow penny stocks in IRAs, but it depends on the platform’s policy and whether the stock meets certain criteria. It’s less common because of the high-risk nature and liquidity concerns.

Yes, the SEC has specific rules like the Penny Stock Rule to increase transparency and protect investors from manipulation. However, because these stocks trade on OTC markets, oversight can still be limited.

Some penny stocks can eventually qualify for listing on exchanges like NASDAQ or NYSE if they meet requirements for share price, market cap, and financial reporting. This transition can significantly increase visibility and liquidity.

Short selling penny stocks is possible, but it's often restricted by brokerages due to extreme volatility and low liquidity. It also carries very high risk and may not be suitable for most investors.

Yes, apps like Webull, Interactive Brokers, and TD Ameritrade support penny stock trading and offer real-time data and research tools. Robinhood, however, limits access to most OTC stocks.

These schemes involve artificially inflating a penny stock’s price through misleading promotions, then selling off shares for a profit. Unsuspecting investors are left holding the stock as the price collapses.

High volume indicates more liquidity, which makes it easier to enter or exit a position. Low volume stocks can have wide spreads and may be harder to sell without impacting price.