Table Of Content

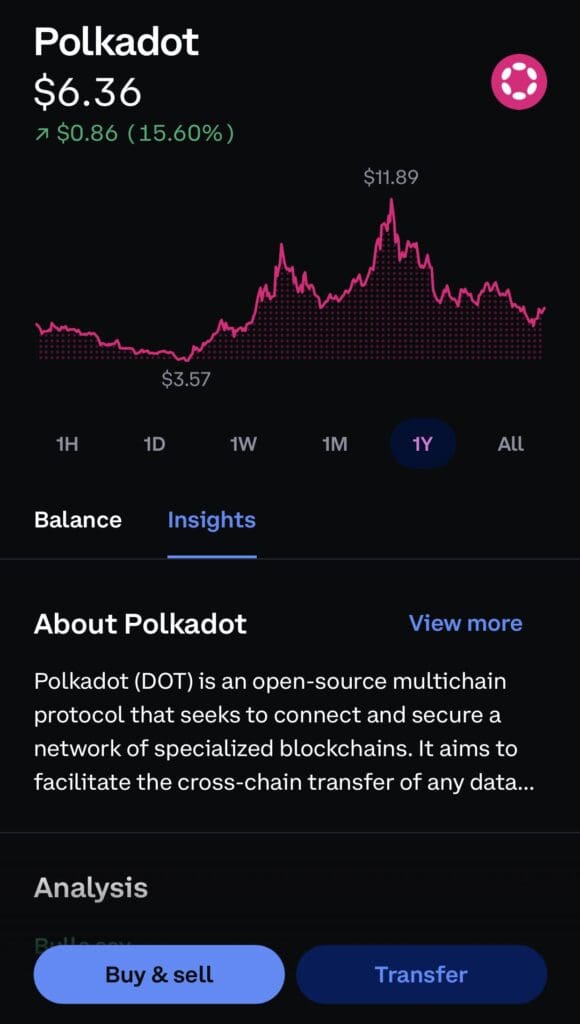

Polkadot is a blockchain platform that connects different blockchains into one unified network. Instead of working in isolation, Polkadot lets blockchains share data and functionality.

This makes it easier for developers to build apps that interact across chains, and for users to benefit from faster speeds, lower fees, and greater innovation.

Due to its unique design, Polkadot is regarded as one of the most promising projects in the Web3 space.

How to Buy Polkadot (DOT) in 4 Simple Steps

Before buying Polkadot, it’s important to go in with a plan. Here's a step-by-step guide to help.

Step 1: Decide If Polkadot Matches Your Investing Style

Instead of jumping in, take time to understand whether Polkadot fits your goals and risk comfort. DOT isn’t just another coin—it powers a complex blockchain network.

Long-term use case: Polkadot is built for developers and future Web3 infrastructure.

Volatility risk: Like many altcoins, DOT can see big price swings—so it's not for everyone.

Ecosystem growth: Polkadot supports parachains, which means growth depends on how many projects use its tech.

Because of this, Polkadot may suit investors looking for cutting-edge tech exposure—but it might not fit short-term traders or conservative buyers.

- The Smart Investor Tip

Use comparison tools like CoinGecko or Messari to compare Polkadot's fundamentals to other projects you’re considering. This helps you make a more informed choice beyond just price speculation.

Step 2: Choose a Crypto Exchange That Supports DOT

To buy DOT, you must use a crypto exchange that lists it and allows deposits in your local currency.

Popular options: Coinbase, Kraken, and Binance all support DOT trading.

Ease of use: Beginners may prefer exchanges like Coinbase or Kraken for their user-friendly interfaces.

Advanced tools: Binance and KuCoin offer features like trading bots and staking for DOT.

Make sure the exchange is licensed in your region and has good reviews. Also, compare fees and deposit methods before signing up.

- The Smart Investor Tip

Before signing up, look at each platform’s customer support ratings and track record. Responsive support can make a big difference in case anything goes wrong with your funds.

Platform | Coins | Spot Trading Fee | Best For | Crypto.com | +350 | 0.075%

For both maker and taker orders. The more you trade, the lower the fees – can decrease to as low as 0% – 0.050%. Holding and staking CRO tokens, Crypto.com native token, unlocks additional fee discounts. | All-in-One Crypto Services |

|---|---|---|---|

Kraken | +300 | 0.40% – 0.25%

0.40% for taker trades and 0.25% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.10%. Using GT tokens to pay trading fees offers a 10% discount | Advanced Traders |

Coinbase | +250 | $0.99 – 2.00% (Standard), 0.05% – 0.60% (Advanced Trade)

For transactions above $200 (standard account): 1.49% fee for using a bank account or USD wallet, 3.99% fee for using a debit or credit card. For Coinbase Advanced Trade: 0.60% for taker trades and 0.40% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.05%. | Beginners |

Gemini | +150 | $0.99 – 1.49% (Web & Mobile), 0.20% – 0.40% (Active Trader)

For Gemini’s website or mobile app users are charged 0.50% convenience fee For Active Trader, 0.40% for taker trades and 0.20% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.03%. | Compliance & Regulation |

Robinhood | +20 | $0 | Fee-Free Trading |

MEXC | +2,300 | 0% – 0.10%

0.00% for taker trades and 0.10% for maker trades. | Low Fee |

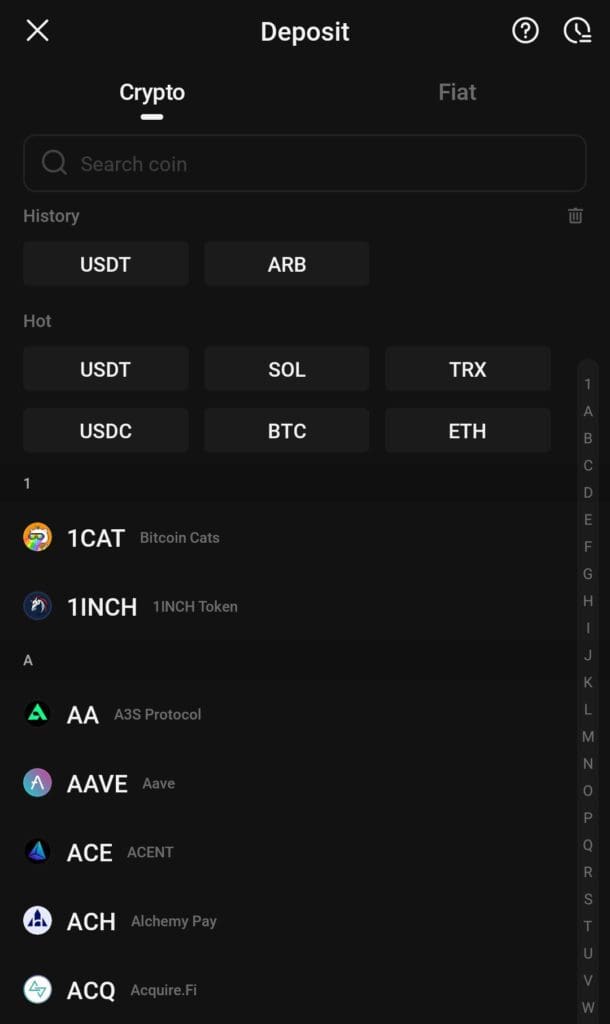

Step 3: Fund Your Account Safely

After signing up, you’ll need to add funds before making a purchase. This can usually be done via bank transfer or credit card.

Bank transfers: Often lower in fees but can take longer to process.

Credit/debit cards: Faster but may involve higher fees.

Stablecoins: Some users prefer to deposit USDT or USDC first, then trade for DOT.

Double-check your exchange’s minimum deposit limits and identity verification rules. To avoid issues, make sure your payment method is in your name.

Step 4: Place Your Polkadot Purchase Order

Now that your account is funded, you're ready to actually buy DOT. Most platforms offer two ways to place your order: market or limit.

Market order: This option buys DOT immediately at the best available price. It’s the fastest method but may cost slightly more during price swings.

Limit order: Here you set the maximum price you’re willing to pay, giving you more control, but it may take longer to complete.

Review your order: Always double-check the amount, fees, and payment method before confirming to avoid costly mistakes.

After submitting your order, the DOT will appear in your exchange wallet within a few minutes. Some platforms even send a confirmation email once your purchase is complete.

Step 5: Store Your DOT in a Secure Wallet

After you buy DOT, it’s important to think about how you’ll store it. Leaving it on an exchange is convenient but can be risky over time.

Hot wallets: Mobile apps like Trust Wallet or browser wallets like Polkadot.js are easy to access but are connected to the internet.

Cold wallets: Hardware wallets like Ledger or Trezor store your DOT offline, offering maximum protection against hacks.

Exchange staking: Some platforms allow you to stake DOT directly without transferring it out, but you trust them with custody.

If you’re planning to hold DOT for months or years, moving it to a cold wallet gives you better control and security. As a result, you protect your investment from unexpected exchange shutdowns or security breaches.

Smart Ways to Buy Polkadot Without Regret

Buying Polkadot can be a great move, but it’s easy to make mistakes if you’re not careful. Here are a few smart tips to help you avoid common pitfalls and buy with more confidence:

Start small if you're unsure: Instead of going all in, try a test purchase with a small amount to learn how the platform works.

Watch transaction fees: Some exchanges charge high fees for buying with a card—check fee details before confirming any purchase.

Use limit orders when possible: This lets you set your price instead of buying at the current market rate, which can save you money.

Buy during low network activity: Polkadot fees are lower than Ethereum, but network congestion can still raise costs during busy times.

Track DOT news and updates: Polkadot’s ecosystem evolves fast—staying informed can help you buy during dips or before major upgrades.

A little prep goes a long way. These steps can make your first or next DOT purchase smoother and potentially more profitable.

Best Platforms to Buy Polkadot (DOT)

DOT can be found on many popular crypto exchanges, but some platforms stand out for their ease of use, safety, or advanced features.

Coinbase: Great for beginners in the U.S., with simple interfaces and clear fees, though slightly higher than others.

Kraken: A solid mix of low fees, strong security, and access to DOT staking features.

Binance: Offers low trading fees and advanced tools for serious traders, but may not be available in all regions.

KuCoin: Known for wide altcoin selection, and often includes DOT promotions and trading competitions.

Crypto.com: A mobile-first platform that also offers DOT staking and a Visa card for spending crypto.

Pick the platform that best fits your experience level, payment method, and security needs. Make sure to verify your identity and enable 2FA before buying.

FAQ

Some exchanges like Coinbase support Apple Pay or PayPal for select users, but availability depends on your region and payment limits.

Yes, most exchanges have a small minimum purchase—often around $2–$10 worth of DOT—depending on the platform’s policies.

Not necessarily. You can hold DOT on your exchange wallet, but for long-term safety, it’s better to set up a personal wallet.

Many exchanges like Kraken and Binance allow you to stake DOT right after purchase, earning passive rewards while holding it.

Buying crypto isn’t usually taxed, but selling or converting it later might trigger capital gains tax depending on your country.

Yes, you can find DOT on some DEXs like Uniswap or PancakeSwap (wrapped versions), but you’ll need a compatible wallet and tokens.

Yes, platforms like Coinbase and Crypto.com offer recurring buys, so you can automate purchases weekly or monthly.

Some states have restrictions on certain exchanges. It’s best to check if your chosen platform is licensed in your state.

Polkadot itself doesn’t use smart contracts directly, but its parachains like Moonbeam allow smart contract functionality.