Who Is Eligible to Open an Interactive Brokers Account?

Interactive Brokers is open to both U.S. and international clients, including individuals, joint applicants, retirement accounts (like IRAs), and institutions.

You must be at least 18 years old and able to provide a valid government-issued ID, tax identification number (like SSN or ITIN for U.S. residents), and proof of residency.

While there's no strict minimum for IBKR Lite, IBKR Pro accounts may require higher funding levels depending on your region and trading preferences.

Interactive Brokers Account Setup: How to Start Trading

Opening an account with Interactive Brokers involves more than just filling out a form—it’s about preparing for a seamless transition into trading. Here’s how to start:

1. Define Your Needs & Compare Brokers

Before committing to Interactive Brokers, take time to define your investing goals and compare it with other platforms.

Are you an active trader, options enthusiast, or passive investor needing low fees and wide asset access?

IBKR offers advanced tools, direct market access, and low commissions, especially appealing to experienced traders.

Compare alternatives like Fidelity, TD Ameritrade, or Charles Schwab if you prioritize U.S.-centric service or customer support over global exposure.

As a result, understanding your goals ensures you’re choosing a platform that aligns with your trading strategy and tools.

2. Prepare Required Information

To avoid delays, gather all required documents and details before starting the application.

You’ll need your Social Security Number (SSN) or Tax ID, employment information, income details, and investment experience.

Be ready to declare your trading objectives and risk tolerance, which affect IBKR account features and margin eligibility.

Have your bank account information handy for funding.

Because IBKR serves international clients, documentation may vary by region, but accuracy is key to account approval.

3. Complete the Application

The application is online and usually takes 15–30 minutes, depending on complexity.

Choose your account type—Individual, Joint, IRA, or Institutional—based on your tax and investing goals.

Customize your preferences, such as base currency, trading permissions (e.g., options, crypto, forex), and security questions.

Upload identity documents (passport, driver’s license) for verification.

IBKR’s process is detailed because it offers global access and complex products. According to IBKR’s onboarding guide, approval may take 1–3 business days.

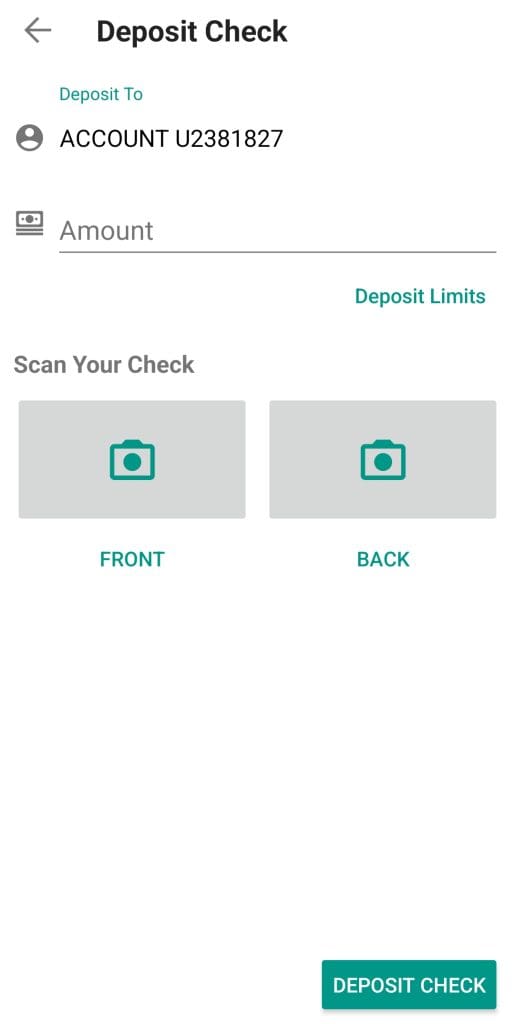

4. Fund Your Account

Once approved, funding is your next step—IBKR accepts multiple funding methods.

Use ACH bank transfer (U.S.), wire transfer, or direct debit, depending on your region.

ACH transfers usually arrive in 1–2 business days, but wire transfers may offer faster availability.

Track your deposit status via the “Transaction History” tab on your dashboard.

Also, set up recurring transfers if you’re a passive investor who wants automated contributions. Keep in mind, some funding methods may require additional verification.

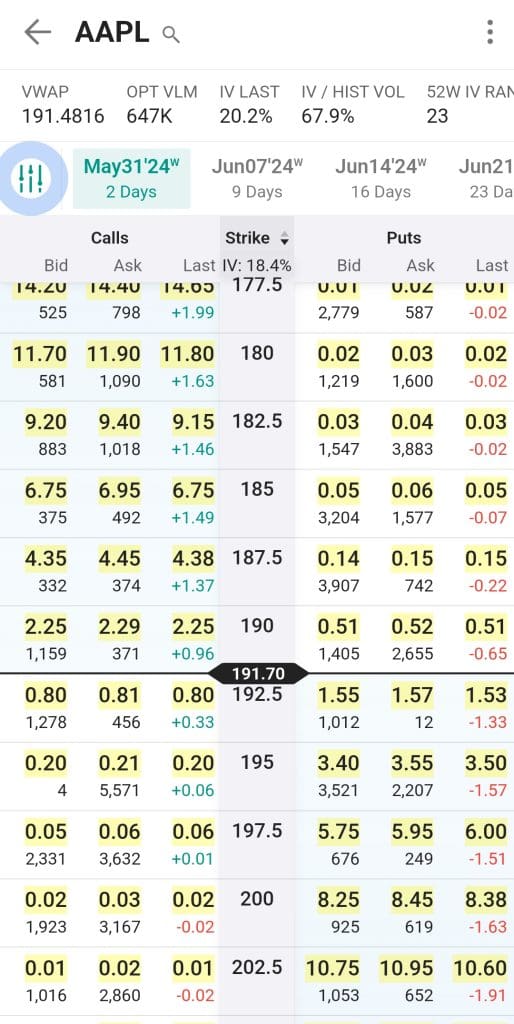

5. Set Up for Trading

After funding, configure your platform so you're ready to trade.

Explore the Client Portal or download Trader Workstation (TWS) for more advanced tools.

Enable optional features such as margin trading, options trading, or API access based on your account permissions.

Adjust notification settings, watchlists, and risk controls before placing your first trade.

For example, if you plan to trade options, make sure you’ve requested the appropriate trading level during sign-up. Beginners can start with the IBKR Mobile App, while advanced traders may prefer the desktop platform.

Learn more about IBKR day trading options.

Interactive Brokers Open Account: Tips

Opening an account with IBKR is straightforward, but a few smart tips can help you save time and avoid delays.

Double-check documentation: Ensure your personal details, ID, and bank information match across all documents to prevent verification issues.

Start with IBKR Lite if unsure: New investors can start with IBKR Lite and upgrade to IBKR Pro once they’re comfortable with the platform.

Use a supported bank for ACH: Linking a well-known U.S. bank speeds up funding and reduces the chance of errors.

Enable 2FA immediately: Turn on two-factor authentication for enhanced security during and after account setup.

Choose the right account type: If you're investing for retirement, go with an IRA. For day trading or leverage, a margin account is more suitable.

These tips help smooth the onboarding process and ensure you're set up with the right tools from the start.

How Long Does It Take to Open and Fund an IBKR Account?

IBKR’s application process is efficient, but processing times can vary depending on the complexity of your profile.

Most individual accounts are approved within 1–3 business days, especially if you submit complete and accurate documents.

ACH bank transfers typically take 1–2 days to reflect in your account, while wire transfers may appear the same day.

International clients may experience slightly longer wait times due to additional regulatory checks.

To speed things up, submit all required ID and financial documents upfront and monitor your email for approval updates or requests for clarification.

What Is the Difference Between IBKR Lite and IBKR Pro?

When setting up your account, one of the first choices is between IBKR Lite and Pro. Each serves a different type of investor.

IBKR Lite: Designed for casual investors who want commission-free U.S. stock and ETF trading with a simplified experience.

IBKR Pro: Built for active traders and professionals seeking lower margin rates, better order routing, and advanced tools like Trader Workstation.

You can switch between Lite and Pro anytime, depending on your evolving needs and trading activity.