Table Of Content

How to Buy NVIDIA Stock

Buying NVIDIA stock is easier than ever, especially for retail investors using online brokerages that offer access to the U.S. stock market.

Whether you're interested in artificial intelligence (AI), gaming, or semiconductor growth, NVIDIA can be a compelling long-term play.

Here’s a practical, step-by-step guide to help you get started — with real examples along the way.

-

1. Choose a Brokerage That Offers Access to NASDAQ Stocks

To invest in NVIDIA, you’ll need a brokerage that supports trading on the NASDAQ, where NVIDIA trades under the ticker NVDA.

Popular brokerages like Fidelity, Robinhood, and Charles Schwab offer commission-free trades and fractional share investing.

Broker | Annual Fees | Best For |

|---|---|---|

E-Trade | 0% – 0.35%

0% on stocks and ETFs in self directed brokrage, 0.35% for Core Portfolio Robo Advisor

| Options & Futures Trading |

Interactive Brokers | 0% – 0.75%

$0 online commission on U.S. listed stocks and ETFs, Options: $0.15 – $0.65 per-contract, Futures: $0.25 – $0.85 per-contract. For Interactive Advisors: asset-based management fees of 0.10% to 0.75% | Professional Trading Tools |

Fidelity | 0% – 1.04%

Fidelity Go® Robo advisor: $0: under $25,000, 0.35%/yr: $25,000 and above

Fidelity® Wealth Management dedicated advisor: 0.50%–1.50%

Fidelity Private Wealth Management® advisor-led team: 0.20%–1.04%

| Retirement Account Investing |

Vanguard | Up to 0.30%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Vanguard Digital Advisor – 0.015%, Vanguard Personal Advisor: 0.03%, Vanguard Personal Advisor Select: up to 0.03%, Vanguard Wealth Management: up to 0.03% | Low-Cost ETF Investors |

J.P. Morgan Self Investing | $0

$0 online commission on U.S. listed stocks and ETFs and $0.65 per-contract | Chase Bank Customers |

Charles Schwab | Up to 0.80%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Schwab Intelligent Portfolio – 0%, Schwab Intelligent Portfolios Premium – One-time planning fee: $300 + Monthly advisory fee: $30, Schwab Wealth Advisory: up to 0.80% | Advanced Trading Tools |

Merrill Edge | 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor | Bank of America Clients |

However, choosing a broker isn’t just about minimizing fees. You should also consider whether the platform provides:

Real-time stock quotes and price alerts

Analyst research and earnings forecasts

Access to educational tools and AI sector trends

Mobile trading features for active users

-

2. Open and Fund Your Brokerage Account

Once you’ve selected a brokerage, the next step is to open and fund your account.

This usually involves uploading an ID, linking your bank, and choosing your account type — such as a taxable brokerage account or a Roth IRA.

Even if NVIDIA stock trades above $800 per share (as it did in early 2025), most platforms now support fractional investing.

For example, with a $300 deposit, you can still buy a portion of a share — useful for building a diversified portfolio without needing thousands upfront.

-

3. Research NVIDIA Stock Before You Invest

Before placing your first order, it’s essential to understand what drives NVIDIA’s value. The company is not just a GPU manufacturer — it's at the core of the AI infrastructure, data center expansion, and autonomous vehicle markets.

Some key areas worth exploring before you buy:

AI and data center growth – NVIDIA’s chips power OpenAI, Tesla, and Meta’s infrastructure

Earnings volatility – Quarterly results often cause major price moves; follow earnings calls for guidance

Competitive landscape – AMD and Intel are competitors, but NVIDIA has a strong lead in AI acceleration

Valuation metrics – Price-to-earnings (P/E) ratios can help assess whether the stock is overhyped or fairly priced

-

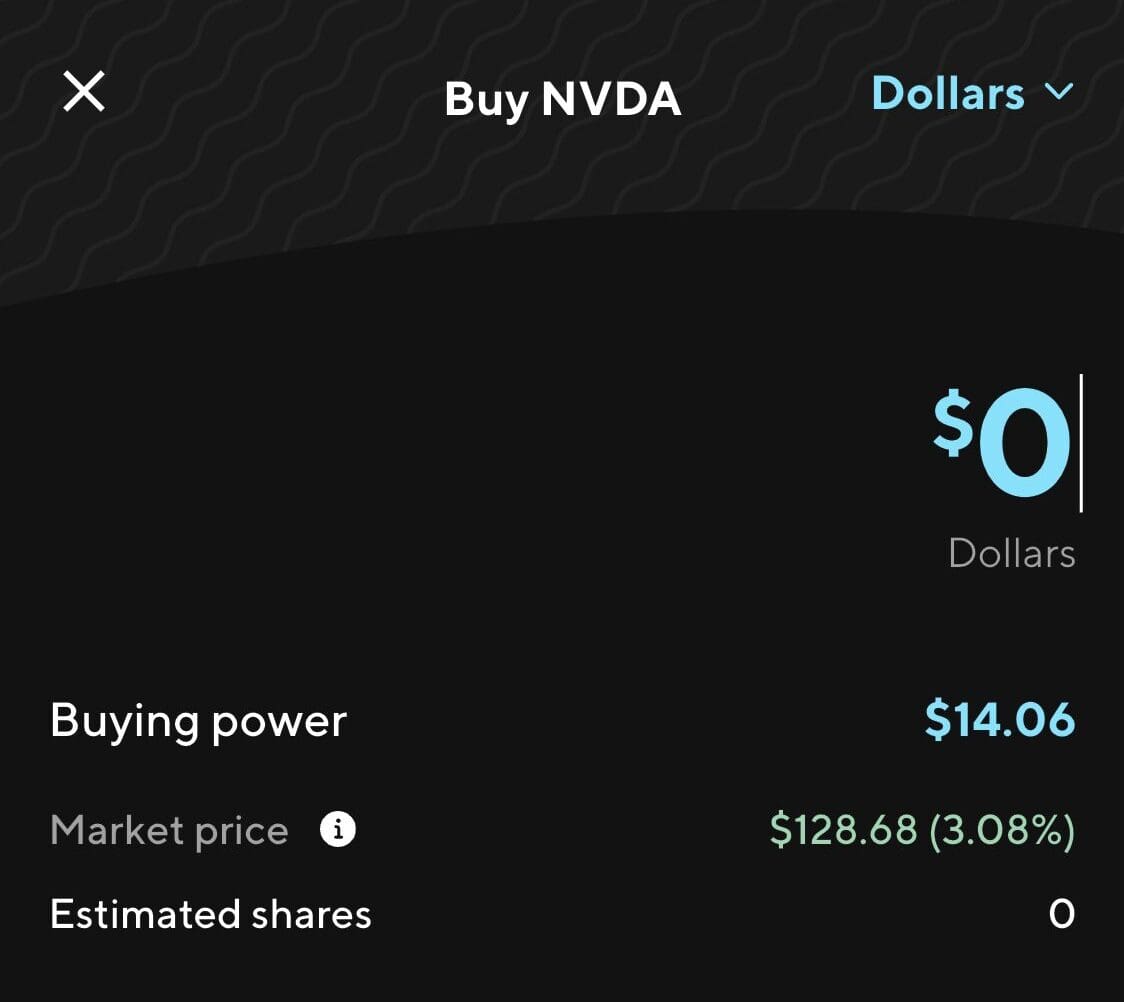

4. Place a Buy Order for NVIDIA Stock

Once you’ve done your research, it’s time to buy. Log into your brokerage, search for NVDA, and choose your preferred order type:

Market Order – Executes immediately at the current market price

Limit Order – Executes only if NVDA hits your target price

Recurring Investment – Ideal for dollar-cost averaging over time

For example, if you believe NVIDIA is temporarily overvalued, you might set a limit order at a lower price point and wait for the dip.

Ways to Invest in NVIDIA Without Buying the Stock

Buying NVIDIA stock directly isn’t the only way to gain exposure to the company.

If you’re looking for more diversification or prefer a lower-risk approach, there are several ways to invest in NVIDIA indirectly — all while tapping into its influence in AI, gaming, and semiconductor growth.

-

Invest in ETFs That Hold NVIDIA

One of the easiest ways to gain indirect exposure to NVIDIA is by investing in exchange-traded funds (ETFs) where it’s a top holding. Because NVIDIA is one of the largest tech companies in the world by market cap, it appears prominently in many tech-focused and broad-market ETFs.

For example:

Invesco QQQ (QQQ) tracks the Nasdaq-100 and has NVIDIA as one of its top positions

SPDR S&P 500 ETF (SPY) includes NVIDIA as part of its tech sector exposure within the S&P 500

iShares Semiconductor ETF (SOXX) focuses on chipmakers like NVIDIA, AMD, and Intel

This strategy is useful for investors who want to benefit from NVIDIA's performance while also spreading their risk across a basket of companies.

ETF Name | Focus Area | Notable Holdings |

|---|---|---|

Invesco QQQ (QQQ) | Nasdaq-100 | Apple, Microsoft, NVIDIA |

SPDR S&P 500 ETF (SPY) | Large-cap U.S. equities | Apple, Microsoft, NVIDIA |

iShares Semiconductor ETF (SOXX) | Semiconductor Industry | NVIDIA, Broadcom, AMD |

Vanguard Information Technology ETF (VGT) | Tech Sector | Apple, Microsoft, NVIDIA |

-

Invest in AI and Data Infrastructure Stocks

You can also invest in companies that operate in NVIDIA’s broader ecosystem — such as those building AI software, managing data centers, or relying heavily on NVIDIA’s chips. This approach captures the broader demand created by NVIDIA’s products.

Consider these examples:

Amazon and Microsoft operate cloud platforms (AWS and Azure) that use NVIDIA GPUs for AI computing

ASML produces lithography equipment essential for chip production, including those used by NVIDIA’s foundries

TSMC (Taiwan Semiconductor) manufactures NVIDIA’s chips, making it a critical part of the supply chain

This method works well if you believe in the long-term AI infrastructure trend — not just NVIDIA, but the entire value chain that supports its growth.

-

Use Mutual Funds or Robo-Advisors with NVIDIA Exposure

If you prefer a hands-off approach, mutual funds and robo-advisors can offer exposure to NVIDIA through diversified portfolios. For example:

Fidelity Blue Chip Growth Fund (FBGRX) has historically held large positions in NVIDIA due to its innovation in GPUs and AI

Robo-advisors like Wealthfront and Acorns often use ETFs like QQQ or VGT that include NVIDIA.

Rovo Advisor | Annual Fees | Minimum Deposit |

|---|---|---|

Wealthfront | 0.25% | $500 |

Betterment | 0.25%

$4 monthly for $0 – $20K balance, 0.25% annually for $20K – $1M balance, 0.15% annually for $1M – $2M balance, 0.10% annually for +$2M balance | $10 |

Acorns | Monthly: $3 – $12

$3 for Bronze, $6 for Silver and $12 for Gold

| $0 |

Schwab Intelligent Portfolios | Up to 0.80%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Schwab Intelligent Portfolio – 0%, Schwab Intelligent Portfolios Premium – One-time planning fee: $300 + Monthly advisory fee: $30, Schwab Wealth Advisory: up to 0.80% | $5,000 |

Vanguard Digital Advisor® | Up to 0.30%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Vanguard Digital Advisor – 0.015%, Vanguard Personal Advisor: 0.03%, Vanguard Personal Advisor Select: up to 0.03%, Vanguard Wealth Management: up to 0.03% | $100 |

E*TRADE Core Portfolios | 0% – 0.35%

0% on stocks and ETFs in self directed brokrage, 0.35% for Core Portfolio Robo Advisor

| $500 |

Merrill Guided Investing | 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor | $1,000 |

This option is best for investors who want NVIDIA exposure as part of a broader, professionally managed portfolio — especially if they’re investing for retirement or general wealth-building goals.

Fund/Platform | NVIDIA Exposure | Strategy Type |

|---|---|---|

Fidelity Blue Chip Growth (FBGRX) | High | Actively Managed Mutual Fund |

Vanguard Growth Index Fund (VIGAX) | Medium | Passive Mutual Fund |

Wealthfront | Medium (via ETFs) | Robo-Advisor |

Betterment | Medium (via ETFs) | Robo-Advisor |

Pros and Cons of Buying NVIDIA Stock Directly

NVIDIA is a leading name in technology and AI, but investing directly in its stock has both upsides and risks you’ll want to consider before committing capital.

Pros | Cons |

|---|---|

Market leader in AI and GPU chips | High valuation compared to peers |

Strong earnings growth fueled by AI demand | Price volatility after earnings announcements |

Invests heavily in R&D and innovation | Sensitive to global semiconductor supply chain risks |

Global partnerships with cloud and auto companies | Sector-specific risks due to chip industry cycles |

- Market Leadership in AI and GPUs

NVIDIA dominates key growth areas like AI training chips and gaming graphics

- High Revenue Growth

The company posted record-breaking earnings driven by AI demand

- Innovation-Driven Business Model

NVIDIA consistently reinvests in R&D, driving future product cycles

- High Valuation Risk

NVIDIA often trades at premium multiples, making it vulnerable to sentiment shifts

- Earnings Volatility

Strong price swings can occur after quarterly reports or guidance changes

- Sector Concentration

Heavy exposure to semiconductors means the stock can be sensitive to macro trends

FAQ

Yes, most brokerages allow you to buy NVIDIA within Roth IRAs or traditional IRAs. This can be a tax-efficient way to invest if you plan to hold it long-term.

You don’t need to buy a full share — most brokers offer fractional shares. That means you can start investing with as little as $10 or $50, depending on the platform.

As of now, NVIDIA pays a modest quarterly dividend. However, most of its value comes from capital appreciation rather than dividend income.

NVIDIA tends to experience higher price swings, especially around earnings reports or major product announcements. This can create both risk and opportunity for traders.

If you want focused exposure and believe in NVIDIA’s long-term growth, buying the stock directly makes sense. For broader diversification, ETFs with NVIDIA exposure are often a safer choice.

NVIDIA trades under the ticker symbol NVDA on the NASDAQ stock exchange. You can search for this symbol in your brokerage platform to place an order.

There’s no perfect time, but many investors watch for dips after earnings or during broader tech selloffs. Dollar-cost averaging can help reduce timing risk.

Yes, many brokers like Fidelity, Robinhood, and Schwab allow recurring investments in individual stocks, including NVIDIA. This is helpful for long-term dollar-cost averaging.

NVIDIA's performance is often driven by AI chip demand, gaming revenue, and data center growth. News about supply chain issues or new product launches can also move the price.

It can be, especially if done through a diversified approach or via fractional shares. Just be sure to understand the risks of investing in volatile tech stocks.