Table Of Content

Can You Short a Stock on Webull?

Yes, you can short stocks on Webull, but only if you have a margin account and meet certain criteria.

Webull allows eligible users to short borrowable stocks, which means the platform must have shares available for you to sell short. Not all stocks are shortable due to availability or volatility restrictions.

You'll also need to maintain minimum equity and understand the associated borrowing fees and margin requirements before initiating a short position.

How to Short a Stock on Webull: Step-by-Step Guide

Short selling on Webull can be a tactical way to profit from a falling stock, but it requires knowledge, discipline, and risk control. Here’s how to do it:

1. Choose/Explore the Asset

Identifying the right stock to short is the foundation of a successful trade. You're looking for weakness—either technical, fundamental, or sentiment-based.

Check borrowability status on Webull: “ETB” (Easy to Borrow) stocks are shortable; “HTB” may not be available.

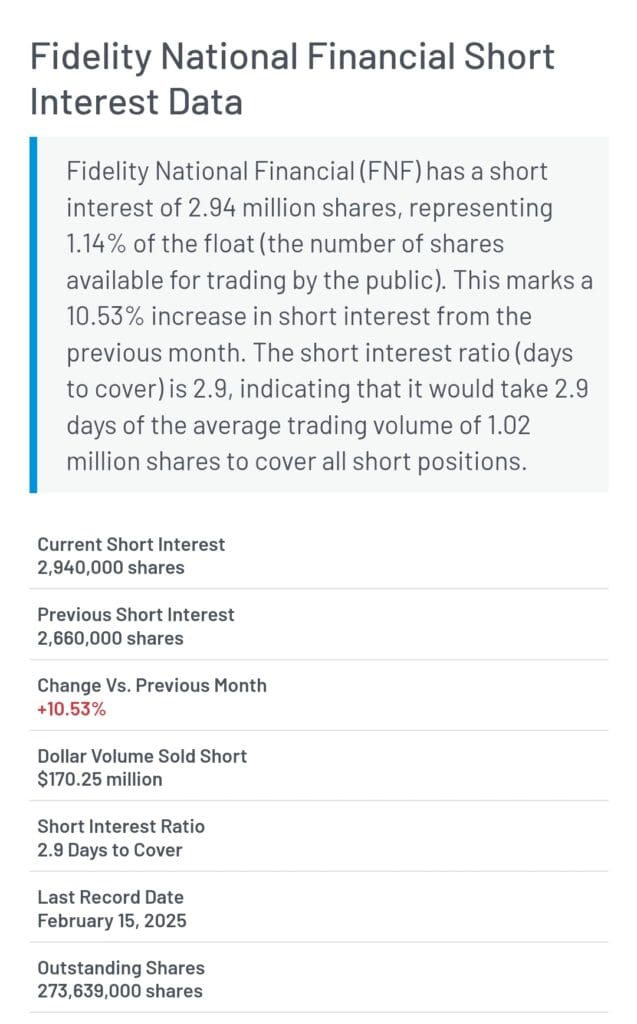

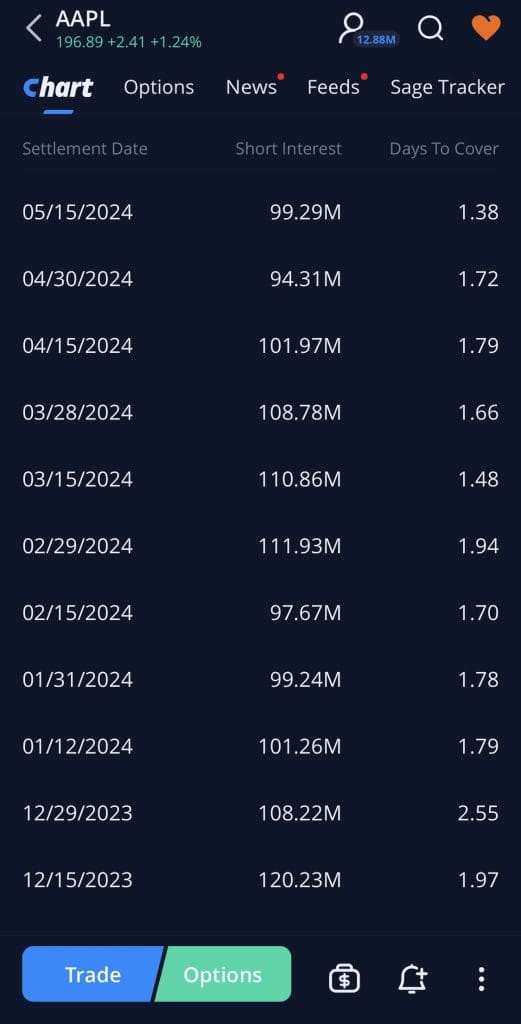

Evaluate short interest via sites like MarketBeat—overcrowded shorts raise squeeze risk.

Analyze chart patterns for breakdown levels, failed rallies, or bearish setups like double tops.

Make sure liquidity is sufficient to avoid slippage. Volatile, low-float stocks often spike unexpectedly, so risk management is key.

2. Personal Considerations

Before shorting, define your strategy and make sure it aligns with your emotional and financial readiness. Losses on shorts can exceed your investment.

Clarify your goal—speculative gain, hedge, or event-driven trade.

Account for borrowing fees, taxes, and possible forced liquidation from margin calls.

Assess emotional tolerance—short squeezes and rapid reversals are common.

Set a risk cap in advance. If you’re unsure how you’ll respond to fast-moving losses, reconsider or use defined-risk options instead.

3. Starting the Shorting Process on the Platform

Webull makes it relatively easy to short, but only for approved margin accounts. The key is knowing where to look and what to check.

Tap the “Short” button on the stock page to see availability and interest rates.

Review margin requirements—Webull generally requires $2,000+ in equity and approval to short.

Understand the fee structure—including borrow rate, SEC fees, and interest charged.

Also, some stocks may be temporarily restricted from shorting due to volatility rules or low supply, even if they appear available.

4. Place and Monitor the Short Position

Once short, your job is active monitoring. Market sentiment can shift quickly and news events can trigger sharp reversals.

Use limit orders instead of market to avoid poor fills in volatile setups.

Set stop-losses or alerts through Webull’s tools to manage downside.

Track borrow fees daily, as they eat into profits on longer holds.

Watch for earnings dates, upgrades, or short squeeze chatter. These events often trigger price spikes that can force exits.

5. Close the Trade & Post-Execution Review

To exit, you’ll use a “Buy to Cover” order, which repurchases the borrowed shares. This step finalizes your gain or loss.

Use limit or trailing stops to lock in gains or cut losses on the way up.

Record your trade metrics—entry, exit, size, profit/loss, and reasoning.

Include borrowing costs and holding duration in your review.

Finally, analyze your setup and execution—what went well, what didn’t. This habit improves your edge and helps avoid repeated mistakes.

-

How to Check Short Availability on Webull

To check if a stock is available to short on Webull, simply search for the ticker and open the stock detail page.

Tap the “Trade” button, then select “Short” from the order options. If the “Short” option is grayed out or unavailable, it means shares are either not borrowable or temporarily restricted.

You’ll also see a label like “ETB” (Easy to Borrow) or “HTB” (Hard to Borrow), which indicates availability. Always check this before planning your short entry to avoid execution issues.

-

Webull Margin Requirements

In order to short sell on Webull, you must have a margin account with a minimum of $2,000 in equity. This account must also be approved for margin and shorting by Webull.

Margin requirements vary based on the stock’s volatility and price. For highly volatile stocks or those trading under $5, Webull may require a higher maintenance margin.

You’ll also be responsible for daily interest charges on borrowed shares. Always review your buying power and margin balance before initiating a trade.

Best Practices for Short Selling on Webull

Short selling on Webull can be profitable, but it demands preparation, discipline, and strong risk management to avoid major losses.

Always confirm short availability before planning your trade. Tap “Short” on the stock page to check borrowable status and borrowing fees.

Use limit orders and stop-losses to control slippage and protect against sudden spikes or short squeezes.

Keep position sizes small—especially on volatile or low-float stocks—to reduce risk exposure.

Stay updated on news and earnings that could quickly reverse price trends and invalidate your thesis.

Review trades regularly to assess what worked, what didn’t, and how borrowing costs impacted your net returns.

Short selling is fast-paced and unforgiving. By sticking to tested habits, you increase your edge and avoid emotional decision-making.