Table Of Content

What Is Crypto Staking?

Crypto staking is the process of locking up your cryptocurrency to support the operations of a blockchain network, typically one that uses a Proof of Stake (PoS) consensus mechanism. In return, you earn rewards—similar to earning interest on a savings account.

By staking, you're helping validate transactions and secure the network. Popular staking coins include Ethereum, Solana, and Cardano.

Because it’s less energy-intensive than mining, staking has become a go-to passive income strategy for long-term crypto holders.

How to Start Staking Crypto in 5 Easy Steps

Staking crypto can be simple once you understand the process. Here’s a step-by-step guide to help you stake efficiently and securely.

Step 1: Choose a Cryptocurrency That Supports Staking

Before anything else, select a coin that allows staking and fits your risk profile.

Research PoS-based Coins: Ethereum (ETH), Solana (SOL), Cardano (ADA), and Polkadot (DOT) are top choices.

Check Minimum Requirements: Some networks, like Ethereum, require a minimum of 32 ETH for solo staking.

Consider APY & Lock-in Periods: Look at annual rewards, but also check how long your crypto must be locked.

Each coin has different rules, reward systems, and risk levels. Therefore, it’s crucial to evaluate how active and secure the network is before staking your funds.

-

Top Cryptocurrencies for Staking

Cryptocurrency | Network Type | Estimated APY |

|---|---|---|

Ethereum (ETH) | PoS | ~4–5% |

Cardano (ADA) | PoS | ~3–6% |

Solana (SOL) | PoS | ~6–7% |

Polkadot (DOT) | NPoS | ~10–14% |

Cosmos (ATOM) | PoS | ~10% |

Step 2: Pick a Staking Method (Solo, Pooled, or Exchange)

There are multiple ways to stake—some require technical skills, while others are beginner-friendly.

Solo Staking: You run your own validator node. Best for advanced users with technical expertise.

Pooled Staking: Stake with others to share rewards and reduce entry barriers.

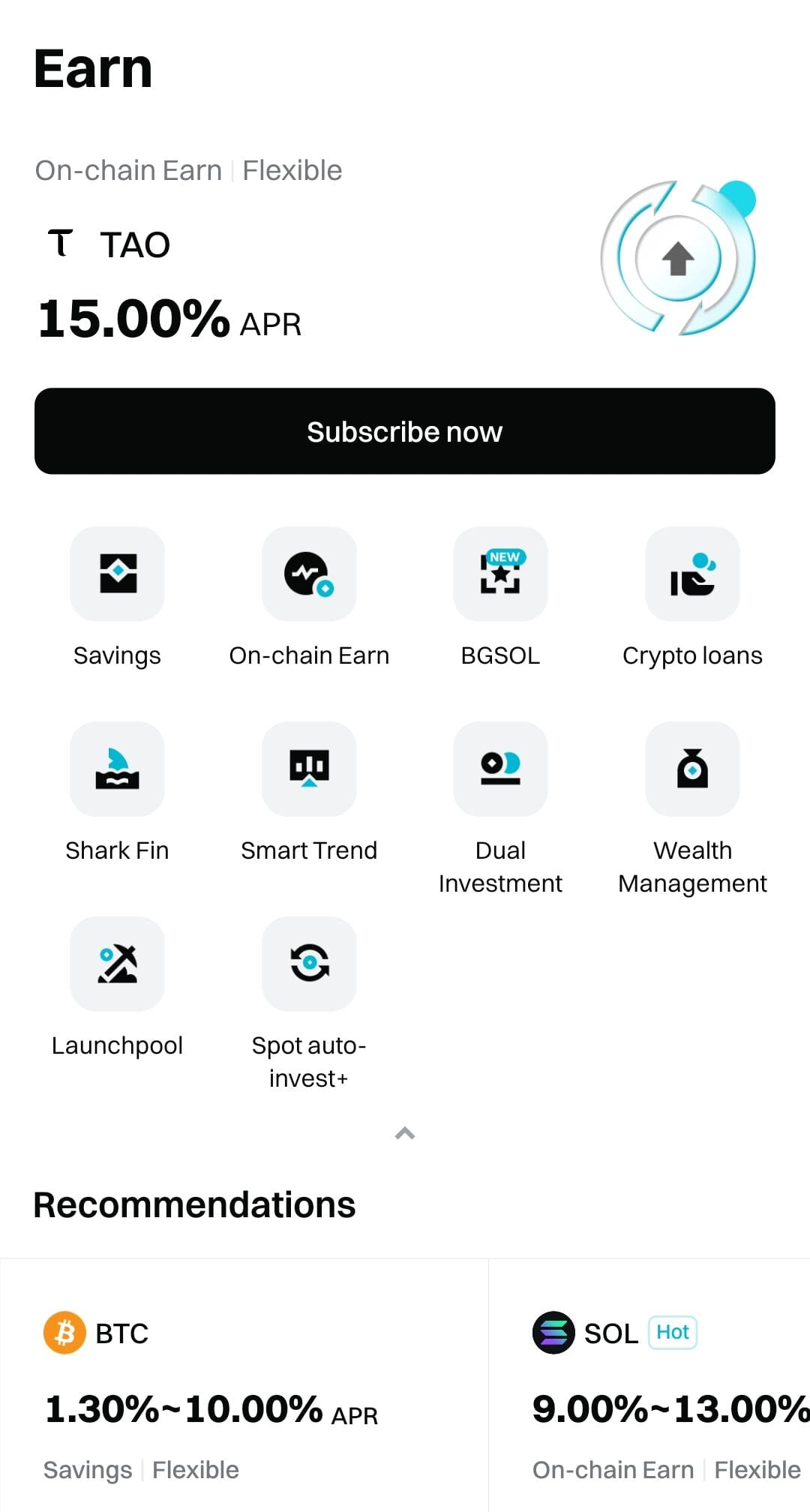

Exchange Staking: Centralized platforms like Coinbase or Binance offer easy, managed solutions.

Each method has trade-offs. For example, while solo staking offers full control, exchange staking is more convenient but may charge higher fees. As a result, beginners often start with pooled or exchange options.

Method | Ease of Use | Control | Fees | Best For |

|---|---|---|---|---|

Solo Staking | Low | Full | Low | Advanced users with 24/7 uptime |

Pooled Staking | Medium | Shared | Medium | Users with less capital |

Exchange Staking | High | Low | High | Beginners, convenience seekers |

Liquid Staking | Medium | Medium | Medium | DeFi users, active traders |

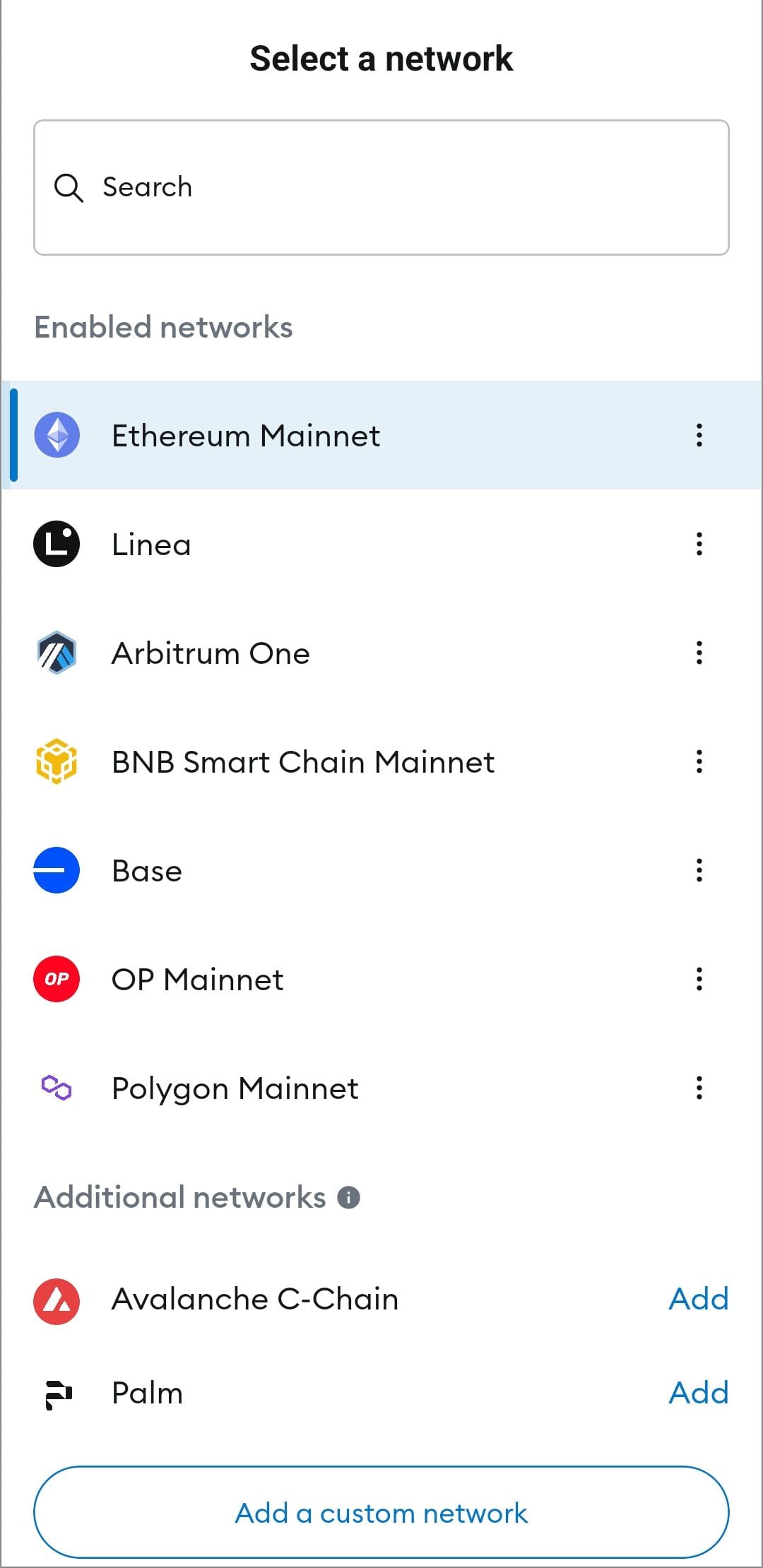

Step 3: Set Up a Compatible Wallet

You need a wallet that supports staking for the specific coin you choose.

Use Official Wallets: Cardano’s Yoroi or Ethereum’s native staking via MetaMask are good starting points.

Enable Staking Functionality: Some wallets require you to delegate or opt in for staking.

Secure Your Wallet: Use strong passwords and enable two-factor authentication or hardware wallets.

Security is vital because staking involves holding and locking funds. Always download wallets from official sources to avoid phishing attacks or malware.

Step 4: Delegate or Stake Your Tokens

Now it’s time to commit your crypto to the network or a validator.

Select a Reputable Validator: Use tools like Validator Ratings on StakingRewards to compare fees and uptime.

Avoid Centralized Validators: Choose decentralized validators to support network health.

Understand Unstaking Rules: Some coins have cooldown periods before you can withdraw staked funds.

Because staking is a long-term commitment in many cases, understanding the validator’s reliability and fee structure helps you avoid poor rewards or unexpected lock-ups.

Step 5: Monitor Rewards and Network Activity

Staking isn’t entirely passive—you need to keep an eye on performance.

Track Rewards Regularly: Use apps or dashboards like Exodus or Ledger Live to view your earnings.

Check Validator Status: If your validator goes offline, you may miss out on rewards or get penalized.

Stay Updated on Protocol Changes: Staking terms can change based on network upgrades or governance votes.

As a result, it’s smart to review your staking setup monthly. Being informed helps you make adjustments, redelegate if necessary, and maximize returns safely.

How to Calculate Staking Rewards & APY

Staking rewards are typically calculated based on the amount of crypto staked, the annual percentage yield (APY), and the duration of staking.

APY includes compounding, unlike simple interest. For instance, staking 1,000 ADA with a 4% APY will earn around 40 ADA in a year, but slightly more if rewards are reinvested.

Rewards may vary depending on network performance, validator uptime, and inflation rates. Use platforms like StakingRewards.com or individual validators’ dashboards for real-time estimates tailored to your coin and method.

The Risks of Staking: What Investors Should Know

Staking can generate passive income, but it’s not without risk. You need to evaluate both technical and market-related dangers.

Slashing Penalties: On some networks, poor validator performance can cause you to lose a portion of your staked funds.

Lock-Up Periods: Funds may be inaccessible during fixed staking periods or unbonding windows, limiting liquidity.

Market Volatility: While your coins are locked, the asset’s value may drop, which can outweigh staking rewards.

Validator Risk: Choosing a low-performing validator may reduce earnings or result in loss of eligibility for rewards.

Platform Custody Risk: Staking via exchanges carries additional risk if the platform faces technical issues or insolvency.

As a result, it’s critical to research the staking model of the specific crypto and consider risk management strategies like diversification or liquid staking options.

Cold Staking vs. Liquid Staking: Which Is Better?

Cold staking allows users to stake from offline wallets, offering enhanced security but limiting flexibility.

Liquid staking, on the other hand, gives users staked tokens (e.g., stETH for Ethereum) that can be traded or used in DeFi, providing added utility.

Your choice depends on your priorities—whether it's maximum safety or maximizing liquidity and DeFi participation.

Factor | Cold Staking | Liquid Staking |

|---|---|---|

Security | Very high (offline, hardware wallets) | Lower (online access, smart contract risk) |

Flexibility | Rigid (funds locked during staking) | Flexible (tokens can be traded or used) |

Usability in DeFi | Not compatible | Fully compatible with DeFi protocols |

Setup Complexity | Requires technical setup | Usually easy via exchanges or staking dApps |

Best For | Long-term holders, maximum security | Yield seekers, DeFi participants |

Mistakes To Avoid When Staking Crypto

While staking can be a great way to earn passive income, there are common pitfalls that can reduce rewards or lead to losses.

Staking with Unreliable Validators: Validators with poor uptime or high slashing risks can cause you to lose part of your staked assets.

Ignoring Lock-Up Terms: Not knowing the unbonding or withdrawal period can leave you without access to funds when you need them.

Using Insecure Wallets or Platforms: Staking through unsecured apps or shady platforms increases the risk of hacks or permanent loss.

Overlooking Platform Fees: Exchange and staking-as-a-service providers may charge high fees that reduce your effective APY.

Failing to Monitor Rewards or Validator Performance: You might miss critical changes or stop earning if you don’t check your staking dashboard regularly.

Avoiding these mistakes ensures a smoother, more profitable staking experience while minimizing avoidable risks.

FAQ

Yes, your staked assets may decrease in value due to market volatility. Also, some networks enforce penalties if your validator performs poorly.

In many countries, staking rewards are treated as taxable income. You'll likely need to report them based on the market value at the time of receipt.

Only if you're running a validator node. Most users who delegate or stake through platforms don't need to keep their device connected.

No, only blockchains that use Proof of Stake or related consensus mechanisms (like Delegated PoS) offer staking functionality.

Yes, many centralized exchanges like Coinbase, Binance, and Kraken offer staking services, often with simplified interfaces for beginners.

Slashing means part of your staked crypto is forfeited because the validator broke network rules or went offline. It's a built-in risk.