Staking Polkadot (DOT) means you lock up your tokens to help secure the network and, in return, earn rewards. Instead of mining, Polkadot uses a system called nominated proof-of-stake where you pick trustworthy validators to support.

Your DOT stays in your control, but it’s tied up while staking. It's an easy way to grow your DOT holdings without active trading.

How to Stake Polkadot (DOT) in 5 Simple Steps

Staking Polkadot (DOT) can be a smart way to grow your holdings while supporting the network. Here’s a simple guide to getting started:

1. Choose Where You Want to Stake

First, decide if you want to stake using a crypto exchange or directly through a Polkadot wallet.

Exchanges like Kraken or Binance make it easy, but staking through the Polkadot.js wallet gives you more control. Think about your experience level and how much time you want to spend managing it.

Crypto Exchange Staking: Great for beginners, as the platform handles technical stuff for you.

Direct Wallet Staking: Better rewards but needs more effort to set up.

Custody Options: Exchanges keep your DOT, but self-staking lets you keep control.

For example, a new DOT holder might prefer using Kraken to stake instantly, while an experienced user might use the native Polkadot wallet to pick their own validators.

- The Smart Investor Tip

Take a moment to compare exchange staking versus direct staking based on your experience. If you prefer zero maintenance, start with Kraken or Binance. If you want deeper involvement, Polkadot.js might be your best bet.

2. Set Up a Compatible Wallet (If Needed)

If you’re staking directly, you’ll need a wallet that supports Polkadot staking, like Polkadot.js or Fearless Wallet.

Setting up a wallet helps you securely hold and manage your DOT. This extra step also gives you the freedom to nominate your validators.

Polkadot.js Extension: The official wallet was built for complete control over staking.

Fearless Wallet: Mobile app built for staking-focused DOT holders.

Ledger Hardware Wallet: Best for extra security while staking.

For example, someone planning to hold DOT for years may set up a Ledger wallet linked to Polkadot.js for maximum protection.

- The Smart Investor Tip

Backup your wallet’s seed phrase safely when setting up. Also, double-check you are downloading the official wallet app or browser extension to avoid phishing risks.

3. Pick Validators to Nominate

On Polkadot, you don’t validate yourself (unless you run a node). You nominate validators who do the heavy lifting.

Picking good validators helps you maximize rewards and avoid penalties if they misbehave. Therefore, it's essential to research before making a choice.

High Performance: Choose validators with excellent uptime and low slashing history.

Commission Rates: Lower commission means you keep more of your rewards.

Reputation and Community Trust: Validators with strong backing tend to be more reliable.

For instance, you might pick validators based on lists from trusted sources like the Polkadot Network Explorer, ensuring your rewards stay consistent.

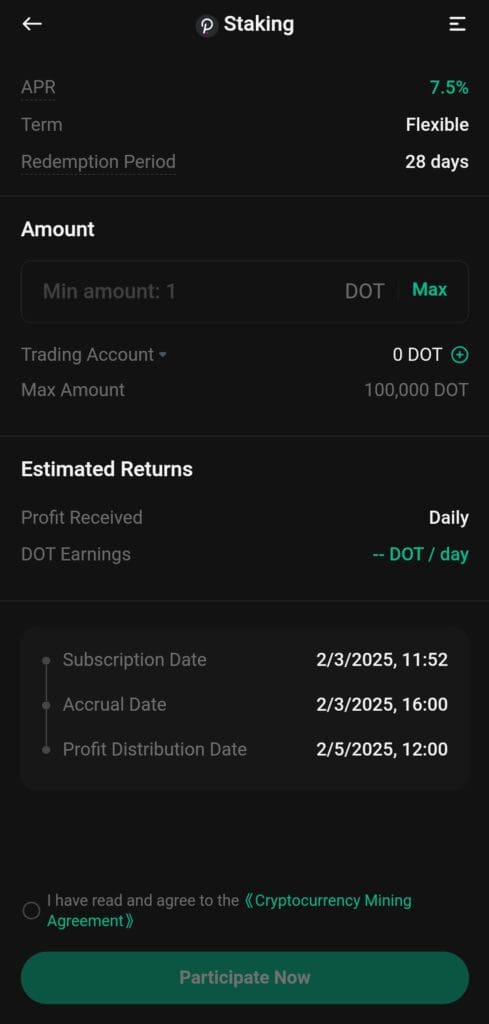

4. Start Staking Your DOT

Once you've chosen where and who to stake with, you can officially bond your DOT and nominate validators.

The amount you stake must meet the network’s minimum requirement, which changes over time. Also, if you want to withdraw, your staked DOT will be locked for an unbinding period.

Bonding DOT: You choose the amount to lock and confirm the transaction.

Nomination: Assign your staked DOT to one or more validators.

Earning Rewards: Once activated, you’ll start earning DOT every era (~24 hours).

For example, a DOT holder who bonds 100 tokens may nominate five validators at once to spread their risk and increase their reward chances.

5. Manage and Monitor Your Staking

Staking isn’t just a set-it-and-forget-it process. You’ll want to keep an eye on your validators to make sure they stay active and avoid penalties.

You can also rebond, switch validators, or even compound your rewards by staking them again.

Validator Monitoring: Use apps like Subscan or Polkadot.js to track validator performance.

Reward Compounding: Stake your earned rewards for higher future returns.

Unbonding DOT: It takes 28 days to unstake your DOT if you want to move or sell it.

For example, if a validator you picked gets slashed, you might decide to nominate a new one quickly to keep your rewards flowing.

Stake Polkadot Rewards & Risks

Staking Polkadot (DOT) can offer steady rewards, but it also comes with risks you should know before jumping in.

You earn passive income by supporting the network, but validator mistakes or market changes can affect your returns.

Also, your DOT is locked during the staking period, which limits quick access to your funds if prices change fast.

How to Choose the Right Polkadot Staking Platform

Choosing the right Polkadot staking platform makes a big difference in how easy, safe, and profitable your staking experience will be.

Reputation And Security: Always pick platforms with a strong track record like Kraken, Binance, or Ledger Live.

Fees And Commissions: Look for low-fee options so you can keep more of your staking rewards.

Ease of Use: Exchanges like Kraken make staking simple even for new users, while wallets require more setup but offer more control.

Minimum Staking Requirements: Some platforms need you to stake a minimum amount, so always double-check the rules before starting.

For instance, a beginner might choose Binance for simplicity, while an advanced user who wants control might prefer Polkadot.js with a Ledger device.

Where You Can Stake Polkadot

You have a few different ways to stake Polkadot (DOT), depending on how much control and convenience you want.

Crypto Exchanges: Platforms like Kraken, Binance, and KuCoin offer easy staking with automatic rewards.

Native Wallets: Use the Polkadot.js extension to nominate validators and fully control your staking process.

Mobile Wallets: Apps like Fearless Wallet allow you to stake directly from your phone, making it super convenient.

Hardware Wallets: Secure your DOT with devices like Ledger and still participate in staking through third-party apps.

For example, a busy professional might prefer staking on Kraken for auto-rewards, while a long-term holder could set up staking on Ledger for maximum security.

FAQ

Your principal DOT is generally safe, but if the validator you nominate gets slashed for bad behavior, you may lose a small portion of your stake.

You usually start earning rewards after your nomination becomes active, which can take 1–2 eras (about 1–2 days) depending on network conditions.

Yes, staking on-chain gives you full control but requires more setup. Exchange staking is easier but you trust the platform with your DOT.

Yes, you can nominate new validators anytime, but changes take effect in the next era cycle, usually within 24 hours.

If a validator goes offline, you might earn fewer rewards for that period. If they are slashed, you could also lose a small part of your stake.

In many countries, staking rewards are considered taxable income when received. Always check your local tax regulations to stay compliant.

Yes, wallets like Fearless Wallet and Nova Wallet allow you to stake DOT directly from your mobile phone easily.

Once you decide to stop staking, it takes 28 days for your DOT to become fully liquid and available for withdrawal.

It depends on your goals. Staking pools can offer easier access and lower minimums, but direct staking gives you full nomination control.