Table Of Content

E*TRADE is a well-rounded platform for day traders seeking a balance between powerful tools and user-friendly features.

While it may not offer the same level of complexity as some other platforms, it provides a great range of functionalities for active traders, especially when it comes to fast execution and intuitive interfaces.

E*TRADE Tools for Day Traders

E*TRADE’s platform offers an impressive suite of tools and features that cater to day traders, ensuring you can make quick and informed decisions.

Unlike the Etrade Core portfolio, which is mainly relevant for passive investors, these tools are designed to handle active, fast-paced trading environments.

-

Advanced Charting & Power E*TRADE (Pro)

ETRADE's Power ETRADE platform provides advanced charting features that day traders can leverage to track and analyze stocks in real-time.

The platform is particularly beneficial for traders who rely on technical analysis to guide their decisions.

Technical Indicators: The platform offers over 25 technical indicators such as MACD, RSI, and moving averages, which are essential for identifying trends and market signals.

Customizable Layouts: Traders can customize their workspaces with multi-chart views and save different setups to quickly switch between trading scenarios.

Advanced Order Types: Utilize limit orders, stop-loss orders, and OCO (one-cancels-other) orders directly from the charting interface.

With Power E*TRADE, day traders have an all-in-one tool to monitor real-time data and execute trades swiftly, a crucial aspect of active day trading.

-

Hotkeys, Rapid Order Entry & Smart Routing

E*TRADE supports fast trade executions with programmable hotkeys and customizable order entry templates, making it ideal for traders who need to place multiple orders in rapid succession.

This feature is especially beneficial for momentum and scalping strategies. Here's what it offers:

Program Custom Hotkeys: Set up hotkeys for fast order entries, adjusting order size, type, and routing preferences with a single keystroke.

Order Presets: Save order templates such as stop-loss and limit orders for quick access during busy trading sessions.

Smart Routing: E*TRADE’s Smart Routing engine optimizes order execution by seeking the best price available across multiple exchanges, minimizing slippage.

This functionality makes it easier to execute high-speed trades, critical for day traders looking to capitalize on small price movements.

-

Advanced Order Types & Risk Management

E*TRADE supports a variety of advanced order types that can help you manage risk while trading during volatile market conditions.

These options allow for better trade management and more control over your entries and exits:

Trailing Stops: Adjust stop-loss orders as the price moves in your favor to buy and sell stocks, locking in profits without having to micromanage exits.

OCO Orders: Place bracket orders where one order is canceled automatically when another is filled, allowing for better control of stop-loss and take-profit levels.

Conditional Orders: Set conditions for when to execute trades based on real-time market data or technical indicators.

These advanced orders ensure that you can manage risk while staying in trades that show potential for further profit.

-

Extended Trading Hours & Market Access

E*TRADE offers access to pre-market (7 AM ET) and after-hours (8 PM ET) trading, which allows you to react to news events before the regular market opens or after it closes.

You can place trades in response to overseas earnings reports or geopolitical events that could impact the U.S. market’s open.

These features enable day traders to act on timely information and trade in fast-moving markets, positioning themselves ahead of market open volatility.

-

Real-Time Market News & Earnings Calendar

For day traders, timely information is crucial. E*TRADE integrates live market news, earnings reports, and macroeconomic events directly into the platform, making it easier to stay informed and react to new developments:

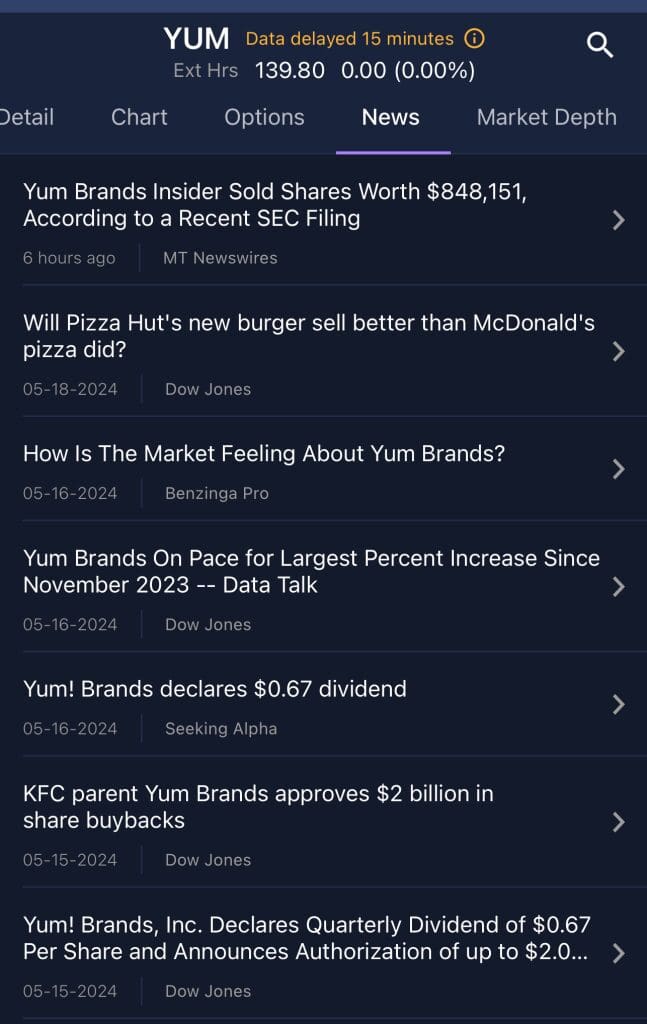

Integrated News Feed: Access live headlines and market news that is directly relevant to your watchlist or holdings, ensuring you’re always up to date.

Earnings Calendar: Track upcoming earnings reports and major corporate actions to plan trades around these events.

Sector Heatmaps: Visualize sector performance and identify market trends by using customizable heatmaps to spot momentum.

This level of integration allows day traders to stay on top of market-moving news without having to juggle multiple information sources.

-

Paper Trading and Strategy Testing in Power E*TRADE

Before committing real capital, E*TRADE’s paper trading feature allows traders to test out their strategies in a risk-free environment. This is essential for refining strategies or adjusting to changing market conditions.

Real-Time Market Simulation: Use paper trading to place orders with live bid/ask prices and watch the market unfold as if you were trading with real money.

Backtesting Capabilities: Test strategies based on historical data to gauge how they would have performed in various market conditions.

Risk Management Practice: Practice risk management strategies, including using stop-loss orders or adjusting position sizes, without financial risk.

For example, traders can simulate a strategy using chart patterns or technical indicators and adjust their entries or exits before applying it in a live market situation.

What’s Still Missing for Some Day Traders

While E*TRADE is a comprehensive platform, there are a few areas where it might fall short for certain traders, especially those looking for highly customizable features or the ability to execute very complex trades.

Learning Curve for Power E*TRADE: Although it’s packed with features, it can take time to master the advanced tools in Power E*TRADE.

Limited Scripting and Automation: Unlike some competitors, E*TRADE offers fewer advanced scripting options for algorithmic trading, which may limit the flexibility for more complex strategies.

Mobile App Limitations: While the E*TRADE mobile app is robust, it may not offer the same depth of functionality as the desktop platform, particularly when it comes to charting or managing large positions.

For those who are looking for a platform with more automation or better mobile usability, E*TRADE may require an adjustment period before fully optimizing it for day trading.

Alternative Platforms for Day Traders

If you find E*TRADE doesn't meet all your day trading needs, several other platforms may offer features better suited to specific trading styles.

Broker | Annual Fees | Best For |

|---|---|---|

Robinhood | $0 – $6.99

$0 for basic account, $6.99 for Robinhood Gold | Beginner Stock & Crypto Traders |

SoFi Invest | $0 | Automated Investing & Beginners |

eToro | $0 | Copy & Social Trading |

Wealthfront | 0.25% | Hands-Off Investors |

Webull | $0 | Active Day Traders |

Cash App Invest | $0 | Easy Stocks & Bitcoin Purchases |

Ally Invest | $0 | Mobile-Friendly Investing |

Charles Schwab Thinkorswim: A powerful platform with advanced charting tools, paper trading, and technical analysis for serious traders.

- Interactive Brokers (IBKR): Ideal for day traders with features like extended trading hours, advanced charting, paper trading, and access to over 150 international markets.

TradeStation: Known for high-speed execution and robust charting, ideal for advanced traders and those seeking quick trade execution.

Webull: Offers an intuitive interface and access to extended trading hours, making it suitable for beginner to intermediate traders.

Fidelity’s Active Trader Pro: A great alternative for those who want strong charting and real-time data with a slightly more beginner-friendly interface than E*TRADE.

Each of these platforms has its own strengths, making them valuable options depending on your specific trading preferences and experience level.