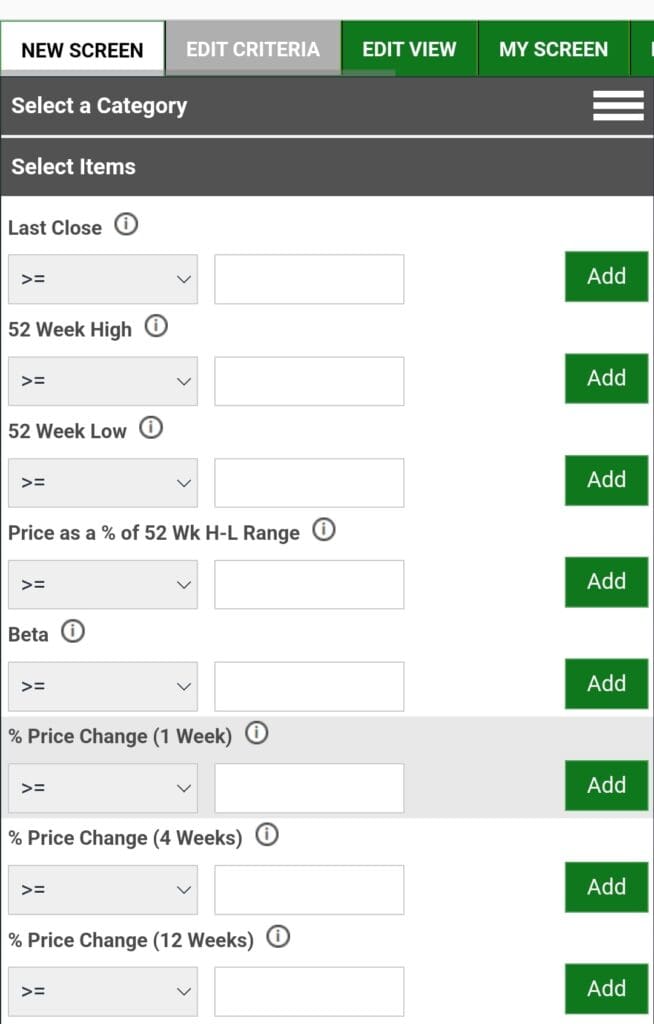

The Zacks Stock Screener helps investors filter stocks based on specific criteria such as market cap, price, sector, performance, and more.

It’s an ideal tool for discovering investment opportunities without the need for a premium subscription.

Plan | Monthly Subscription | Promotion |

|---|---|---|

Zacks Premium | Annual: $249 ($20.75/month)

No monthly plan | 30-day free trial |

Zacks Investor Collection | $59

$495 ($41.25 / month) if paid annually | 30-day free trial |

Zacks Ultimate | $299

$2,995 ($249.5 / month) if paid annually | 30-day free trial |

Best Free Zacks Stock Screener Features

The Zacks Stock Screener allows users to filter stocks based on various criteria, helping investors find opportunities aligned with their goals.

Key features include customizable filters, performance data, and real-time updates. Let's explore them:

1. Zacks Rank Screening (Limited)

One of the standout features in Zacks' free version is the Zacks Rank. This filter helps identify stocks with positive earnings momentum. Based on earnings estimate revisions, stocks are ranked from #1 (Strong Buy) to #5 (Strong Sell).

Zacks Rank #1 (Strong Buy): Focus on stocks with strong upward revisions in earnings estimates.

Earnings Momentum: Use the Zacks Rank to find stocks that are likely to outperform based on analyst sentiment and earnings revisions.

-

Example

We used Zacks Rank #1 to filter for stocks in the technology sector, discovering several companies with strong earnings growth potential.

These stocks had positive earnings revisions and were recommended by Zacks analysts.

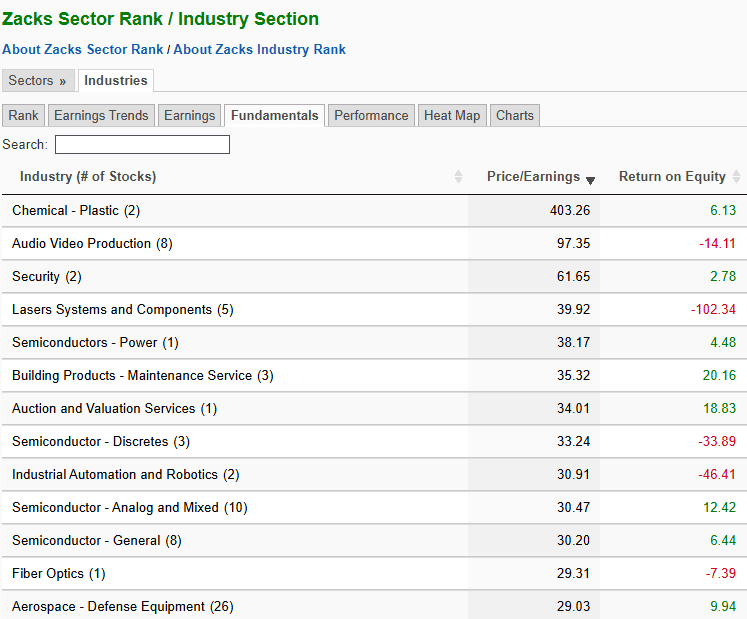

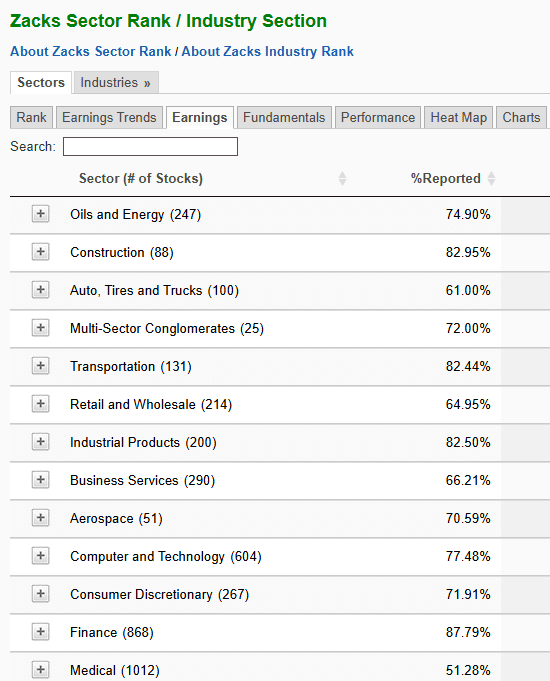

2. Sector and Industry Screening

Zacks offers filters for both sectors and industries, allowing investors to focus on specific areas of the market.

This feature is helpful for those looking to target certain sectors or diversify their portfolio across different industries.

Sector Filter: Narrow down your search by broad sectors such as Technology, Healthcare, or Financials.

Industry Filter: Drill down into more specific industries, like semiconductors or biotech, to find focused opportunities.

-

Example

When we wanted to find companies in the defense sector, we set Sector: Industrials and Industry: Aerospace & Defense.

This helped us pinpoint stocks in a high-growth area with long-term potential.

3. Earnings Estimate Revisions Screening

Earnings estimate revisions are a critical factor when identifying stocks that might have strong future growth potential.

Zacks allows you to filter stocks based on upward or downward earnings estimate revisions.

Upward Revisions: Focus on stocks where analysts have increased their earnings estimates, signaling positive momentum.

Downward Revisions: Use the downward revisions filter to avoid stocks with declining earnings expectations.

-

Example

We ran a filter for stocks with upward earnings revisions, identifying several small-cap biotech companies with strong growth potential due to improved earnings forecasts.

4. Dividend Screening

Zacks also provides free filters for dividend-paying stocks, which is beneficial for income-focused investors looking to build a stable portfolio with reliable yields.

Dividend Yield: Filter for stocks offering higher-than-average dividend yields.

Payout Ratio: Use the payout ratio to assess sustainability—lower ratios are generally a sign of potential for future dividend increases.

Dividend Growth: Filter for companies with a track record of consistently increasing dividends.

-

Example

A retiree focusing on income generation could use Dividend Yield >3% and Payout Ratio <60% to find financially healthy companies with strong dividend growth, identifying several stable, income-generating stocks in consumer staples.

5. Price-to-Book (P/B) Ratio Screening

The Price-to-Book (P/B) ratio filter helps investors find undervalued stocks by comparing the market value of a company to its book value. This is especially useful for value investors.

P/B Ratio: Screen for companies with a low P/B ratio, indicating the stock might be undervalued relative to its book value.

High P/B Stocks: Conversely, look for high P/B stocks if you're seeking companies with strong growth potential that are priced at a premium.

-

Example

For a value strategy, we filtered stocks with a P/B Ratio <1.5 to uncover companies that might be trading below their intrinsic value.

This helped us identify financial stocks that were undervalued due to market fluctuations.

How To Use Zacks Stock Screener Premium Features

If you're considering Zacks' subscription, the Zacks’ premium plans unlock advanced features for serious investors and active traders.

These tools provide deeper insights, expert research, and smarter stock filtering capabilities to enhance your investing strategies

6. Zacks Rank Screener

One of the premium features in Zacks' paid plans is the Zacks Rank Screener, a powerful tool that helps you find stocks based on Zacks' proprietary ranking system. The Zacks Rank is updated daily and assigns a rating from #1 (Strong Buy) to #5 (Strong Sell) based on earnings estimate revisions.

Buy/Hold/Sell Consensus: Focus on stocks with a “Strong Buy” (Zacks Rank #1) consensus to target companies with positive analyst sentiment.

Earnings Revisions: Filter stocks based on recent earnings estimate revisions that can influence price momentum.

Fair Value Estimates: Access Morningstar’s fair value estimates in Zacks Premium to identify undervalued stocks based on comprehensive research.

-

Example: How We Used Zacks Rank Screener

We ran a screen filtering for Zacks Rank #1 stocks in the healthcare sector with positive earnings revisions.

This revealed several undervalued companies with strong long-term growth potential.

7. Smart Money Tracker

The Smart Money Tracker is a unique feature in Zacks Premium, which allows users to track institutional investor activity.

By filtering for stocks with high hedge fund or mutual fund ownership, you can align your strategy with the so-called “smart money.”

Institutional Activity: Identify stocks being heavily bought by hedge funds or large asset managers, signaling strong institutional confidence.

Recent Buys: Focus on stocks with recent institutional purchases in the last quarter to follow the latest investment trends.

Ownership Percentage: Filter for stocks where institutional ownership exceeds a specific percentage, indicating a strong backing.

-

Example

We filtered for stocks with over 70% institutional ownership and recent institutional buys in the financial sector, highlighting stocks that large funds were actively adding to their portfolios.

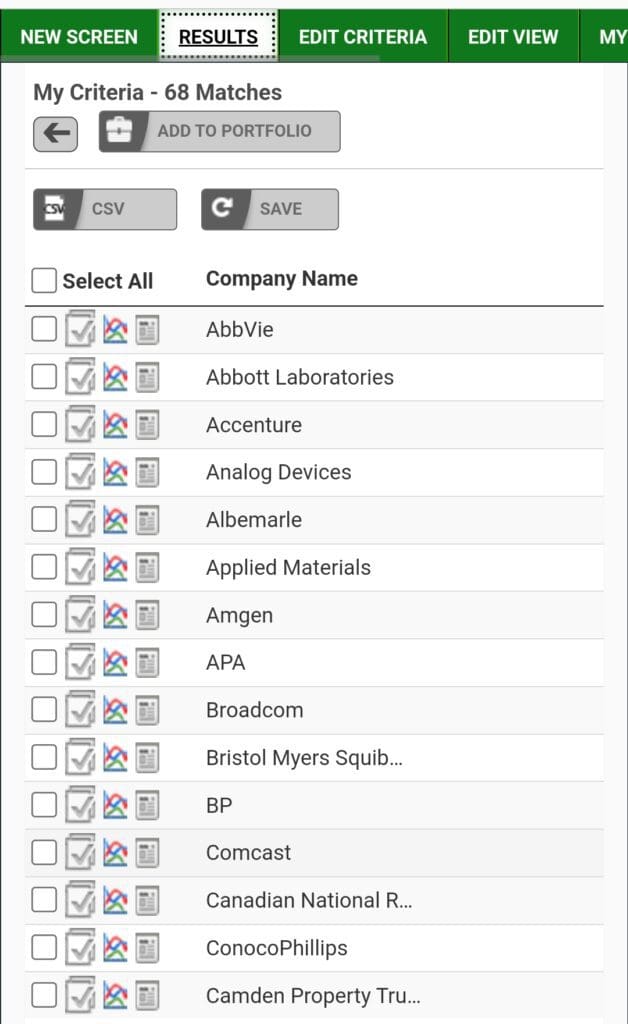

8. Predefined Stock Screens

Zacks Premium subscribers gain access to a variety of predefined stock screens designed to identify stocks with strong potential across different investment strategies.

Diverse Strategies: Choose from over 45 predefined screens targeting various investment approaches, including value, growth, momentum, and income.

Expertly Curated: These screens are strategically created to help investors beat the market by focusing on stocks with favorable characteristics.

Customizable Filters: Tailor these screens by applying additional filters to align with your specific investment criteria.

-

Example

Utilizing the “Top Zacks Rank & Undervalued” screen, we identified stocks with high price target upside, positive Zacks Ranks, and low P/E ratios, aligning with value-investing principles.

9. Thematic Screens

Zacks offers thematic screens that allow investors to explore stocks aligned with current market trends and future growth areas.

Dynamic Investment Themes: Access screens focusing on over 30 investment themes, such as renewable energy, artificial intelligence, and emerging markets.

Focused Research: These screens help investors identify companies poised to benefit from specific market trends and innovations.

Easy Navigation: Browse through various themes to find investment opportunities that match your interests and outlook.

-

Example

Exploring the “Renewable Energy” thematic screen led us to companies actively involved in sustainable energy solutions, aligning with our interest in environmentally conscious investments.

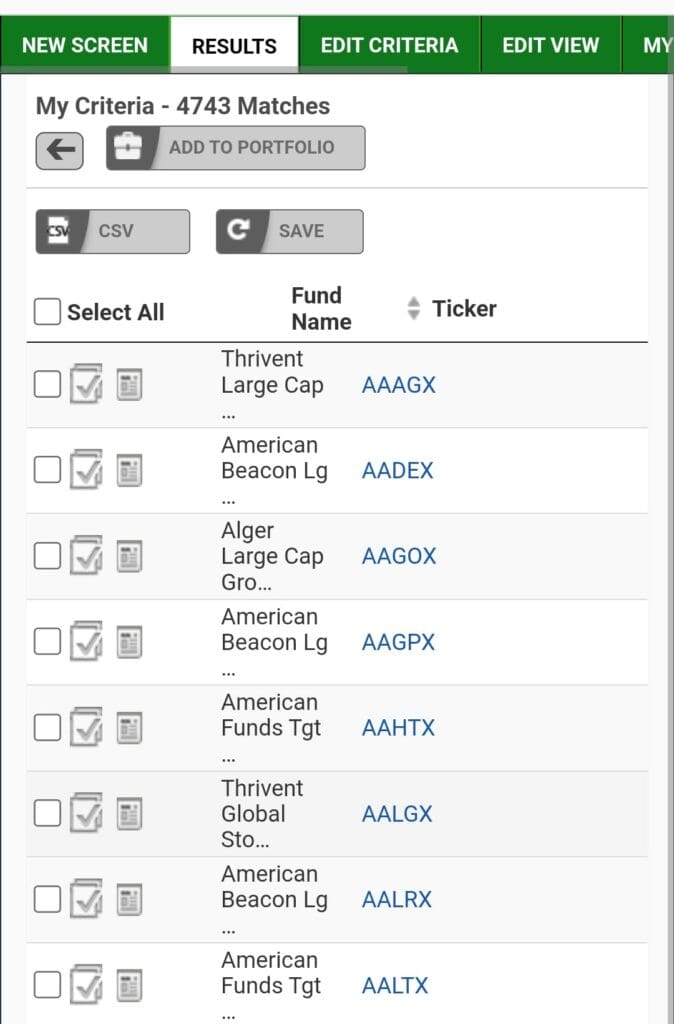

10. Mutual Fund and ETF Screeners

Beyond stocks, Zacks Premium provides tools to screen mutual funds and ETFs, offering a comprehensive approach to portfolio diversification.

Mutual Fund Screener: Filter mutual funds based on criteria like expense ratio, performance, and holdings to find funds that suit your investment goals.

ETF Screener: This tool identifies ETFs with desired characteristics, such as asset class, expense ratio, and performance metrics.

Integrated Research: Access Zacks' proprietary ratings for mutual funds and ETFs to assess their potential.

-

Example

Using the mutual fund screener, we filtered funds with low expense ratios and strong performance in the technology sector, aligning with our investment strategy.

FAQ

Zacks Rank is a proprietary rating system based on earnings estimate revisions, with stocks ranked from #1 (Strong Buy) to #5 (Strong Sell). It is updated daily and provides a quick way to identify stocks with positive or negative earnings momentum.

Zacks primarily focuses on fundamental metrics such as earnings revisions, analyst ratings, and valuation. However, Zacks Premium offers predefined stock screens that help identify stocks with strong momentum, though technical pattern filtering is not a core feature.

Yes, Zacks offers a free version of its stock screener that includes basic filters like Zacks Rank, earnings growth, and sector performance. For advanced features like institutional activity and earnings revisions, you would need the Zacks Premium subscription.

Zacks updates its stock rankings daily, based on the most recent earnings estimate revisions and analysts' opinions. This ensures that investors have access to the latest information when making decisions.

Zacks Premium offers thematic screens focusing on over 30 investment themes, including trends like renewable energy, technology, and emerging markets. These screens help investors find stocks poised to benefit from current and future market trends.

Yes, Zacks Premium allows you to filter both mutual funds and ETFs. You can screen based on various criteria such as performance, expense ratios, and sector exposure, offering a comprehensive tool for diversified investing.

Zacks Premium provides the Smart Money Tracker, which allows you to track institutional investor activity. You can filter for stocks with high institutional ownership or recent institutional buys, aligning your strategy with professional investors' choices.