Table Of Content

With over 30 million investors, Vanguard is known for its low-cost index funds and long-term investment philosophy — making it a favorite among retirement-focused and buy-and-hold investors.

However, Vanguard does make it easy to invest in gold indirectly through gold-backed ETFs and mutual funds that include gold-related stocks or mining companies.

How to Invest in Gold Using Vanguard: Guide

Vanguard doesn’t offer direct gold purchases — you can’t buy gold bullion or coins through the platform. But you can gain exposure to gold by investing in ETFs or mutual funds that track the price of gold or invest in gold miners.

Here’s how to do it.

How to Buy Gold ETFs on Vanguard

Gold ETFs are among the easiest ways to invest in gold without storing it yourself. These funds track the price of physical gold and are backed by bullion held in vaults.

Vanguard allows you to trade a range of ETFs through your brokerage account.

-

Follow These Steps

Once you're logged into your Vanguard brokerage account, here’s how to get started:

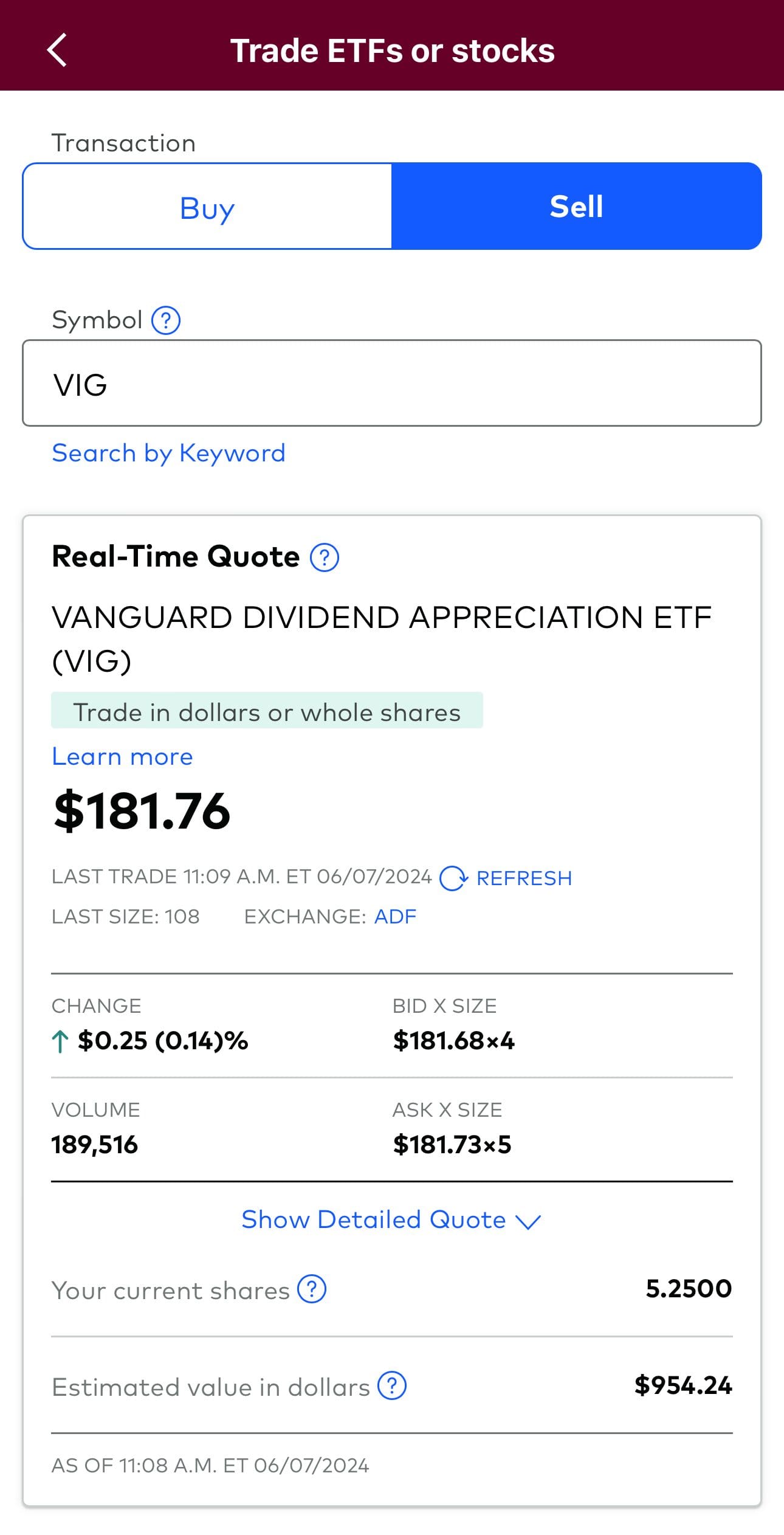

- Search for a gold ETF: In the search bar, enter a ticker symbol like GLD (SPDR Gold Shares), IAU (iShares Gold Trust), or SGOL (Aberdeen Standard Physical Gold Shares). These are some of the most popular gold ETFs, and all are available to buy on Vanguard.

- View ETF details: Click on the fund to review key details — including performance, fees, holdings, and risk rating. Vanguard provides a clear breakdown of the fund’s strategy and expense ratio.

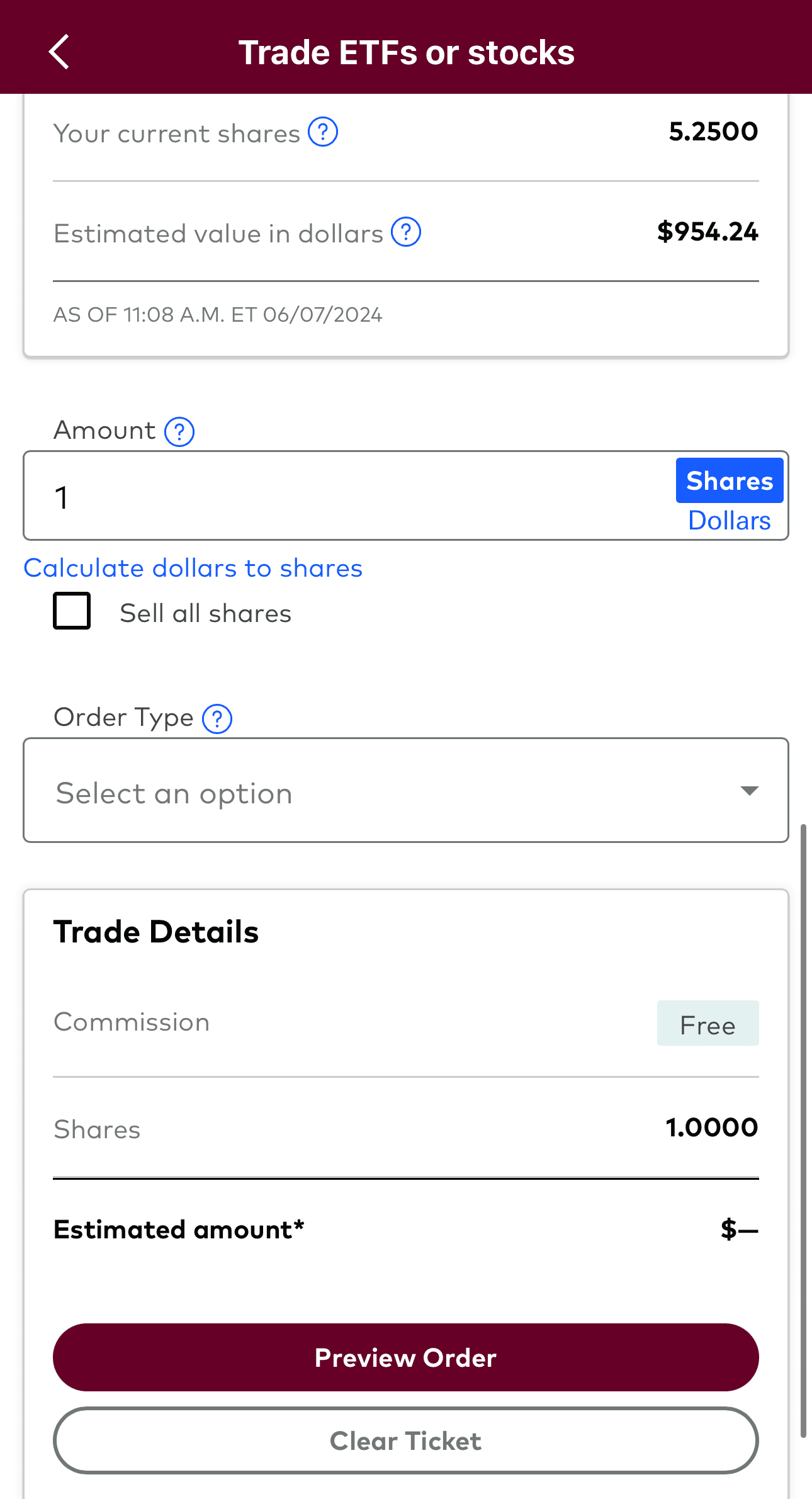

- Place your trade: Click “Buy & Sell” and enter the number of shares (or dollar amount) you want to invest. Choose your order type (market or limit), review your order, and confirm the purchase.

-

Popular Gold ETFs Available on Vanguard

Here are some well-known gold ETFs you can buy through your Vanguard account:

GLD – SPDR Gold Shares

One of the largest and most liquid gold ETFs. Tracks the price of physical gold.IAU – iShares Gold Trust

Offers similar exposure to GLD but with a slightly lower expense ratio.SGOL – abrdn Physical Gold Shares ETF

Stores gold in Swiss vaults and appeals to investors looking for added transparency.GLDM – SPDR Gold MiniShares Trust

A lower-cost, smaller version of GLD for budget-conscious investors.

All of these ETFs are eligible to be held in taxable brokerage accounts or IRAs at Vanguard.

How to Buy Gold Stocks on Vanguard

If you’re looking for more upside potential — and can handle more volatility — you might consider investing in gold mining companies.

Vanguard gives you access to individual gold stocks or diversified mining ETFs.

-

Follow These Steps

Buying gold stocks on Vanguard is easy – as long as you made the necessary analysis before:

- Search for a gold mining company: Look up ticker symbols like NEM (Newmont Corporation), GOLD (Barrick Gold), or FNV (Franco-Nevada). These are major global gold producers and commonly included in gold-focused portfolios.

- Analyze the company profile: Each stock listing includes financial reports, dividend yield, analyst coverage, and price charts. Use this info to decide if the stock fits your goals.

- Buy shares: From the stock profile, click “Buy & Sell,” enter your trade details, and submit the orde

-

Popular Gold Stocks Available on Vanguard

Ticker | Company Name | Market Focus | Dividend Potential | Key Feature |

|---|---|---|---|---|

NEM | Newmont Corporation | Global operations | Offers steady dividends | One of the largest gold producers |

GOLD | Barrick Gold | North America, Africa | Moderate yield | Known for large-scale mining projects |

FNV | Franco-Nevada Corporation | Royalty/streaming model | Consistent income source | Lower operational risk than miners |

AEM | Agnico Eagle Mines | Canada & Europe | Regular dividends | Strong reserves and cost control |

WPM | Wheaton Precious Metals | Silver and gold streaming | Dividend growth potential | Exposure to multiple mining projects |

Understanding Vanguard’s Gold Investment Fees & Costs

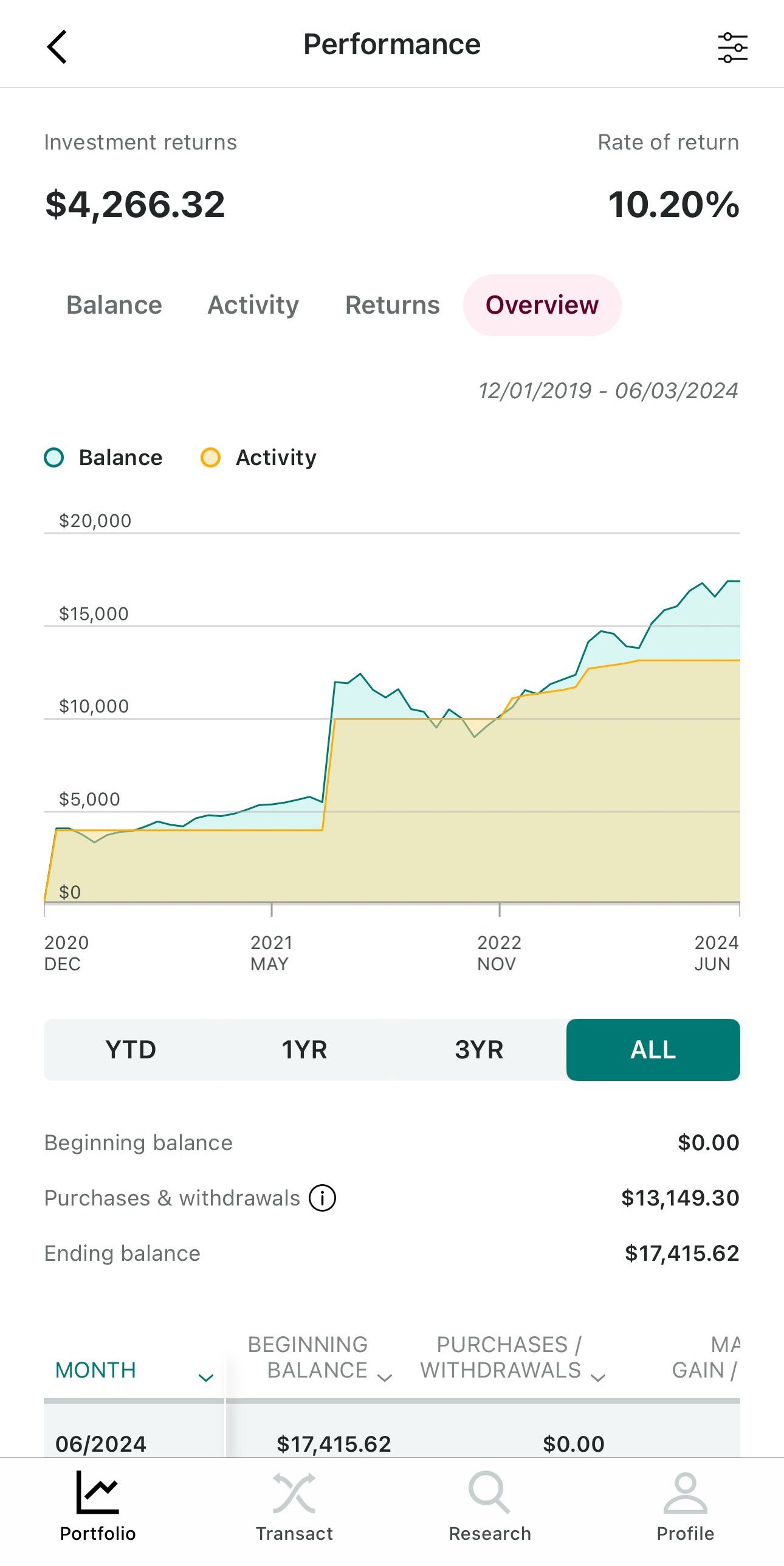

Vanguard doesn’t charge commissions on most online trades for ETFs and stocks, including gold-related assets.

However, keep in mind:

Gold ETF Expense Ratios: ETFs like GLD and IAU charge annual fees ranging from 0.15% to 0.40%, which are deducted from the fund itself — not billed separately.

Stock Trading: Individual gold stock trades are also commission-free when done online, but spreads and other market factors still apply.

There are no account maintenance fees for most Vanguard brokerage accounts. However, minimum balances may apply depending on the type of account you open.

Tips for Investing in Gold Through Vanguard

Whether you're adding gold for diversification or seeking inflation protection, here are a few helpful tips:

Know Your Goal: Are you hedging against inflation, or seeking long-term capital growth? ETFs are better for passive exposure, while mining stocks carry more risk and reward.

Consider Low-Cost Options: ETFs like IAU or GLDM may offer lower fees than older funds like GLD — making them better for cost-conscious investors.

Use Retirement Accounts: You can hold gold ETFs and mining stocks inside your Vanguard IRA for potential tax advantages.

Diversify Your Holdings: Don’t go all-in on gold. It works best as a small portion of a broader portfolio that includes stocks, bonds, and other assets.

Rebalance Periodically: As gold prices move, your portfolio allocation may shift. Check your mix once or twice a year and rebalance as needed.

Can I Invest in a Gold IRA via Vanguard?

Yes — but only using paper gold, not physical bullion.

Vanguard offers Traditional, Roth, and SEP IRAs, and within those accounts, you can invest in gold-related ETFs or stocks (like GLD or Newmont Mining).

You cannot buy or store physical gold in a Vanguard IRA — the company does not offer self-directed IRAs that allow for physical gold ownership.

If your goal is to hold physical coins or bars inside a retirement account, you’ll need to go through a specialized Gold IRA provider.

FAQ

Yes, you can find ETFs related to silver, platinum, and other metals, though gold-focused funds tend to be more widely available and liquid.

Yes, international gold mining companies listed on US exchanges — like Barrick Gold — can be bought through Vanguard.

Some broader funds may have indirect exposure through holdings in mining companies, but Vanguard doesn’t offer a dedicated gold mining mutual fund.

You can hold gold ETFs or mining stocks in regular brokerage accounts, IRAs, and other tax-advantaged accounts like SEP or Roth IRAs.

Yes, most major gold ETFs available on Vanguard — like GLD and IAU — are physically backed, with bullion stored in secure vaults.