Can You Buy Truth Social Stock?

Yes, you can invest in Truth Social by purchasing shares of its parent company, Trump Media & Technology Group Corp.

(TMTG), which trades under the ticker symbol DJT on the NASDAQ exchange. TMTG became publicly traded in March 2024 following a merger with Digital World Acquisition Corp.

(DWAC). Investors should be aware that DJT's stock has experienced significant volatility, influenced by company developments and broader market dynamics.

How to Buy Truth Social Stock?

Investing in DJT stock involves a straightforward process accessible through most major brokerage platforms. Follow these steps to acquire shares:

-

1. Select a Brokerage Account

Choose a reputable brokerage platform that offers access to NASDAQ-listed stocks. Platforms like Robinhood, SoFi Invest, and Fidelity allow trading of DJT shares.

[elementor-template id=”211350″]

-

2. Open and Fund Your Account

After selecting a brokerage, complete the account setup by providing the necessary personal information and linking a bank account. Deposit sufficient funds to cover your intended investment in DJT shares.

For example, if you plan to purchase 100 shares at $18.76 per share, ensure your account has at least $1,876, excluding any potential fees.

-

3. Research DJT Stock

Before making a purchase, conduct thorough research on TMTG's financial health, recent performance, and market trends.

Given the stock's volatility, staying informed about company news and market conditions is crucial.

For instance, recent filings indicate that insiders, including Donald Trump's trust, may sell significant shares, potentially impacting stock prices.

-

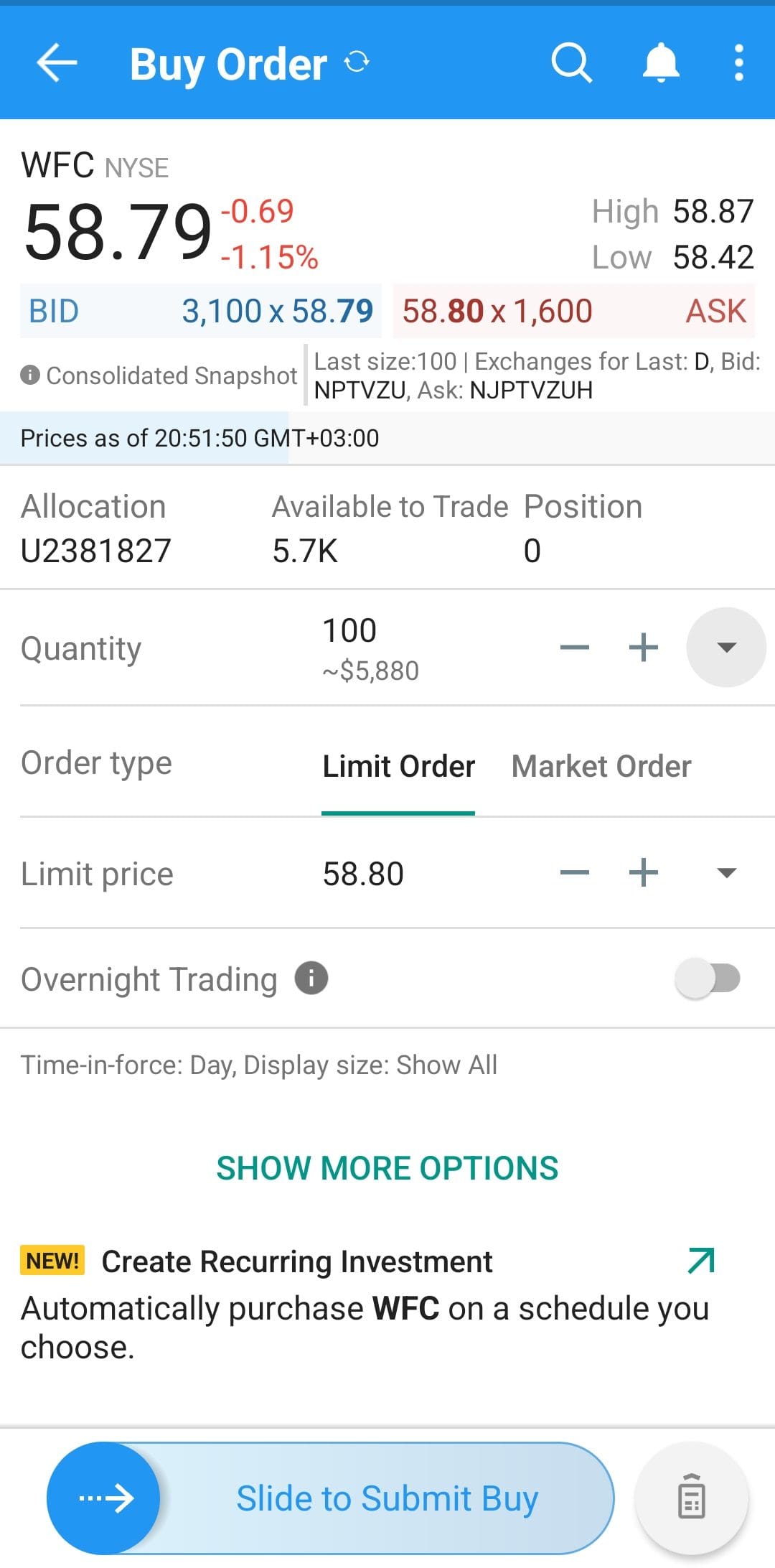

4. Place a Buy Order

Log into your brokerage account and navigate to the trading section. Enter the ticker symbol DJT, specify the number of shares you wish to purchase, and choose the order type:

Market Order: Buys shares immediately at the current market price.

Limit Order: Sets a specific price at which you're willing to buy; the order executes only if the stock reaches this price.

For example, if DJT is trading at $18.76 but you anticipate a slight dip, you might set a limit order at $18.50.

-

5. Monitor Your Investment

After purchasing, regularly review your investment's performance. Utilize tools and alerts provided by your brokerage to stay updated on price movements and company news.

For instance, setting up price alerts can help you react promptly to significant changes in DJT's stock value.

How Truth Social Plans to Generate Revenue

Truth Social, operated by Trump Media & Technology Group (TMTG), primarily generates revenue through digital advertising.

Similar to platforms like Facebook and Twitter, Truth Social displays paid advertisements to its users, aiming to monetize user engagement.

For instance, businesses can pay to have their ads shown in users' feeds, targeting specific demographics to promote their products or services.

However, as of 2023, the platform reported modest revenues, with $3.4 million earned in the first nine months, indicating challenges in scaling its advertising model.

Additionally, TMTG has expressed intentions to diversify its revenue streams, potentially exploring subscription models or premium features in the future.

Should You Invest in Truth Social?

Investing in Truth Social's parent company, TMTG, requires careful consideration of its potential and associated risks.

Pros | Cons |

|---|---|

Niche Market Appeal | Financial Instability |

High-Profile Leadership | Regulatory Scrutiny |

Expansion Opportunities | Competitive Pressure |

Market Differentiation | Leadership Controversies |

- Niche Market Appeal

Truth Social caters to users seeking alternative social media platforms, potentially capturing a dedicated user base.

- High-Profile Leadership

Association with President Donald Trump may attract media attention and user interest, boosting platform visibility.

- Expansion Opportunities

Plans to introduce new features or services could open additional revenue streams beyond advertising.

- Market Differentiation

Positioning as a free speech-centric platform may appeal to users disenchanted with mainstream social media policies.

- Financial Instability

TMTG reported significant losses, with a net loss of nearly $401 million on $3.6 million in sales in 2024, raising concerns about long-term viability.

- Regulatory Scrutiny

The company has faced investigations, including SEC inquiries into its merger processes, which could impact operations.

- Competitive Pressure

Competing with established platforms like Facebook and Twitter poses challenges in user acquisition and retention.

- Leadership Controversies

Dependence on Donald Trump's brand means any negative publicity could adversely affect the platform's reputation.

FAQ

Yes, if your brokerage allows margin trading, you can short DJT. Be aware that shorting volatile stocks carries higher risk and potential for rapid losses.

Few mainstream analysts currently cover DJT due to its unique position and limited financial data. This makes independent research especially important for potential investors.

DJT is listed on the NASDAQ, so it's primarily available through U.S.-based brokerages. However, international investors can access it through global platforms that support U.S. equities, such as Interactive Brokers.

Yes, many self-directed IRAs allow you to invest in publicly traded stocks, including DJT. Be sure to check with your IRA custodian for eligibility and requirements.

As of now, DJT does not pay any dividends. The company is focused on growth and scaling its operations rather than distributing profits.

Stock price movements are often driven by political events, media coverage, or announcements related to Trump Media. Because of its high-profile ties, it's more volatile than typical social media stocks.