|

| |

|---|---|---|

JM Bullion | American Hartford Gold | |

Min. Investment | $0 | $5,000 / $10,000

$5,000 for cash purchases / $10,000 for gold IRA |

Established | 2011 | 2015 |

Storage Fees | 0.5% – 1%

Varies by account, usually 0.5% – 1% . Estimated annual fee. | $200 – $280 |

Coin & Bar Selection | Broad range, includes collectors' coins | IRA-focused, fewer collectibles

|

Payment Methods | Cards, PayPal, Wire, eCheck, Crypto | Wire transfers and checks only

|

Pricing Transparency | Live prices shown on website | Must call for current pricing

|

Best For | DIY buyers, online tools, variety | Retirement investors, white-glove service

|

Our Rating |

(4.3/5) |

(4.6/5) |

Read Review | Read Review |

JM Bullion vs. American Hartford: Trust Scores Compared

Both JM Bullion and American Hartford Gold maintain excellent reputations, but AHG holds a slight edge.

Platform | Rating |

|---|---|

Trustpilot

| 4.7 (1,373 reviews) |

Better Business Bureau (BBB) | A+ | Accredited Since 2016 |

Consumer Affairs | 4.6 (891 reviews) |

With a Trustpilot score of 4.7 vs. JM’s 4.3, and strong customer support mentions, AHG is praised for its personalized service and ease of IRA setup.

JM Bullion performs well on product transparency and logistics but occasionally sees complaints about order processing delays.

Platform | Rating |

|---|---|

Trustpilot

| 4.3 (1,493 reviews) |

Better Business Bureau (BBB) | A+ | Accredited Since 2014 |

Consumer Affairs | 4.5 (790 reviews) |

Both companies hold A+ BBB ratings and are highly trusted, but AHG's consistency across platforms gives it the win here.

AHG vs JM Bullion: Which Is Best For Buying Gold?

Our preferred choice for buying physical precious metals is JM Bullion, mainly due to its real-time pricing, full e-commerce experience, and wider payment flexibility.

But there are a few key differences that could influence your decision:

Where they’re both strong:

Product range: Both dealers offer gold, silver, platinum, and palladium coins and bars. JM Bullion also carries copper.

Free shipping: Orders over $199 include free insured delivery.

Buyback programs: Both accept buyback and options to sell your gold online, even if you didn’t originally purchase from them.

Payment flexibility: Multiple payment methods supported, including checks and wires.

Where JM Bullion stands out:

Transparent pricing: Live prices and spot premiums are clearly listed on the website.

Payment methods: Accepts credit/debit cards, PayPal, and even Bitcoin.

E-commerce tools: The AutoBuy feature lets you schedule recurring buys, while the Fear & Greed Index offers market sentiment insights.

24/7 buyback tool: You can lock in sell prices without calling a representative.

Where American Hartford Gold stands out:

Personalized service: Purchases and questions are handled through a dedicated rep.

Price match guarantee: They’ll match lower prices from competitors upon request.

Promotional offers: Occasionally includes free silver for qualifying purchases or IRA rollovers.

If you’re looking for speed, flexibility, and full control, JM Bullion offers the better experience for direct buyers. AHG is still strong but more suited for those who prefer human assistance over digital convenience.

Best Gold IRA Provider: AHG or JM Bullion?

Our preferred choice for precious metal IRAs is American Hartford Gold, mainly due to its hands-on guidance, low minimum investment, and generous fee waivers.

Both JM Bullion and American Hartford Gold support Gold and Silver IRAs through reputable custodians, offering investors a path to diversify their retirement savings. But they cater to different types of investors.

Where they’re both strong:

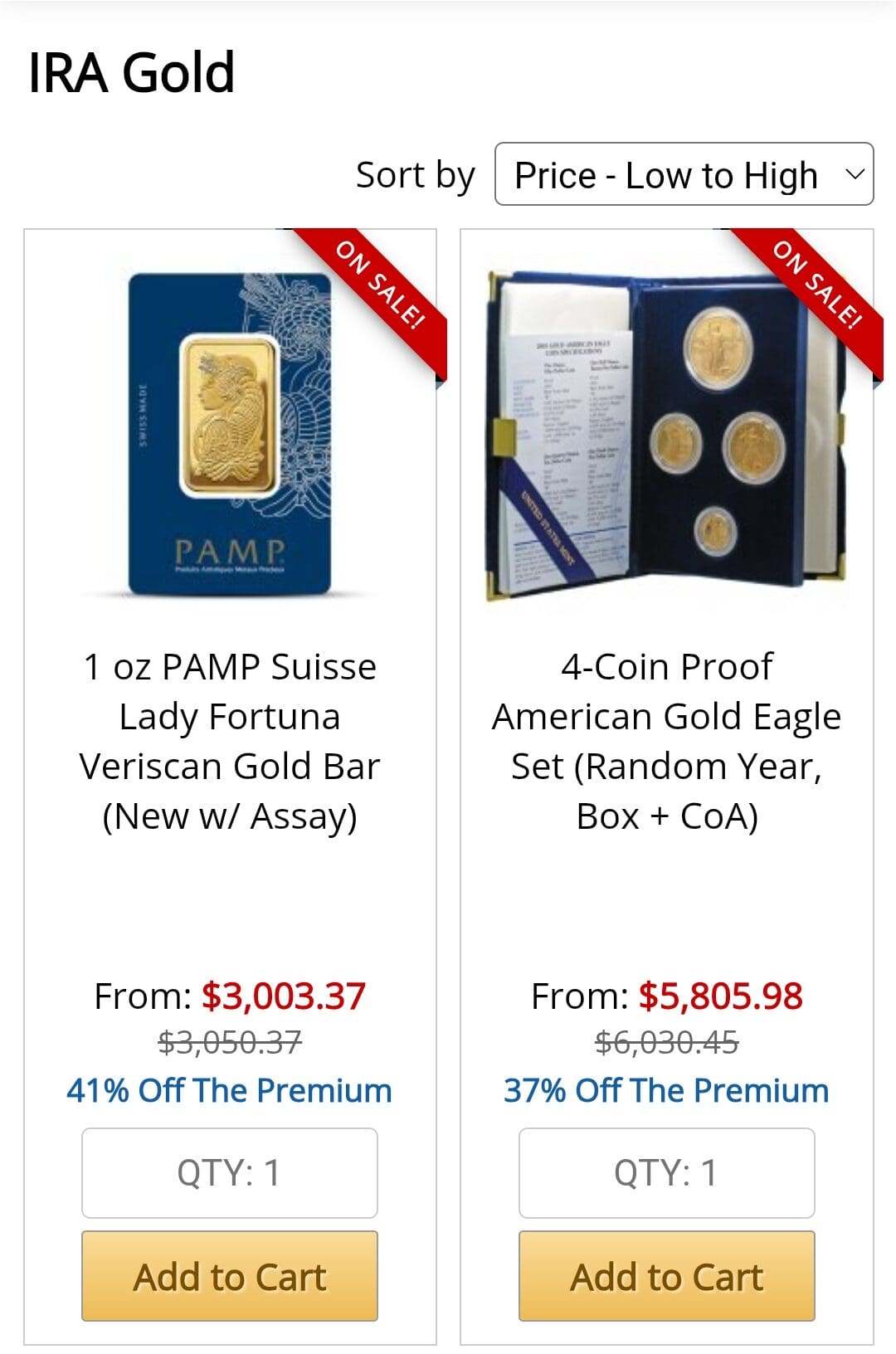

IRA-eligible metals: Both offer IRS-approved gold and silver products.

Buyback support: Both dealers offer to repurchase your metals without extra fees.

Secure storage: Depositories like Brinks, Delaware Depository, and TDS Vaults are used for IRA holdings.

Where American Hartford Gold stands out:

End-to-end IRA setup: AHG provides full support with rollovers, transfers, and account setup, including DocuSign paperwork.

Lower minimums: Gold IRAs can start with just $10,000.

Fee waivers: Up to 3 years of IRA fees waived for larger investments.

Phone-based help: Specialists walk you through every step, ideal for retirement investors seeking guidance.

Where JM Bullion stands out:

Digital transparency: Clear fee structures, live IRA-eligible pricing, and helpful educational tools.

Global storage: Offers depositories in Zurich, Toronto, and Singapore for international diversification.

Market tools: AutoBuy, price charts, and sentiment indicators assist strategic investors.

In short, JM Bullion gives tech-savvy investors more control, while American Hartford Gold delivers a smoother, fully guided IRA experience. We prefer AHG for Gold IRAs thanks to its comprehensive, hassle-free support.

Final Verdict: American Hartford Gold vs JM Bullion

Overall, we recommend JM Bullion for casual buyers and experienced online investors, while American Hartford Gold is our top pick for Gold IRAs and hands-on customer support.

Ratings Winner: American Hartford Gold – Slightly higher customer satisfaction and fewer complaints.

Best for Direct Purchase: JM Bullion – Transparent pricing, flexible payments, and full online shopping experience.

Best for IRA: American Hartford Gold – Lower entry minimum, full concierge service, and fee waivers.

The right choice depends on whether you prioritize digital flexibility or white-glove retirement account service.