|

| |

|---|---|---|

Kraken | eToro | |

Supported Coins | +300 | +25 |

Spot Trading Fees | 0.40% – 0.25%

0.40% for taker trades and 0.25% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.10%. Using GT tokens to pay trading fees offers a 10% discount | 1% |

Future Trading Fees | 0.02% – 0.05%

0.05% for taker trades and 0.02% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0.005%% – 0.015%. Using GT tokens to pay trading fees offers a 10% discount | $3–$5 per action |

Our Rating |

(4.3/5) |

(4.4/5) |

Read Review | Read Review |

Kraken vs eToro: Compare Crypto Features & Experience

Choosing between Kraken and eToro can be tricky because both offer strong advantages for crypto investors and traders.

Let's break it down side-by-side, showing exactly where each shines — and where they fall short — so you can find the right fit for your goals.

-

Ease of Use & Mobile App Experience

Kraken offers a clean mobile app for beginners with Instant Buy, but its Kraken Pro desktop platform is more complex because it targets advanced traders.

Setting up 2FA and verifying your account is straightforward, yet navigating futures and margin tools can feel overwhelming at first.

eToro focuses on simplicity from start to finish, offering an intuitive web and mobile experience that’s perfect for beginners. Plus, the $100,000 virtual account helps users practice easily.

-

Cryptocurrency Selection

Kraken supports +300 cryptocurrencies, ranging from Bitcoin and Ethereum to smaller altcoins and NFT-related tokens like ApeCoin (APE). This wide selection allows users to explore DeFi tokens and rare projects easily.

eToro, on the other hand, has a more limited crypto offering — especially for U.S. users — with +25 popular cryptocurrencies.

-

Wallet Options

Kraken allows users to deposit and withdraw both fiat and crypto, offering traditional bank methods like ACH and wire transfer.

Crypto assets are stored securely with cold storage practices, but Kraken does not offer a standalone user-controlled wallet.

eToro provides the eToro Money Wallet for storing, sending, and receiving crypto. However, once crypto is transferred to the wallet, it cannot be moved back to the trading platform.

-

Trading Crypto Features & Experience

Kraken offers advanced trading options, such as margin trading (up to 5x leverage), futures trading (up to 50x leverage), and an OTC desk for large trades.

Kraken Pro users can access order books, customizable charts, and deep liquidity for complex trading strategies. Futures traders, for example, can short Bitcoin using leveraged contracts.

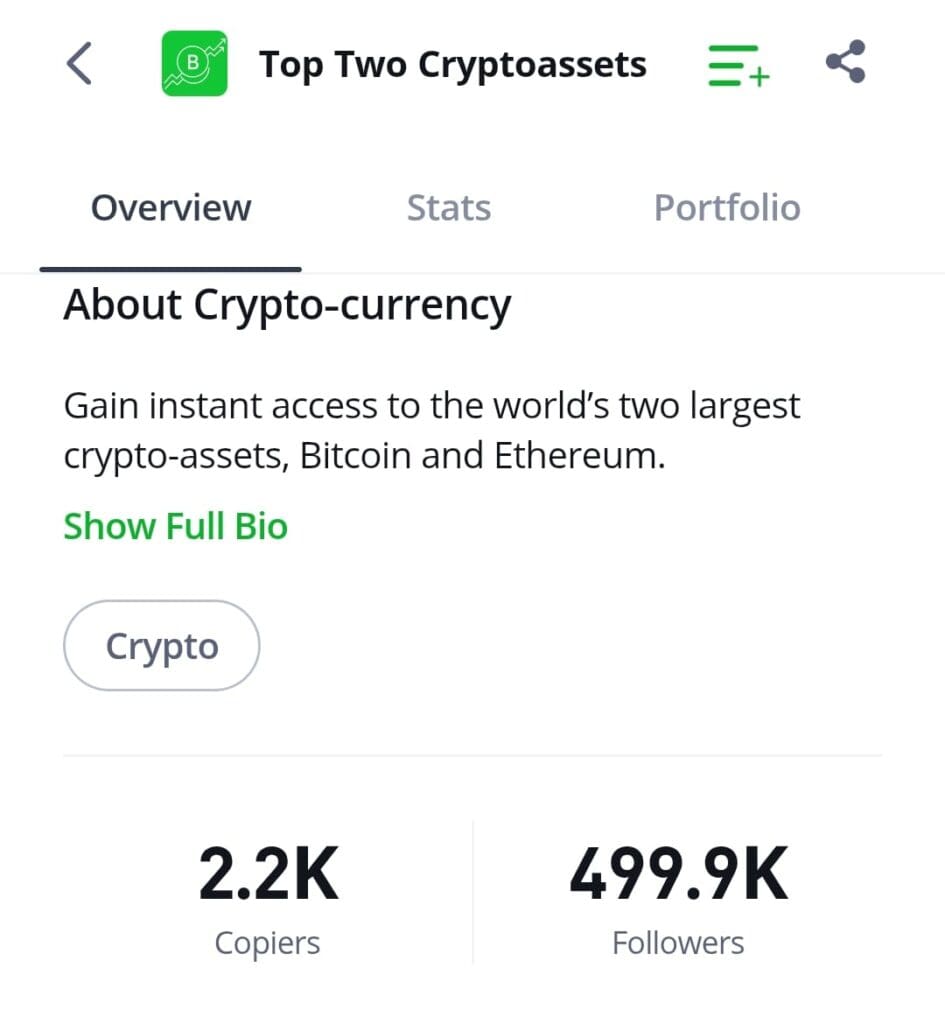

eToro focuses more on investing ease, offering CopyTrader to replicate expert traders and Smart Portfolios for thematic investing. However, margin trading for crypto is not available, limiting high-risk strategies.

-

Staking Options and Rewards

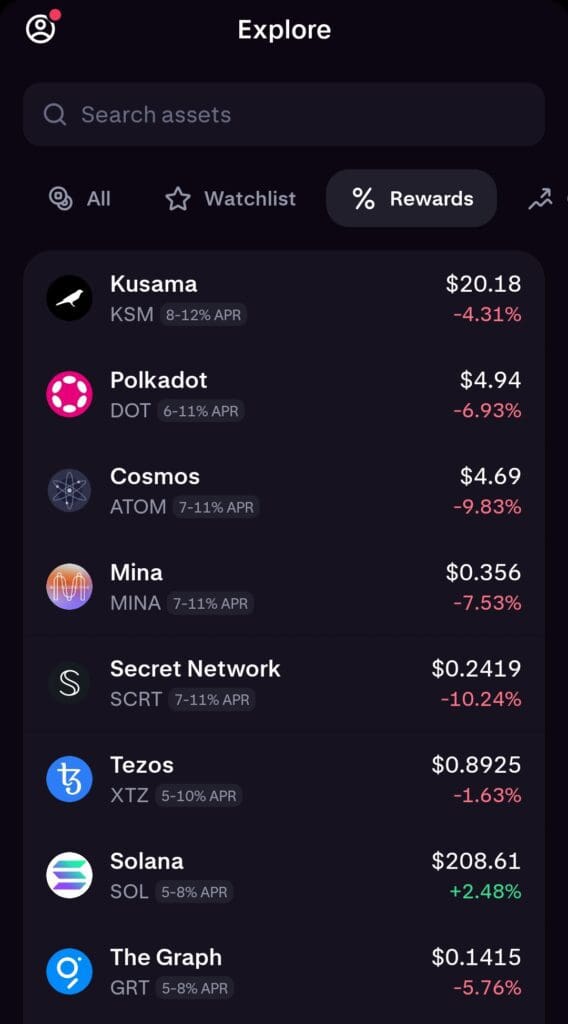

Kraken offers staking for U.S. users, supporting coins like Ethereum (ETH), Cardano (ADA), Solana (SOL), and Polkadot (DOT).

Stakers can earn rewards that vary by asset, with payouts made regularly. Kraken usually charges a 20% commission on staking yields.

eToro offers automatic staking for select cryptocurrencies, including Ethereum and Solana. Rewards are automatically distributed monthly, and investors receive 45-90% of staking yields, depending on their eToro Club tier.

Staking happens without manual setup, making it easier for beginners.

Overall, Kraken offers wider staking options globally, but eToro’s automated approach is better for casual users.

-

DApps and Web3 Integration

Neither platform is ideal for Web3 users, but eToro offers slightly better flexibility through its crypto wallet.

Kraken has minimal Web3 features: while you can buy tokens like Uniswap (UNI) or Chainlink (LINK), you cannot directly connect to DApps or decentralized platforms through Kraken.

eToro also lacks true Web3 integration, but it offers the eToro Money Wallet to store, send, and receive crypto, providing a bit more flexibility for users who want control over their crypto assets.

-

Trading Bots and Automation

Kraken offers customizable trading tools through Kraken Pro, but it does not provide built-in trading bots. Users must rely on manual order types like limit and stop-loss, or use external platforms.

eToro focuses on social trading instead of bots. Its CopyTrader feature automates portfolio management by copying expert traders, offering a more beginner-friendly form of automation without custom bots.

Overall, eToro offers better automation for beginners via CopyTrader, while Kraken suits manual traders.

Who Should Consider Kraken Exchange?

Kraken is ideal for users who prioritize strong security and want access to a wide range of cryptocurrencies. It’s also a great choice for more experienced traders who plan to use margin trading, futures, or OTC services.

Advanced Traders: Those looking for spot, margin, or futures trading with powerful Kraken Pro tools.

Security-Conscious Investors: Users who value cold storage, 2FA, and regulatory compliance.

Institutional and High-Volume Traders: Investors needing OTC trading for large transactions.

Crypto Enthusiasts: Those wanting access to 300+ digital assets, including niche altcoins.

Kraken’s deep liquidity, professional-grade features, and competitive Pro fees make it a go-to for serious crypto traders.

Who Should Consider eToro Crypto?

eToro is perfect for beginner and casual investors who want an easy and social way to invest in cryptocurrencies. It’s also strong for users who like simple automated solutions.

Beginner Investors: Those who want an intuitive platform and a $100,000 demo account for practice.

Social Traders: Investors interested in using CopyTrader to follow and replicate successful traders.

Stock and Crypto Investors: Users who want to combine crypto with stocks and ETFs in one account.

Passive Investors: Those preferring Smart Portfolios managed by professionals without manual trading.

With zero-commission stock trading, social features, and a user-friendly app, eToro lowers the barrier to investing for many.

Bottom Line

Kraken excels in security, cryptocurrency variety, and advanced trading options, such as futures and margin trading, making it the best choice for serious and professional crypto traders.

eToro stands out for its beginner-friendly platform, social trading features like CopyTrader, and easy diversification across stocks, ETFs, and crypto.

If you want professional tools and deep liquidity, Kraken wins. If you prefer easy investing with social features, eToro is the smarter choice.