| ||

|---|---|---|

Kraken | Gemini | |

Supported Coins | +300 | +150 |

Spot Trading Fees | 0.40% – 0.25%

0.40% for taker trades and 0.25% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.10%. Using GT tokens to pay trading fees offers a 10% discount | $0.99 – 1.49% (Web & Mobile), 0.20% – 0.40% (Active Trader)

For Gemini’s website or mobile app users are charged 0.50% convenience fee For Active Trader, 0.40% for taker trades and 0.20% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.03%. |

Future Trading Fees | 0.02% – 0.05%

0.05% for taker trades and 0.02% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0.005%% – 0.015%. Using GT tokens to pay trading fees offers a 10% discount | |

Our Rating |

(4.3/5) |

(4.2/5) |

Read Review | Read Review |

Kraken vs Gemini: Compare The Best Features

If you’re deciding between Kraken and Gemini for crypto trading, you’re in the right place. Both platforms offer secure environments and popular features, but they cater to different types of users.

Let’s break down their strengths and weaknesses across core areas like ease of use, crypto selection, and advanced features.

-

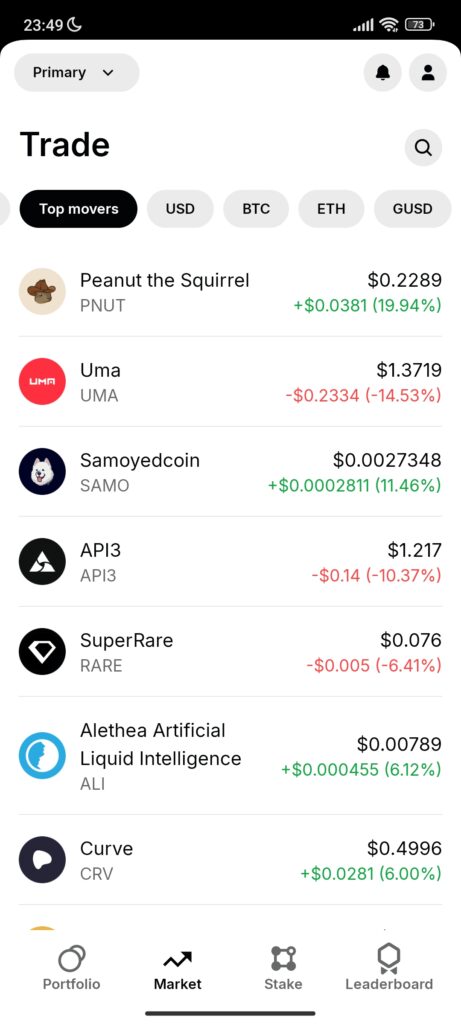

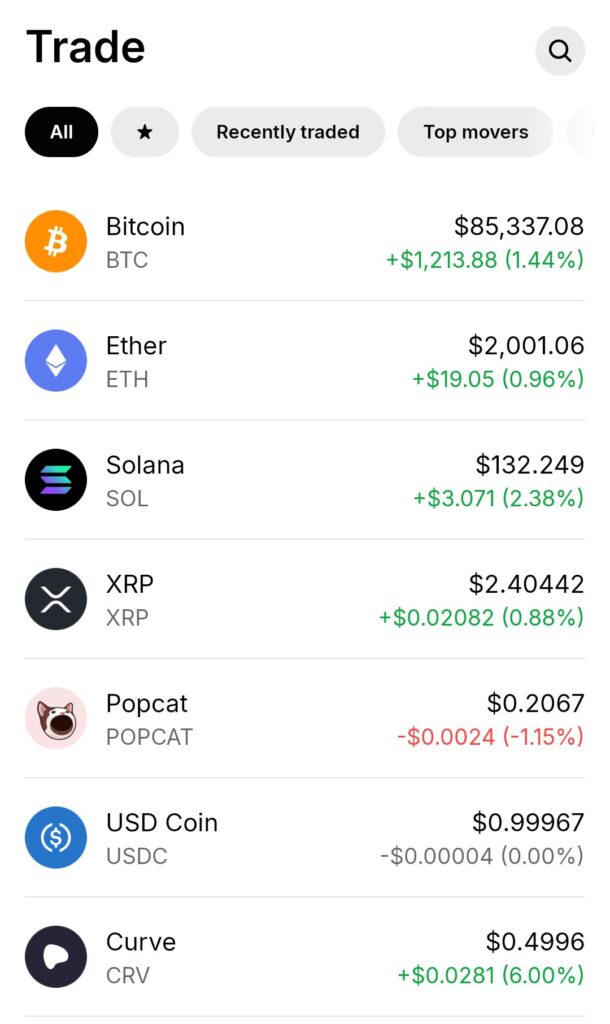

Ease of Use & Mobile App Experience

Kraken offers a clean mobile app that supports instant buying, selling, and account management. However, Kraken Pro’s advanced features can overwhelm beginners because of detailed charts and trading tools.

Gemini delivers a smooth, beginner-friendly app for casual investors, while its ActiveTrader platform offers fast execution and deep tools for pros. Gemini’s apps mirror the desktop functionality, making mobile trading seamless.

Overall, for ease of use and mobile experience, Gemini edges ahead, especially for new crypto users who want simplicity and speed.

-

Cryptocurrency Selection

Kraken supports +300 cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and smaller altcoins like Flow (FLOW), giving traders a wide variety to diversify.

Gemini, by contrast, offers +150 cryptocurrencies, with a strong focus on major assets and stablecoins like Gemini Dollar (GUSD). Gemini’s selection is solid but noticeably smaller.

-

Trading Crypto Features & Experience

If you’re an experienced trader seeking leveraged trading, advanced order types, and futures contracts, Kraken is clearly the stronger platform.

Kraken shines when it comes to advanced trading tools, offering margin trading (up to 5x leverage), futures contracts (up to 50x), and Kraken Pro for professional-grade charting. For example, day traders can set complex limit orders to manage risk precisely.

While Gemini offers ActiveTrader with lower fees and advanced charts, it lacks futures and margin trading for U.S. users and focuses more on spot trading and portfolio management.

-

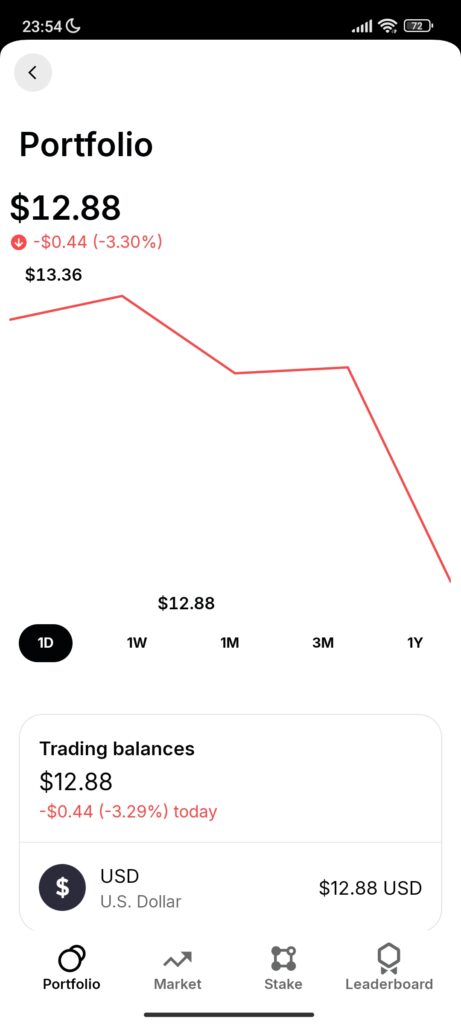

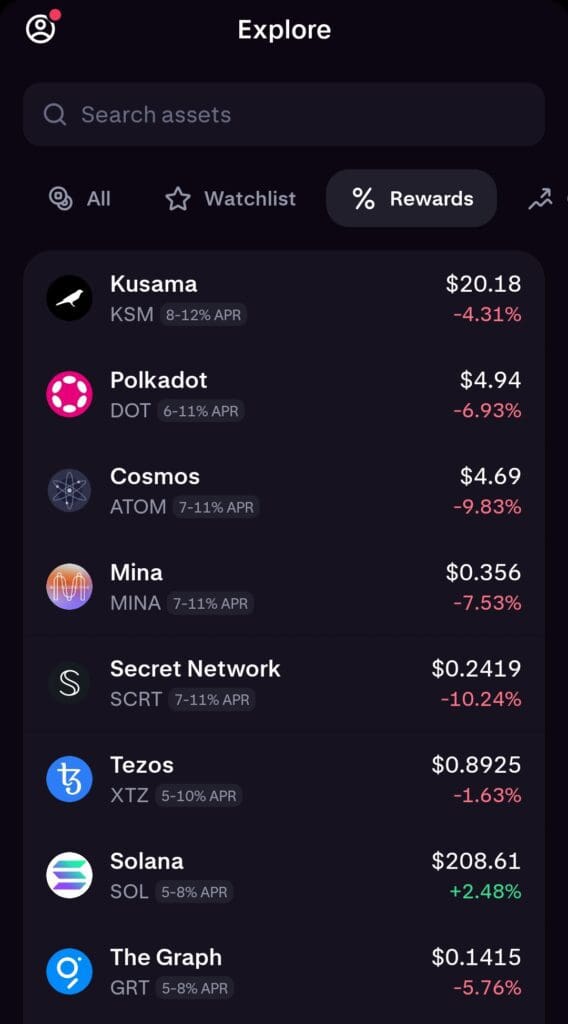

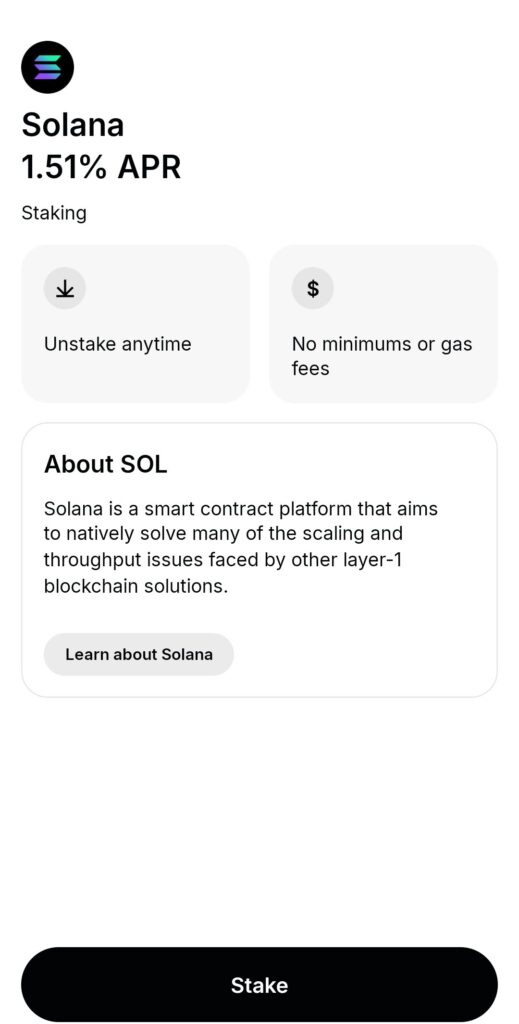

Staking Options and Rewards

Kraken has reintroduced staking services for U.S. customers in 2025, offering 17 digital assets including Ethereum (ETH), Solana (SOL), Polkadot (DOT), and Cardano (ADA). Rewards are paid weekly, with flexible and bonded staking options available.

However, commissions can be up to 20% for flexible staking and 12% for bonded staking.

Gemini provides staking for Ethereum (ETH), Polygon (MATIC), and Solana (SOL), with a 15% staking service fee deducted from rewards. Staking is simplified for users, allowing them to earn rewards without managing their own nodes.

-

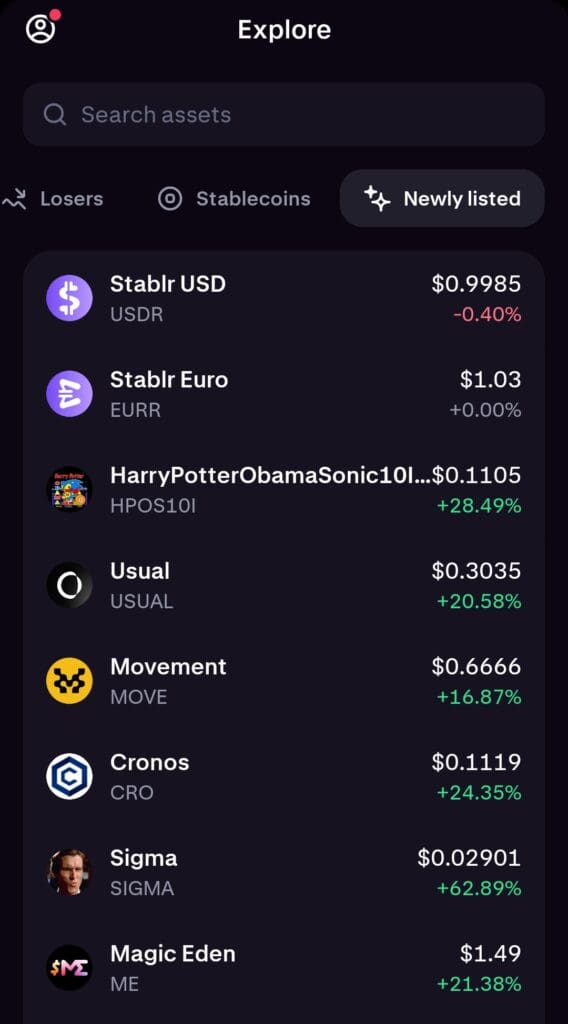

DApps and Web3 Integration

For Web3 and NFT interaction, Gemini offers stronger integration and easier access to digital collectibles.

Gemini extends into Web3 via Nifty Gateway, letting users buy and store NFTs directly. It also enables interactions with blockchain gaming and DeFi projects, although these are still limited compared to pure DeFi platforms.

Kraken is mainly a trading platform with minimal direct Web3 or decentralized application (DApp) support. It allows trading of tokens like Uniswap (UNI) but doesn't connect wallets to DApps.

-

Wallet Options

Kraken offers the Kraken Wallet, a self-custody solution that allows users to store and manage cryptocurrencies, NFTs, and interact with DeFi platforms securely. It supports WalletConnect for DApp integration.

Gemini provides a custodial wallet with assets stored in insured hot wallets or institutional-grade cold storage. While secure, it lacks the flexibility of self-custody and direct DApp interactions.

-

Trading Bots and Automation

Both exchanges facilitate trading automation; however, Kraken provides more robust native support for advanced trading bots.

Kraken supports trading bots through APIs, allowing users to automate strategies via platforms like 3Commas and TradersPost. These bots can execute trades based on predefined conditions, enhancing trading efficiency.

Gemini offers API access for custom trading bots and integrates with third-party platforms like Bitsgap and GoodCrypto, enabling users to automate trading strategies such as grid and DCA.

Who Should Consider Kraken Exchange?

Kraken stands out for active, experienced traders and those prioritizing security. Investors who may prefer Kraken include:

Advanced Traders: Kraken Pro's flexibility will appeal to those who use margin trading, futures, and advanced order types.

Security-Focused Users: Investors prioritizing cold storage, two-factor authentication, and withdrawal whitelisting will find Kraken’s security measures reassuring.

Diversified Crypto Holders: Anyone seeking access to 300+ cryptocurrencies, including small-cap and DeFi tokens, will benefit.

International Traders: Non-U.S. users who want staking rewards, futures trading, and a broader range of features.

Kraken's powerful trading tools, deep liquidity, and robust security make it an ideal choice for active and security-conscious investors.

Who Should Consider Gemini Exchange?

Gemini appeals to users who want a secure, easy-to-use platform with regulatory clarity. Investors who may prefer Gemini include:

Beginner Traders: Those new to crypto will appreciate Gemini’s simple web and mobile interfaces.

U.S.-Based Investors: Investors in all 50 states benefit from Gemini’s full legal compliance and regulatory approvals.

NFT Enthusiasts: Users interested in buying, selling, and storing NFTs via Nifty Gateway find Gemini’s ecosystem attractive.

Institutional and Long-Term Holders: Those needing insured, custodial cold storage and a regulated environment will feel secure.

Gemini’s balance of user-friendliness, regulatory focus, and Web3 access makes it a strong choice for beginners and long-term crypto holders.

Bottom Line: Kraken vs Gemini – Who Excels at What?

Kraken excels for advanced, security-conscious traders who want access to a wide variety of crypto assets, margin trading, and futures.

Gemini, on the other hand, is perfect for beginners, NFT collectors, and users seeking maximum regulatory protection and insured storage.

Choosing the right platform comes down to your trading experience, feature needs, and long-term goals — both exchanges offer strong, but very different, advantages.