| ||

|---|---|---|

Morningstar Investor | Motley Fool Epic | |

Price | $249 ($20.75 / month) | $499 (41.60 / month)

No monthly plan

|

Best Features | ||

Our Rating |

(4.5/5) |

(4.4/5) |

Read Review | Read Review |

Compare Stock Research & Analysis Features

In this comparison, we’ll take a closer look at Motley Fool Epic vs. Morningstar Investor, focusing on their stock research tools, market sentiment analysis, and portfolio management features.

We’ll walk you through what each platform does best to help you pick the right fit for your investment strategy

-

Stock Screening Tools

Morningstar offers a highly customizable stock screener that lets us filter U.S. stocks based on factors like valuation, growth potential, sector, and Morningstar ratings.

It’s particularly strong for long-term investors who prioritize fundamentals and fair value estimates.

On the other hand, Moneyball, the Motley Fool Epic’s stock screener, provides a pretty short list of stocks.

Moneyball is a proprietary AI-driven database system that scores and analyzes thousands of companies across multiple categories

Users can customize score ranges, select specific industries, and add custom columns to identify companies matching their exact investment criteria and priorities.

-

Fundamental Analysis Tools

We compared the fundamental analysis tools of both platforms, and Morningstar stands out for its in-depth research and detailed company reports.

It provides key metrics like fair value estimates, economic moat ratings, and comprehensive financial data. The platform’s independent analyst reports offer valuable insights into stocks, ETFs, and mutual funds.

Motley Fool Epic, on the other hand, excels with its access to FoolIQ and the Moneyball Database, which offer AI-powered insights and scoring systems.

While both platforms offer strong tools, Morningstar's detailed analyst-driven reports provide a deeper dive into the financial health of companies.

Overall, Morningstar Investor offers superior fundamental analysis tools with its robust research and comprehensive company insights.

-

Stock Picks & Recommendations

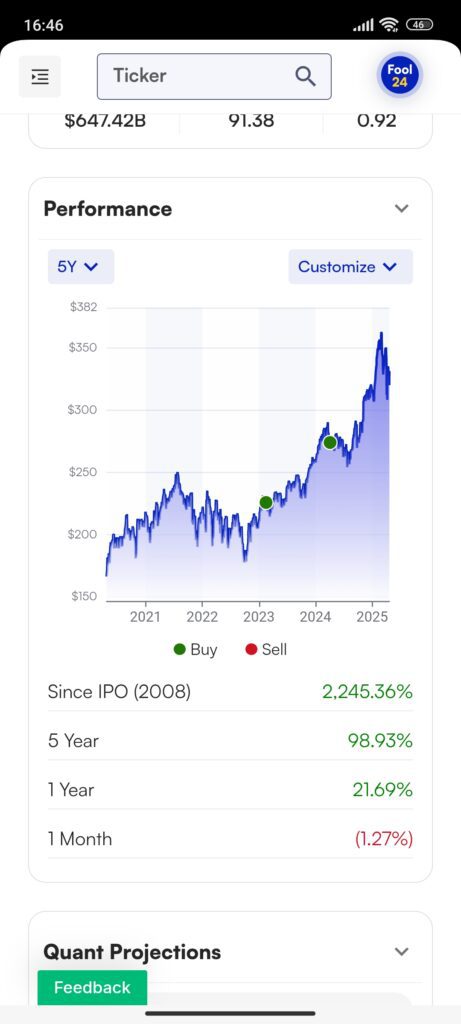

We tested the stock picks and recommendations of both platforms, and Motley Fool Epic delivers more in terms of monthly stock picks, with five new recommendations each month.

These picks come with detailed reports, AI-driven scoring, and growth projections.

The Motley Fool Epic plan's focus on growth and long-term performance, especially through its Foundational Stocks and portfolio strategies, makes it more attractive for those seeking consistent stock recommendations.

Morningstar, while strong in providing fair value estimates and economic moat ratings, does not offer the same number of frequent stock picks.

-

Market Sentiment Analysis

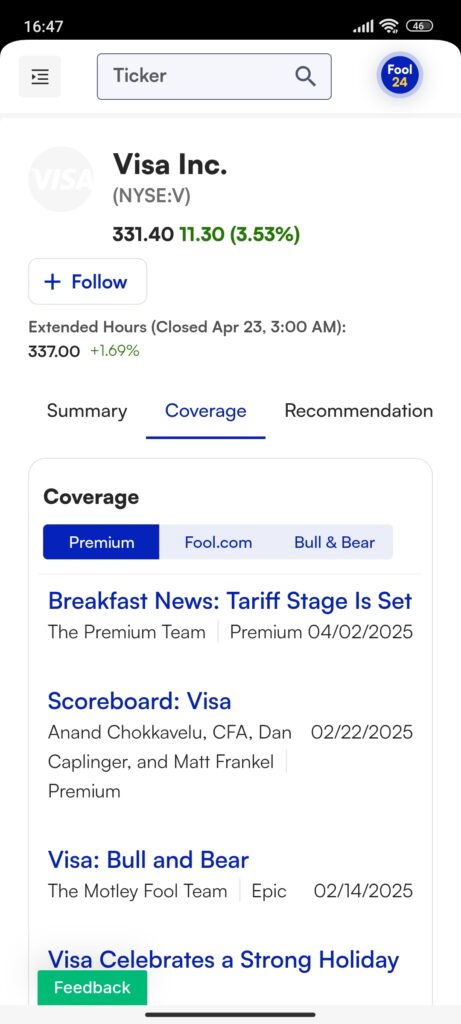

In our review, we found that Motley Fool Epic has a significant advantage when it comes to market sentiment analysis.

It provides access to Fool24’s Live Coverage, where we received real-time market insights, analyst discussions, and exclusive stock analysis every trading day.

The platform’s PGI (Potential Growth Indicator) also tracks investor sentiment, providing a clear view of market confidence.

Morningstar, while it offers market commentary, does not provide the same level of real-time sentiment tracking or social features like Motley Fool Epic’s in-depth news coverage and podcast series

-

Portfolio Analysis & Alerts

We tested both platforms' portfolio management features and found that Morningstar offers a comprehensive suite, including the Portfolio X-Ray tool, which provides deep insights into asset allocation and risk diversification.

The platform also includes email-based alerts for price movements and analyst updates.

Motley Fool Epic, on the other hand, offers portfolio strategies (cautious, moderate, aggressive) and My Stocks tracking tool, but lacks real-time alerts.

While both platforms provide useful tools, Morningstar’s detailed portfolio analysis is more robust.

-

Technical Analysis Options

Neither of the offers string technical analysis capabilities.

Morningstar provides basic charting tools, allowing us to overlay indicators like moving averages and RSI, but it lacks the advanced technical indicators that many traders rely on, such as Fibonacci retracements or MACD.

In contrast, Motley Fool Epic does not offer any technical analysis tools or real-time charts.

While both platforms cater to long-term investors, Morningstar’s technical analysis features, though basic, are more useful for analyzing price trends.

-

ETF, Bonds & Fund Analysis Tools

Morningstar’s strong points are its ETF and mutual fund analysis tools, which offer detailed reports on costs, performance, and fund manager strategies.

It offers one of the advanced ETF screeners, letting us filter funds by risk level, cost, and performance.

Motley Fool Epic, while offering some ETF recommendations, does not provide the same level of in-depth analysis or screener tools for ETFs, bonds, or funds.

Which Investors May Prefer Morningstar Investor?

Morningstar Investor is a great fit for long-term, fundamental-focused investors who want deep insights into stocks, ETFs, and mutual funds. It’s ideal for:

Value-driven investors: Those seeking detailed analysis on fair value, economic moats, and long-term growth potential.

ETF and fund investors: Investors focused on fund performance, costs, and manager track records.

Retirement-focused investors: Perfect for those who want robust portfolio management and diversification insights, especially for long-term retirement planning.

Income-focused investors: With its dividend yield analysis, Morningstar is suited for those prioritizing stable income from investments.

Plan | Annual Subscription | Promotion |

|---|---|---|

Morningstar Investor | $249 ($20.75 / month) | 7-Day free trial |

Which Investor Types May Prefer Motley Fool Epic?

Motley Fool Epic is ideal for investors who want regular stock picks, AI-powered insights, and personalized portfolio strategies. It suits:

Growth-focused investors: Those seeking high-growth stock picks with long-term potential, backed by expert analysis.

Retirement-focused investors: With its GamePlan+ tools, Epic is great for building long-term retirement portfolios and strategies.

AI-driven researchers: Investors who value data-backed stock analysis from tools like the Moneyball Database and Quant: 5Y Scoring.

Diversification-seeking investors: Epic provides personalized portfolio strategies tailored to different risk levels, from cautious to aggressive.

Plan | Annual Subscription | Promotion |

|---|---|---|

Motley Fool Stock Advisor | $199 (16.60 / month)

No monthly plan

| 30-day money-back guarantee |

Motley Fool Stock Epic | $499 (41.60 / month)

No monthly plan

| 30-day money-back guarantee |

Motley Fool Epic Plus | $1,999 (166.60 / month)

No monthly plan

| 30-day money-back guarantee |

Bottom Line

Morningstar Investor excels in fundamental research, with strong portfolio analysis tools, fair value estimates, and comprehensive fund analysis.

It's perfect for long-term investors focused on deep stock, ETF, and mutual fund insights.

Motley Fool Epic stands out with its frequent stock picks, AI-driven analysis, and personalized portfolio strategies, making it ideal for growth-focused investors looking for regular recommendations.