Table Of Content

If you're looking to invest but unsure whether to go digital or work with a real person, you're not alone. Today’s investors have two main choices: robo-advisors and financial advisors.

Each comes with its own pros and cons depending on how much help you need and how much you're willing to pay.

In this guide, we’ll break down how both options work so you can choose the right fit for your financial goals.

What Is a Robo-Advisor and How Does It Work?

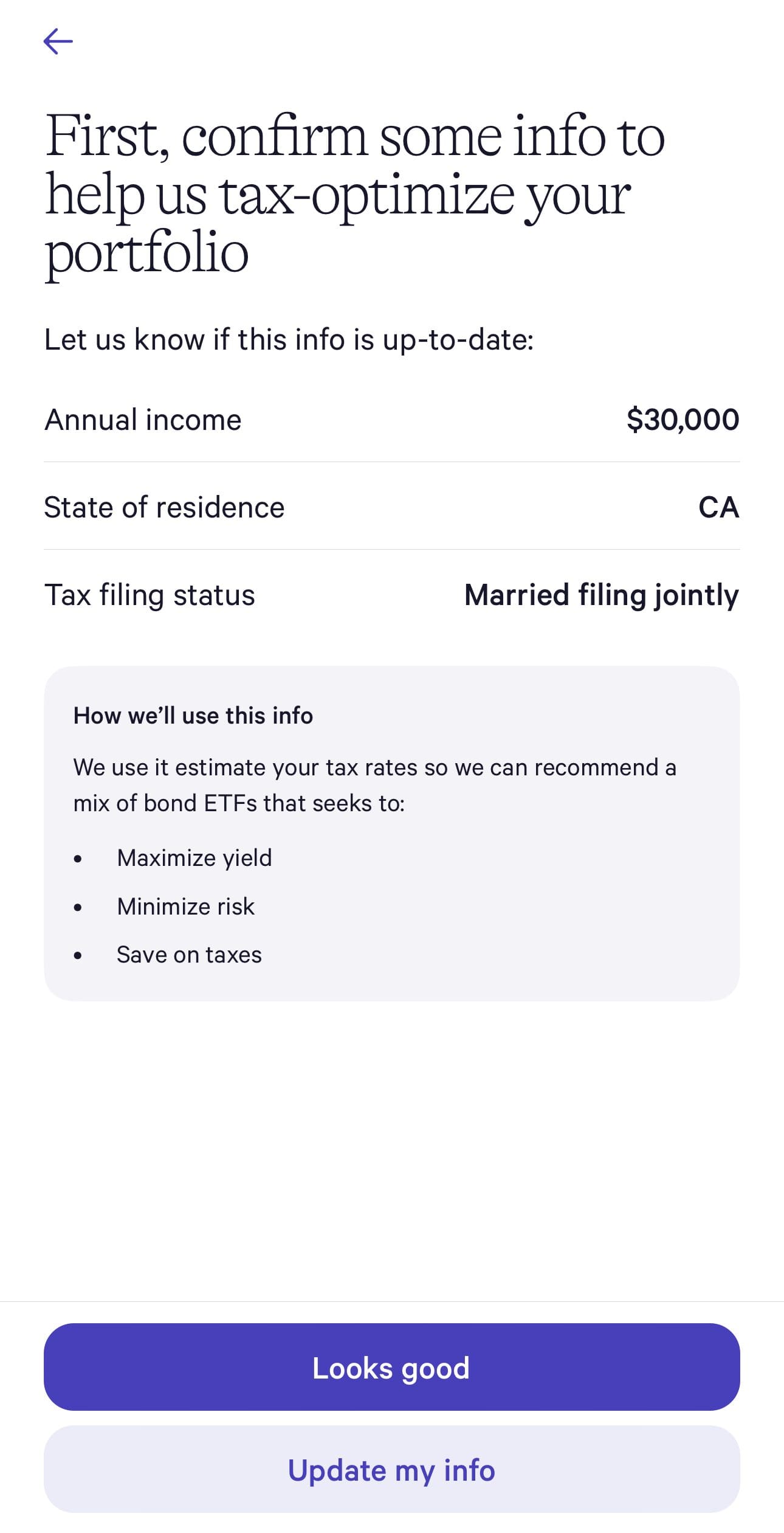

A robo-advisor is an automated investment platform that builds and manages a portfolio for you based on your goals and risk tolerance.

You typically start by answering a few questions about your finances, and the system uses that info to create a diversified mix of assets (often ETFs). The platform automatically rebalances your portfolio as markets move and may offer features like tax-loss harvesting.

Robo-advisors are popular for their simplicity, low fees, and hands-off approach—great for investors who want to “set it and forget it.”

Pros | Cons |

|---|---|

Low fees (often under 0.50% annually) | Limited customization compared to human advisors |

Easy to use, even for beginners | No human interaction for complex advice |

Automatically rebalances your portfolio | May not address unique life or tax situations |

Great for long-term, passive investors | Limited help during major market swings |

What Is a Financial Advisor and How Does It Work?

A financial advisor is a licensed professional who provides personalized financial guidance. They help clients create comprehensive plans covering everything from investing and retirement to taxes and estate planning.

You typically meet in person or virtually to discuss your goals, then the advisor builds a custom strategy. Financial advisors charge either a percentage of assets under management, a flat fee, or hourly rates.

They’re ideal for people who want more tailored advice or are navigating big life events, such as buying a home or retiring.

Pros | Cons |

|---|---|

Personalized guidance for complex situations | Typically more expensive than robo-advisors |

Helps with full financial planning | Quality can vary depending on the advisor |

Emotional support during market downturns | May have account minimums |

Can help navigate tax, estate, or retirement issues | In-person meetings may not suit everyone |

Key Differences: Robo-Advisors vs. Financial Advisors

Choosing between a robo-advisor and a financial advisor depends on your goals, budget, and how hands-on you want to be. While both help you manage your money, they offer very different experiences.

Here's how they stack up:

-

Cost and Fees

The most noticeable difference is cost. Robo-advisors typically charge 0.25% to 0.50% annually.

Some, like SoFi Invest, even offer basic robo services with no management fee. In contrast, financial advisors often charge 1% of assets under management—or hourly or flat fees.

For example, if you have a $100,000 portfolio, a robo might cost $250–$500 a year, while a financial advisor could cost $1,000 or more. That gap adds up over time.

For investors focused on keeping expenses low—especially early in their investing journey—a robo-advisor offers a budget-friendly way to get started without sacrificing diversification or automated management.

Rovo Advisor | Annual Fees | Minimum Deposit |

|---|---|---|

Wealthfront | 0.25% | $500 |

Betterment | 0.25%

$4 monthly for $0 – $20K balance, 0.25% annually for $20K – $1M balance, 0.15% annually for $1M – $2M balance, 0.10% annually for +$2M balance | $10 |

Acorns | Monthly: $3 – $12

$3 for Bronze, $6 for Silver and $12 for Gold

| $0 |

Schwab Intelligent Portfolios | Up to 0.80%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Schwab Intelligent Portfolio – 0%, Schwab Intelligent Portfolios Premium – One-time planning fee: $300 + Monthly advisory fee: $30, Schwab Wealth Advisory: up to 0.80% | $5,000 |

Vanguard Digital Advisor® | Up to 0.30%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Vanguard Digital Advisor – 0.015%, Vanguard Personal Advisor: 0.03%, Vanguard Personal Advisor Select: up to 0.03%, Vanguard Wealth Management: up to 0.03% | $100 |

E*TRADE Core Portfolios | 0% – 0.35%

0% on stocks and ETFs in self directed brokrage, 0.35% for Core Portfolio Robo Advisor

| $500 |

Merrill Guided Investing | 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor | $1,000 |

-

Human Interaction and Support

Robo-advisors are mostly digital tools. You interact through an app or dashboard, with no direct access to a person unless you upgrade (e.g., Betterment Premium includes human advisors for an extra fee).

In contrast, financial advisors offer hands-on, personalized service. If you’re nearing retirement and want to discuss your withdrawal strategy, a human advisor can talk you through tax-efficient options.

For example, someone using Vanguard’s personal advisory service might have monthly calls to review progress or adjust for life changes. If you value conversation and want someone to walk you through big decisions, a financial advisor is likely a better fit.

-

Personalization and Planning Depth

Robo-advisors offer limited customization. You answer a few questions about your goals and risk tolerance, and the platform chooses a portfolio—usually built with ETFs.

That’s great for simplicity, but not ideal for unique needs. Financial advisors can build comprehensive plans based on your full situation.

For example, if you're self-employed, planning for a child's college, and managing real estate income, a financial advisor can help juggle all those pieces. Robo-advisors aren’t designed for that level of complexity.

If you have a straightforward investment goal, such as retirement in 30 years, robo-advisors like Wealthfront work well. For layered finances, human help shines.

-

Investment Approach and Flexibility

Robo-advisors tend to follow strict asset allocation models based on Modern Portfolio Theory. They automatically rebalance and may include features like tax-loss harvesting (offered by platforms like Wealthfront).

However, they usually won’t let you pick specific stocks or funds. Financial advisors have more flexibility.

If you prefer a tilt toward dividend-paying stocks or have specific preferences for ESG (environmental, social, governance) investing, an advisor can tailor your portfolio accordingly.

For instance, a client who wants to overweight healthcare stocks due to family history might not find that option with a robo. A human can better handle custom investing strategies.

-

Services Beyond Investing

Robo-advisors are primarily focused on investing and portfolio management. Some platforms offer extras like basic retirement calculators or goal tracking, but the scope is limited.

Financial advisors provide a wide range of services—estate planning, tax strategies, insurance analysis, debt management, and more.

For example, a couple planning to move states and start a business might need help navigating tax rules, budgeting, and investment strategy. A financial advisor can manage all of this under one plan.

Robo-advisors can't offer that full-spectrum advice. If you need help outside your investments—especially with big financial transitions—a financial advisor brings more value.

How to Know Which One Is Best for You

Choosing between a robo-advisor and a financial advisor depends on what kind of help you want, how much you’re willing to spend, and how complex your finances are. Neither is “better” across the board—it’s all about the right fit for your current stage in life.

Here’s how to decide:

Go with a robo-advisor if you want low fees, automated investing, and a hands-off experience. Ideal for beginners or long-term savers.

Choose a financial advisor if you need personalized help, are going through a major life event (like retirement or divorce), or want a full financial plan.

Consider a hybrid solution (like Vanguard Personal Advisor or Betterment Premium) if you want the convenience of automation plus occasional access to a human advisor.

Think about your comfort with technology—if you prefer speaking to someone, a human advisor may give you more peace of mind.

Review your financial goals and complexity—the more moving parts you have (estate, taxes, multiple income sources), the more a human touch may help.

FAQ

Yes, most robo-advisors are registered with the SEC and must follow fiduciary standards just like traditional advisors.

Yes, you can transfer your assets to a financial advisor, but be aware of potential transfer fees or tax implications.

Some robo-advisors, like Blooom, specialize in managing 401(k) plans, but most focus on IRAs and taxable accounts.

Most robo-advisors monitor portfolios daily and automatically rebalance as needed to keep you on track.

Some do, but many have account minimums ranging from $25,000 to $250,000. However, fee-only advisors may be more flexible.

Yes, hybrid services like Vanguard Personal Advisor Services combine robo-technology with access to human advisors.

Not always—some are fiduciaries, others are commission-based. It’s important to ask upfront.

Related Posts

- Should You Pay Off Debt First or Start Investing?