Table Of Content

If you're looking to grow your money without constantly watching the market, you've likely come across robo-advisors and index funds. Both offer simple, low-cost ways to invest — but they work differently.

A robo-advisor manages your portfolio automatically, while index funds are a type of investment you can buy and hold on your own.

Depending on how involved you want to be (and how much you want to pay in fees), one might fit your goals better than the other.

What Is a Robo-Advisor and How Does It Work?

A robo-advisor is an automated investment platform that builds and manages your portfolio based on your goals, risk tolerance, and time horizon.

You typically start by answering a few questions, and the robo-advisor uses algorithms to invest your money in a diversified mix of ETFs.

It then automatically rebalances your portfolio and can even manage tax strategies like tax-loss harvesting. Robo-advisors are ideal for people who want a “set-it-and-forget-it” option without needing to hire a human financial advisor.

Pros | Cons |

|---|---|

Low-cost portfolio management | Annual fees (usually 0.25%–0.50%) |

Automatic rebalancing and tax strategies | Limited personalization beyond risk profile |

Easy to use and beginner-friendly | May underperform custom-built portfolios |

Requires no investment knowledge | Less control over where your money is invested |

What Is an Index Fund and How Does It Work?

An index fund is a type of mutual fund or ETF that aims to track the performance of a specific market index, such as the S&P 500.

Instead of trying to beat the market, it simply mirrors it by holding most of the same stocks in the index. Index funds are passive investments, meaning they don’t require active management, which keeps fees very low.

You can invest in them through a brokerage account or retirement plan and hold them long-term.

Pros | Cons |

|---|---|

Extremely low fees | No automatic rebalancing or management |

Historically strong long-term performance | You’re on your own to manage your portfolio |

Simple, transparent, and easy to understand | Still subject to market ups and downs |

Great for long-term, passive investors | May not suit short-term or high-risk strategies |

Key Differences Between Robo-Advisors & Index Funds

If you're choosing between a robo-advisor and index funds, you're already thinking in the right direction.

Both options are low-cost, passive ways to grow your wealth — and great alternatives to picking individual stocks or paying high fees to a traditional advisor.

But here’s the catch: while they share some similarities, robo-advisors and index funds serve different roles in your investment journey.

Let’s walk through the key differences to help you figure out which one fits your financial goals, time commitment, and comfort level.

-

Robo-Advisors Are a Service, Index Funds Are an Investment Product

The most important distinction is what they actually are. A robo-advisor is a platform or service that builds and manages a portfolio on your behalf. It typically invests in a mix of index funds or ETFs based on your risk tolerance.

An index fund, on the other hand, is a type of investment — a fund that tracks a market index like the S&P 500.

When you invest in an index fund, you're putting your money directly into a basket of stocks or bonds. You manage it yourself (unless you use a robo-advisor to do it for you).

In other words, robo-advisors often use index funds as part of your portfolio, while index funds are individual tools you can invest in directly.

-

Level of Involvement: Set-It-and-Forget-It vs. DIY Simplicity

Robo-advisors are designed for people who want a fully hands-off experience. You answer a few questions, and the system handles everything — from picking investments to rebalancing and adjusting your portfolio over time.

Index funds are easy to use, but they’re not completely hands-off. You’ll need to:

Choose which index funds to invest in

Decide your allocation (e.g., 70% stocks, 30% bonds)

Rebalance your portfolio periodically

If you want to be involved — but not overwhelmed — index funds may suit you. But if you prefer to automate everything, choose a robo-advisor for convenience.

-

Fees and Costs: Robo-Advisors Charge for Convenience

Robo-advisors typically charge an annual management fee, usually around 0.25%–0.50% of your invested assets. This fee is in addition to the underlying fund fees, such as the expense ratios of the ETFs it uses.

Index funds, especially ones from providers like Vanguard or Fidelity, often have very low expense ratios — sometimes as low as 0.03%. If you manage your own index fund portfolio, you avoid that extra advisory fee.

So, if you want the lowest possible cost, a DIY index fund approach comes out ahead.

-

Control and Customization

With index funds, you’re in the driver’s seat. You decide which funds to buy, how much to allocate to each, and when to make changes. That gives you more control — but also more responsibility.

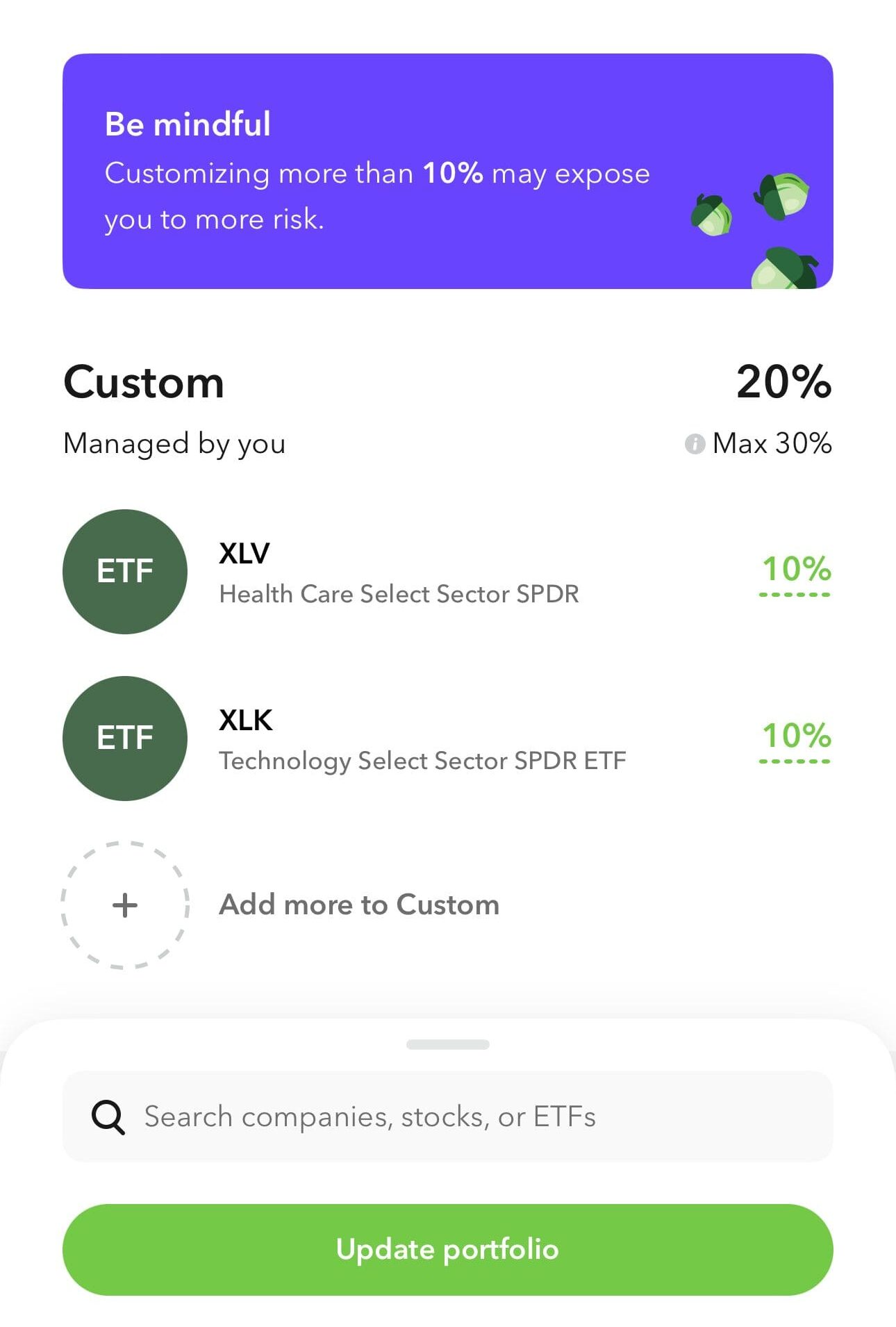

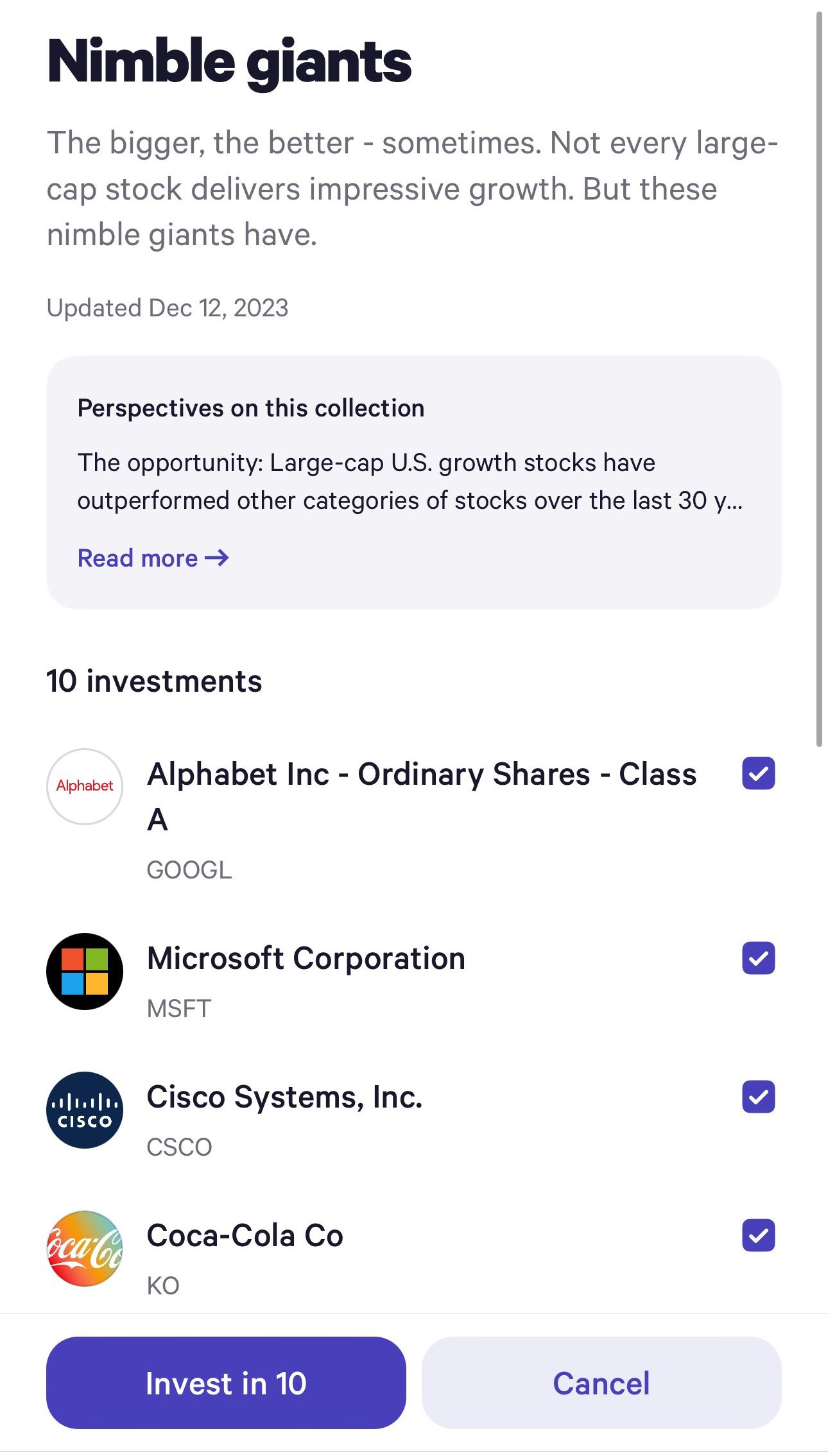

Robo-advisors offer limited customization. You can usually set your risk level (e.g., conservative or aggressive), and some may let you tweak your portfolio slightly. But beyond that, you're trusting the algorithm to decide what’s best.

For example, Wealthfront allows you to invest in a set of stocks:

If you enjoy making your own investing decisions, index funds offer more flexibility. If you want to avoid those decisions altogether, robo-advisors are better.

-

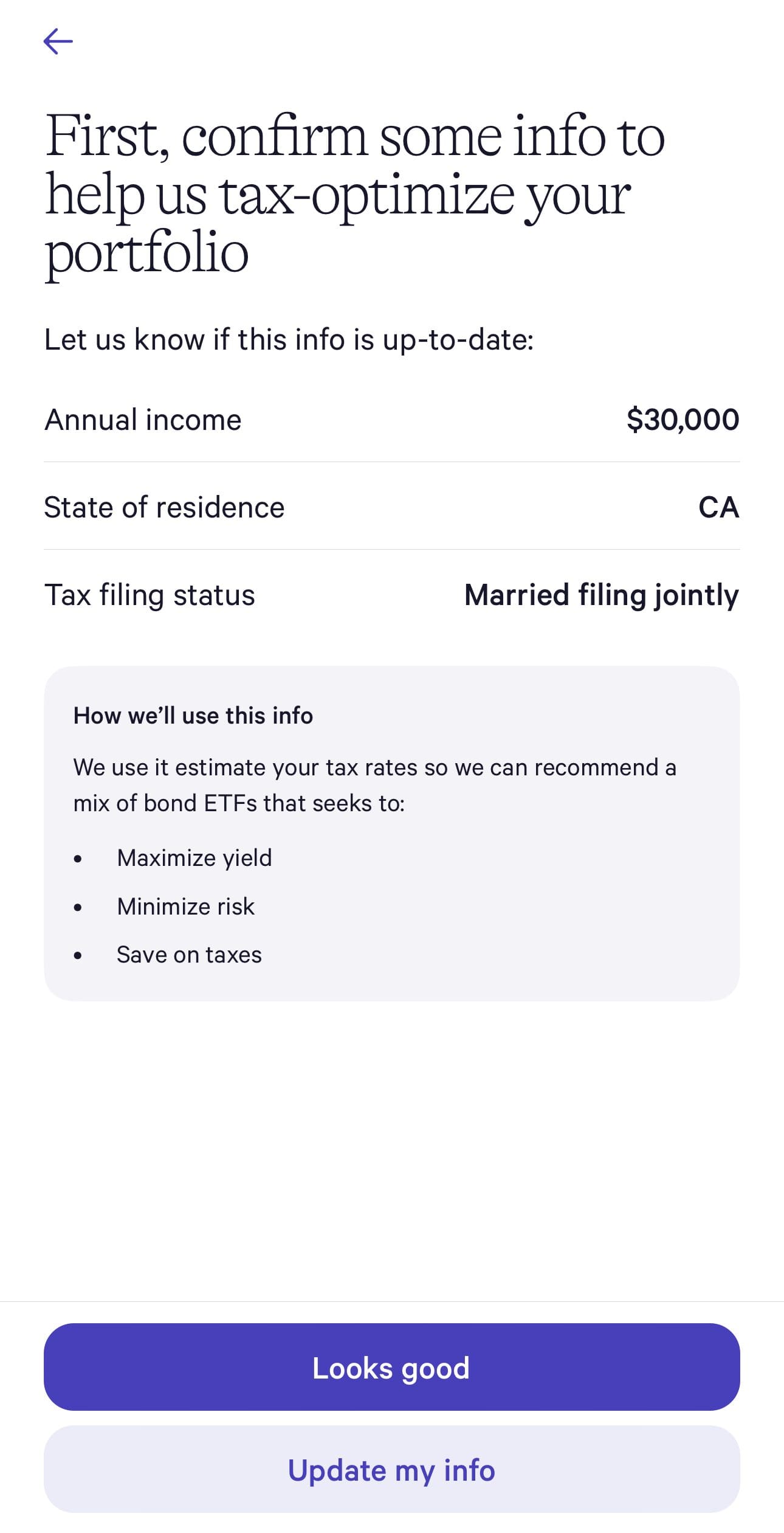

Tax Efficiency and Rebalancing

Robo-advisors often include helpful automated features like:

Rebalancing your portfolio when your asset allocation drifts

Tax-loss harvesting (selling investments at a loss to reduce your tax bill)

These services can help you avoid costly mistakes and save on taxes — especially if you’re investing in taxable accounts.

With index funds, you’d need to rebalance manually and likely won’t have access to tax-loss harvesting unless you work with a full-service advisor.

For those with larger taxable accounts, the extra tax features from robo-advisors may be worth the added fee.

How to Know Which One Is Best for You

Choosing between a robo-advisor and index funds comes down to how involved you want to be, your comfort with managing investments, and your long-term goals. Both are great options, but they fit different investor personalities.

Here’s how to figure out which one makes more sense for you:

Feature | Robo-Advisors | Index Funds |

|---|---|---|

What it is | Automated investment platform | Type of mutual fund or ETF |

User involvement | Very low (fully managed) | Moderate (self-managed) |

Fees | 0.25%–0.50% annually + fund fees | ~0.03%–0.10% expense ratio |

Rebalancing | Automatic | Manual (unless set up through broker) |

Tax-loss harvesting | Often included | Not included |

Customization | Limited | High (you choose funds and mix) |

Best for | Beginners or hands-off investors | DIY investors seeking ultra-low fees |

-

A robo-advisor may be right for you if:

You want a hands-off approach with automatic investing and rebalancing

You’re new to investing and want help building a diversified portfolio

You’re okay paying a small management fee (typically 0.25%–0.50%)

You want automated tax-loss harvesting in taxable accounts

You prefer guided help instead of making investment decisions on your own

You don’t want to deal with portfolio rebalancing or market timing

Here are some of the top robo advisors available:

Rovo Advisor | Annual Fees | Minimum Deposit |

|---|---|---|

Wealthfront | 0.25% | $500 |

Betterment | 0.25%

$4 monthly for $0 – $20K balance, 0.25% annually for $20K – $1M balance, 0.15% annually for $1M – $2M balance, 0.10% annually for +$2M balance | $10 |

Acorns | Monthly: $3 – $12

$3 for Bronze, $6 for Silver and $12 for Gold

| $0 |

Schwab Intelligent Portfolios | Up to 0.80%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Schwab Intelligent Portfolio – 0%, Schwab Intelligent Portfolios Premium – One-time planning fee: $300 + Monthly advisory fee: $30, Schwab Wealth Advisory: up to 0.80% | $5,000 |

Vanguard Digital Advisor® | Up to 0.30%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Vanguard Digital Advisor – 0.015%, Vanguard Personal Advisor: 0.03%, Vanguard Personal Advisor Select: up to 0.03%, Vanguard Wealth Management: up to 0.03% | $100 |

E*TRADE Core Portfolios | 0% – 0.35%

0% on stocks and ETFs in self directed brokrage, 0.35% for Core Portfolio Robo Advisor

| $500 |

Merrill Guided Investing | 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor | $1,000 |

-

Index funds may be better if:

You’re comfortable managing your own investments or learning how to

You want the lowest possible fees (some index funds cost as little as 0.03%)

You like full control over your asset allocation and fund choices

You’re investing through an IRA, 401(k), or long-term brokerage account

You want to build a simple, low-cost DIY portfolio

You’re okay rebalancing your portfolio occasionally on your own

FAQ

Robo-advisors often require $0–$500 minimums, while index fund minimums vary by provider, sometimes starting at $100–$3,000.

Yes — many investors use a robo-advisor for taxable accounts and manage index funds in retirement accounts like IRAs.

Yes, the best robo advisors are regulated, use encryption, and have SIPC insurance to protect your cash and securities.

Absolutely — many offer IRAs, Roth IRAs, and even SEP IRAs with automated management.

You can choose from stock index funds, bond index funds, international funds, or sector-specific options.

Most are transparent, but always check for underlying fund fees and account-level costs like transfer or closing fees.

Both can be great for long-term investing — index funds might edge ahead due to lower fees, but robo-advisors offer automation benefits.

Yes, both are subject to market risk — they’re not guaranteed returns, even though they're diversified.

Not regularly — the whole point is that it’s automated, though it’s good to check in occasionally.

Yes, you can transfer or roll over your assets if you decide to manage them yourself down the road.

Many do — especially stock index funds — and you can choose to reinvest or take them as cash.

Yes — many robo-advisors offer socially responsible (ESG) portfolios, and you can find ESG index funds as well.