Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

Charles Schwab | Robinhood | |

Monthly Fee | Up to 0.80%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Schwab Intelligent Portfolio – 0%, Schwab Intelligent Portfolios Premium – One-time planning fee: $300 + Monthly advisory fee: $30, Schwab Wealth Advisory: up to 0.80% | $0 – $6.99

$0 for basic account, $6.99 for Robinhood Gold |

Account Types | Brokerage, Retirement, Wealth Management | Brokerage, Retirement, Crypto |

Savings APY | 0.05% | 3.75%

|

Minimum Deposit | $0 – $500,000

$0 for brokerage account, $5,000 for Schwab Intelligent Portfolios, $25,000 for Schwab Intelligent Portfolios Premium, $500,000 for Schwab Wealth Advisory | $0 |

Best For | Active Traders, Retirement, Robo Advisor | Active Traders, Tech Savvy Investors |

Read Review | Read Review |

Schwab vs. Robinhood: Compare Features

Robinhood, meanwhile, is ideal for active, hands-on investors and beginners. It offers commission-free trading, fractional shares, and cryptocurrency access.

Robinhood | Schwab | |

|---|---|---|

Investing Options | Over 5,000 securities, most U.S. stocks and ETFs listed on U.S. exchanges | Full Access To Almost Any Asset |

Investing Types | Stocks, Options, Futures, ETFs, Crypto, Margin, Fractional Shares | Stocks, Options, Futures, ETFs, Bonds & Fixed Income, Forex,Mutual Funds, Money Market Funds |

Automated Investing | No | Yes |

Paper Trading | No | Yes |

IPO Access | Yes | Yes |

Dedicated Advisor | No | Yes |

Tax Loss Harvesting | No | Yes |

Schwab really stands out with its wide range of services, including paper trading options, automated investing and a top-notch trading platform packed with powerful analytical tools

-

Self Investing And Fundamental Analysis Options

Schwab is our winner in self-investing, mainly due to its broader options for long-term investors.

If you're into fundamental analysis, you’ll love Schwab’s research resources. They offer insights from their expert team, plus real-time alerts, stock screeners, and loads of educational materials to help sharpen your trading skills.

You can even buy fractional shares—known as “Schwab Slices”—and get some practice with Schwab Paper Money, plus access to IPOs!

Robinhood has good access to different assets, including more than 5,000 securities with a great variety of U.S. stocks and ETFs, but less than Schwab.

-

Trading Options And Technical Analysis Tools

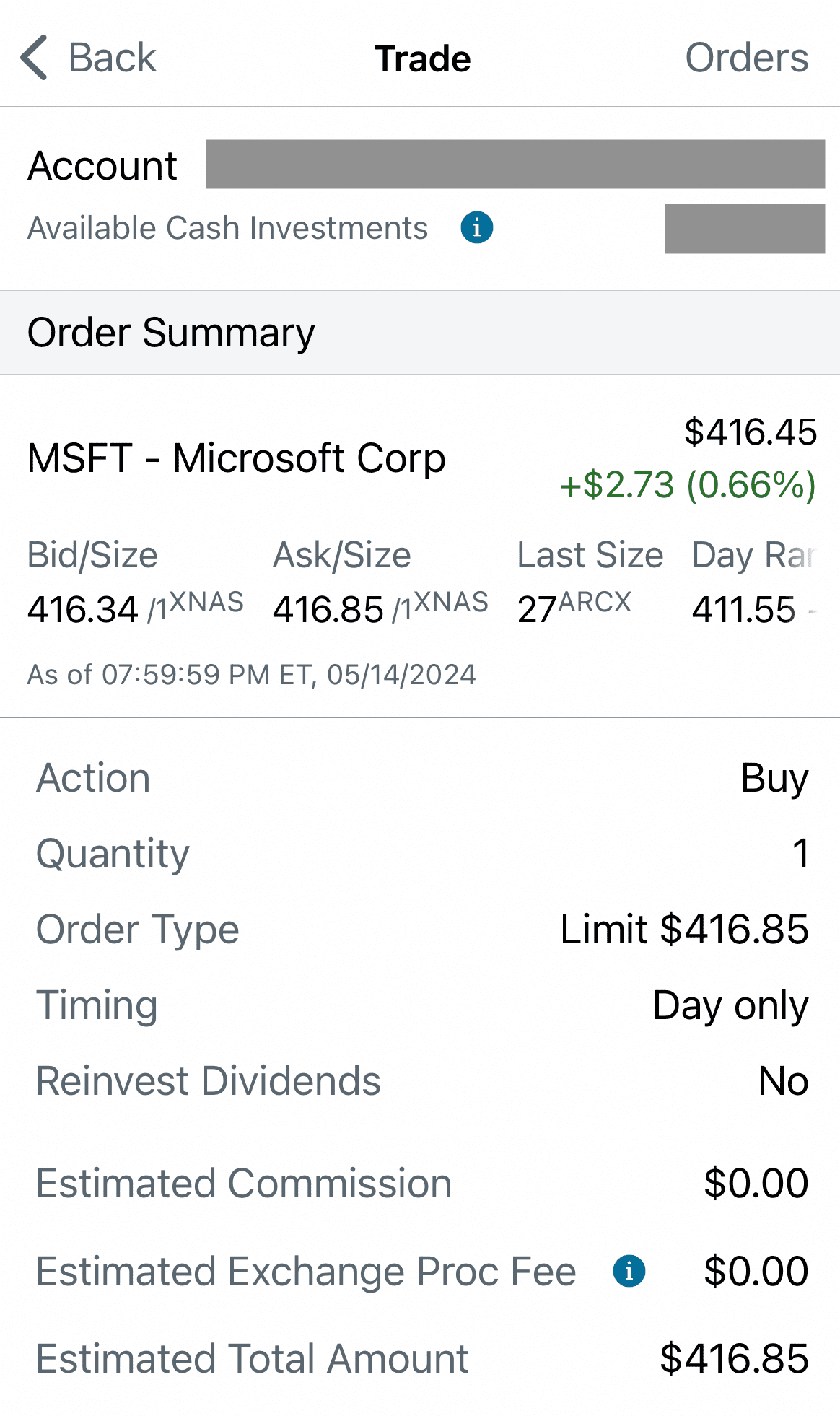

There is no clear winner when it comes to technical analysis and trading experience and features. Robinhood is geared toward active traders and those who want more control over their trades.

It stands out with its advanced charting features, offering real-time data, technical indicators, and customizable charts, making it a better choice for users need to analyze market trends and make quick decisions.

On the other hand, the Thinkorswim platform is a game changer for active traders, providing comprehensive trading options and advanced analytics.

It features robust charting tools, letting you create custom charts with various indicators and studies, perfect for digging deep into market insights.

-

Robo Advisor And Automated Investing

Schwab is a clear winner here, as Robinhood falls short in this area because it doesn't offer a dedicated robo-advisor or automated investing option.

Schwab’s Intelligent Portfolios offer a flexible robo-advisory experience with no management fees and over 80 low-cost ETF options.

It does have a higher minimum investment of $5,000, but you get 24/7 live support, automatic rebalancing, and tax-loss harvesting to help manage your portfolio effectively.

-

Retirement Accounts

Schwab offers a more sophisticated array of investment options within its retirement accounts, but Robinhood has some unique benefits to consider.

Schwab has you covered with a variety of options—traditional, Roth, rollover, SEP, and Simple IRAs—making it a great choice for small business owners and anyone looking for tailored solutions.

They even have a self-directed retirement brokerage account, Schwab Personal Choice.

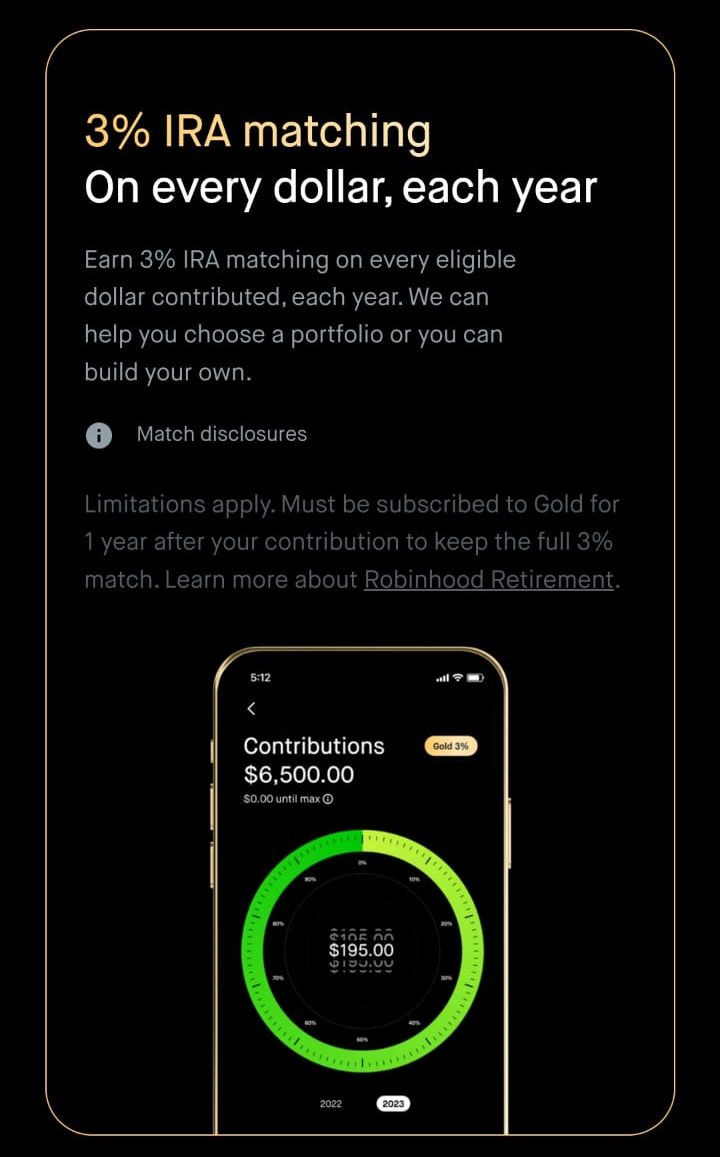

Robinhood, in contrast, has a more streamlined offering with traditional and Roth IRAs but doesn’t support the broader range of retirement accounts that Schwab does, such as SEP IRAs or 401(k) rollovers.

However, Robinhood stands out by offering IRA contribution matching, even for non-employer plans, which can give investors an extra boost in their retirement savings.

-

Fees

When it comes to fees, Robinhood is our winner.

Robinhood is known for its commission-free trading on stocks, ETFs, options, and cryptocurrencies, as well as no account maintenance fee

Schwab | Robinhood | |

|---|---|---|

Fees | Up to 0.80%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Schwab Intelligent Portfolio – 0%, Schwab Intelligent Portfolios Premium – One-time planning fee: $300 + Monthly advisory fee: $30, Schwab Wealth Advisory: up to 0.80% | $0 – $6.99

$0 for basic account, $6.99 for Robinhood Gold |

Schwab offer commission-free trading for U.S. stocks, ETFs, and mutual funds, with options trading at $0.65 per contract. For robo-advisors, Schwab’s Intelligent Portfolios are a cost-effective choice with no management fee

-

Cash Management And Savings Rates

Robinhood is a bit more attractive when it comes to cash management due to its competitive rates on uninvested cash.

Schwab | Robinhood | |

|---|---|---|

Savings APY | 0.05% | 3.75%

|

Robinhood cash management account offers banking options such as a debit card, free ATM access, and instant deposits. It provides a competitive interest rate of 3.75% APY on uninvested cash for Gold members.

The Schwab Bank Investor Checking account is a winner with no monthly fees, plus you get unlimited ATM fee rebates all around the globe and no foreign transaction fees.

On top of that, they offer handy features like bill pay, mobile check deposit, and real-time transaction alerts, making it easy to manage your money securely. Just keep in mind that the interest rate on uninvested cash isn’t very high.

-

Wealth Management Options

Only Schwab offers wealth management options.

Schwab’s Wealth Advisory service provides personalized investment strategies crafted by certified financial planners, focusing on your long-term goals.

And for those with larger portfolios, Schwab Private Client Services and Schwab Private Wealth Services offer dedicated access to financial advisors for tailored advice and planning based on your unique situation.

Bottom Line

The differences between these brokerages are pretty clear— Schwab offers many more options for investors, including robo advisors, and wealth management.

On the other hand, Robinhood is best for beginners and traders. Its technical tools are great, and some assets, such as crypto, are not available with Schwab.

Compare Robinhood Side By Side

Vanguard offers more options for investors, including retirement, robo advisors, and wealth management, while Robinhood is best for traders.

Merrill Edge is best for long-term investments, including retirement, while Robinhood is perfect for active traders who value simplicity.

Merrill Edge vs. Robinhood: Compare Brokerage Account Options

JP Morgan wins when it comes to fundamental investing tools, but Robinhood is better for technical analysis and trading. Here's why:

J.P. Morgan Self-Directed Investing vs. Robinhood : Compare Brokerage Accounts

Fidelity is our winner for diversified long-term investing, while Robinhood shines in cost-effective options for active traders and beginners.

Robinhood is an excellent choice for beginner and casual investors, but IBKR is better suited for experienced investors and advanced traders.

Interactive Brokers vs. Robinhood: Compare Brokerage Account Options

Robinhood is best for low-cost platform for various trading needs, including Crypto. Etrade is better for one stop shop, including banking.

Robinhood is best for traders looking for easy, cost-free trading, while Stash is great for beginner investors who need a financial management tool

While Robinhood caters to traders and advanced investors, Acorns focuses on automated investing and banking. Here's our full comparison.

Webull is better suited for experienced traders needing advanced tools, whereas Robinhood caters to beginners and those who prefer simplicity.

How Schwab Compares to Other Online Brokers

Both Schwab and Fidelity offer great options for traders, plans for wealth management, and sophisticated auto-investing platforms.

Schwab provides broader tools and analysis options for long-term, value investors, while Interactive Brokers is more suited to active traders.

Schwab vs. Interactive Brokers: Which Brokerage is Right for You?

Schwab is our pick for long-term investors, wealth management, or retirement. E-Trade may be better for traders and cash management.

While Vanguard appeals to buy-and-hold investors, Schwab’s platform is designed for those who want to engage actively with the market.

Schwab surpasses JPM self-directed in most categories, including self-directed investing, robo advisory, and technical analysis.

Schwab vs. J.P. Morgan Self-Directed: Which Brokerage Is Best?

Schwab is our winner for investors and traders. However, the differences between brokerages are not significant. Here's our comparison: