|

| |

|---|---|---|

SD Bullion | Birch Gold Group | |

Min. Investment | $0 | $10,000

|

Established | 2012 | 2003 |

Storage Fees | 0.29% – 0.39%

Starts at $9.99. 0.29% annual fee for gold amd platinum products, 0.39% for silver | $100

$100 for annual storage fee, but there is additional $125 for account maintenance . Estimated annual fee. |

Coin & Bar Selection | Broad, includes novelty items | IRA-approved, traditional coins

|

Payment Methods | Cards, PayPal, Wire, eCheck, Crypto | Wire, check only

|

Pricing Transparency | Yes, real-time online pricing | No pricing shown online

|

Best For | Online buyers, price-conscious | IRA investors, hands-on help |

Our Rating |

(4.3/5) |

(4.5/5) |

Read Review | Read Review |

Birch Gold Has the Ratings Advantage

Birch Gold Group slightly outpaces SD Bullion when it comes to online reputation.

[elementor-template id=”203460″]

While both boast A+ BBB ratings and solid Trustpilot scores (4.3), Birch also earns near-perfect ratings on Google (4.7) and Consumer Affairs (5.0), showing consistent satisfaction across platforms. SD Bullion’s ratings are respectable but more mixed, especially on Sitejabber.

[elementor-template id=”203456″]

Overall, Birch’s well-rounded and consistently high feedback gives it the edge.

SD Bullion vs. Birch: Which Is Best for Gold Buying?

Our preferred choice for digital metals access is SD Bullion, primarily due to its real-time price locking, online purchasing platform, and wider range of payment methods including crypto.

But there are a few key differences that could influence your decision:

Where they’re both strong:

Product range: Both offer gold, silver, platinum, and palladium in coins, bars, and rounds.

Buyback programs: Each has a reliable buyback option with competitive spot pricing.

Customer service: Both provide knowledgeable phone and email support on weekdays.

Trusted custodians: Both work with established IRA custodians to support retirement investing.

Where SD Bullion stands out:

Online access: Full e-commerce platform with live metal pricing and self-checkout.

Crypto payments: Accepts Bitcoin for purchases up to $250,000.

Spot price locking: Locks in your price even if your payment takes time to clear.

Better discounts: Up to 4% off for wire, e-check, and check payments.

Where Birch Gold stands out:

Personalized guidance: A Dedicated specialist is assigned to every client.

Transparent fees: Clear, flat-rate annual IRA fee structure.

Educational support: More robust educational resources and guides.

IRA focus: Better tailored for retirement investors who prefer managed help.

If your goal is flexibility, speed, and digital convenience, SD Bullion leads. If you’re looking for a more consultative approach for retirement planning, Birch is a strong choice.

Which Is Better for a Gold or Silver IRA?

Our preferred choice for precious metal IRAs is Birch Gold Group, mainly due to its clear flat-fee structure, multiple storage options, and one-on-one expert guidance.

Both SD Bullion and Birch Gold help customers set up Gold and Silver IRAs through trusted custodians, but there are meaningful differences:

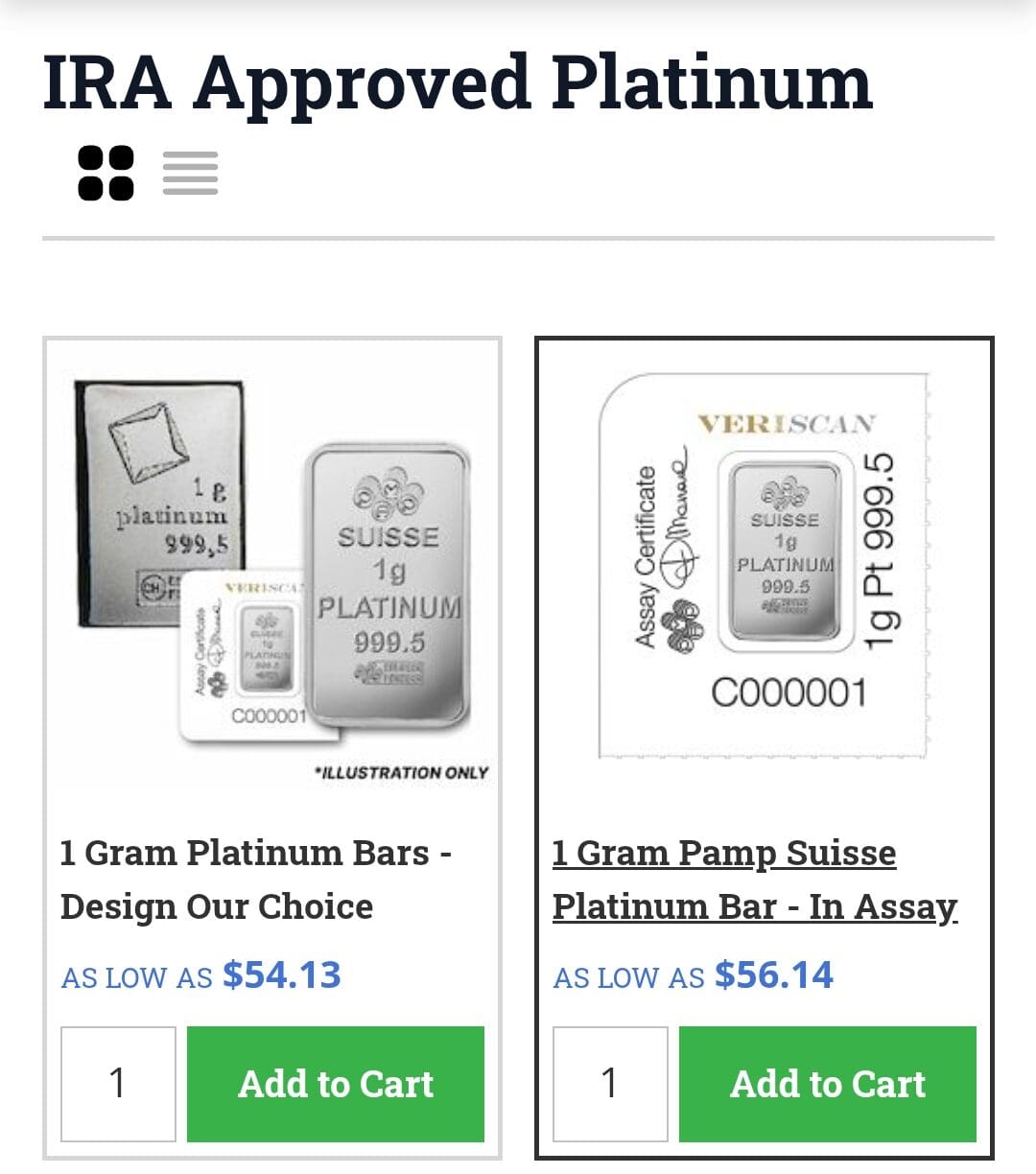

Fee transparency: Birch Gold offers a simple, flat annual fee of $200 that covers storage and administration. SD Bullion does not publish IRA-related fees online.

Storage options: Birch Gold partners with several IRS-approved vaults including Delaware Depository and Brink’s, giving you a choice of where to store your metals. SD Bullion uses its own SD Depository, which is secure but lacks geographic flexibility.

Buyback & liquidity: Both offer reliable buyback programs, but Birch Gold provides more personalized help when liquidating IRA assets.

Minimum investment: Birch requires a $10,000 minimum, which aligns with most IRA-focused dealers. SD Bullion is less clear about minimums for IRAs.

Customer support: Birch assigns you a specialist to walk you through every step. SD Bullion offers solid weekday support, but no dedicated IRA advisor or live chat.

In summary, Birch Gold is better suited for retirement investors who value personalized guidance and cost transparency.

SD Bullion is a strong alternative, but less ideal for those who want IRA pricing and storage details upfront.

Summary: SD Bullion vs Silver Gold Bull

When it comes to gold dealer performance:

Ratings Winner: Birch Gold Group – More consistent and higher ratings across platforms

Best for Direct Purchase: SD Bullion – Competitive pricing, flexible payments, real-time locking

Best for IRA: Birch Gold Group – More transparent and flexible IRA process

Overall, we recommend SD Bullion for direct buyers who want the best deal and an online purchase experience. For IRA investors, Birch Gold is our top pick thanks to its transparent fees, multiple vault options, and personalized support.