Table Of Content

Trading cryptocurrency involves buying and selling digital assets to profit from market price changes.

It's accessible to anyone online, but smart strategies and risk management are essential for success.

How to Start Trading Cryptocurrency: Step by Step

To begin trading crypto, you’ll need to follow a few essential steps that ensure you’re prepared, protected, and positioned to act smartly in volatile markets.

1. Choose a Reliable Crypto Exchange

Before trading, you need a platform where you can buy and sell digital currencies. Crypto exchanges vary in fees, features, and available assets, so choose wisely.

Reputation and Regulation: Use well-established exchanges like Coinbase or Kraken that follow KYC and AML regulations for security.

Asset Availability: Ensure the platform supports many coins, including Bitcoin, Ethereum, and smaller altcoins.

Fees and Features: Some exchanges charge higher fees but offer advanced tools like stop-loss orders, margin trading, and real-time charts.

For example, Binance is known for its wide asset range and low fees, while Coinbase is better for beginners due to its user-friendly design. Choose one that fits your experience level and trading goals.

Exchange | Trading Fees | Supported Coins | Regulatory Compliance |

|---|---|---|---|

Binance US | Strong (USA) | +120 | Moderate |

Coinbase | High | +250 | Strong (USA) |

Kraken | Medium | +2,000 | Strong (USA/EU) |

Bybit | Low | +650 | Moderate |

OKX | Low | +300 | Moderate |

2. Create and Secure Your Trading Account

After picking your exchange, you’ll need to create an account and take security measures seriously to avoid hacks or unauthorized access.

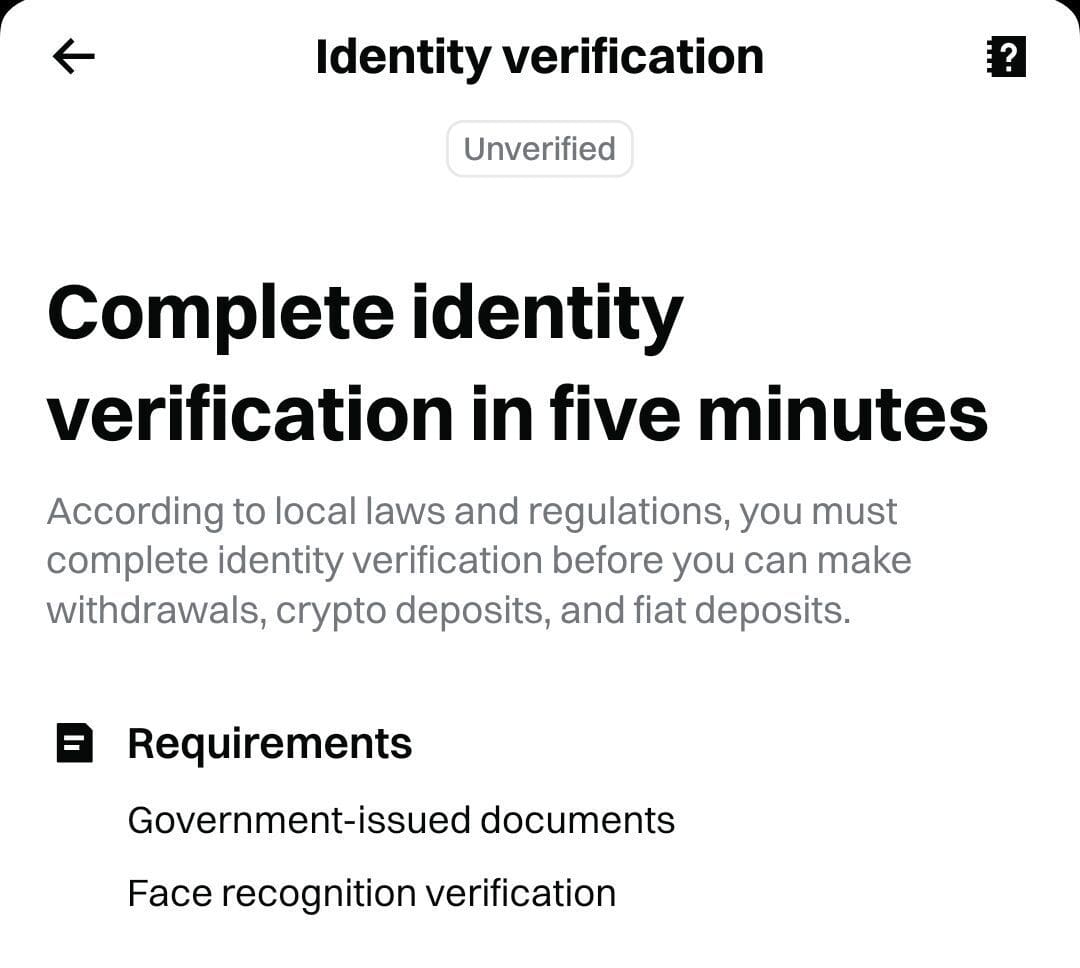

Verify Identity: Most platforms require identity verification using a photo ID and personal info to comply with regulations.

Set Up Two-Factor Authentication: Enable 2FA with apps like Google Authenticator to add a security layer beyond your password.

Use Strong, Unique Credentials: To reduce risk, avoid reusing passwords and store them in a secure password manager.

Although creating an account is quick, securing it is critical. Some traders also choose to withdraw large balances to hardware wallets for safer long-term storage.

3. Fund Your Account with Fiat or Crypto

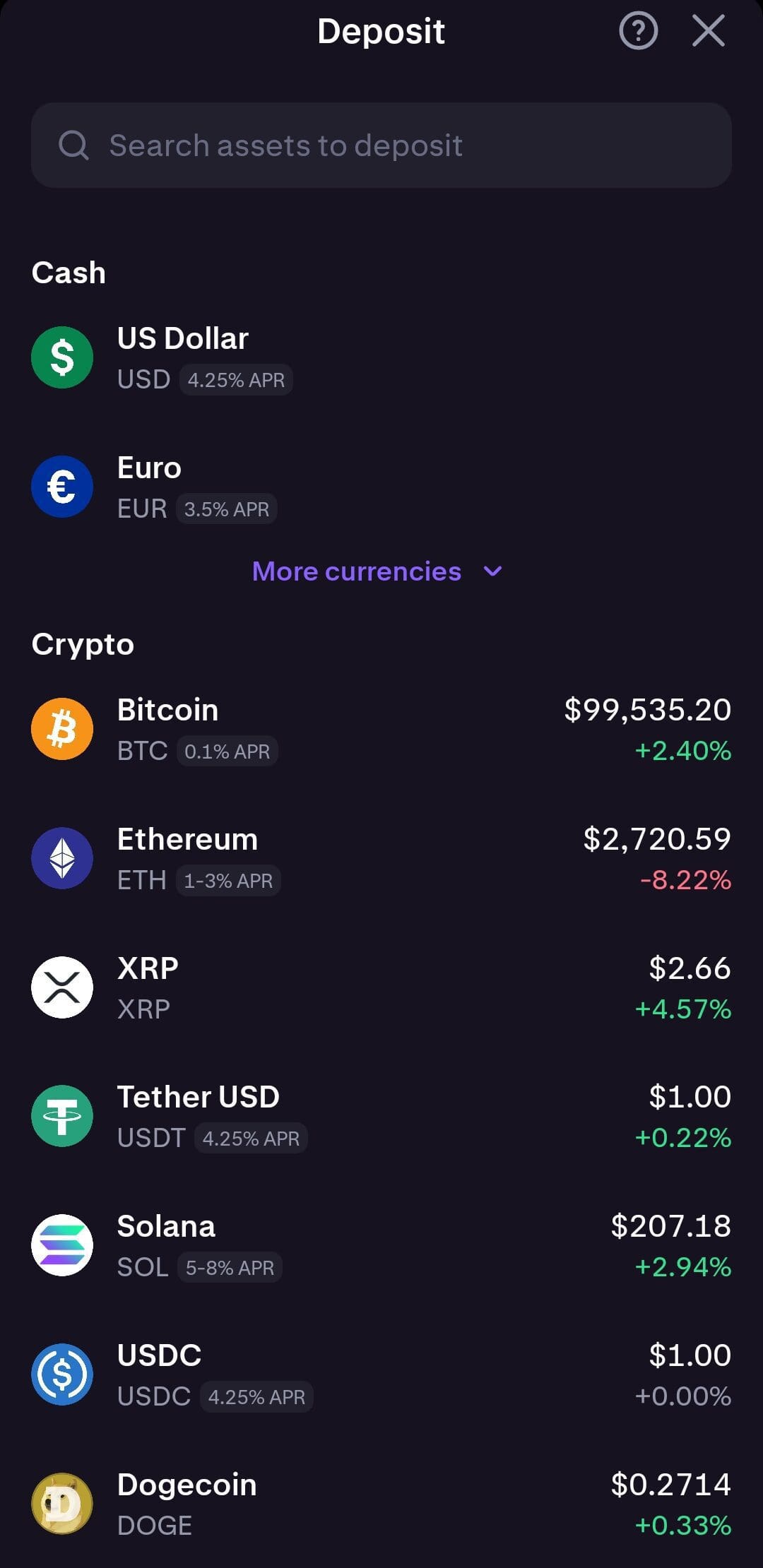

You need to deposit funds to start trading. Exchanges accept different funding methods, so pick what’s fast, safe, and affordable.

Use Bank Transfers or Cards: Platforms like Coinbase accept debit cards and ACH transfers, but fees and speeds differ.

Deposit Existing Crypto: If you own crypto, transfer it to your exchange wallet using the correct blockchain address.

Check Deposit Fees: Some platforms charge a small fee, especially for card payments or specific cryptocurrencies like ERC-20 tokens.

For example, Kraken offers free SEPA transfers for European users, while credit card deposits on Bitstamp may carry higher fees. Always confirm fees before funding.

4. Learn Basic Trading Tools and Strategies

Before making your first trade, understand how crypto markets work and get familiar with essential tools and strategies that help reduce risk.

Use Limit and Market Orders: Limit orders let you set your desired price, while market orders execute instantly at current prices.

Explore Technical Indicators: Tools like RSI, MACD, and moving averages help analyze trends and identify entry/exit points.

Start Small and Use Demo Accounts: Many platforms, like eToro, offer practice accounts to test strategies without real money.

Trading without a strategy can lead to emotional decisions and losses. Therefore, study basic technical analysis and consider paper trading to build confidence.

Order Type | Function | When to Use |

|---|---|---|

Market Order | Buys/sells instantly at best available price | Urgent trades or fast market moves |

Limit Order | Executes at a set price or better | Price-specific entries or exits |

Stop-Loss | Sells once price drops to a certain level | Risk management for active trades |

5. Place Your First Trade on the Exchange

Once your account is funded and you’ve reviewed basic strategies, it’s time to place your first buy or sell order on the crypto exchange.

Choose a Trading Pair: For example, if you’re buying Ethereum with USD, select the ETH/USD pair. On Binance or Coinbase, use the “Trade” tab to find your pair.

Select Order Type: Use a market order if you want to buy instantly at the current price, or a limit order to set your preferred entry price.

Enter Amount and Confirm: Decide how much you want to invest, double-check the fees and total cost, then click “Buy” or “Sell” to execute.

As an example, say you want to invest $100 in ETH. You might place a limit order at $3,000, and it will only be executed when the ETH price reaches that level. Therefore, using limit orders can help you buy at better rates during volatile moves.

After placing the trade, you’ll see your assets reflected in your wallet balance on the platform. Always monitor your positions and consider using stop-loss orders to manage risk going forward.

6. Review Performance and Adjust Your Strategy

To grow as a trader, you need to regularly assess your results and refine your strategy and crypto portfolio based on what works — and what doesn’t.

Analyze Past Trades: Look back at successful and failed trades to identify patterns, timing, or emotional errors.

Adjust Risk Per Trade: Use risk-reward ratios and position sizing rules to avoid major losses on a single bad decision.

Stay Adaptable: What works in a bull market may fail in a downturn. Be willing to tweak or pause strategies as conditions change.

Trading is not a “set and forget” process. Even experienced traders review their win rates, journal trades, and stay flexible to adapt to evolving market dynamics.

Things To Consider Before You Start Trading Crypto

Before jumping into crypto trading, it’s important to understand the risks, requirements, and market dynamics that can impact your results.

Volatility Is High: Prices can swing 10–20% or more in a single day, so risk management is crucial.

Know Your Risk Tolerance: Avoid investing more than you can afford to lose, especially in speculative altcoins.

Understand Taxes and Reporting: In many countries, crypto trades are taxable—use tools like CoinTracker to track gains.

Stay Protected from Scams: Always double-check wallet addresses and avoid unsolicited trading advice on social media.

Start Small: In order to learn without heavy losses, begin with small amounts and gradually increase as you gain experience.

Taking time to build foundational knowledge can prevent costly mistakes, especially in a fast-paced market that never sleeps.

Popular Cryptocurrencies for Trading

When choosing a coin for trading, look for high liquidity, consistent volume, and strong community support. These factors ensure smoother execution and less slippage.

Cryptocurrency | Liquidity | Primary Use Case |

|---|---|---|

Bitcoin (BTC) | Very High | Store of Value |

Ethereum (ETH) | Very High | Smart Contracts / DeFi |

Solana (SOL) | High | Fast dApps |

Ripple (XRP) | High | Cross-border payments |

Cardano (ADA) | Medium | Proof-of-Stake network |

Bitcoin (BTC): Offers the highest liquidity and is ideal for both long-term trades and short-term price action strategies.

Ethereum (ETH): Popular for trading due to its utility in DeFi, NFT platforms, and its upgrade cycle which often moves the price.

Solana (SOL): Known for fast transaction speeds and growing ecosystem, but also carries more price volatility.

Ripple (XRP): Often trades in reaction to legal or regulatory news, making it appealing to event-driven traders.

Cardano (ADA): Has strong community backing and moves based on network updates or staking upgrades.

Coins like BTC and ETH are generally more stable, while altcoins like SOL or ADA may offer bigger swings—but also greater risk.

FAQ

Spot trading involves buying crypto outright, while margin trading lets you borrow funds to increase position size—amplifying both gains and losses.

Yes, crypto markets operate 24/7 worldwide, unlike traditional stock markets that close on weekends and holidays.

Some exchanges let you start with as little as $10, but it’s best to start with an amount you’re comfortable losing while learning.

Common strategies include day trading, swing trading, scalping, and holding (HODLing), each with its own risk and time requirements.

Automated bots can help execute trades efficiently but require careful setup and risk controls—especially in volatile markets.

No. Some platforms only support crypto-to-crypto trading, while others accept bank transfers, debit cards, or PayPal for fiat deposits.

Most regulated exchanges require identity verification. However, some decentralized platforms allow trading with no KYC, though they carry more risks.

Use platforms like TradingView for charting and CoinMarketCap or CoinGecko for price tracking and historical data.

Slippage happens when your order executes at a different price than expected due to market volatility or low liquidity.

Yes. Frequent trades on high-fee platforms can erode profits, especially when trading small price movements.