Table Of Content

If you're trying to figure out whether a stock is a good buy, you're probably choosing between two main strategies: technical analysis or fundamental analysis.

Both are popular among investors, but they take very different paths to reach a decision.

In this article, we’ll break down the differences, highlight when each method works best, and help you decide which one fits your investing goals.

What Is Fundamental Analysis?

Fundamental analysis is about figuring out what a company is really worth.

Instead of focusing on price movements, you look at the company’s financial health—things like revenue, profit margins, debt, and future growth potential.

Investors using this method often review earnings reports, balance sheets, and industry trends.

-

Example: What Is Fundamental Analysis?

For example, if Apple’s revenue and profits are growing steadily, a fundamental investor might see it as a strong long-term buy, regardless of short-term price changes.

This approach helps you determine whether a stock is undervalued or overvalued.

What Is Technical Analysis?

Technical analysis focuses on price trends and trading volume—not company fundamentals. It’s about studying charts to spot patterns and signals.

Technical traders use tools like moving averages, candlestick patterns, RSI, and MACD to predict where prices might go next.

-

Example: What Is Technical Analysis?

For instance, if a stock forms a “bullish flag” pattern after a strong rally, a technical analyst may expect it to rise further.

This method is commonly used by short-term traders who want to capitalize on quick price movements, not necessarily on long-term business value.

Technical vs. Fundamental Analysis: Key Differences

While both technical and fundamental analysis aim to guide investment decisions, they differ greatly in approach, tools, and timing.

Here’s a breakdown of their key differences—and when to use each.

Feature | Technical Analysis | Fundamental Analysis |

|---|---|---|

Focus | Price movements and trends | Company financials and intrinsic value |

Timeframe | Short-term (minutes to weeks) | Long-term (months to years) |

Tools Used | Charts, indicators, volume | Financial reports, ratios, earnings |

Decision Basis | Market behavior and patterns | Business performance and value |

Entry/Exit Timing | Precise timing using signals | Less precise, based on long-term outlook |

Best For | Active traders and momentum strategies | Long-term investors and value seekers |

1. Time Horizon and Strategy: Long-Term vs. Short-Term

Fundamental analysis is best suited for long-term investors who want to hold a stock for years.

It focuses on evaluating a company’s value over time, often using metrics like earnings growth, industry trends, and competitive advantages.

For example, someone who bought Apple in 2010 based on its innovation and strong earnings outlook likely benefited from long-term compounding.

Technical analysis, on the other hand, is ideal for short-term traders who rely on price action to make fast decisions. A swing trader might buy Tesla based on a bullish chart pattern and plan to sell within days.

-

When To Use It?

Use fundamental analysis when you’re building a long-term portfolio. Use technical analysis when you want to trade on short-term momentum or time your entry and exit points more precisely.

2. Data Sources and Tools

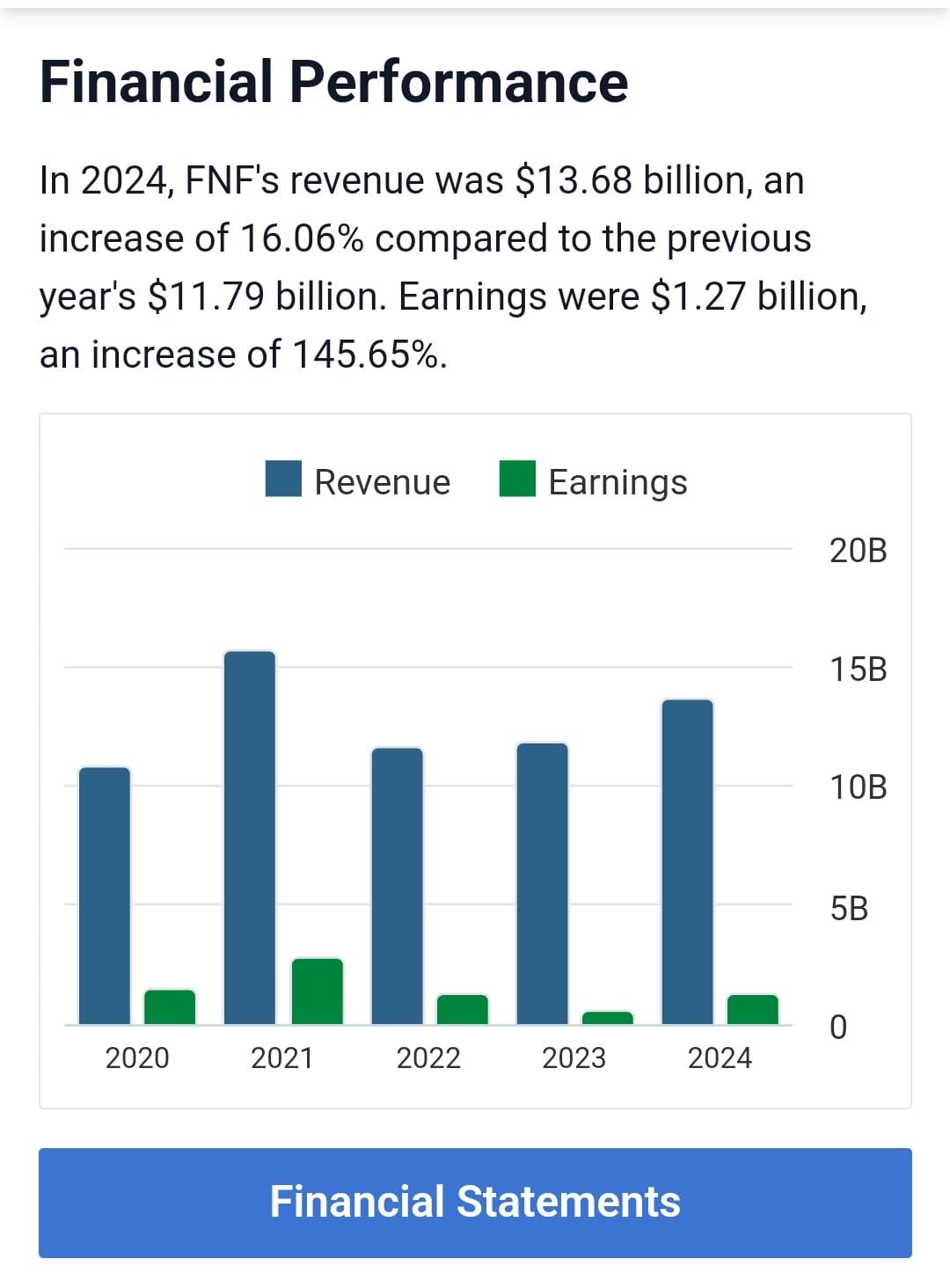

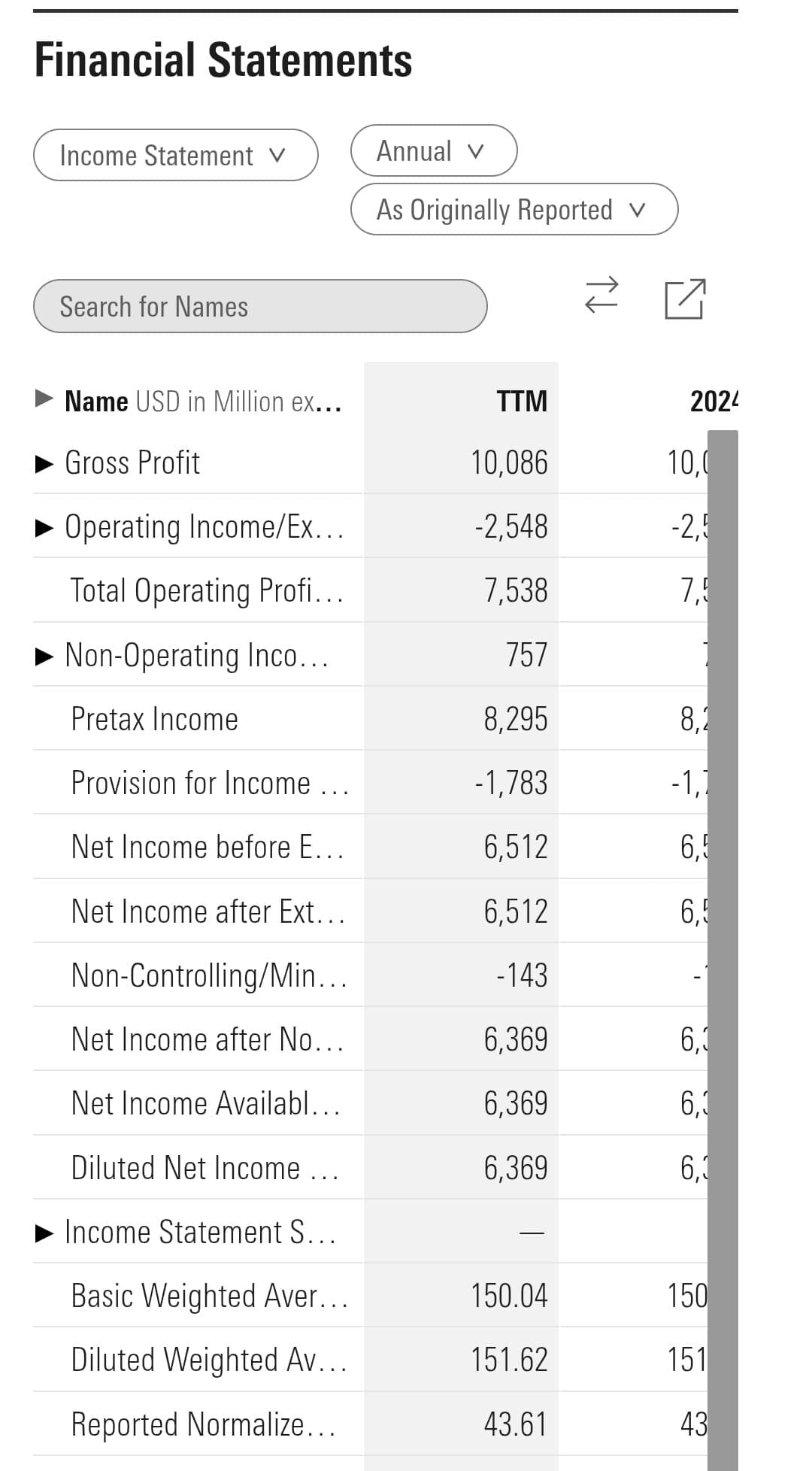

Fundamental analysis pulls from earnings reports, company filings (like 10-Ks), valuation ratios (like P/E), and macroeconomic trends. You’ll analyze things like revenue growth, profit margins, and debt levels.

For instance, if a company has consistent year-over-year earnings growth and low debt, that’s a green flag for long-term investors.

Technical analysis relies on stock price charts, trading volume, and technical indicators like RSI, MACD, Bollinger Bands, and moving averages. It doesn’t concern itself with the company’s actual business—just how the stock price behaves.

-

When To Use It?

Choose fundamental tools when you’re evaluating a company’s true business strength. Use technical tools when your focus is on price behavior and market timing.

3. Entry and Exit Timing

Fundamental analysis tells you what to buy—but not always when. You may know a stock is undervalued, but the price could stay low for a while. That’s fine for patient investors with a long-term horizon.

Technical analysis helps you with when to buy or sell. For example, a technical trader might spot a bullish pennant pattern on Nvidia and enter at the breakout point, then exit once the momentum fades.

-

When To Use It?

Use technical analysis when you want to fine-tune your timing for trades or even for long-term buys at better prices.

Use fundamental analysis when you’re focused on value and long-term growth, even if short-term timing isn’t ideal.

4. Risk Management and Volatility

Technical analysis often comes with built-in risk management tools. Traders can set stop-loss and take-profit levels based on chart support or resistance lines.

For example, a trader might cut losses if a stock falls below a certain moving average.

Fundamental investors tend to ride out volatility as long as the company’s core metrics remain strong. They don’t typically react to short-term price dips unless new financial data suggests trouble.

-

When To Use It?

If you’re worried about short-term swings or need a disciplined risk approach, technical analysis can help.

If your conviction is in a company’s long-term story, fundamental analysis gives you a strong foundation to stay the course.

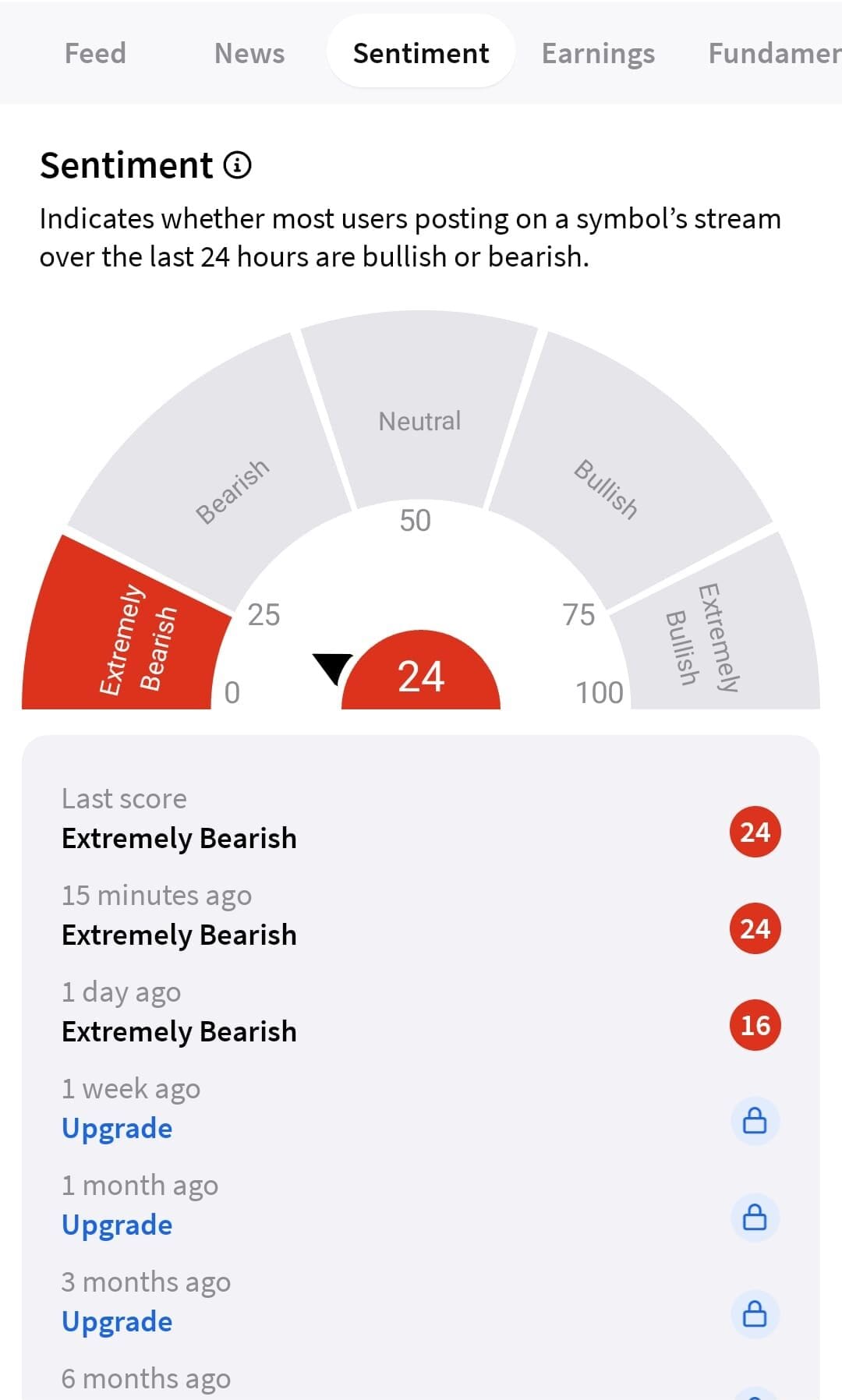

5. News and Market Sentiment

Fundamental investors often focus on how news affects business performance—like earnings growth, product launches, or regulatory shifts. If Google announces a new AI breakthrough, a fundamental investor might raise their growth forecast.

Technical traders, however, care more about how the market reacts. They might watch to see if the stock breaks a key level after the news, regardless of whether the news is objectively “good” or “bad.”

-

When To Use It?

Use fundamental analysis when news directly affects the company’s future earnings. Use technical analysis when your edge comes from trading price reactions to news—not the news itself.

6. Psychology and Behavior

Technical analysis assumes that all information is already reflected in the price—and that patterns often repeat due to investor psychology. For example, fear and greed can drive breakout or breakdown patterns that savvy traders act on.

Fundamental analysis focuses less on short-term emotions and more on company performance over time. It assumes the market will eventually “get it right.”

-

When To Use It?

If you believe in reading the crowd and catching price momentum, technical analysis is for you. If you think long-term fundamentals outweigh market noise, go with fundamental analysis.

When To Use Fundamental Analysis?

Use fundamental analysis when you’re investing for the long haul.

It’s ideal for buying and holding quality companies with strong financials, competitive advantages, and steady growth potential. This approach is perfect for retirement planning, dividend investing, or value stock selection.

If you care about the real business behind the stock—and not just the price—you’ll want to dig into financial statements, earnings reports, and industry outlooks.

It’s especially useful when evaluating companies for 3+ year holds or building a well-balanced, long-term portfolio.

When To Use Technical Analysis?

Technical analysis shines when you’re trying to time the market or trade over short periods.

It’s useful for swing traders, day traders, or even long-term investors who want better entry and exit points.

If you prefer charts, patterns, and price action over financial reports, this method gives you quick decision-making tools. Use it when you need to spot momentum, identify support/resistance levels, or manage risk with stop-loss orders.

It’s also a helpful add-on for long-term investors looking to enter a stock at a technically strong level.

Which Tools Can Be Used for Technical & Fundamental Analysis?

Both analysis styles come with their own toolkits. Here are some of the most commonly used tools for each, with examples of platforms where you can use them:

Tool Type | Tool / Feature | Example Platform | Purpose |

|---|---|---|---|

Technical Analysis | Interactive Charting | TradingView | Pattern recognition, trend spotting |

Technical Analysis | RSI, MACD, Moving Averages | StockCharts.com | Momentum and trend confirmation |

Technical Analysis | Volume Tracking | Finviz | Confirm trend strength or weakness |

Fundamental Analysis | Financial Reports & Filings | Yahoo Finance | Revenue, earnings, cash flow analysis |

Fundamental Analysis | Valuation Ratios | Morningstar | Stock valuation and peer comparison |

Fundamental Analysis | Earnings Estimates | Zacks Investment Research | Growth forecasting and rating insights |

FAQ

It depends on your investment style. Long-term investors often favor fundamental analysis to understand a company’s true value, while short-term traders use technical analysis to time entries and exits based on price action.

Yes, many investors combine both approaches. For example, you might use fundamental analysis to select strong companies and technical indicators to find the best time to buy or sell.

Technical indicators are more effective in trending or volatile markets but may give false signals during sideways or choppy conditions. It’s important to understand market context when applying them.

Technical analysis is generally better for short- to medium-term trading. Long-term investors usually rely more on fundamentals, although technicals can help with better entry points.

Not usually—day traders focus on price movement, volume, and short-term catalysts. Fundamentals change slowly and are more relevant for long-term outlooks.

Fundamental analysis uses company financials, economic indicators, and industry data. Technical analysis relies on charts, price patterns, and indicators like RSI, MACD, and moving averages.

No, technical tools can’t forecast specific events but may reflect market expectations through price movement leading up to news. Fundamentals are better for understanding how news might impact a stock long term.

Both have strengths and weaknesses. Fundamental analysis helps assess long-term value, while technical analysis can provide timing signals—reliability depends on the user’s skill and market environment.

Yes, especially traders and hedge funds. Even institutional investors sometimes apply technicals for trade execution or to analyze short-term sentiment.