Table Of Content

What Is Webull Paper Trading and How Does It Work?

Webull’s paper trading feature allows you to simulate real market trades without risking actual money. You get access to a $1,000,000 virtual portfolio to practice buying and selling stocks, ETFs, and options — all within a live market environment.

Because it mirrors real-time market conditions, paper trading on Webull is useful for both beginners testing the waters and experienced traders refining strategies.

You can track performance, practice chart setups, and evaluate risk management techniques — all without financial consequences.

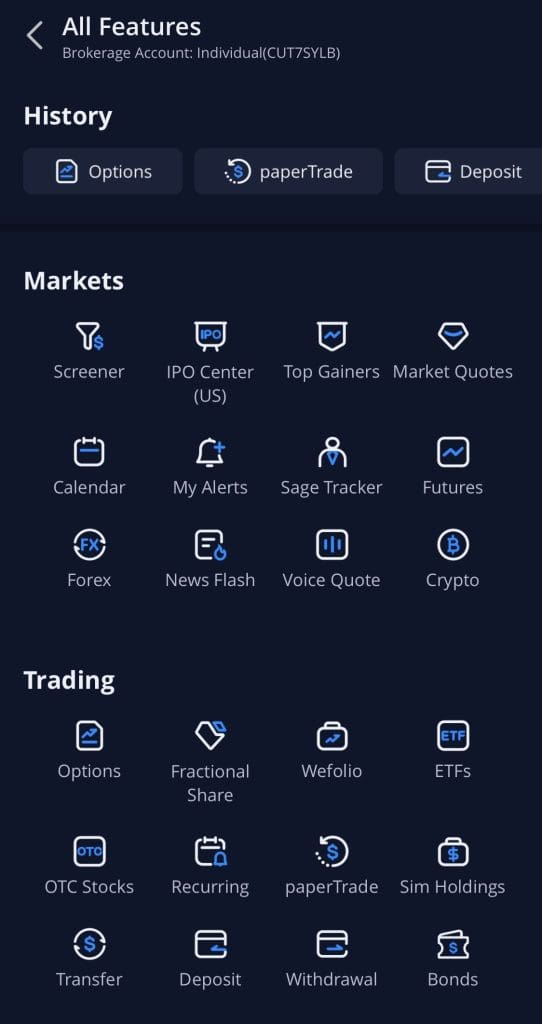

Access to paper trading is free and built directly into the Webull mobile and desktop apps. There’s no separate signup required — just toggle into “Paper Trading” from the homepage or menu.

How to Start Paper Trading on Webull: Step-by-Step

Paper trading on Webull feels like the real thing — but it’s safe for beginners and strategy testing. Here’s how to make the most of it:

1. Open and Access Your Paper Trading Account

After creating a Webull account, open the app or desktop platform and navigate to “Paper Trading” from the main menu. Tap “Reset” if you want to start fresh with your virtual $1,000,000 balance.

Because it reflects live prices and real bid/ask spreads, your trades feel realistic — just without the monetary risk. We found it takes less than a minute to place a paper order after logging in.

This environment is ideal for learning how orders work — especially limit orders, stop-loss setups, or bracket trades.

2. Customize Your Watchlist and Tools

Before placing trades, build a watchlist focused on stocks, ETFs, or sectors you want to study. Webull allows you to explore news, real-time charts, and financial metrics all from the same dashboard.

Key tools to explore include:

Technical indicators like MACD, EMA, and RSI for trade signals

Order entry features to test conditional orders

Stock screeners for idea generation based on fundamentals or technicals

As a result, you can mirror your real trading goals and evaluate performance using real tools — no shortcuts.

3. Define Your Trading Plan and Goals

Successful paper trading isn’t about random clicks — it’s about building a plan. Decide whether your focus is short-term day trades, swing trading, or long-term investing.

Your strategy should outline:

Entry/exit rules, such as buying after an EMA crossover

Position sizing, like risking no more than 2% of the portfolio per trade

Risk controls, including stop-loss and take-profit logic

Review intervals, such as analyzing results weekly

This discipline helps simulate emotional decision-making, because even paper trading can teach you how to deal with overconfidence, losses, or impatience.

4. Make Your First Trades and Track Performance

Once your setup is ready, start trading. Use market or limit orders depending on your strategy. Webull’s interface shows P&L in real time, and the trade history allows you to review everything.

After placing several trades, take time to reflect:

Did you follow your rules?

Were entries and exits timed well?

How did volatility affect outcomes?

Keep a basic journal — even a spreadsheet — where you log entries, exits, outcomes, and thoughts.

For instance, one of our early lessons was realizing we held onto losers too long in fast-moving tech names — that insight came directly from paper trading history.

5. Adjust Your Strategy Before Going Live

Paper trading is most valuable when you use it to iterate. If your setups are inconsistent, tweak your rules. Maybe your entry signals are late, or maybe you’re setting stop-losses too tight during high-volatility periods.

But also, be cautious: seeing positive results in your paper account doesn’t mean you’re ready to trade real money. In our experience, it’s easy to overtrade or take unrealistic risks in simulation — and that’s not something you want to carry into live trading.

Once you consistently apply your rules and get stable results over a few weeks, you can consider transitioning to real trading — but with small amounts and the same strategy.

Webull Paper Trading: Tips For New Users

Webull’s simulator can be powerful if used correctly. These tips helped us get more out of the experience:

Treat It Like Real Money: Don’t place reckless trades just because it's virtual. Practice realistic order sizes and setups — or you won’t learn meaningful lessons.

Focus on Process, Not Just P&L: Success isn’t just about green trades — it’s about consistency, discipline, and execution. Log what works and what doesn’t.

Explore Advanced Tools: Try testing options strategies, bracket orders, and multi-indicator setups. Webull’s tools let you experiment freely.

Identify Weak Spots Early: For example, we noticed we hesitated too long on stop-loss exits. Identifying emotional triggers during paper trading makes you more aware when you go live.

By taking paper trading seriously, you build confidence and structure — which translates into better real-world decisions.