Table Of Content

What Is a Crypto Wallet?

A crypto wallet is a digital tool that allows users to store, send, and receive cryptocurrencies like Bitcoin and Ethereum.

Unlike traditional wallets that hold physical currency, crypto wallets store private keys—essential credentials that give users access to their digital assets.

Wallets can be software-based (mobile or desktop) or hardware devices. Because ownership of crypto is tied to these keys, wallet security is critical.

Crypto Wallet Main Features

Crypto wallets offer a unique blend of security, flexibility, and blockchain-specific features. Below are five essential aspects every investor should understand:

-

Private Key Control

Wallets provide access to your crypto through private keys, which must be securely stored.

Self-custody: With non-custodial wallets like MetaMask or Ledger, you control your keys—not a third party.

Security risks: If you lose your private key, you lose access to your funds permanently.

Cold vs. hot storage: Hardware wallets (cold storage) are disconnected from the internet, reducing hacking risks.

Because you own the keys, you’re in full control of your crypto, but also fully responsible for its safety. That’s why many long-term investors use cold wallets for secure storage.

-

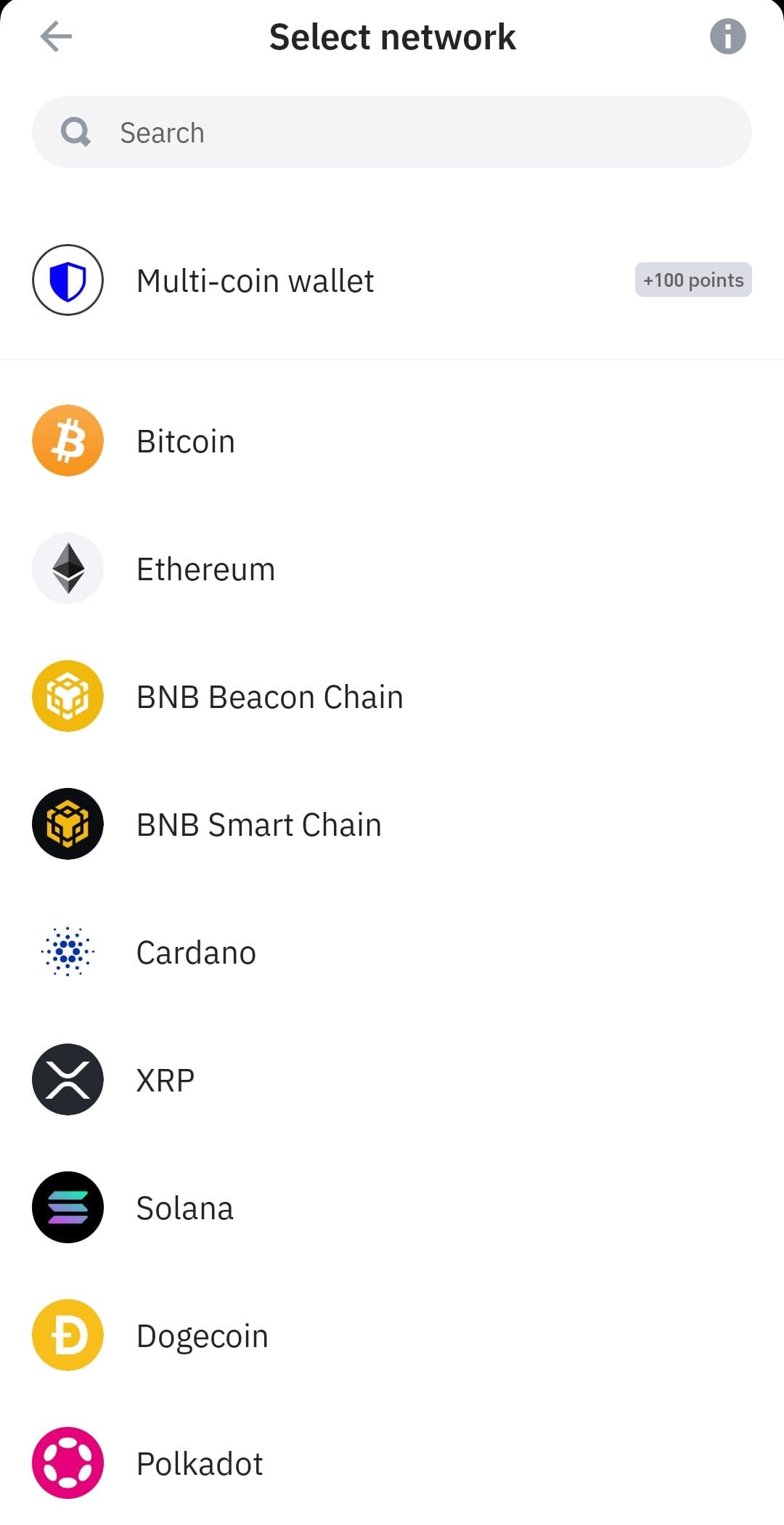

Compatibility with Multiple Blockchains

Most advanced wallets now support several cryptocurrencies and networks.

Multi-asset support: Tools like Trust Wallet and Atomic Wallet let you manage Bitcoin, Ethereum, Solana, and more.

Custom tokens: Many wallets allow importing ERC-20 or BEP-20 tokens manually.

Cross-chain tools: Some wallets even integrate bridges or swaps between blockchains.

As a result, users don’t need to switch apps or platforms to manage multiple coins, which saves time and reduces risk of errors during transfers.

-

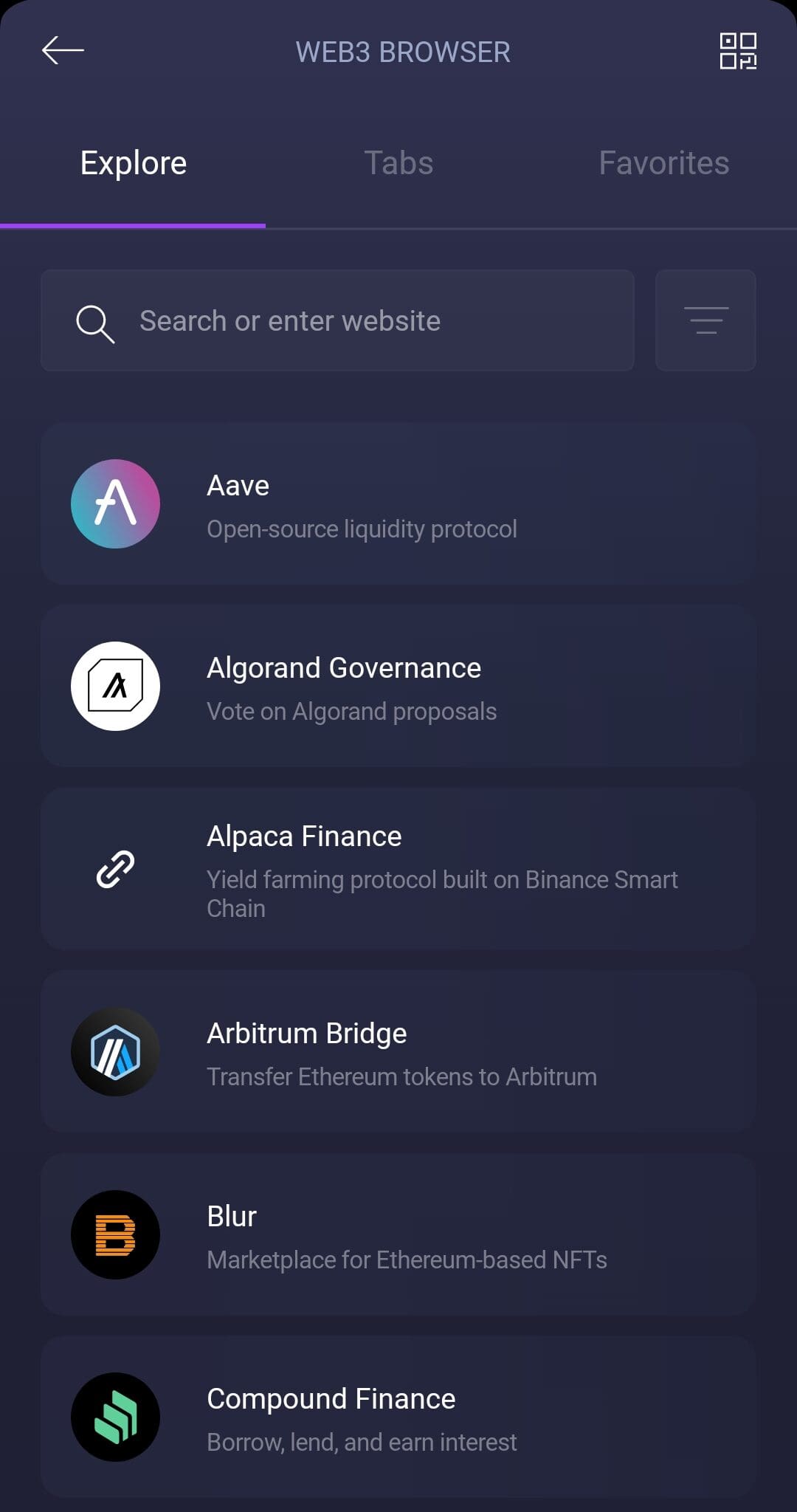

Built-In Web3 Features

Modern wallets go beyond storage—they enable interaction with decentralized apps (dApps) and participation in DeFi.

Browser extension wallets: Wallets like MetaMask act as Web3 gateways to DeFi platforms, games, and NFT marketplaces.

Token swaps: Many wallets now include native swaps using decentralized exchanges (DEXs).

Staking and yield farming: Some wallets allow you to stake tokens or earn passive income directly within the app.

Because wallets integrate these features, they serve not only as storage but also as a portal to the broader cryptocurrency economy.

-

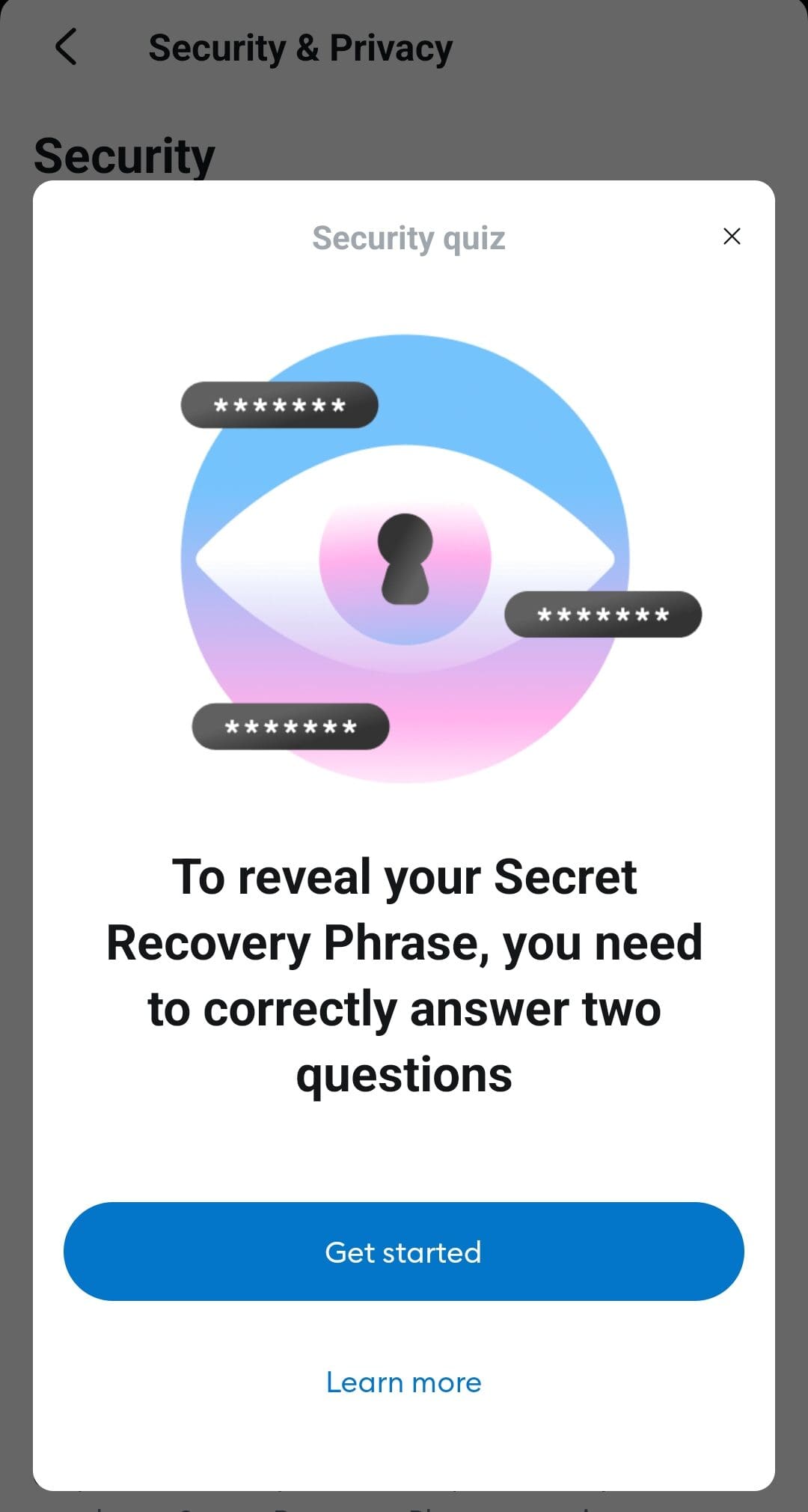

Backup and Recovery Options

Losing a wallet doesn’t always mean losing funds—if you have a recovery phrase.

Seed phrase: Most wallets provide a 12–24 word backup phrase to restore access if you lose the device.

Cloud backups: Some mobile wallets offer encrypted cloud-based recovery options.

Paper backups: Writing the phrase on paper and storing it securely is still a common practice.

However, if someone else gains access to your seed phrase, they can take your funds. Therefore, secure storage of recovery data is just as important as the wallet itself.

-

Open-Source and Auditability

Many crypto wallets are open-source, allowing community audits and transparency.

Code visibility: Anyone can inspect the wallet’s code for bugs or security flaws.

Third-party audits: Reputable wallets undergo external audits from cybersecurity firms.

Community trust: Open-source wallets often gain trust more quickly because issues can be identified and fixed quickly.

As a result, choosing wallets with open codebases and transparent audit histories can reduce the chance of hidden vulnerabilities.

Crypto Wallet Benefits and Risks

Crypto wallets provide flexibility and control over your digital assets, but they also come with significant responsibilities and potential security issues.

Pros | Cons |

|---|---|

Full Ownership | Security Risks |

DeFi and dApp Access | Responsibility Burden |

Multi-Coin Management | Complex for Beginners |

Fast Transactions | Limited Recovery Options |

- Full Ownership

You control your private keys, giving you complete control over your funds and eliminating reliance on a bank or exchange.

- DeFi and dApp Access:

Non-custodial wallets make it easy to connect to DeFi platforms, NFT marketplaces, and blockchain games.

- Multi-Coin Management

Many wallets allow storage of multiple assets across different blockchains, offering a unified experience.

- Fast Transactions

With hot wallets, you can send and receive crypto almost instantly, useful for traders and active users.

- Security Risks

Hot wallets connected to the internet are more vulnerable to hacks and phishing attacks.

- Responsibility Burden

If you lose your private key or seed phrase, you permanently lose access to your funds.

- Complex for Beginners

Setting up and understanding how wallets work can be overwhelming for new users.

- Limited Recovery Options

Recovery usually depends solely on the seed phrase—there is no customer service to help if you forget it.

Hot Wallets vs. Cold Wallets

Hot wallets are internet-connected and ideal for daily use, while cold wallets remain offline, offering enhanced security for long-term storage.

While hot wallets like MetaMask or Trust Wallet allow quick access to DeFi tools and token swaps, they are more prone to phishing attacks.

Cold wallets such as Ledger and Trezor, on the other hand, are best suited for holding large sums safely over time.

Feature | Hot Wallet | Cold Wallet |

|---|---|---|

Internet Connection | Yes | No |

Accessibility | Instant, convenient | Requires physical access |

Security Level | Lower (susceptible to online threats) | Higher (offline by default) |

Ideal Use Case | Trading, frequent transactions | Long-term storage, large balances |

Examples | MetaMask, Trust Wallet | Ledger Nano X, Trezor Model T |

How to Choose a Crypto Wallet?

Choosing the right crypto wallet depends on your usage, goals, and desired level of security.

Assess Your Activity Level: A hot wallet offers speed and convenience if you trade often or interact with dApps.

Prioritize Security for large funds: use a cold wallet, like Ledger, for significant or long-term holdings that don’t require constant access.

Look for Multi-Asset Support: Wallets like Trust Wallet or Atomic Wallet support a wide variety of tokens and networks.

Consider User Interface: A wallet with a clean, intuitive UI—especially mobile-friendly—makes it easier for beginners to avoid mistakes.

Check for Web3 Integration: Choose wallets that allow you to access DeFi apps, NFT platforms, and token swaps securely.

Because different wallets suit different user needs, it’s common to use both types for different parts of your portfolio.

Popular Crypto Wallets

Here are some of the most widely used crypto wallets and what makes each unique:

MetaMask: A browser-extension and mobile wallet, MetaMask is ideal for Ethereum-based tokens and Web3 dApp access.

Trust Wallet: Backed by Binance, Trust Wallet supports a wide array of blockchains and has an intuitive mobile interface.

Ledger Nano X: A secure hardware wallet that stores private keys offline and supports 5,500+ coins and tokens.

Coinbase Wallet: A non-custodial mobile wallet with strong DeFi support and built-in access to Coinbase dApps.

Trezor Model T: Offers robust offline protection and supports integration with platforms like MetaMask for added flexibility.

These options each serve different use cases—from beginners looking for simplicity to advanced users managing multi-chain assets.

Platform | Supported Coins | Swap Fee | MetaMask Wallet | +16 | 0.875% |

|---|---|---|

Coinbase Wallet | +3,000 | 1% |

Trust Wallet | +5,000 | 0%

Users still need to pay blockchain network fees (gas fees) and potential liquidity provider fees when swapping assets |

Ledger Hardware Wallet | +5,000 | About 0.25%

The Swap service is facilitated by third-party providers such as Changelly and ParaSwap, each with their own fee structures. For instance, Changelly charges a transaction fee of approximately 0.25%. |

Exodus Wallet | +300 | 0%

Users still need to pay blockchain network fees (gas fees) and potential liquidity provider fees when swapping assets |

Crypto.com OnChain | +1,000 | 0.3% |

FAQ

Yes, many wallets offer cross-platform access, but you’ll need to securely import your seed phrase or use syncing tools if supported.

Not necessarily. Centralized exchanges hold assets in custodial wallets, but transferring to your own wallet gives you full control.

As long as you have the recovery phrase, you can restore your funds using another wallet that supports the same blockchain.v

Hot wallets are more vulnerable to malware or phishing. Cold wallets are safer, but still require careful physical and digital handling.

No. An exchange holds your funds in its custody. A wallet gives you private key ownership and direct control of the assets.

Some wallets support multiple blockchains. For example, Trust Wallet and Ledger can manage BTC and ETH in separate native apps.

For long-term investors or anyone storing large amounts of crypto, the enhanced security of cold wallets justifies the price.

Yes. Wallets like Trust Wallet and Coinbase Wallet offer staking or DeFi integrations where users can earn passive income.

Only download from official websites or verified app stores. Also, cross-check hashes or signatures when downloading desktop wallets.