Table Of Content

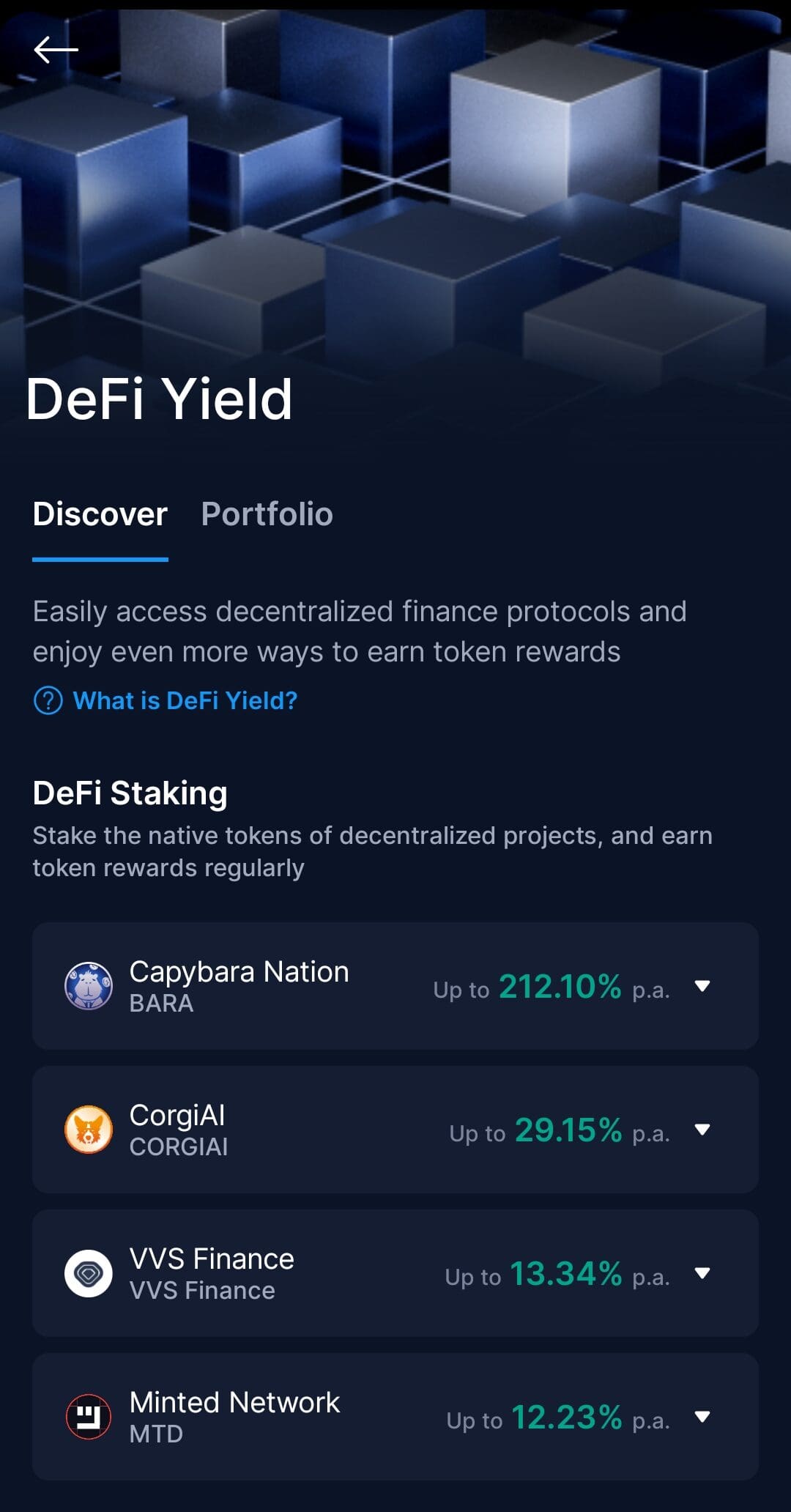

What Is DeFi Staking?

DeFi staking refers to locking up your crypto assets in a decentralized finance protocol in order to earn rewards—usually in the form of interest, yield, or governance tokens.

Unlike traditional staking on centralized exchanges, DeFi staking gives you full control over your crypto while participating in decentralized networks.

It’s a core part of how many blockchains maintain security and consensus, but it's also a way for users to earn passive income without giving up custody.

As a result, DeFi staking has become increasingly popular among crypto investors seeking yields without relying on intermediaries.

How DeFi Staking Works

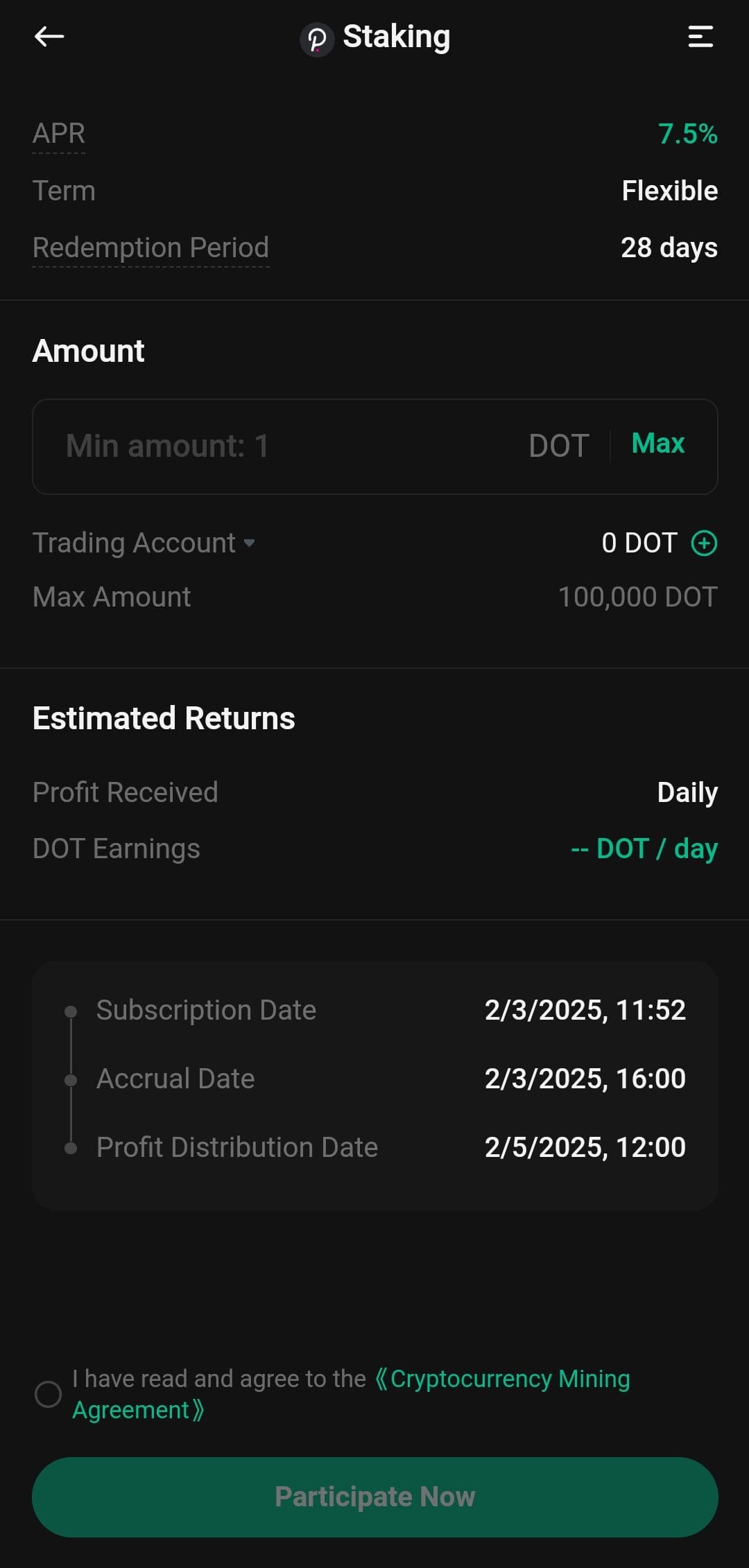

DeFi staking relies on smart contracts and blockchain protocols to facilitate rewards, often without any central authority involved. Here’s how it typically works:

- Locking Funds in Smart Contracts: You deposit tokens into a protocol like Lido, Rocket Pool, or a DeFi platform’s staking vault, where they're used to validate network activity or support liquidity.

- Earning Rewards Automatically: In return, you receive staking rewards—often in the form of the same token or another governance/reward token. These are distributed automatically based on your contribution and lock-up period.

- Liquidity Options Through Staking Derivatives: Some platforms offer liquid staking (e.g., stETH for ETH), allowing you to keep earning rewards while still using a tradable token representing your stake.

- Smart Contract Risk Exposure: Your assets remain non-custodial, but they are subject to the risk of protocol bugs or exploits, which makes platform choice and due diligence essential.

Because DeFi staking is decentralized and transparent, it's popular among users who value control, yield opportunities, and blockchain-based finance.

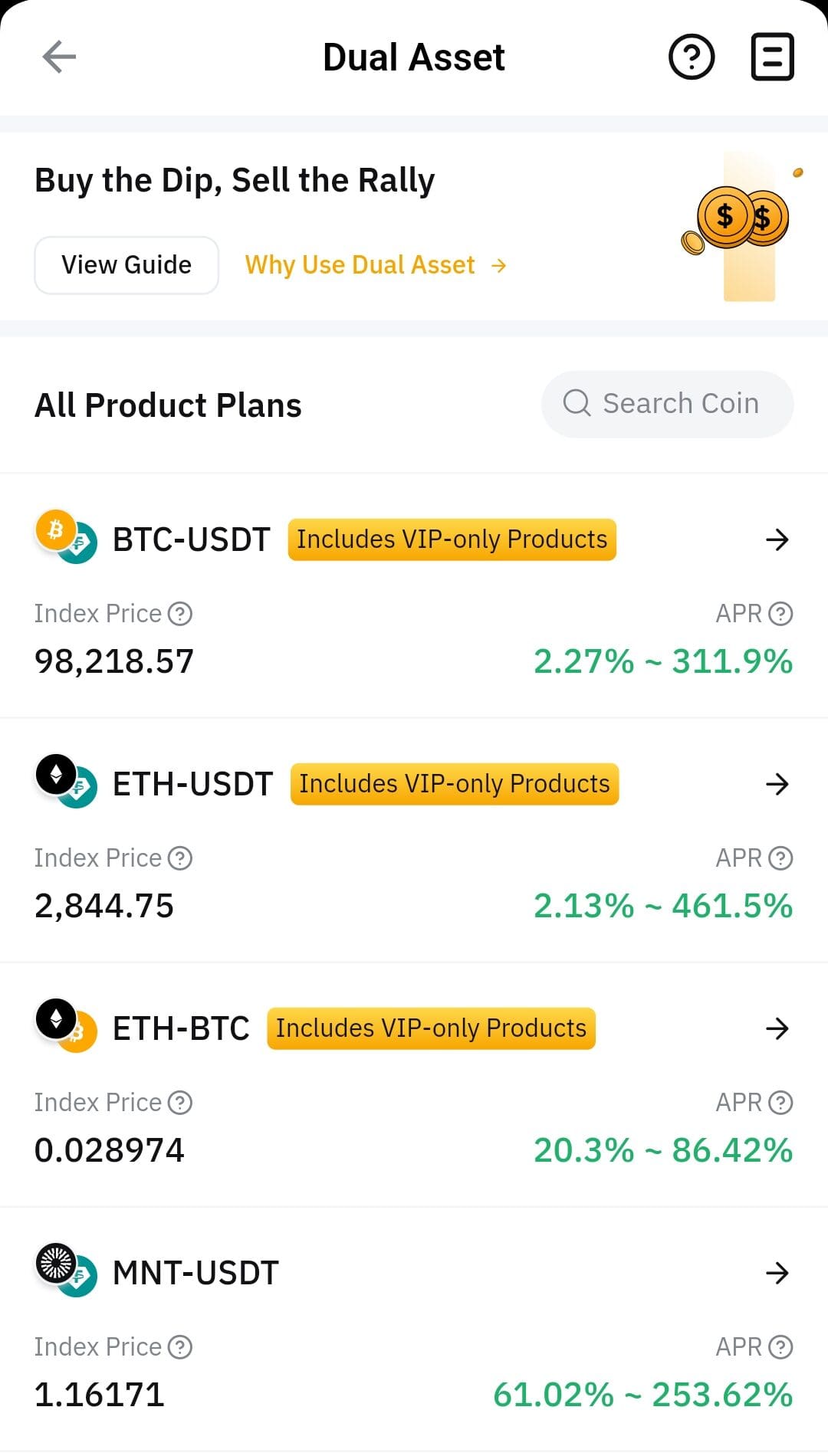

DeFi Staking vs Centralized Staking: Key Differences

DeFi staking lets you interact directly with blockchain protocols, while centralized platforms (like Coinbase or Binance) handle everything for you—but keep custody of your assets.

Here's a comparison of the main differences:

Feature | DeFi Staking | Centralized Staking |

|---|---|---|

Custody | You keep full control | Platform holds your crypto |

Risk | Smart contract risk | Counterparty/platform risk |

Access | Requires wallet connection (e.g., MetaMask) | App-based, easier for beginners |

Reward Transparency | Rewards determined on-chain | May involve hidden fees or lower returns |

Liquidity Options | Possible with liquid staking platforms | Usually requires un-staking period |

DeFi Staking: Pros and Cons

DeFi staking offers attractive yields and decentralized control, but it also introduces unique risks and technical considerations.

Pros | Cons |

|---|---|

Potential for high APYs | Smart contract vulnerabilities |

No need for intermediaries | Impermanent loss or token devaluation |

Supports network decentralization | Lock-up periods may limit liquidity |

Option for liquid staking (e.g., stETH) | Gas fees can reduce net returns |

- Earn Passive Income

By staking tokens, you can earn consistent rewards over time without needing to trade or actively manage positions.

- Decentralized and Trustless

You interact directly with smart contracts—no centralized authority or third-party wallet needed.

- Flexibility and Control

Some platforms offer liquid staking, letting you exit positions or move funds more easily than traditional staking.

- Participation in Governance

Many stakers receive governance tokens or voting power, allowing them to help shape the protocol’s future.

- Smart Contract Risks

If there’s a vulnerability or exploit in the protocol, funds can be lost—even if you control your keys.

- Market Volatility

Staked tokens can lose value rapidly if the market crashes, especially in newer or less-established platforms.

- Complexity for Beginners

Understanding gas fees, wallet connections, and APY mechanics may be difficult for those unfamiliar with DeFi tools.

- Potential Lock-Up

Some platforms require a fixed lock-up period, limiting your ability to respond quickly to market changes.

How to Start DeFi Staking Safely

Getting started with DeFi staking requires careful planning to reduce risk and maximize returns.

- Choose a Trusted Platform: Research the protocol’s security record, audits, and community. Lido, Aave, and Rocket Pool are common starting points.

- Connect a DeFi Wallet: Use a non-custodial wallet like MetaMask or Trust Wallet to connect securely to the staking platform.

- Review Staking Options: Some protocols offer flexible staking, others have fixed periods or governance incentives. Understand the trade-offs.

- Start with a Small Amount: As a beginner, test the process with a small amount to learn how the staking, reward, and withdrawal mechanisms work.

- Monitor and Adjust: Track your rewards, gas costs, and token performance. Reevaluate your strategy based on protocol updates or price changes.

Security Tips for DeFi Staking

Even though you maintain control of your crypto, DeFi staking has risks that require proactive steps to mitigate.

- Double Check Smart Contracts: Only use audited and reputable platforms. Avoid unknown forks or unaudited clones.

- Use Hardware Wallets When Possible: Pair your MetaMask with a hardware wallet for extra protection when interacting with DeFi protocols.

- Be Wary of Fake URLs: Always verify the website domain before connecting your wallet to avoid phishing attacks.

- Keep Software Updated: Make sure your wallet extension or app is always updated to reduce vulnerabilities.

- Avoid Overconcentration: Don’t stake all your assets in one protocol. Diversifying platforms and tokens can reduce risk.

How to Choose a DeFi Staking Platform

When selecting where to stake, consider your goals, technical comfort, and the token ecosystem. Here’s what to look for:

- Supported Tokens and Networks: Some protocols only support Ethereum-based assets, while others offer staking across multiple blockchains.

- Staking Flexibility: Platforms vary in lock-up periods, APYs, and whether they offer liquid staking tokens.

- Reward Rates and Tokenomics: Understand how rewards are calculated, whether they’re inflation-based, and how sustainable the returns are.

- Ease of Use: For newer users, some platforms like Lido and Yearn Finance offer simplified staking with user-friendly interfaces.

- Reputation and Audit History: Prioritize protocols with thorough audits, open-source code, and a strong development community.

FAQ

DeFi staking involves locking tokens to help secure a network or protocol, while liquidity mining typically requires providing token pairs to a pool in exchange for rewards.

Yes, many platforms offer staking or yield opportunities for stablecoins like USDC or DAI, often through lending protocols or liquidity pools rather than traditional staking.

Reward frequency varies by platform—some offer real-time accruals, while others distribute rewards daily, weekly, or upon withdrawal.

In many jurisdictions, staking rewards are considered taxable income at the time of receipt, and capital gains may apply when you sell the rewards later.

Staking derivatives, like stETH from Lido, represent your staked position and allow you to maintain liquidity while still earning staking rewards.

No, most DeFi staking platforms use pooled or liquid staking models, so you can participate without running your own validator.

If a smart contract is exploited, funds locked in the contract could be lost. This is why audits and protocol reputation are critical before staking.

Yes, you may face losses due to smart contract bugs, token price drops, impermanent loss, or poorly designed reward systems.

Yes, interacting with DeFi protocols typically involves gas fees, especially on Ethereum. Choosing Layer 2 networks or gas-efficient chains can help.

It depends on the protocol. Some allow instant unstaking, while others require waiting periods or charge early withdrawal penalties.