Table Of Content

What Is Options Trading and How Does It Work?

Options trading involves buying and selling contracts that give investors the right, but not the obligation, to buy or sell an underlying asset, such as a stock, at a predetermined price within a specific timeframe.

These contracts are known as options, and they come in two types: calls (buy) and puts (sell).

Because options derive their value from an underlying asset, they’re known as derivatives. Traders use options to hedge risks, generate income, or speculate on market movements.

-

How Options Trading Work?

For example, an investor who thinks a stock will rise might buy a call option instead of the stock itself. This requires less capital and limits downside risk.

However, options trading involves unique risks and strategies, so it's essential to understand concepts like strike price, expiration date, and premium.

As a result, many beginners start by paper trading or using basic strategies before entering live markets.

-

Buying vs Selling Options: What’s the Difference?

When trading options, investors can either buy or sell (write) contracts, and each approach carries a different risk-reward profile.

Buying options (calls or puts) gives you the right, but not the obligation, to trade the underlying asset. Your maximum loss is limited to the premium paid. This strategy appeals to traders seeking big upside potential with controlled risk.

On the other hand, selling options obligates you to fulfill the contract if the buyer exercises it.

While sellers collect premiums upfront, they take on potentially unlimited losses—especially when selling uncovered (naked) options. As a result, selling requires more margin and experience.

Feature | Buying Options | Selling Options |

|---|---|---|

Capital Required | Low | Higher (due to margin) |

Risk Level | Limited to premium paid | Potentially unlimited |

Profit Potential | High (especially with calls) | Limited to premium received |

Strategy Objective | Speculate or hedge | Generate income |

For example, buying a call on a stock may cost $150, but your profit potential is theoretically unlimited. Selling that same call earns you $150 upfront—but could lead to much larger losses if the stock soars.

What Are Call Options and How Do They Work?

A call option gives the buyer the right to purchase an underlying asset at a fixed price (strike price) before a certain expiration date.

Investors typically buy calls when they expect a stock’s price to rise, but others may sell calls to collect income if they think the stock will stay flat or fall.

Example 1 (Buying a Call): You buy a call option on XYZ stock with a $50 strike price. If XYZ rises to $60 before expiration, you can buy at $50 and sell at $60, profiting from the price difference.

Example 2 (Selling a Call): You sell a call option with a $50 strike price for $2/share. If the stock stays below $50, you keep the $200 premium. But if it rises to $60, you may be forced to sell the stock at $50, missing out on gains.

Scenario | Action | Strike Price | Market Price | Outcome |

|---|---|---|---|---|

Stock rises significantly | Buying | $50 | $60 | Profitable for buyer |

Stock stays below strike | Selling | $50 | $48 | Profitable for seller (keeps premium) |

Stock rises past strike | Selling | $50 | $60 | Seller may face obligation and losses |

What Are Put Options and How Do They Work?

A put option gives the buyer the right to sell an asset at a specific price (strike price) before expiration.

Traders buy puts when they believe a stock will fall, but investors can also sell puts to generate income if they think the stock will stay stable or rise.

Example 1 (Buying a Put): You buy a put option on ABC stock with a $100 strike price. If ABC falls to $85, you can sell at $100 and profit from the drop in value.

Example 2 (Selling a Put): You sell a put option with a $100 strike price for $3/share. If the stock stays above $100, you keep the $300 premium. But if it falls to $85, you may be forced to buy the stock at $100, creating a loss.

Scenario | Action | Strike Price | Market Price | Outcome |

|---|---|---|---|---|

Stock drops significantly | Buying | $100 | $85 | Profitable for buyer |

Stock stays above strike | Selling | $100 | $105 | Profitable for seller (keeps premium) |

Stock drops below strike | Selling | $100 | $85 | Seller may have to buy at a loss |

Risks and Rewards of Options Trading

Options trading offers flexible strategies and leverage, but it also involves complex risks that can lead to losses if not managed properly.

Pros | Cons |

|---|---|

Leverage with less capital | Complex and difficult to master |

Profit in various directions | Time decay reduces value quickly |

Hedging capabilities | Uncapped risk for sellers |

Defined risk for buyers | Liquidity can be an issue |

- Leverage With Lower Capital

You can control 100 shares of stock with just one option contract, which allows larger exposure with less capital.

- Profit in Any Market Direction

Traders can use calls for rising markets, puts for falling markets, or combined strategies for sideways movement.

- Hedging Against Losses

Investors use puts to protect long stock positions, acting like insurance during downturns.

- Defined Risk for Buyers

Buyers of options can only lose the premium paid, therefore making risk predictable and limited.

- Rapid Time Decay

Options lose value as expiration nears, especially if the underlying asset doesn't move favorably.

- Complex Strategies

Multi-leg trades like spreads or straddles require deep understanding and may confuse new traders.

- Unlimited Risk for Sellers

Selling uncovered options can result in large losses, because there’s no cap on how high or low a stock can go.

- Liquidity and Execution Issues

Thinly traded options may have wide bid-ask spreads, making it harder to enter or exit trades efficiently.

Options Trading: Key Strategies for Beginners

To start trading options more confidently, beginners often use simple strategies that reduce risk while offering flexibility and learning opportunities.

Covered Call: This involves owning a stock and selling a call option. It generates income from the premium while limiting upside if the stock rises.

Cash-Secured Put: If assigned, you sell a put option and keep enough cash to buy the stock. It’s used to buy stocks at a lower price potentially.

Protective Put: Buying a put option while holding a stock helps protect against downside risk, like insurance in case the stock drops.

Long Call: You buy a call option expecting the stock to rise. This strategy offers unlimited upside with limited loss (only the premium paid).

Long Put: Buying a put lets you profit if the stock drops, helpful in bearish markets or for hedging other holdings.

Before actual trading, it's advised to dig deeper and understand how and when to use each strategy.

How to Buy and Sell Options on a Trading Platform

Most online brokerages now allow users to trade options, but the process involves more steps than buying stocks.

Open an Options-Approved Brokerage Account: You must apply for options trading and get approved because brokers assess your experience and risk tolerance.

Choose the Stock and Strategy: Search for the stock or ETF you want to trade options on, then select a strategy—like buying a call or selling a put.

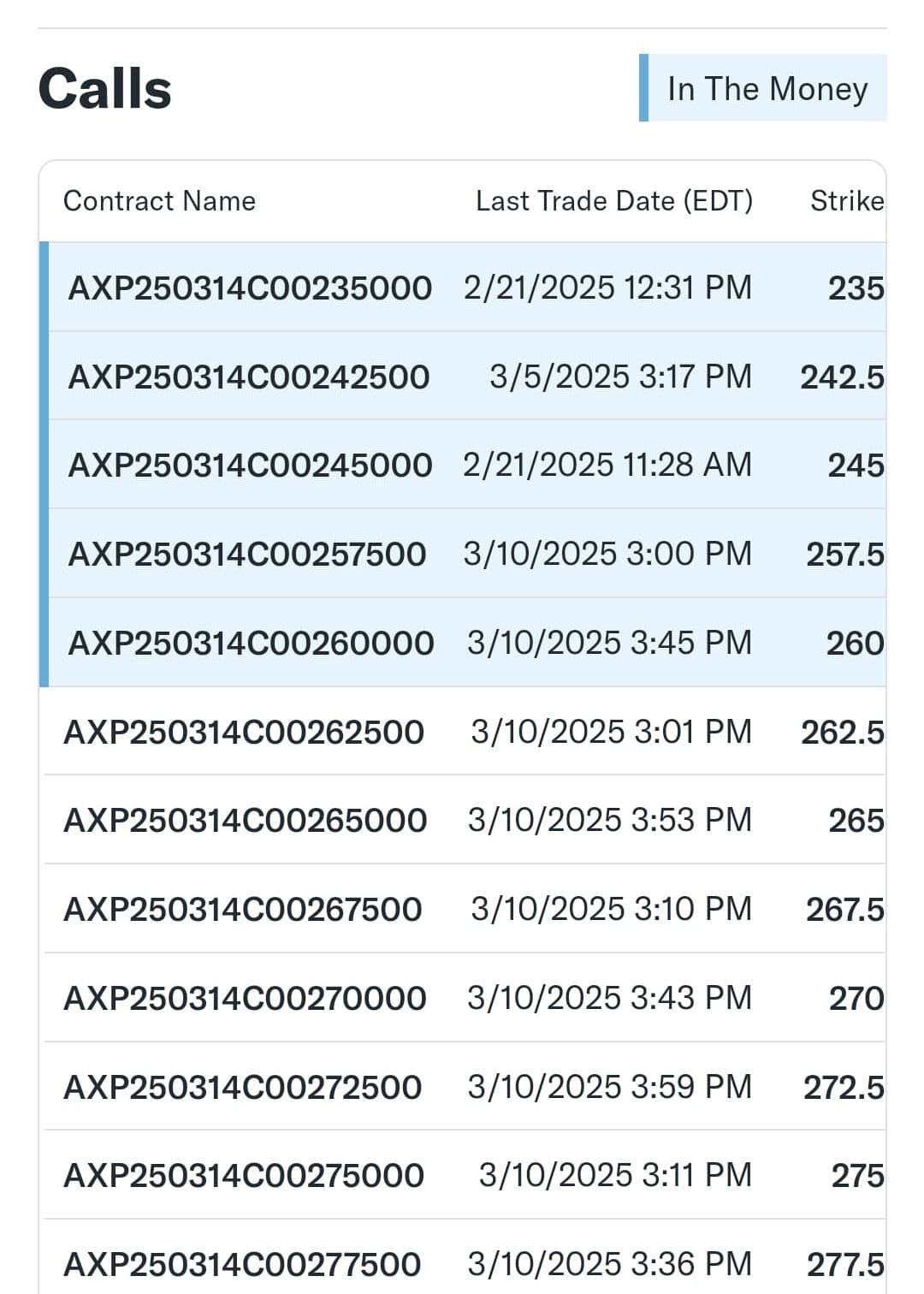

Use the Options Chain: The options chain lists available contracts. Select your desired strike price, expiration date, and contract type.

Review and Place Your Trade: Confirm the premium, total cost, and potential outcomes before placing the order. Platforms like Merrill Edge and Fidelity show detailed previews.

Monitor and Manage the Position: After executing the trade, you can close the position early or wait until expiration.

Common Mistakes Beginners Make in Options Trading

Options trading can offer strong potential returns, but beginners often make costly mistakes due to lack of knowledge or poor strategy.

Ignoring Time Decay: Many new traders hold out-of-the-money options too long, not realizing value declines rapidly as expiration nears.

Misunderstanding Strike Prices: Choosing unrealistic strike prices might lower premiums but reduces the chance of profit. For example, buying a $120 call on a $90 stock is unlikely to pay off quickly.

Skipping Risk Management: Some traders risk large amounts without protective stops or defined strategies, therefore exposing themselves to major losses.

Selling Naked Options Without Experience: Beginners may be tempted by high premiums, but selling uncovered options can result in unlimited risk if the market moves sharply.

FAQ

American options can be exercised at any time before expiration, while European options can only be exercised at expiration. This makes American options more flexible for active traders.

Options Greeks—Delta, Gamma, Theta, Vega, and Rho—help traders measure how option prices react to changes in stock price, time, and volatility. Understanding these helps manage risk and adjust strategies.

An option's premium includes intrinsic value (if any) and time value, which is influenced by volatility, time to expiration, and underlying price. Higher volatility often increases premiums.

Implied volatility reflects the market's forecast of a stock's future volatility. Traders use it to gauge expected price movement and determine if options are fairly priced.

If an option expires in the money, it is automatically exercised by most brokers unless the trader closes it or instructs otherwise. This can result in stock being bought or sold.

Yes, many brokers allow limited options trading in IRAs, typically for conservative strategies like covered calls or cash-secured puts. Risky strategies are usually restricted.

LEAPS (Long-Term Equity Anticipation Securities) are options with expiration dates longer than one year. They allow long-term strategic positioning with reduced time decay.

Dividends can reduce call option premiums and increase put values because the stock price typically drops by the dividend amount on the ex-dividend date.

Assignment happens when an option seller is obligated to fulfill the terms of the contract—selling or buying the stock at the strike price. This can occur any time for American options.

Yes, especially when selling uncovered options. Buyers of options risk only the premium, but sellers can face unlimited losses depending on market movement.

Yes, but frequent trading in a margin account may trigger pattern day trading rules, requiring a minimum account balance. Cash accounts have different restrictions.