Table Of Content

What Is Paper Trading?

Paper trading is a method of simulating real trades in the stock market without using actual money. It allows investors—especially beginners—to practice trading strategies in a risk-free environment.

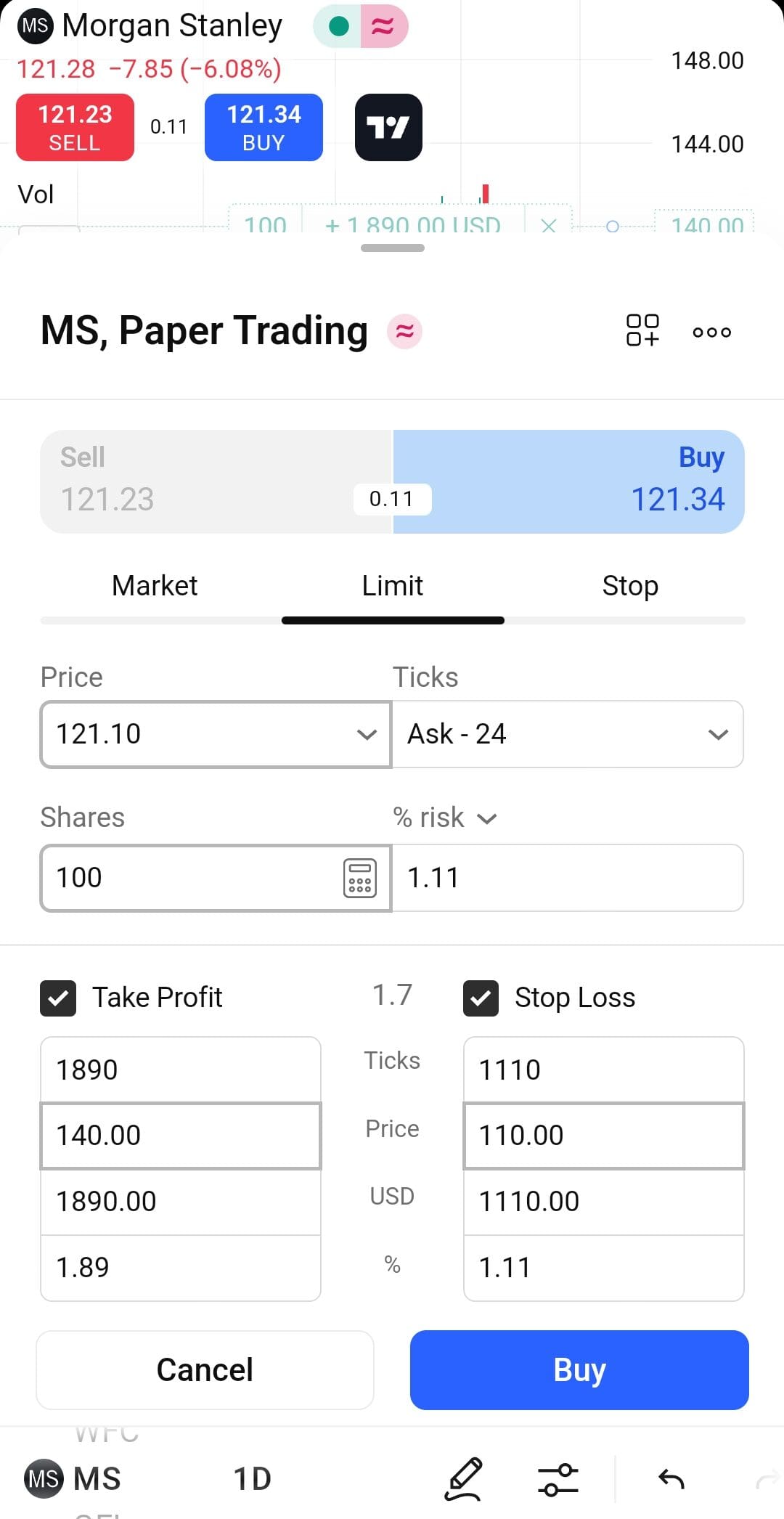

Platforms like TradingView or Webull offer paper trading features where users can place mock buy and sell orders, track market movements, and monitor their virtual portfolios in real-time.

-

How Does It Work

For example, a beginner interested in swing trading can use paper trading to test entry and exit points on stocks without risking capital.

The process mirrors real trading: you pick a stock, choose how many shares to “buy,” and watch how your trade would have performed.

This way, users learn how price movements, order types, and timing affect results. Paper trading doesn’t involve emotional risk, but it closely mimics the mechanics of live trading.

-

Paper Trading vs. Live Trading – Key Differences

Factor | Paper Trading | Live Trading |

|---|---|---|

Risk Level | None | Real financial risk involved |

Emotional Impact | Low – no money at stake | High – fear and greed can influence decisions |

Execution Speed | Often idealized or instant | Can experience delays or slippage |

Market Conditions | Real-time or delayed data | Real-time with actual price fills |

Strategy Testing | Ideal for testing ideas risk-free | Crucial for refining execution under pressure |

How to Start Paper Trading?

Getting started with paper trading is simple, and it can provide valuable hands-on experience without risking your actual money.

Choose a reliable platform with paper trading features: Start by selecting a brokerage or platform. For example, TradingView offers a full-featured simulator, where you can access real-time data and trading tools similar to live accounts.

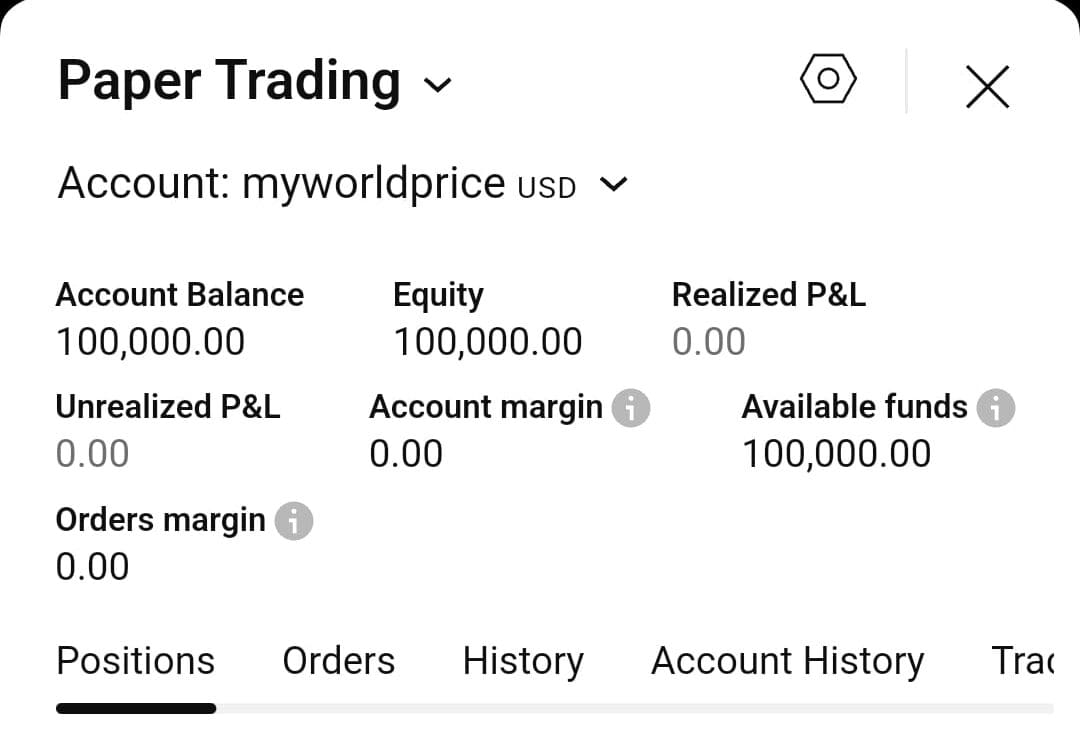

Set up your virtual portfolio and trading preferences: Decide how much “virtual” cash you want to trade with. For instance, some users start with $100,000 to mimic a real investment account and practice managing risk across multiple assets.

Explore the interface and tools: Familiarize yourself with features like stock screeners, charting tools, and order types. On platforms like TradingView, you can place simulated trades using various technical indicators.

Place your first mock trade: Choose a stock you’re interested in—say, Apple (AAPL)—and place a buy order with a stop-loss to simulate risk management. Review how the position performs over a few days or weeks.

How to Use Paper Trading to Test Strategies

Paper trading allows investors to experiment with a variety of strategies in real market conditions, without risking real money. Here's how to make the most of it:

-

1. Try Long-Term Investing Scenarios

Use paper trading to simulate a buy-and-hold strategy.

For example, you can “buy” shares of companies like Apple or Coca-Cola and hold them in your virtual portfolio for several months. Track how dividends, earnings announcements, or interest rate changes affect the stock price over time.

This helps beginners see how long-term investing works in different market cycles without committing real funds.

- The Smart Investor Tip

Set calendar reminders for earnings dates and major macroeconomic events (like Fed meetings) to see how your paper portfolio reacts during real-world news cycles.

-

2. Test Short-Term Trading Techniques

If you're interested in day trading or swing trading, paper trading is the perfect place to start. Try placing quick trades based on breakout patterns or technical signals.

For instance, you might practice entering a trade when a stock breaks above its 20-day moving average, then set a stop-loss and profit target.

These simulated trades can help fine-tune your timing and risk management before going live.

- The Smart Investor Tip

Focus on just 1–2 stocks for short-term practice to develop a feel for their volatility and price behavior before expanding to other assets.

-

3. Combine Technical Indicators to Build Your Signals

Paper trading platforms allow you to use multiple indicators together.

You can build a system that triggers mock trades when certain conditions are met—for example, when the RSI falls below 30 and the MACD shows a bullish crossover.

Watching how this system performs over weeks can reveal whether your strategy is consistent or needs tweaking.

- The Smart Investor Tip

Don’t overload your chart—stick to a maximum of three indicators and test one variable at a time to clearly evaluate what’s working.

-

4. Analyze Results and Adjust Tactics

Keep a record of each trade: what strategy you used, why you entered, and what the outcome was. After 20–30 paper trades, analyze your win rate and average return.

For example, you may notice that your momentum trades do well mid-week but underperform on Mondays. This kind of insight is key to developing a real edge.

- The Smart Investor Tip

Include screenshots of your entry/exit points with notes on your thought process. This visual feedback can reveal patterns and decision-making habits over time.

When to Transition from Paper Trading to Live Trading

The right time to move from paper trading to live trading depends on your consistency, confidence, and ability to manage risk—not just time spent practicing. Here are signs you're ready to make the shift:

You’ve achieved consistent profitability: If you’ve paper traded for several weeks or months and are consistently profitable using the same strategy, it’s a strong indicator you're ready to go live.

You follow a trading plan with discipline: Being able to stick to a defined plan—entry rules, exit strategy, position sizing—even in simulated conditions shows you have the structure needed for real trades.

You’ve handled different market conditions: If your strategy has been tested across varying market environments (volatile days, sideways markets, earnings season), you're more likely to adapt well in real trading.

You’ve built emotional awareness: Even though paper trading doesn't involve real money, if you've practiced managing simulated losses without overreacting, you're in a better place to handle real emotions.

You understand the risks of real trading: Once you fully understand slippage, fees, tax implications, and the psychological pressure of risking real capital, and you still feel prepared, it’s time to start small.

We recommend beginning with a small live account and trading in fractional sizes or micro lots. This way, you ease into the emotional side of real trading while limiting your financial exposure.

Which Paper Trading Platforms Recommended?

There are several platforms that offer free paper trading tools with real-time data and a wide range of market features.

-

Charles Schwab’s thinkorswim (paperMoney)

Thinkorswim paperMoney offers a professional-grade paper trading simulator where users can test complex options, stock, and futures strategies. It’s ideal for more advanced simulations, including technical chart setups and backtesting.

-

TradingView

Great for visual traders who rely on indicators and price action.

For example, users can simulate trades using MACD crossovers or Fibonacci levels while watching how trends unfold in real time.

-

Webull

Geared toward newer traders, Webull’s paper trading feature is mobile-friendly and simple to use.

It’s perfect for testing basic stock trades on the go, especially for younger investors learning market dynamics.

-

Investopedia Simulator

This educational tool allows you to build a virtual portfolio while competing in challenges.

For example, you can try buying sectors like energy or tech and compare performance with other users.

FAQ

The main goal of paper trading is to practice trading strategies without risking real money. It helps traders build confidence and develop discipline before transitioning to live markets.

Yes, most platforms mirror real-time market conditions including volatility, news events, and price fluctuations. However, some emotional factors like fear and greed are absent.

Yes, several platforms like TradingView and Webull allow paper trading of cryptocurrencies. It's a great way to test strategies in volatile crypto markets.

Absolutely. Experienced traders often use paper trading to test new strategies or refine technical setups before risking real capital.

Yes, it’s one of the best ways to apply technical analysis in a risk-free setting. You can test indicators like RSI, MACD, or moving averages live.

Some platforms allow you to simulate dividend payments and reinvestments, especially those that support long-term investing simulations.

Most platforms offer unlimited paper trading, so you can practice for as long as needed. Some competitions or simulators may have deadlines.

No real money is involved, so you can’t lose actual funds. You only risk virtual capital to measure performance.

Not entirely. While prices may be real-time, your simulated orders don’t interact with actual market participants, so fills are idealized.