Table Of Content

What Makes a Good Options Screener?

A good options screener helps investors quickly filter through contracts to find strategic opportunities based on clear trading goals.

Custom Filters – Let users sort by strike price, expiration date, implied volatility, and more to match their strategy.

Unusual Activity Alerts – Highlights contracts with higher-than-average volume or open interest, often signaling big-money moves.

Profit and Risk Metrics – Calculates breakeven, max profit/loss, and risk/reward ratios for better decision-making.

Strategy Support – Offers screeners tailored to common strategies like covered calls, vertical spreads, or iron condors.

Real-Time Data Access – Ensures quotes, volume, and volatility data are current, which is crucial for options trading.

With so many variables in options trading, a powerful screener simplifies the process and allows investors to stay focused on opportunities that match their risk profile and outlook.

Top Free and Paid Options Screeners

Whether you're a beginner looking for basic filters or a seasoned trader tracking volatility, the right options screener can save time and uncover strategic trade setups.

Below are some of the top free and premium tools, with real use cases and standout features to consider.

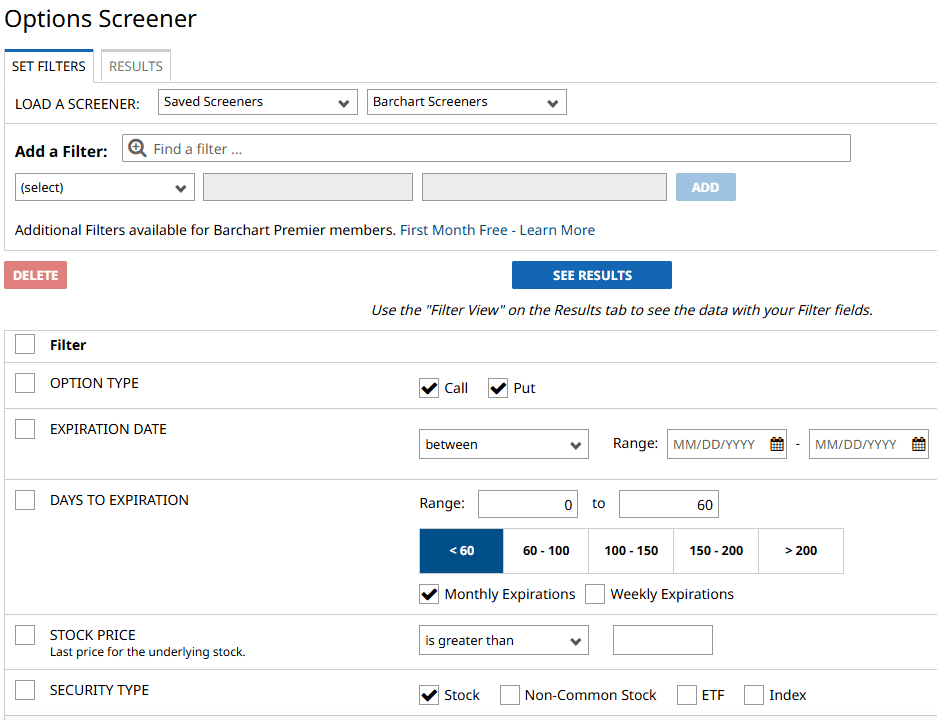

1. Barchart Options Screener

Barchart offers a user-friendly options screener with both free and premium tools suited for retail investors and active traders.

The free version provides core filters, while the Barchart Premier plan expands into advanced strategy analysis.

Custom Strategy Filters – Traders can screen for covered calls, naked puts, and spreads, adjusting for strike distance and time to expiration.

Implied Volatility Rankings – Helps users find high IV contracts for earnings plays or volatility strategies.

Unusual Options Activity – The premium version includes alerts for unusual volume and open interest, often used to spot institutional trades.

For example, if you plan an earnings play on Nvidia, you can sort options with elevated IV and short-dated expirations.

Barchart’s platform is simple to navigate and includes export tools for deeper analysis.

2. Fidelity Options Screener

Fidelity’s screener is built into its powerful Active Trader Pro platform, which offers brokerage clients free access to detailed contract data, risk metrics, and strategy insights.

Greeks and Probability Data – Includes real-time data on delta, theta, and probability of profit, useful for risk-conscious strategies like iron condors.

Strategy-Focused Screening – Users can filter options by strategy type (e.g., vertical spreads) based on their trade plan.

Integration with Research Tools – Contracts are linked to in-depth equity research and earnings reports for smarter decision-making.

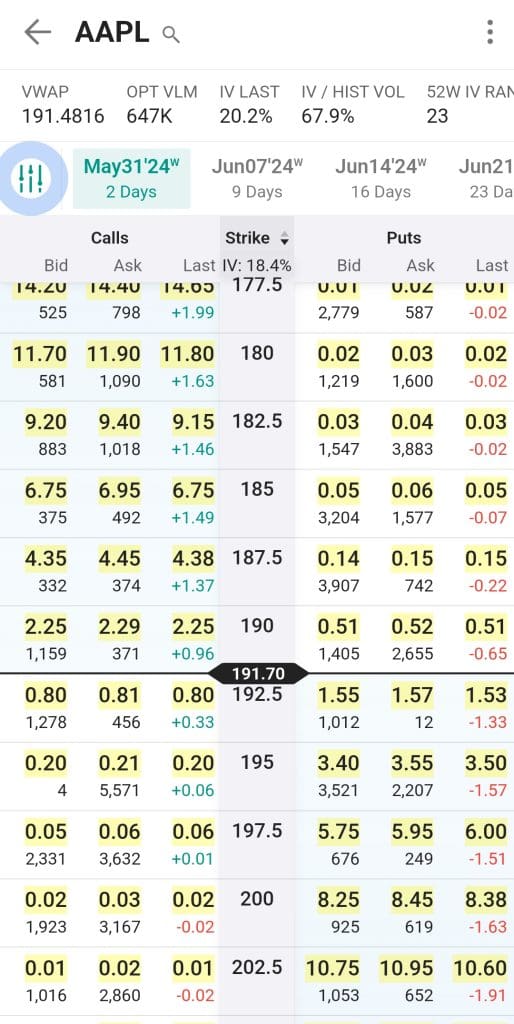

Let’s say you want to sell a put on Apple with a 70% probability of profit—Fidelity makes this possible through risk-based filters.

While it lacks some of the visual flair of premium screeners, the data depth is unmatched for a free tool.

3. Interactive Brokers (IBKR) Options Tools

IBKR offers one of the most advanced options screeners through its Trader Workstation (TWS), designed for experienced investors who need precision and speed.

Volatility Lab & Probability Lab – Visualizes historical, implied, and forecast volatility, allowing traders to build positions around market expectations.

Multi-Leg Strategy Scanner – Filters for advanced setups like butterflies or diagonals with control over spread width and net credit/debit.

Real-Time Greeks – Offers dynamic Greeks as markets move, critical for managing positions actively throughout the day.

If you're running a delta-neutral strategy or analyzing Vega exposure before a Fed announcement, IBKR's platform gives you institutional-level depth. While free for clients, it may overwhelm casual traders due to its steep learning curve

4. Market Chameleon

Market Chameleon stands out for its focus on unusual activity, earnings trades, and implied volatility edge—perfect for swing traders and options specialists.

Earnings Option Screener – Filters options around earnings reports, showing historical patterns, win rates, and IV crush data.

Unusual Options Volume – Tracks large trades outside the norm, helpful for following smart money before price moves.

Volatility Skew Analysis – Visualizes skew to identify pricing inefficiencies in puts vs. calls.

For example, if you’re evaluating a pre-earnings straddle on Tesla, Market Chameleon shows how implied volatility behaves compared to previous quarters. Some features are free, but full access requires a premium plan.

5. Zacks Options Screener

Zacks combines fundamental research with options filtering, making it ideal for investors who want to pair stock rankings with strategic trades.

Bullish/Neutral/ Bearish Screeners – Match options strategies to your market outlook, such as using bull call spreads on Zacks Rank #1 stocks.

Expected Return Metrics – Premium users get modeled return vs. risk outputs, making tradeoffs clearer.

Linked Equity Ratings – See analyst ratings, earnings estimates, and valuation metrics beside each contract.

If you’re bullish on a company with strong earnings momentum, you can easily find matching call spreads or LEAPS. While free users get access to basic filters, the premium screener unlocks predictive analytics.

6. Option Samurai

Option Samurai focuses on automation and simplicity, appealing to traders who want actionable setups without digging through charts all day.

Smart Presets – Includes pre-built scans like “High Probability Credit Spreads” or “Low Risk Iron Condors.”

Expected Move Estimation – Highlights options pricing relative to projected stock movement, useful for straddles and strangles.

Excel/Email Integration – Sends daily options picks directly to your inbox or spreadsheet.

A swing trader might use Option Samurai to auto-scan for weekly cash-secured puts on low-volatility stocks. While there’s no free plan, its time-saving tools and clear dashboards justify the subscription for active traders.

How to Use Options Screeners to Find High-Potential Trades?

Options screeners help you narrow down trade opportunities based on strategy, risk profile, and market outlook. Here’s how to use them effectively:

Start with a Clear Strategy – Choose whether you're looking for income (e.g., covered calls), speculation (e.g., long calls), or hedging.

Filter by Expiration and Strike – Narrow the list to contracts that align with your time horizon and target price.

Use Volume and Open Interest Filters – Focus on liquid contracts to ensure tighter spreads and easier trade execution.

Check Implied Volatility and IV Rank – Spot overpriced options to sell or underpriced ones to buy, especially around earnings events.

Incorporate Delta and Probability of Profit – Prioritize trades that offer favorable risk/reward and high likelihood of success.

Scan for Unusual Activity – Look for spikes in volume or open interest that may indicate insider or institutional sentiment.

Link to News or Fundamentals – Confirm that the trade idea makes sense based on recent news, analyst upgrades, or earnings forecasts.

By combining technical filters with strategic logic, options screeners become a powerful tool to surface opportunities that match your investment goals.

FAQ

Stock screeners filter entire equities based on price, volume, or fundamentals, while options screeners focus on contracts and strategies tied to those stocks.

Some platforms like Yahoo Finance and Barchart offer free tools, but advanced features such as volatility filters or strategy scans may require subscriptions.

Yes, advanced screeners like OptionsPlay or Market Chameleon support multi-leg strategies like iron condors or credit spreads, allowing full trade setup analysis.

Accuracy depends on real-time data and inputs. Results can highlight opportunities, but users must still validate trades based on market trends and news.

Some do. Platforms like Barchart and MarketBeat let you filter contracts by upcoming earnings dates, which is useful for volatility-based trades.

Yes, most screeners allow you to filter by expiration date, including weekly contracts—great for short-term income or event-driven strategies.

Many advanced screeners offer filters for delta, theta, and gamma, letting you fine-tune trades based on risk and time decay exposure.

Yes. Many screeners calculate return on risk or annualized yield, especially for credit spreads and covered calls, helping prioritize efficiency.