Yahoo Finance Gold Plan

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Pros & Cons

The Yahoo Finance Gold plan is the most advanced tier, offering deep financial data, personalized trade ideas, and sophisticated stock screening tools.

A standout feature is the Personalized Trade Ideas, which helps users discover potential investments based on technical indicators, stock momentum, and analyst insights. The Smart Money Screener and Top Holdings Screener allow users to track hedge fund and institutional trades

Gold also provides 40 years of historical financial statements, helping fundamental investors analyze long-term stock trends, revenue growth, and cash flow consistency.

For technical traders, Gold introduces 50+ technical chart patterns, event annotations, and real-time alerts for key market movements.

Despite these strengths, Gold still has limitations. It lacks real-time Level 2 market data, AI-powered stock recommendations, and in-depth options flow analysis, making it less suitable for day traders, options traders, and algorithmic investors.

- Personalized Trade Ideas

- 40 Years of Financial Data

- 50+ Technical Chart Patterns

- Smart Money Screener

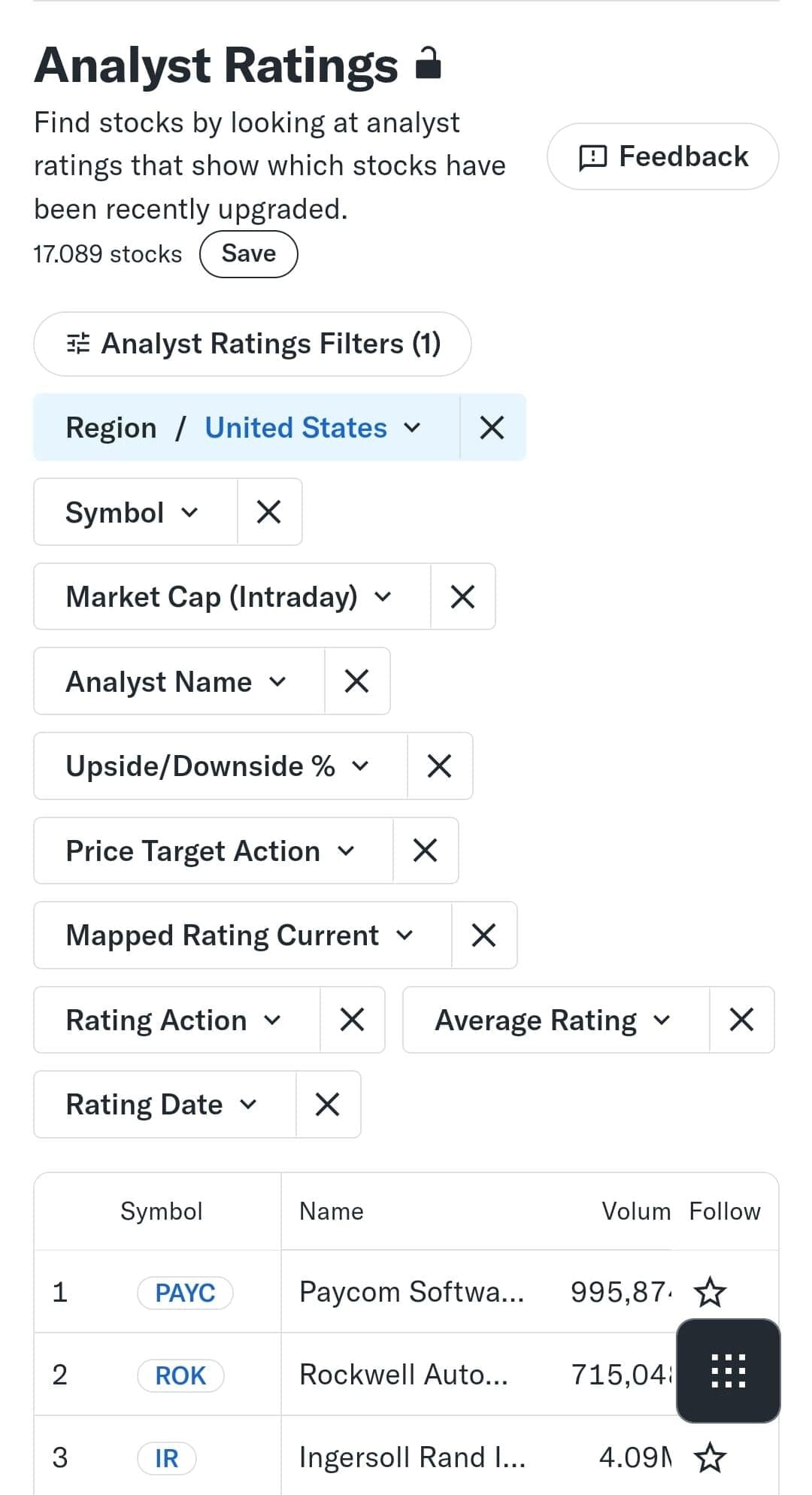

- Analyst Ratings Screener

- Top Holdings Screener

- Technical Alerts & Annotations

- Morningstar & Argus Stock Ratings

- Stock & ETF Screener

- Portfolio Performance Analysis

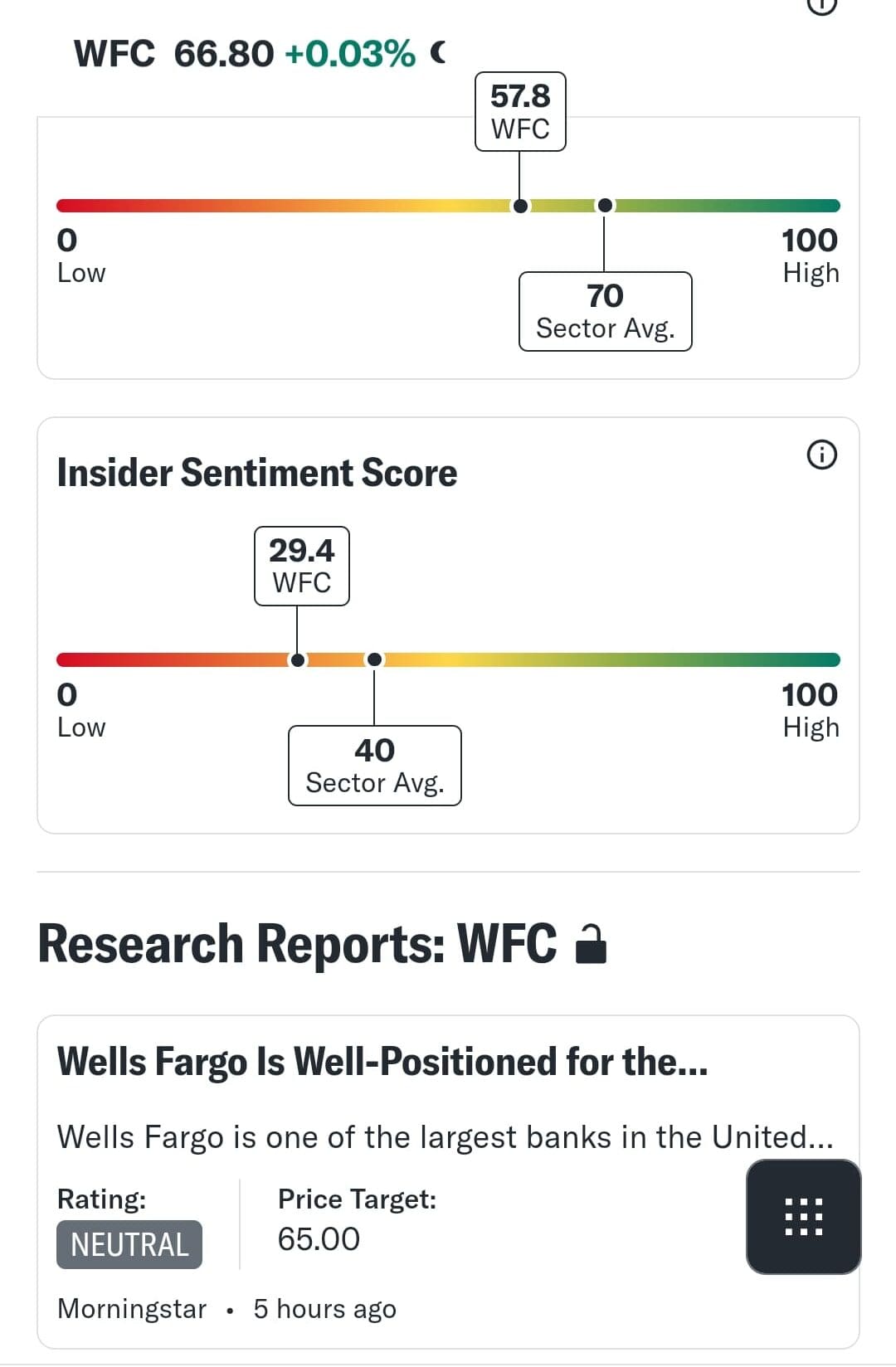

- Insider Trading Insights

- Real-Time Stock Quotes

- Deep historical financial data

- Personalized trade recommendations

- Smart Money stock tracking

- Advanced technical charting tools

- Premium financial news access

- No Level 2 market data

- Lacks AI-powered recommendations

- Limited global market coverage

- No options flow tracking

- No automated trading tools

Yahoo Finance Gold: Pricing And Comparison

The Yahoo Finance Gold plan is the most advanced tier, offering more tolls and options comapred to any oher Yahoo Finance plan.

Plan | Monthly Subscription |

|---|---|

Yahoo Finance – Bronze | $9.95

$95.40 ($7.95 / month) if paid annually |

Yahoo Finance – Silver | $24.95

$239.40 ($19.95 / month) if paid annually |

Yahoo Finance – Gold | $49.95

$479.40 ($39.95 / month) if paid annually |

While Bronze and Silver focus on portfolio analysis and fundamental research, Gold is ideal for investors who need both deep financial data and technical trading insights.

Gold Plan: Multiple Analysis & Research Tools

The Yahoo Finance Gold Plan includes advanced options for investors and traders – from personalized trade ideas to charting and various key insights:

-

Personalized Trade Ideas

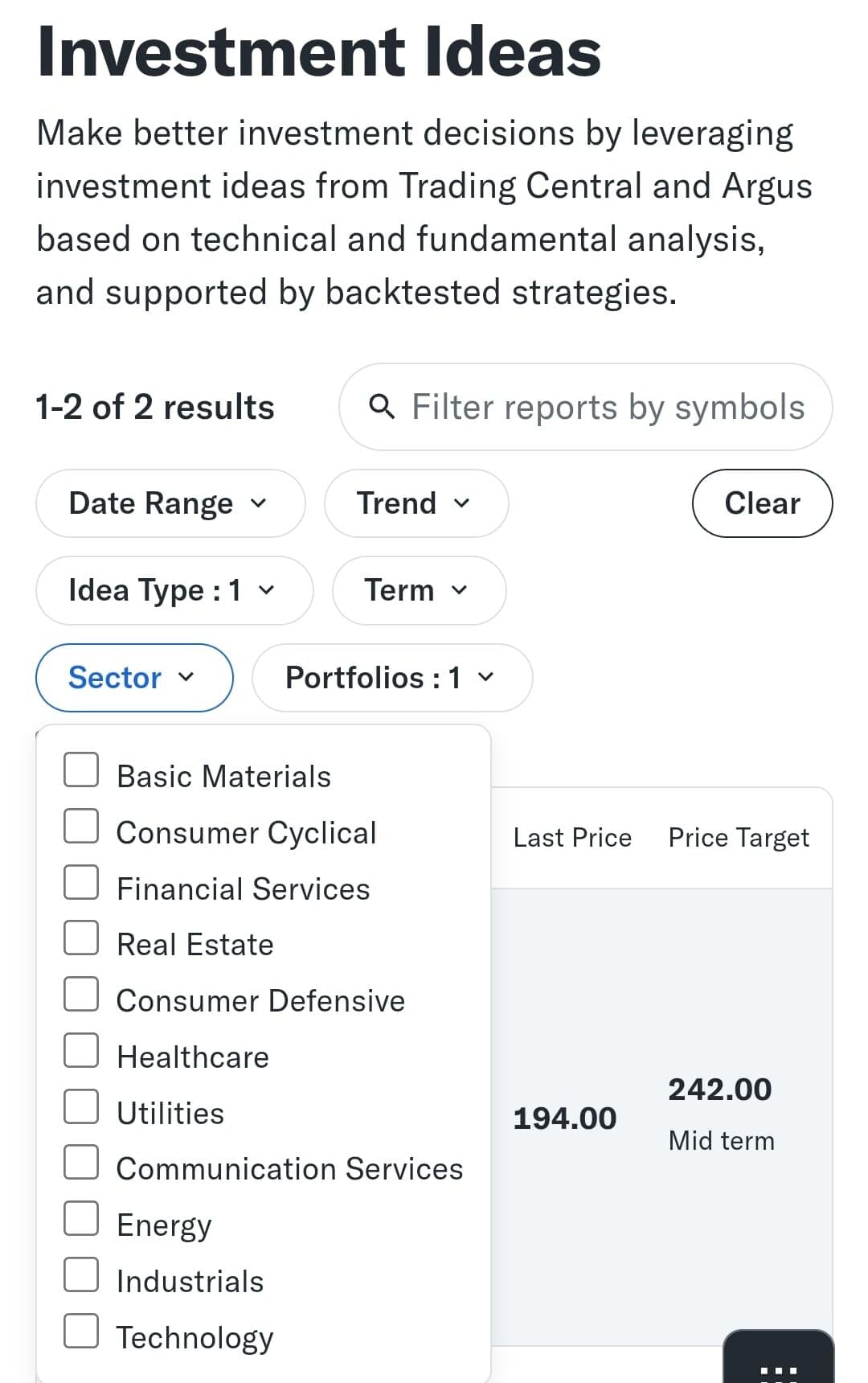

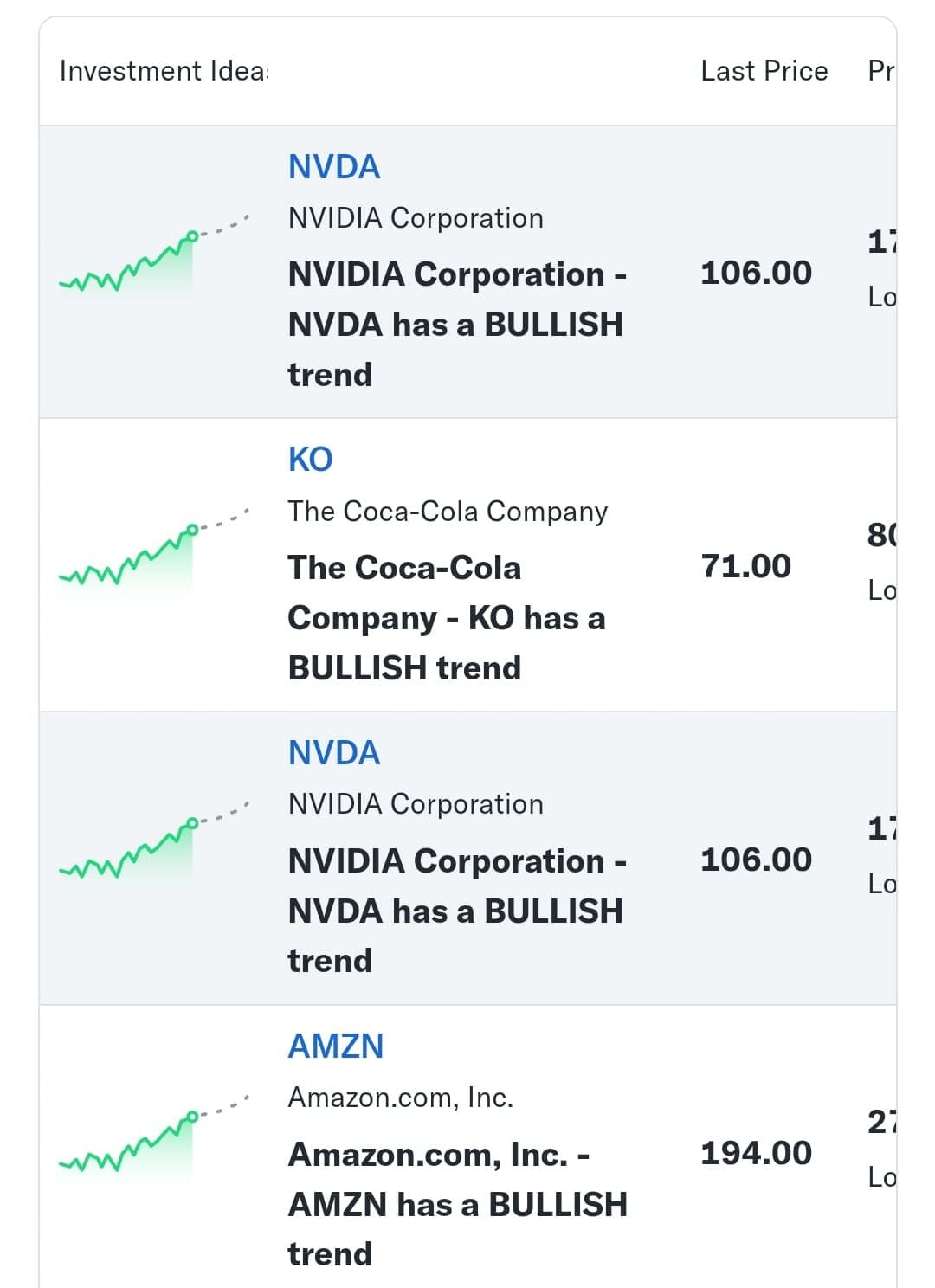

One of the most powerful features of Yahoo Finance Gold is Personalized Trade Ideas, which analyzes market trends, stock performance, and technical signals to generate customized trade opportunities.

Unlike the Silver plan, which provides research reports and stock ratings, Gold takes it further by offering actionable trade suggestions tailored to your interests and portfolio.

For investors looking to streamline stock research, this feature helps cut through market noise and focus on high-probability trades.

We tested it by entering a mix of growth stocks, dividend stocks, and value plays, and it returned curated investment ideas based on recent price trends, earnings performance, and technical indicators.

-

40 Years of Financial Statements

Yahoo Finance Gold gives users access to 40 years of historical financial statements, including income statements, balance sheets, cash flow reports, and earnings data.

The extended data set provides a much broader perspective on company stability, earnings consistency, and valuation trends.

For investors who conduct deep stock analysis, backtesting strategies, or long-term investment research, this feature is invaluable.

-

Advanced Charting – 50+ Technical Patterns & Annotations

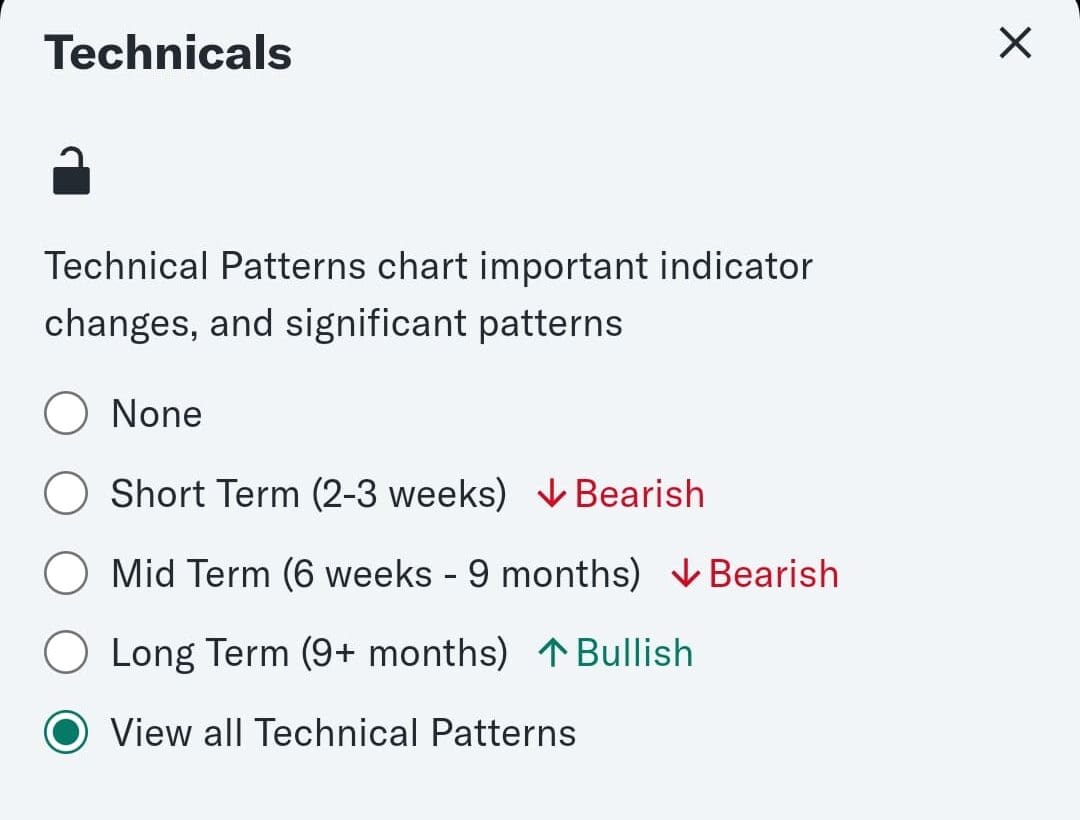

Yahoo Finance Gold brings professional-grade technical charting tools, including 50+ technical chart patterns, custom annotations, and event tracking.

We tested these tools by analyzing our preferred banking stocks, and it was clear how much of an upgrade this is over the basic charts in Silver.

Traders can use pattern recognition tools to identify head-and-shoulders formations, double bottoms, and breakout signals, making it easier to spot trading opportunities.

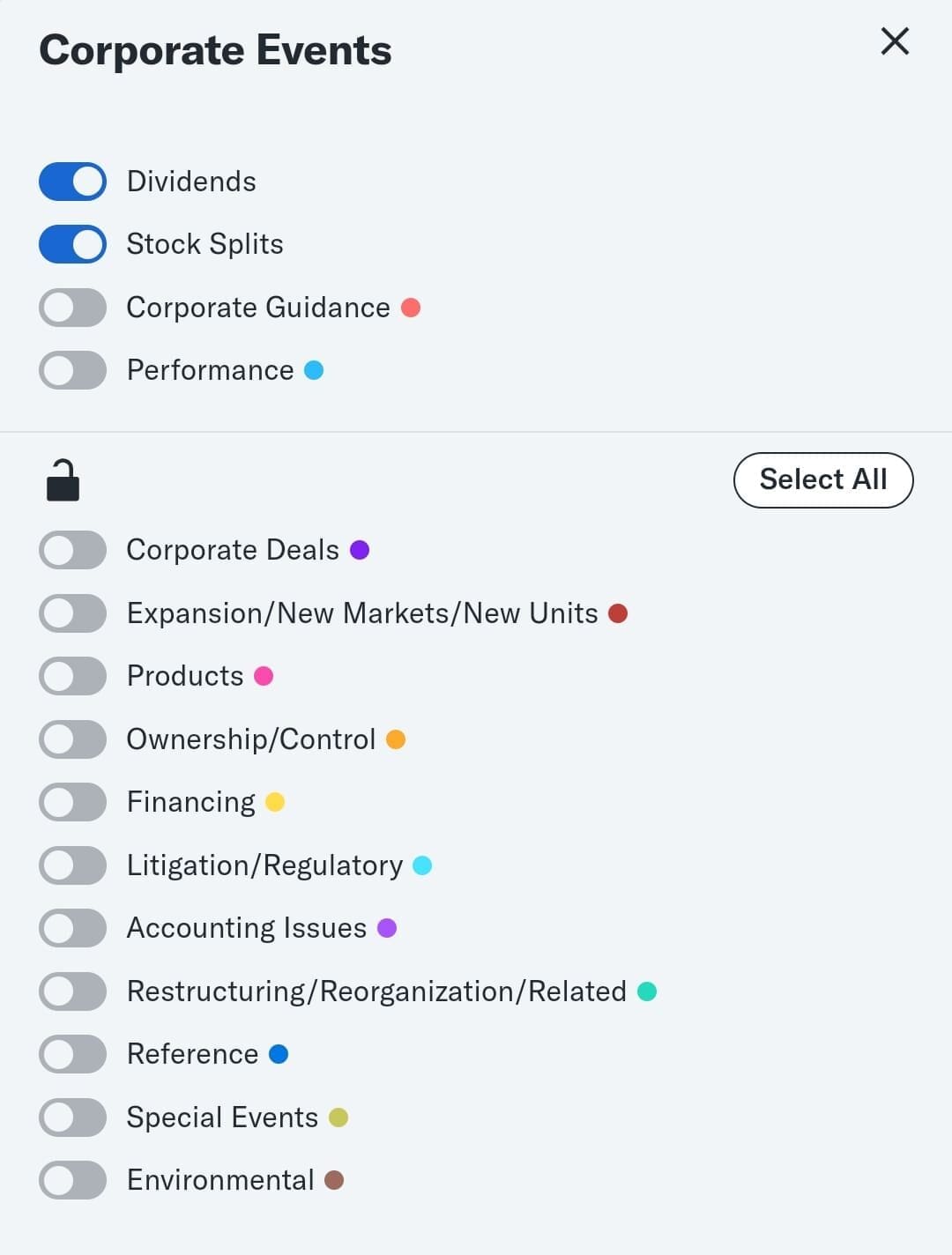

The ability to add custom annotations, event markers (earnings, dividends), and trend lines makes it useful for both short-term traders and long-term investors tracking price movements.

-

Smart Money Screener

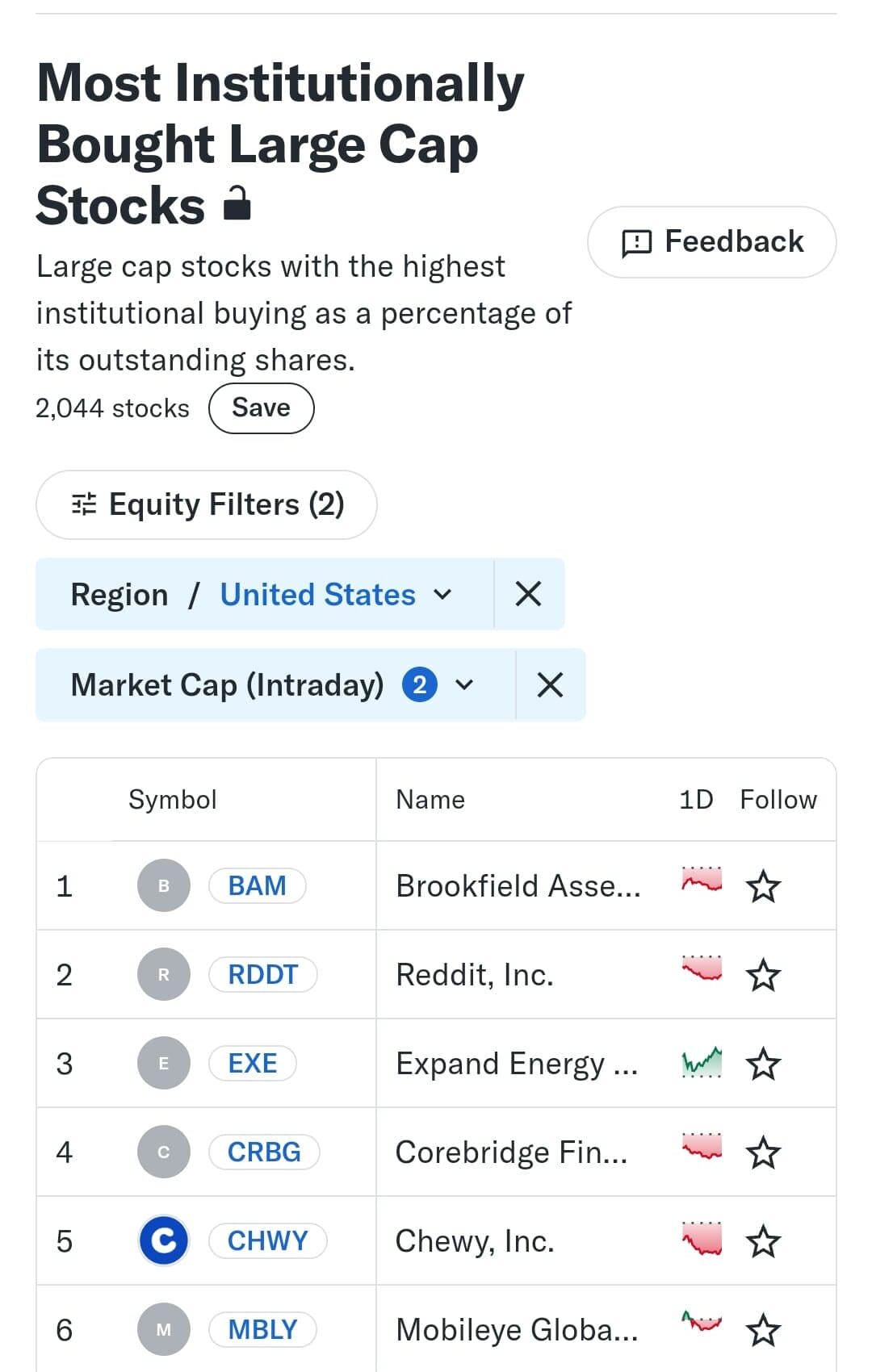

The Smart Money Screener in Yahoo Finance Gold is one of the most valuable research tools for investors looking to track what hedge funds, mutual funds, and large institutions are buying and selling.

We tested this by screening for stocks with strong institutional accumulation and found that it quickly highlighted companies gaining attention from major investment firms.

This tool helps investors align their portfolios with hedge fund strategies by identifying stocks with high institutional ownership, recent bulk purchases, and strong analyst sentiment.

-

Analyst Ratings Screener

The Analyst Ratings Screener compiles buy, hold, and sell ratings from multiple analysts and allows users to screen stocks based on consensus recommendations.

For long-term investors, this feature helps identify strong investment opportunities based on professional research, while short-term traders can use it to spot momentum stocks that recently received upgrades.

Additional Features & Tools Unique To The Gold Plan

Yahoo Finance Gold expands upon the Silver plan with additional unique features. Below are some of the standout features only available in Gold:

- Export Historical Data to CSV: Gold users can export historical stock data, earnings reports, and financial statements for in-depth analysis in Excel or Google Sheets.

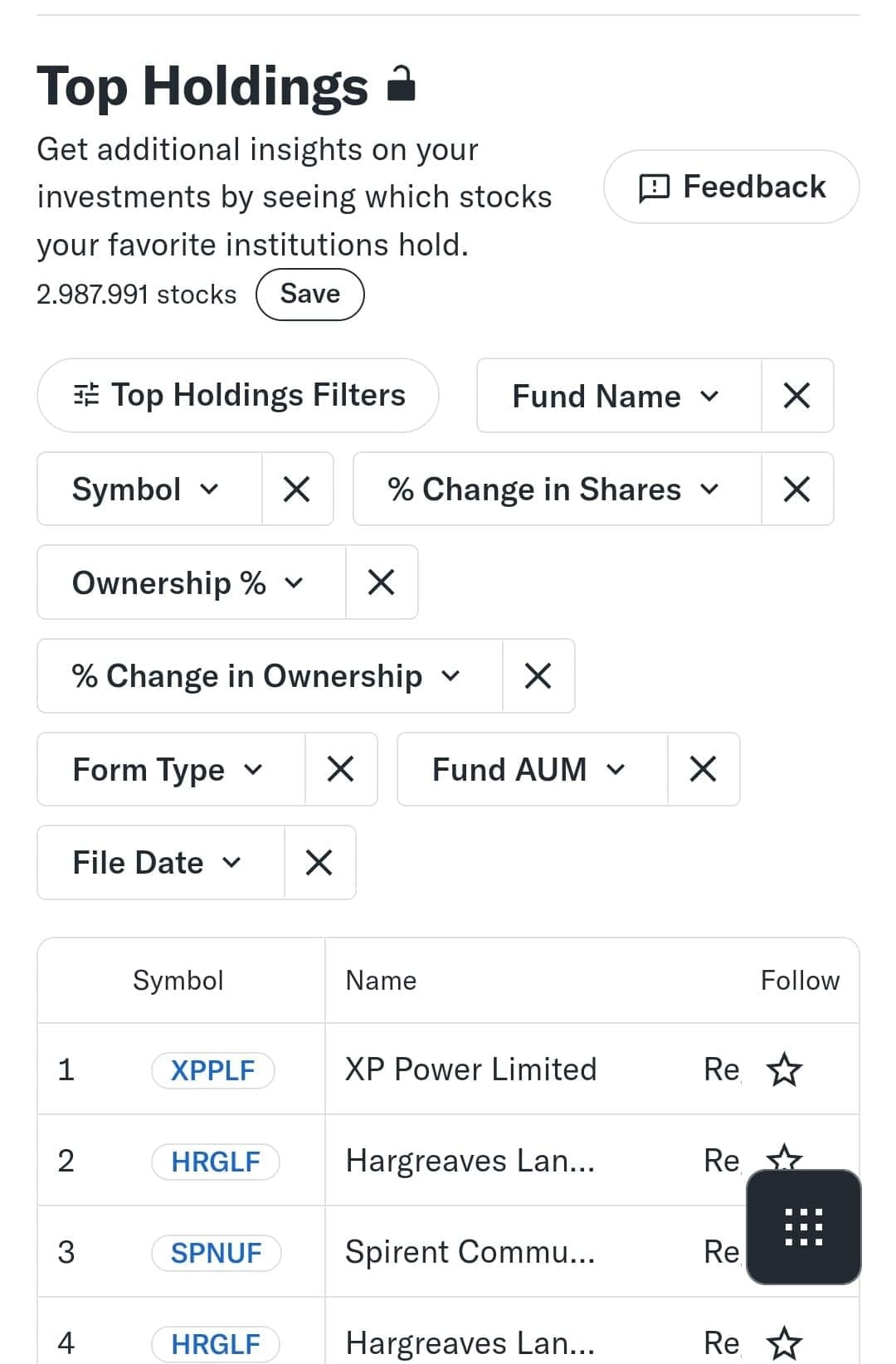

- Top Holdings Screener: This tool tracks stocks most commonly held by hedge funds, mutual funds, and institutional investors. It helps investors align their portfolios with major market players and institutional money trends.

- Alerts for Technical Patterns: Receive real-time alerts when stocks form technical patterns like breakouts, moving average crossovers, or trend reversals. This feature helps traders act quickly without constantly monitoring charts.

- Chart Events & Annotations: Gold users can mark key price levels, earnings events, and technical trends directly on stock charts. This helps with visualizing stock movements and identifying historical price reactions to market events.

- Technical Events Screener: This screener scans for key technical patterns across the market, helping traders find breakouts, trend reversals, and support/resistance levels. It’s ideal for identifying trade setups without manually reviewing charts.

Various Tools For Portfolio Analysis & Stocks Research

Yahoo Finance Gold Plan also offers various tools for research – whether it's stock screneer, expert reports

-

Morningstar Stock Ratings & Argus Research Stock Picks

Yahoo Finance Gold provides access to Morningstar stock ratings and Argus Research stock picks, offering independent, expert-backed investment insights.

We tested both features and found them invaluable for identifying high-quality stocks based on professional analysis.

- Morningstar’s star-rating system helps investors evaluate fair value, financial stability, and competitive positioning, making it easier to spot undervalued stocks with strong fundamentals.

- Argus Research adds actionable stock recommendations, highlighting buy and strong buy opportunities based on macroeconomic trends and sector performance.

For long-term investors, these tools simplify stock research by providing detailed reports and analyst opinions

-

Stock & ETF Screener

Yahoo Finance Gold users still have access to the Stock & ETF Screener, a powerful tool for finding high-potential stocks based on fundamental and technical criteria.

We tested it by filtering stocks with strong earnings growth, high dividend yields, and positive analyst ratings, and it quickly provided quality investment ideas.

For traders, the screener helps identify momentum stocks or undervalued opportunities, while long-term investors can screen for stable, dividend-paying companies.

Gold users benefit from added technical screeners that help fine-tune stock selection even further.

-

Portfolio Performance Analysis

Gold users continue to enjoy the Portfolio Performance Analysis tool, which offers a detailed breakdown of returns, sector allocation, and volatility exposure.

We tested it by linking multiple stocks and ETFs, and it provided a clear visual of portfolio diversification and risk.

For long-term investors, this tool helps ensure proper asset allocation and risk management. Traders can use it to track short-term gains and identify underperforming assets.

The deeper historical financial data in Gold makes portfolio tracking even more powerful.

-

Insider Trading & Institutional Holdings

Tracking insider transactions and institutional trades is a valuable feature Gold users retain.

We used this tool to see which executives were buying or selling shares, helping us gauge insider confidence in a stock.

For investors following hedge fund strategies, this tool helps identify stocks gaining institutional interest.

Gold users benefit from the ability to export data for further analysis, giving them an advantage in tracking big money movements.

-

Real-Time Stock Quotes

One major advantage Gold users retain is real-time stock quotes, ensuring instant price updates without delay.

When we tested this feature, it provided accurate and up-to-the-minute price movements, which is essential for traders making quick decisions.

While free users experience delayed data, Gold members get live market updates, helping them track price changes, monitor watchlists, and react to breaking news in real time.

-

Premium Newsfeed

Gold users retain access to premium news sources like Financial Times and The Information, providing institutional-grade financial journalism.

We used this feature to stay updated on global economic shifts, earnings insights, and stock-specific reports, helping us make better-informed investment decisions.

Compared to free financial news, these reports are more detailed and timely, allowing investors to anticipate market moves before they happen.

Gold’s deeper historical data allows users to track how past news events impacted stock prices.

-

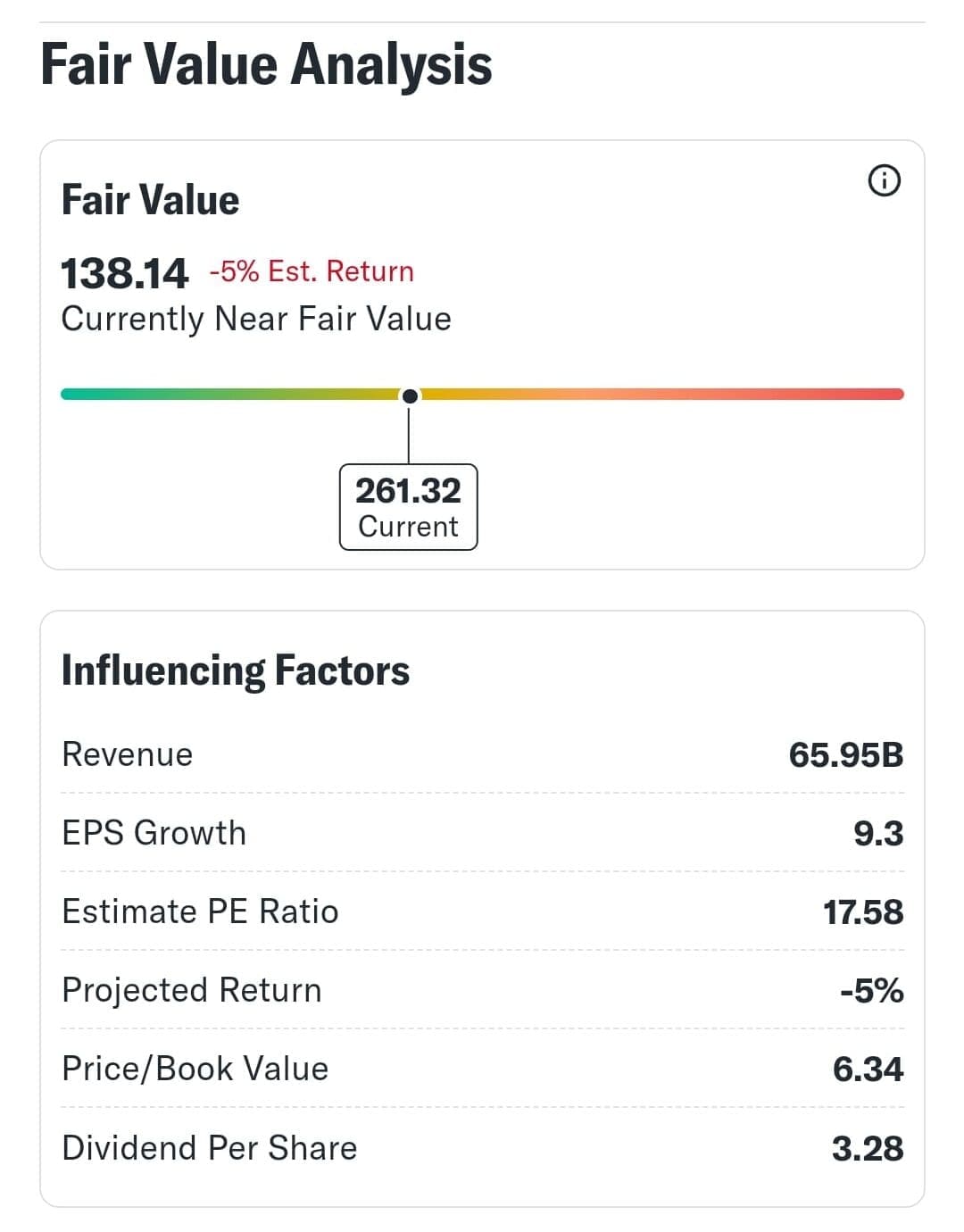

Fair Value & Dividend Analysis

Yahoo Finance Gold continues to offer fair value and dividend sustainability analysis, helping investors identify undervalued stocks and strong dividend payers.

We used this tool to screen for stocks trading below fair value with strong dividend growth, and it provided actionable insights.

For income investors, this feature highlights dividend safety scores, payout ratios, and expected yield growth, ensuring they choose financially stable companies.

Gold users also get historical fair value comparisons, making valuation analysis even more robust.

Yahoo Finance Gold: Where It Falls Short

The Yahoo Finance Gold plan is the most advanced tier. However, despite its premium features, it still has some notable limitations that could be improved:

-

No Comprehensive Global Market Coverage

Yahoo Finance Gold primarily focuses on U.S. markets, with limited international stock data and research coverage.

For global investors looking for deep insights into European, Asian, or emerging markets, Gold lacks the real-time financial data and research reports that competitors like Bloomberg Terminal, FactSet, and Interactive Brokers provide.

-

No Options Flow Data or Advanced Derivatives Analysis

For options traders, Yahoo Finance Gold does not include real-time options flow tracking, implied volatility charts, or options-specific stock ratings.

Platforms like Market Chameleon or Tastyworks provide options trade flow data, max pain levels, and volatility insights, which are critical for trading options strategies.

-

No Customizable Technical Indicators or Strategy Automation

Yahoo Finance Gold improves charting with 50+ technical patterns, but it does not allow users to create or customize technical indicators like TradingView, ThinkorSwim by Schwab, or NinjaTrader.

Additionally, there is no automated trading or backtesting capability, meaning traders must manually analyze setups without automated alerts or scripts.

Yahoo Finance Gold: Who Should Use It?

The Yahoo Finance Gold plan is designed for investors and traders who need advanced stock research, technical analysis tools, and historical financial data.

Here’s who will benefit the most:

- Long-Term Investors & Value Investors: Access to 40 years of financial data, fair value analysis, and Morningstar stock ratings helps long-term investors identify undervalued stocks with strong fundamentals.

- Investors Who Follow Institutional Money: The Smart Money Screener and Top Holdings Screener allow investors to track where hedge funds and major institutions are investing.

- Stock Market Researchers & Data Analysts: The ability to export historical stock data to CSV is useful for those who backtest strategies or analyze financial trends over time.

- Active Investors Who Want Personalized Trade Ideas: The custom trade suggestions provide guidance for investors looking for curated stock picks based on market trends and performance.

Yahoo Finance Gold: Who Should Avoid It?

While Yahoo Finance Gold is a great choice for fundamental investors, it still lacks some key features that active traders, options traders, and AI-driven investors may need. Here’s who might find it less suitable:

- Day Traders & High-Frequency Traders: Gold does not include Level 2 market data, real-time bid/ask spreads, or advanced order flow tracking, which are essential for fast-paced trading strategies.

- Options & Futures Traders: Yahoo Finance Gold does not provide real-time options flow data, implied volatility tracking, or options trade analytics, making it less useful for derivatives traders compared to platforms like ThinkorSwim or Market Chameleon.

- Global Market Investors: The platform focuses primarily on U.S. stocks, with limited real-time data and research on international markets, making it less useful for investors trading European, Asian, or emerging market stocks.

Yahoo Finance Gold Plan Compared to Competitors

Yahoo Finance Gold competes with TipRanks Ultimate, TradingView Premium, InvestingPro+, and Seeking Alpha PRO.

While it offers deep historical data and technical charting tools, it lacks real-time order flow, AI-driven trade signals, and institutional sentiment tracking that exist in most competitors.

Plan | Subscription | Promotion |

|---|---|---|

Motley Fool Epic | $499 (41.60 / month)

No monthly plan

| 30-day money-back guarantee |

TradingView Premium | $59.95

$432 ($23.98 / month) if paid annually | 30-day free trial |

Zacks Ultimate | $299

$2,995 ($249.5 / month) if paid annually | 30-day free trial |

InvestingPro+ | $39.99

$300 ($24.99 / month) if paid annually | N/A |

Seeking Alpha PRO | $2,400 ($200 / month)

No monthly subscription | $99 for 1 month |

TipRanks Ultimate | $599 ($50 / month)

No monthly plan | 30 day money-back guarantee |

Yahoo Finance Gold | $49.95

$479.40 ($39.95 / month) if paid annually | N/A |

FAQ

No, while it provides portfolio tracking and diversification insights, it does not offer automated rebalancing or tax-efficiency recommendations like robo-advisors such as Wealthfront or Personal Capital.

Gold includes 50+ technical chart patterns and screeners, but it lacks fully customizable screening tools that allow users to create their own trading indicators like TradingView or ThinkorSwim by Schwab.

Yes, Gold users can export historical stock data and financial reports to CSV files, making it easier to perform custom analysis in Excel or Google Sheets.

Yes, Gold users can set alerts for price movements, analyst ratings, and technical chart patterns, ensuring they never miss important market signals.

No, Yahoo Finance does not provide full earnings call transcripts. Platforms like Seeking Alpha Pro or Zacks Research offer more detailed earnings call analysis.

Yes, Gold includes Smart Money Screener and Top Holdings Screener, which allow users to see where hedge funds and institutional investors are putting their money.

Gold includes everything in Silver, plus personalized trade ideas, 40 years of financial data, technical pattern alerts, and institutional trade tracking, making it better suited for advanced investors and traders.

Review Premium Stock Analysis Tools

How We Rated Premium Investing Analysis & Research Tools

At The Smart Investor, we evaluated premium investment research platforms based on their advanced features, data depth, and overall value compared to other paid alternatives. Each platform was rated based on the following key aspects:

- Advanced Fundamental Analysis Tools (20%): We assessed the depth of financial data, historical reports, earnings forecasts, and valuation models. Platforms that provided institutional-grade insights, DCF analysis, customizable financial models, and access to premium analyst reports scored higher.

- Advanced Technical Analysis Features (20%): We reviewed the availability of real-time charting, advanced indicators, custom scripting, and AI-driven pattern recognition. Platforms that offered backtesting tools, automated trading strategies, and integration with third-party software received better ratings.

- Stock Screener & Premium Filters (15%): A high-quality screener is essential for pro investors, so we evaluated customization depth, real-time filtering, and AI-driven stock discovery. Platforms offering pre-built expert screeners, backtesting capabilities, and sector-specific analytics scored the highest.

- Portfolio Tracking & Advanced Alerts (10%): We rated platforms on their ability to provide real-time performance tracking, portfolio rebalancing tools, and tax optimization insights. Platforms with smart alerts, AI-driven risk assessments, and brokerage integration ranked higher.

- Ease of Use & Customization (15%): We assessed how well premium platforms balance advanced capabilities with user-friendly interfaces. Those offering custom dashboards, API access, and seamless multi-device usability received better ratings.

- Pricing (20%): We considered how the plan's pricing compared to other premium plans and what benefits traders/investors get. Is it worth it overall?