AmONE was created with the intention of making it easier to help you find a personal loan. This lender marketplace uses your information to match you up with the right loan.

APR

6.78-35.99%

Loan Amount

$1,000 – $50,000

Term

24-84 months

Min score

300

AmONE was created with the intention of making it easier to help you find a personal loan. This lender marketplace uses your information to match you up with the right loan.

APR

6.78-35.99%

Loan Amount

$1,000 – $50,000

Term

24-84 months

Min score

300

- Our Verdict

- Pros & Cons

AmONE is a personal loan marketplace. With different lending options available, you can shop here for any type of personal loan. After becoming pre-qualified, they will help you find the right loan.

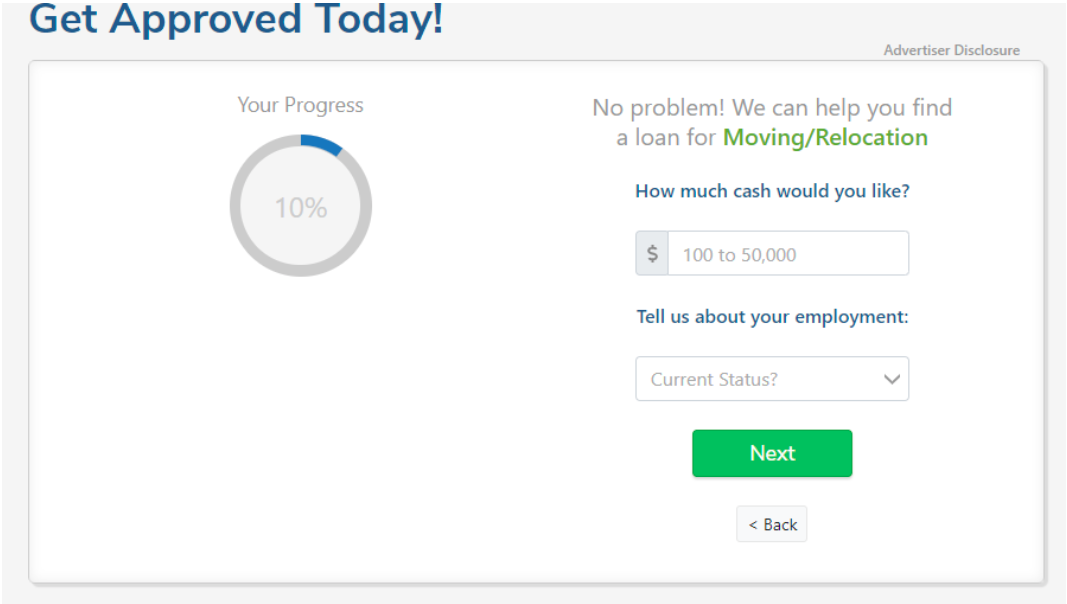

You will get approved quickly and can have access to the right loan for you within a matter of minutes. The first thing you will do is select the purpose of your personal loan and what your estimated credit score is.

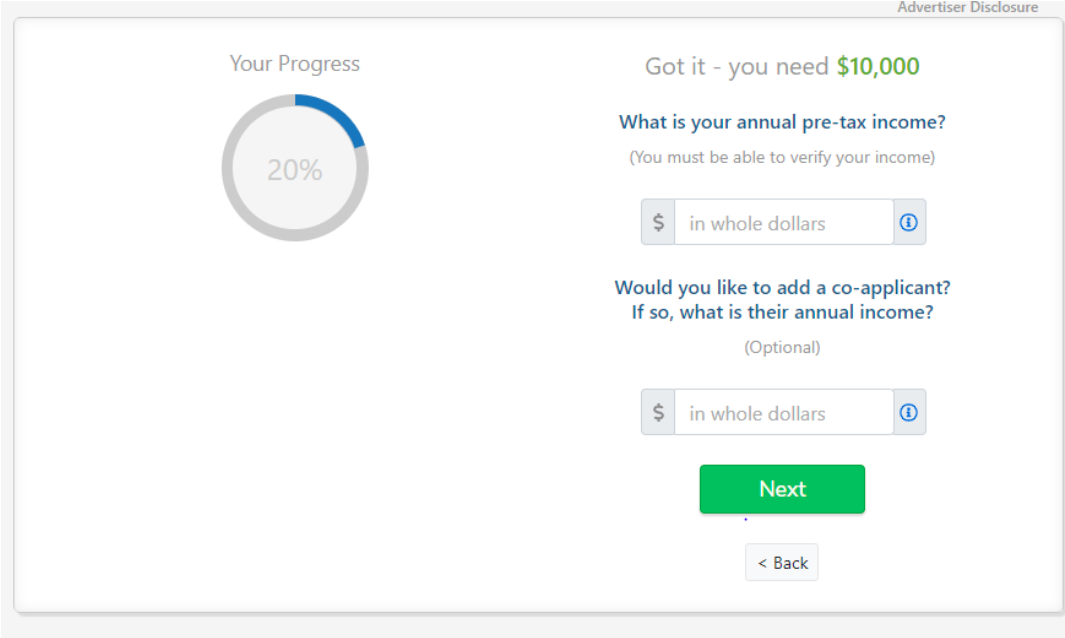

After this step, you input how much money you are trying to borrow and what your employment status is. It takes you through other basic information like income, marital status, and mortgage information. You can see your loan options right on the screen after inputting all your information.

Keep in mind that AmONE will not be your lender; they just work to connect you with the right lender for you. With so many lending partners available, you are sure to find the right loan.

Remember that like most financial transactions and loans, you have a chance at a better interest rate the higher your credit score. If you are having credit trouble, AmONE can still work to find you a loan partner.

- Easy Application Process

- Different Help Available

- Compare Options

- Excellent Service

- Rate Information is Tucked Away

- Detailed Application Process

- Too much Information

In this Review..

AmONE Loan Pros & Cons

As we know, each lender has its own pros & cons – here are the relevant things we found for potential borrowers:

- Easy Application Process

AmONE went out of their way to streamline the application process. After you enter in your information, you are connected with loan options almost immediately.

- Different Help Available

AmONE has other resources on their website as well. You can also link to credit card options no matter what your credit history is and they also walk you through all available options for debt relief, making them a marketplace that is great at working with people with iffy credit.

- Compare Options

You can easily shop and compare and to figure out which lender or loan is the best option for you to pursue. Comparing different options has never been as easy as it is with AmONE.

- Excellent Service

AmONE has great best customer service with a 1-800 number you can call to talk to a real human being if you need to. They do go above the call of duty to make sure you are satisfied with their marketplace.

- Rate Information is Tucked Away

Some marketplaces have rates available on the landing page, but that is not the case with AmONE. You do have to go through the application process to see what your rate options will be. It would be nice if there were ballpark rates included on the landing page.

- Detailed Application Process

The good news is you will get your loan recommendations after the applications, the bad news is there are a lot of questions to fill out. It can feel like you are sharing your entire life history and the application might feel like it will never end.

- Too much Information

AmONE focuses a lot on debt relief and debt consolidation. This is good news if that’s what you are looking for. But, you might not have any debt. Just because you are shopping for a personal loan doesn’t mean that you are in debt. You could just be doing a home renovation or buying a boat. It can be cumbersome sifting through the debt relief information if you aren’t interested in reading it.

What Can a AmONE Personal Loan Be Used For?

Since you are looking for a marketplace for choosing a loan lender, you are going to get a lot of interest rates returned based on your credit history. These are real rates that AmONE has acquired for you from real lenders. If the interest rates seem high it is because your credit is bad, and you might want to consider some of the debt consolidation information on the website before securing a loan.

AmONE is not yet accredited through the Better Business Bureau, but on Consumer Affairs they were rated 4.7/5 by customers who have used their service. A solid rating, you likely won’t be disappointed if you use AmONE.

AmOne Reputation

- A+ on BBB: BBB assigns ratings from A+ (highest) to F (lowest). BB ratings are based on information in BBB files with respect to factors such as the business's complaint history with BBB, type of business, time in business, transparent business practices, and more.

- 4.7/5 on Consumer Affairs (+230 reviews): Consumer Affairs reviews allow customers to post positive, negative, or neutral reviews about marketplace experiences.

- 4.6/5 on Trustpilot ( +850 reviews): TrustScore is also an overall measurement of reviewer satisfaction, represented numerically from 1 to 5.

- J.D Power: We considered J.D. Power’s lending consumers satisfaction study. .J.D Power offers the most comprehensive and independent study of personal loans consumer satisfaction . The study aims to help consumers and issuers to understand user opinions and ratings of top lenders. It covers terms, benefits, services, communication, transparency and more. AmOne wasn't rated in the 2020 research.

How to Get Rates on AmONE Website?

- 1.

Start by choosing the purpose of the loan you are requesting and entering an amount for the loan you are requesting and what your estimated credit score is.

- 2.

Let AmONE know how much you need to borrow and what your employment status is.

- 3.

From here, you will share your income and other personal information. Don’t withhold any information as the banks will ultimately require it before issuing you a loan.

- 4.

After you finish everything you will see what loans are available for you. It only takes a few minutes and you can start comparing loans right away.

AmONE FAQs

Should I use AmOne?

AmOne has a lot to offer. If you are in need of a personal loan because you are in debt, this is a great company to work with. Their customer service is great and they can help you every step of the way.

While AmOne might not be able to get you great rates if you have bad credit, they can work with you so you can see how you can clear up some debt.

Is AmOne trustworthy?

AmOne has a solid reputation within the lending industry. The company has an excellent rating on Trustpilot (4.5 out of 5) with hundreds of positive reviews and an A+ BBB rating with no complaints on file. This suggests that if any issues do arise, the AmOne team deals with them promptly, so consumers are not venting their frustrations with independent review sites.

Does AmOne affect credit score?

AmOne provides access to loans for all types of credit and financial circumstances. The preapproval process does not involve a hard credit search, so it won’t affect your credit score.

However, if you decide that you want to proceed with a loan deal, the lender working with AmONE may ask permission to check your credit file.

Is AmOne better than Credible?

Like AmONE, Credible has a decent reputation, especially on Trustpilot. However, while AmONE has a focus on personal loans, business loans and debt consolidation, Credible offers access to student loans and student loan refinancing, home loans and mortgages. This may mean that it is not as flexible for you if you have a start up in need of finance.

Both companies offer loan options for different credit ratings, but AmOne advertises that you can receive funds in as little as 24 hours after approval. However, Credible has a lower APR for those with good credit and can help you source loans up to $100,000 rather than the $50,000 cap with AmOne.

Is AmONE better than Monevo?

Monevo also provides access to loans up to $100,000 , but the actual rate will depend on your circumstances. Additionally, while AmONE has a good BBB rating, Monevo is BBB accredited, which means the company adheres to the strict BBB guidelines.

Another key difference is that Monevo allows you to select the amount and reason for seeking finance to compare appropriate types of loans. AmONE specializes in different types of finance, which may be more appropriate for some consumers.

Alternative Personal Loans Marketplaces

| |||

|---|---|---|---|

APR Range

The annual percentage rate (APR) is the total annual cost of borrowing money. This rate includes the interest rate as well as any additional finance charges. When you take out a personal loan, for example, you may be required to pay loan origination fees.

| 7.49% – 35.99%

| 4.99% – %35.99

| 5.99% – 35.99%

|

Term

The term of your loan is the amount of time you have to repay it. For example, if you get a 24 months personal loan, the loan term is 24 months.

| 12-84 months | 6-84 months | 3-72 months |

Loan Amount | $600 – $200,000 | $1,000 – $100,000 | $1,000 – $35,000 |