InvestingPro | Benzinga Pro Basic | |

Price | $120 ($9.99 / month)

| $367 ($30.58 / month) |

Best Features | ||

Our Rating |

(4.5/5) |

(4.4/5) |

Read Review | Read Review |

InvestingPro vs. Benzinga Pro: Compare Top Features

In this article, we’ll compare InvestingPro and Benzinga Pro Basic, diving deep into their features and tools.

We’ll help you understand which platform offers the best value for stock research, market analysis, and investment strategies.”

-

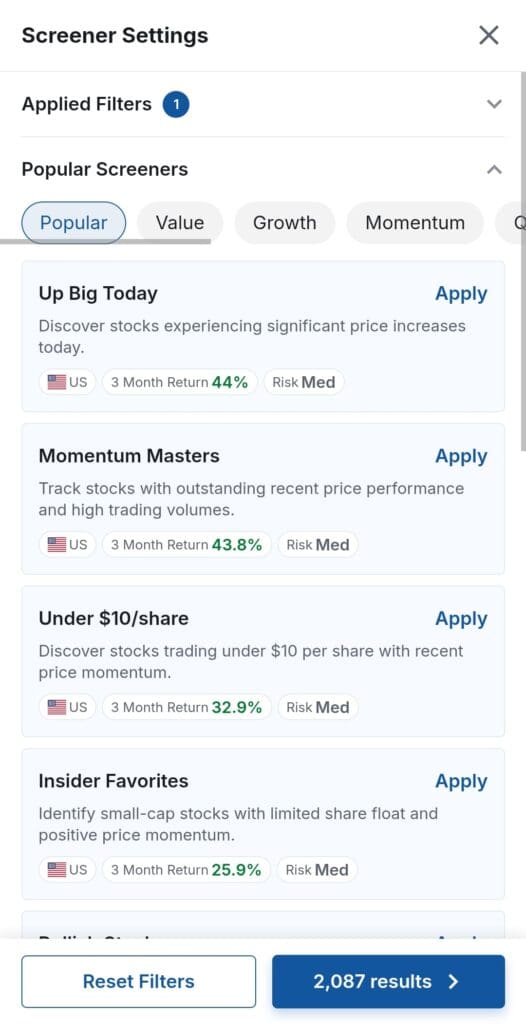

Stock Screening Tools

InvestingPro’s advanced stock screener stands out for its comprehensive filtering options, including over 1,000 metrics such as revenue growth, profitability indicators, and valuation measures.

It lets us filter stocks based on sector, country, and other key criteria, making it easy to find high-potential opportunities.

On the other hand, Benzinga Pro Basic lacks an advanced screener, offering only basic search functions without the ability to filter based on detailed financial metrics.

-

Our Winner

InvestingPro clearly outperforms Benzinga Pro Basic in this category.

-

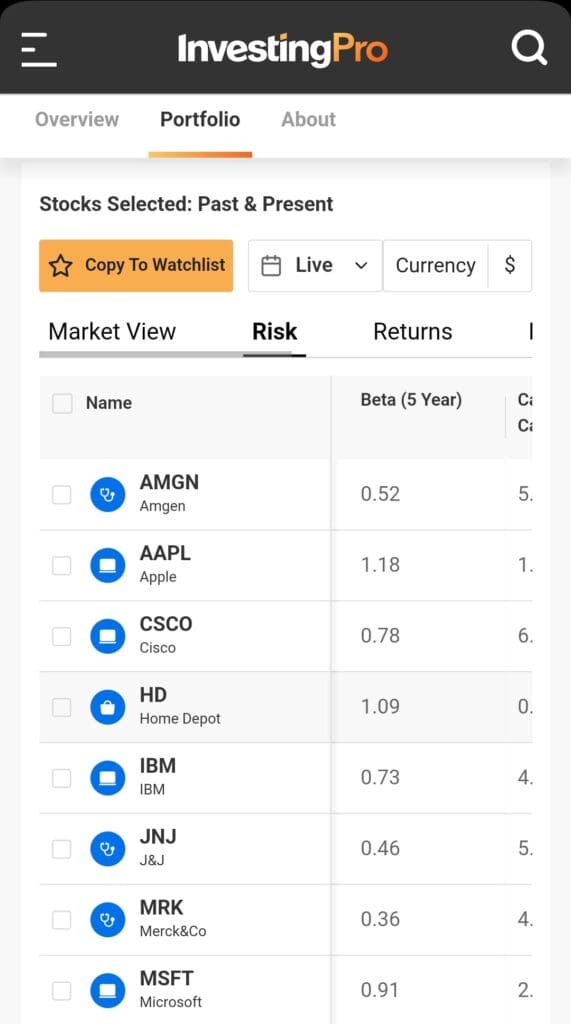

Fundamental Analysis Tools

In terms of fundamental analysis, InvestingPro provides a robust set of tools, including in-depth fair value estimates, company health scores, and over 1,000 data points for financial analysis.

The ProTips feature gives us actionable insights on individual stocks based on a deep dive into company metrics and sector rankings.

In contrast, Benzinga Pro Basic focuses more on stock news and financial updates but lacks tools like comprehensive stock analysis reports or in-depth company metrics.

While it provides essential earnings data and insider trading information, it doesn’t offer the same level of fundamental depth.

-

Our Winner

InvestingPro excels with its advanced fundamental analysis features.

-

Stock Picks & Recommendations

InvestingPro’s AI-powered stock picks (AI ProPicks) are a key feature, as they help investors identify potential opportunities based on proven strategies and market patterns.

This gives us stock recommendations without the need for extensive manual research.

However, Benzinga Pro Basic does not offer any proprietary stock picks or recommendations. Instead, it provides stock-moving news and analyst ratings, but these are not as curated or driven by AI as InvestingPro’s picks.

-

Our Winner

For those seeking automated stock recommendations, InvestingPro is the better choice.

-

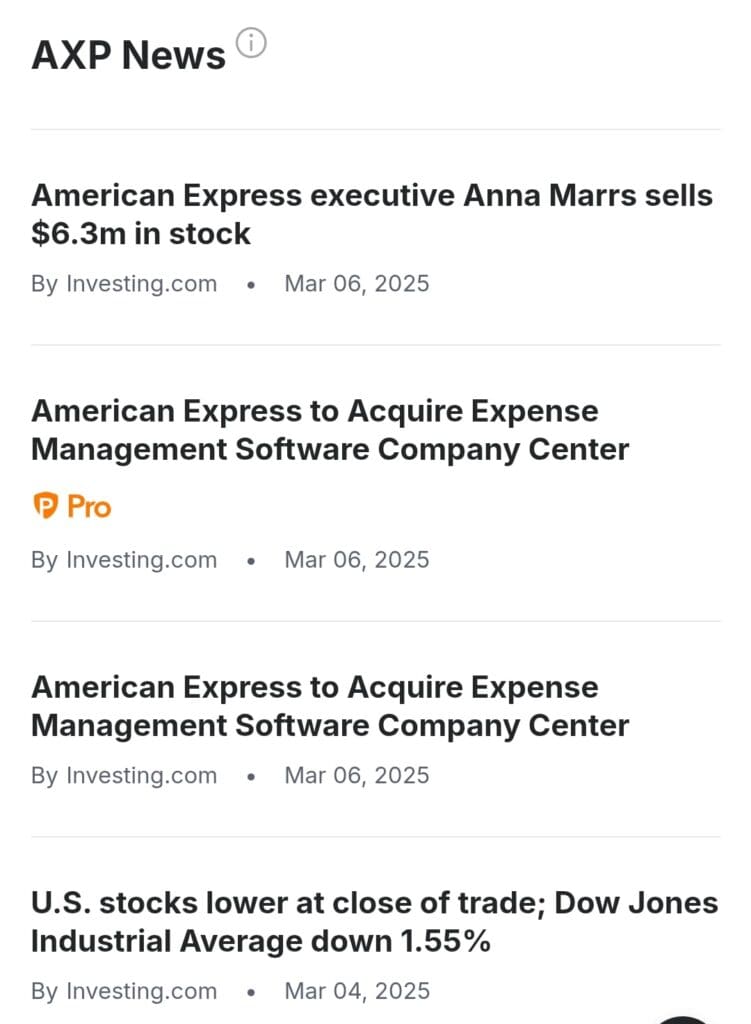

Market Sentiment Analysis

Both platforms offer market sentiment analysis, but they focus on different aspects. InvestingPro’s real-time market data and premium news keep us up-to-date with stock prices, earnings reports, and breaking market news.

The platform provides stock alerts and watchlists to track changes in real-time, but lacks social sentiment or social media integration.

On the other hand, Benzinga Pro Basic shines with its full newsfeed, offering real-time updates and the ability to track stock movers and earnings reactions.

Additionally, it includes some social aspects, such as insider trading alerts and analyst ratings.

-

Our Winner

Benzinga Pro Basic provides a more dynamic news-driven sentiment analysis tool.

-

Portfolio Analysis & Alerts

InvestingPro offers stock alerts and watchlists to help track price changes, fair value gaps, and market news. The alerts are highly customizable, allowing us to monitor multiple stocks effectively.

Benzinga Pro Basic also offers watchlist alerts, notifying us of price movements, news, and earnings reports.

While both platforms excel in this area, InvestingPro’s custom stock alerts and its integration with fair value changes make it a more comprehensive tool for portfolio management.

-

Our Winner

InvestingPro provides more advanced portfolio alerts.

-

Technical Analysis Options

We tested the technical analysis tools on both InvestingPro and Benzinga Pro Basic.

InvestingPro provides customizable stock charts that include basic technical indicators and overlays, making it easy to track price action, trends, and technical signals.

However, it lacks advanced charting features like real-time charting or custom technical indicators, which limits its use for active traders.

On the other hand, Benzinga Pro Basic includes interactive charts with momentum, stochastic, and volatility indicators, but it only supports two indicators per chart, which can be restrictive for in-depth analysis.

-

Our Winner

Benzinga Pro Basic has a slight edge in technical analysis features.

InvestingPro offers basic but useful charting, while Benzinga Pro provides slightly more technical indicators but with fewer customization options.

-

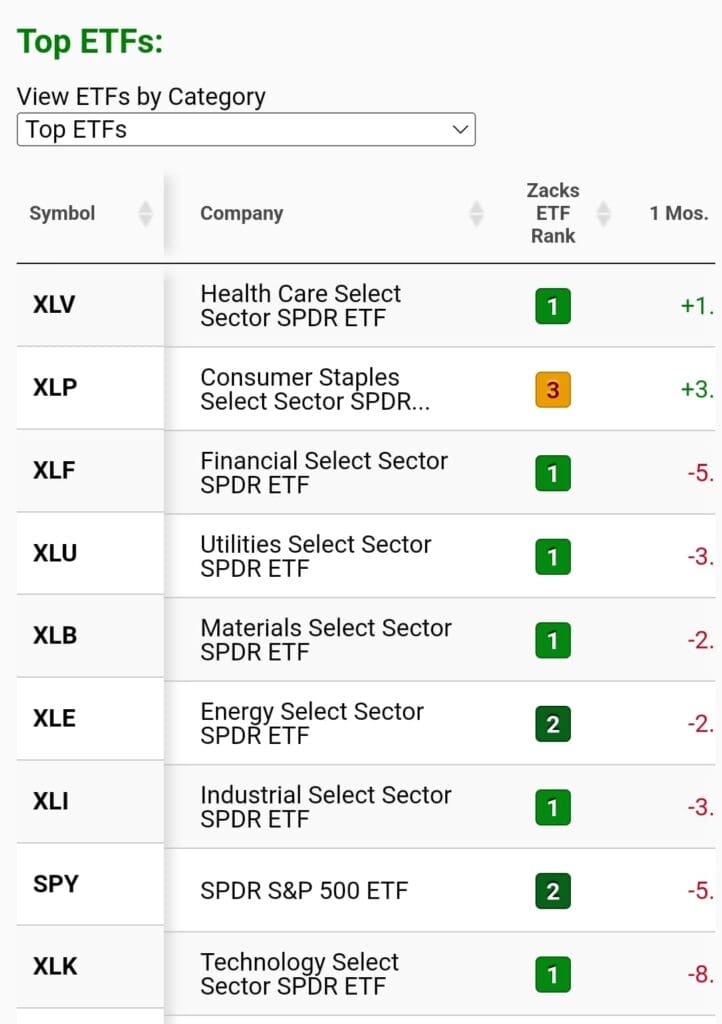

ETF, Bonds & Fund Analysis Tools

InvestingPro includes ETF performance tracking, sector trends, and holdings analysis, but its main strength lies in stock research, making it a bit more limited for bond or fund analysis.

Benzinga Pro Basic, while offering basic ETF data and trends, excels in monitoring stocks within funds and provides access to dividends, earnings reports, and insider activity.

However, neither platform provides in-depth bond analysis tools, which would be useful for bond investors.

-

Our Winner

Benzinga Pro Basic offers slightly more in terms of ETF tracking and general fund analysis.

Which Investors May Prefer InvestingPro?

An InvestingPro subscription can be ideal for investors focusing on deep fundamental analysis and long-term stock valuation. It's ideal for:

Long-Term Investors: Its focus on fair value estimates and company health scores helps identify undervalued stocks for long-term holdings.

Value Investors: Those looking for stocks trading below intrinsic value will benefit from its extensive financial metrics.

Dividend Investors: Features like dividend growth tracking and payout analysis make it easy to find reliable income-generating stocks.

Fundamental Analysts: If you prefer analyzing financials, balance sheets, and valuation, InvestingPro provides over 1,000 data points.

Plan | Monthly Subscription |

|---|---|

InvestingPro | $15.99

$120 ($9.99 / month)

if paid annually |

InvestingPro+ | $39.99

$300 ($24.99 / month) if paid annually |

Which Investors May Prefer Benzinga Pro?

A Benzinga subscription is ideal for investors who want to prioritize real-time news and market updates so they can react quickly. It suits:

Active Traders: With real-time stock quotes and stock movers data, it helps make swift decisions based on market movements.

News-Driven Investors: Those who rely on breaking news, earnings reports, and SEC filings to guide investment decisions.

Momentum Traders: Benzinga Pro’s customizable alerts and earnings reaction data make it ideal for tracking and capitalizing on price movements.

Long-Term Investors: Although basic, it still offers valuable stock data, analyst ratings, and insider trading activity.

Plan | Monthly Subscription | Promotion |

|---|---|---|

Benzinga Pro – Basic | $37

$367 ($30.58 / month) if paid annually | 14-day free trial |

Benzinga Pro – Streamlined | $147

$1,497 ($124.75 / month) if paid annually | 14-day free trial |

Benzinga Pro – Essential | $197

$1,997 ($166.42 / month) if paid annually | 14-day free trial |

Benzinga Edge | $19

$228 if paid annually

| $129

$129 for new member’s annual price ($11/month), including 7-day money-back guarantee

|

Bottom Line

InvestingPro excels in fundamental analysis, offering comprehensive stock research tools, AI-driven stock picks, and fair value analysis, making it perfect for long-term and value investors.

On the other hand, Benzinga Pro shines in delivering real-time news, earnings updates, and stock alerts, making it a top choice for active and news-driven traders.