|

| |

|---|---|---|

MarketBeat All Access | Benzinga Pro Basic | |

Price | $399 ($33.25 / month) | $367 ($30.58 / month) |

Best Features | ||

Our Rating |

(4.6/5) |

(4.4/5) |

Read Review | Read Review |

MarketBeat vs. Benzinga Pro: How They Compared?

In this comparison, we’ll break down MarketBeat All Access and Benzinga Pro Basic, showing you what each platform brings to the table.

From stock research to market analysis, we’ll help you figure out which one gives you the best bang for your buck.

-

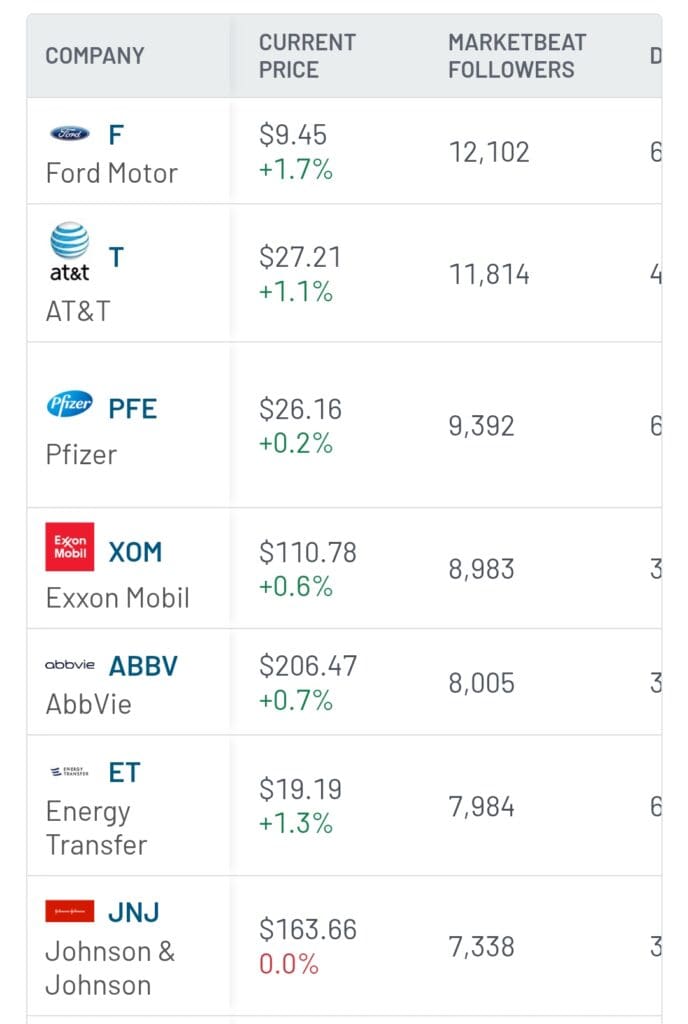

Stock Screening Tools

Benzinga Pro's Basic Plan lacks an advanced stock screener, limiting its ability to filter stocks based on specific criteria. It only provides basic stock alerts and fundamental data, requiring users to turn to external platforms for more in-depth screening.

On the other hand, MarketBeat All Access shines with its powerful stock and ETF screener, which includes advanced filters like MarketRank scores, P/E ratios, earnings growth, and insider trading data.

This makes it a more effective tool for identifying investment opportunities and an excellent screening tool for penny stocks.

-

Our Winner

MarketBeat All Access is the clear winner for stock screening, offering a more comprehensive and advanced set of tools.

-

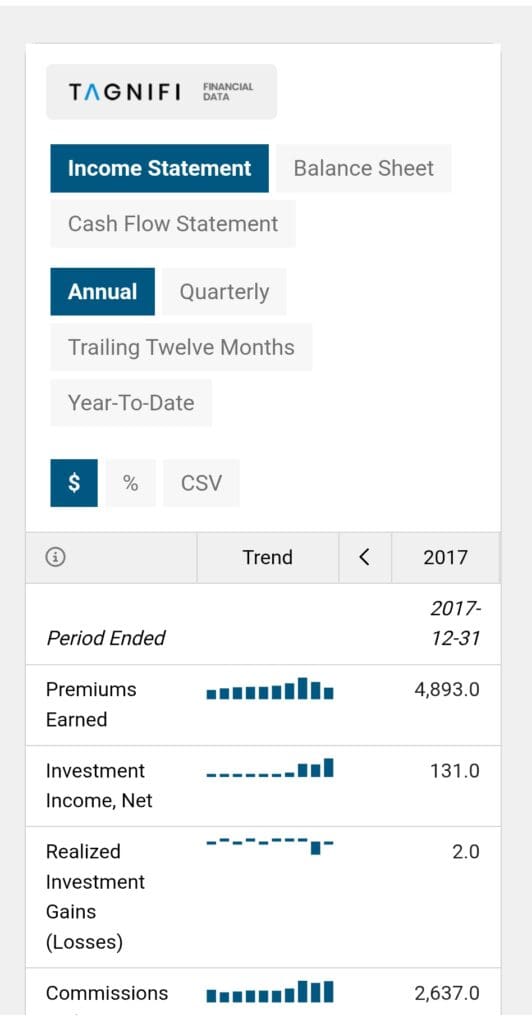

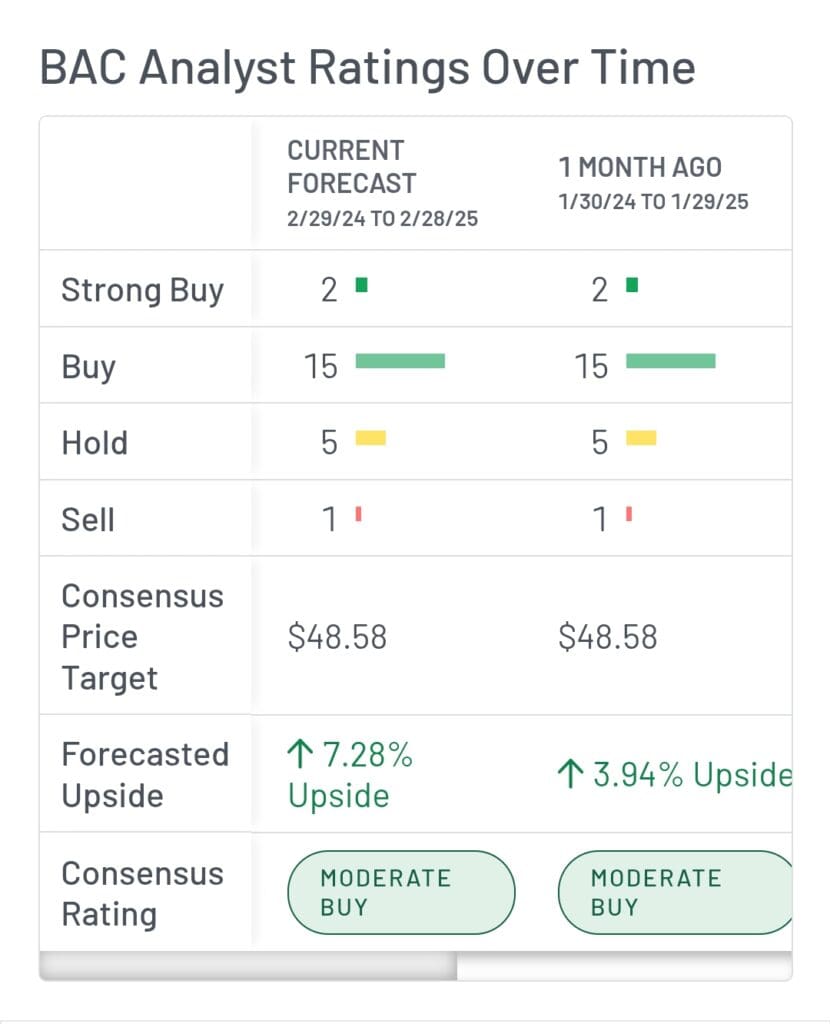

Fundamental Analysis Tools

MarketBeat All Access excels with its robust range of fundamental research tools. It offers detailed proprietary reports, access to top-rated analyst stocks, and analyst performance ratings.

These features are enhanced by the Idea Engine™ and the ability to track analysts' performance ratings over time, giving investors richer insights.

In contrast, Benzinga Pro provides useful basic data like earnings forecasts, analyst ratings, and insider trading activity.

However, its lack of integration with third-party premium research providers and no advanced stock screener limits the depth of analysis.

-

Our Winner

MarketBeat All Access leads in fundamental analysis tools with its deeper research and analyst insights.

-

Stock Picks & Recommendations

MarketBeat All Access, however, stands out by offering curated lists of top-rated stocks based on analyst recommendations, earnings performance, and market sentiment.

Its proprietary reports and daily newsletters provide fresh stock ideas, making it a more comprehensive tool for stock picking.

Benzinga Pro’s Basic Plan does not offer stock recommendations or proprietary rankings, which is a significant drawback for investors seeking expert-curated stock picks.

-

Our Winner

MarketBeat All Access.

-

Market Sentiment Analysis

In terms of market sentiment analysis, Benzinga Pro is strong with its real-time breaking news feed, which includes earnings reports, analyst ratings, and insider trading activity.

The platform tracks news sentiment and offers stock movers data, which is valuable for traders looking to capitalize on market shifts.

MarketBeat All Access, on the other hand, offers sentiment analysis with its unique tools like Trending Stocks, which tracks social media sentiment and analyst interest.

It also includes momentum alerts based on news and social media discussions, helping investors spot stocks gaining attention early.

-

Our Winner

MarketBeat All Access offers better market sentiment analysis tools with its social media sentiment tracking and momentum alerts, while Benzinga Pro focuses more on breaking news.

-

Portfolio Analysis & Alerts

Benzinga Pro offers real-time stock alerts and customizable watchlist notifications, which help traders stay on top of market movements. However, it lacks portfolio tracking capabilities.

On the other hand, MarketBeat All Access provides more comprehensive portfolio monitoring, allowing investors to track performance against major indices.

It also offers real-time alerts for earnings, insider trades, and analyst rating changes, ensuring users are immediately informed about important updates.

-

Our Winner

MarketBeat All Access provides better portfolio monitoring and real-time alerts compared to Benzinga Pro’s basic alert features.

-

Technical Analysis Options

Benzinga Pro’s Basic Plan offers solid charting tools with a few basic indicators like momentum, stochastic, and volatility.

However, the platform limits users to only two indicators per chart, which may be insufficient for advanced traders.

In comparison, MarketBeat All Access provides fewer technical analysis tools, mainly focusing on basic indicators.

-

Our Winner

Benzinga Pro’s charting features are more advanced compared to MarketBeat, though both platforms fall short in offering high-level technical analysis options.

-

ETF, Bonds & Fund Analysis Tools

When it comes to ETF and fund analysis, Benzinga Pro provides useful data on ETFs, including performance trends, holdings, and sector allocations.

However, its coverage is somewhat limited, and the tools lack in-depth research insights.

MarketBeat All Access offers a more advanced ETF screener with the ability to filter by benchmarks, expense ratios, and regional focus.

While it lacks detailed mutual fund research, MarketBeat’s ETF tools are more comprehensive for those focused on funds.

-

Our Winner

MarketBeat All Access offers more advanced and detailed ETF analysis tools, making it the better option for investors focused on funds.

Which Investor Types May Prefer MarketBeat All Access?

MarketBeat subscription is ideal for investors prioritizing research-driven stock analysis and portfolio monitoring. The platform's features cater to both short-term traders and long-term investors.

Fundamental Investors: Excellent for those who rely on analyst ratings, earnings reports, and performance metrics.

Dividend Investors: Provides tools for tracking dividend-paying stocks and related metrics.

Swing Traders: The trending stock features and momentum alerts are perfect for short-term trades.

Portfolio-Focused Investors: Real-time alerts and portfolio tracking tools make it easy to stay informed on holdings.

Which Investor Types May Prefer Benzinga Pro?

A Benzinga subscription can be beneficial for active traders who rely on breaking news and real-time alerts to make quick decisions.

Active Traders: Real-time quotes, breaking news, and stock movers are ideal for active traders.

Momentum Traders: The platform’s stock movers and alert features help capitalize on short-term opportunities.

News-Driven Investors: Perfect for those who make decisions based on earnings reports, analyst ratings, and breaking news.

Day Traders: Real-time updates help day traders stay ahead in fast-paced markets.

Bottom Line

MarketBeat All Access excels with its comprehensive fundamental analysis tools, powerful stock screeners, and real-time alerts for earnings and analyst ratings. It’s ideal for investors seeking data-driven insights.

Benzinga Pro, on the other hand, stands out with its real-time news feed, customizable alerts, and stock movers data, perfect for active traders and momentum investors.