| ||

|---|---|---|

MarketBeat All Access | Morningstar Investor | |

Price | $399 ($33.25 / month) | $249 ($20.75 / month) |

Best Features | ||

Our Rating |

(4.6/5) |

(4.5/5) |

Read Review | Read Review |

MarketBeat vs. Morningstar: Compare Platforms

In this comparison, we’re diving into MarketBeat All Access and Morningstar Investor, breaking down their features and tools.

We’ll help you figure out which platform gives you the best bang for your buck when it comes to stock research, market analysis, and investing.

-

Stock Screening Tools

Morningstar Investor provides a comprehensive stock screener that allows users to filter U.S. stocks based on valuation, growth potential, sector, economic moat, and fair value estimates, which is ideal for long-term investors focused on fundamentals.

MarketBeat All Access, on the other hand, offers an advanced stock and ETF screener with filters for MarketRank™, earnings growth, insider trading, and sentiment analysis.

It also includes filters for technical indicators like RSI, making it a more versatile choice for traders looking to incorporate momentum factors.

-

Our Winner

While Morningstar excels in fundamental screening, MarketBeat’s screening tool is more tailored for active traders.

-

Fundamental Analysis Tools

We reviewed the fundamental analysis tools available on both platforms, and each tool caters to different investor needs.

Morningstar Investor offers a solid set of research features, including a Fair Value Estimate, economic moat ratings, and a wealth of independent analyst reports focusing on long-term valuation and company health.

It’s perfect for investors who prioritize deep financial insights.

MarketBeat All Access, on the other hand, provides a detailed performance rating system for analysts and their recommendations, along with proprietary research reports.

However, its fundamental tools are more focused on individual stock insights and less comprehensive than Morningstar’s.

MarketBeat's strength lies in its ease of access to expert recommendations and analysis.

-

Our Winner

Morningstar Investor provides more comprehensive fundamental analysis, making it the better tool for long-term investors who need detailed company insights.

-

Stock Picks & Recommendations

Morningstar Investor excels with its independent analyst reports and star ratings that help evaluate a stock’s potential over the long term.

It also uses a Five-Star Rating system for risk-adjusted returns, which is valuable for those with a conservative investment strategy.

MarketBeat All Access, however, focuses more on immediate opportunities with its Top-Rated Stocks and Idea Engine™, which provides weekly stock picks based on technical indicators, sentiment, and analyst ratings.

These are updated daily, making it suitable for traders looking for fresh, actionable picks.

-

Our Winner

While Morningstar’s stock picks are backed by long-term fundamental analysis, MarketBeat's recommendations are better suited for those seeking short-term opportunities.

-

Market Sentiment Analysis

MarketBeat All Access provides a more dynamic approach with its Trending Stocks tool, which analyzes news sentiment, social media trends, and analyst opinions in real time.

This makes it ideal for active traders or anyone looking to track market sentiment quickly.

MarketBeat also includes Momentum Alerts, which notify users about significant price movements and volume spikes.

Morningstar Investor’s tools focus on economic moat ratings, analyst reports, and fair value estimates, which offer insights into a company’s overall market position but lack real-time sentiment tracking.

-

Our Winner

MarketBeat All Access is superior for market sentiment analysis due to its real-time tracking of news and social media, making it more effective for active traders.

-

Portfolio Analysis & Alerts

Morningstar Investor offers its Portfolio X-Ray tool, which provides insights into asset allocation, sector exposure, and geographic distribution, helping users manage risk.

Additionally, its alert system notifies investors about changes in stock ratings or valuation.

MarketBeat All Access, on the other hand, provides real-time portfolio alerts for earnings reports, insider trades, and analyst rating changes, ensuring that users stay informed about market events.

-

Our Winner

Morningstar Investor offers more sophisticated tools for portfolio analysis, making it better suited for long-term investors or retirees.

However, MarketBeat All Access offers superior portfolio alert functionality with real-time notifications, making it a better choice for active investors.

-

Technical Analysis Options

Morningstar Investor offers basic charting tools with trendlines, moving averages, and overlays like RSI and Bollinger Bands.

These features are suitable for long-term investors who want to observe price trends over time, but they lack the advanced indicators that short-term traders rely on.

MarketBeat All Access, on the other hand, provides more comprehensive technical analysis, including filters for technical indicators like RSI, MACD, and beta, making it more suited for active traders and those looking to incorporate technical factors into their decision-making.

-

Our Winner

MarketBeat All Access excels in technical analysis options with a more extensive range of indicators, making it better for active traders.

-

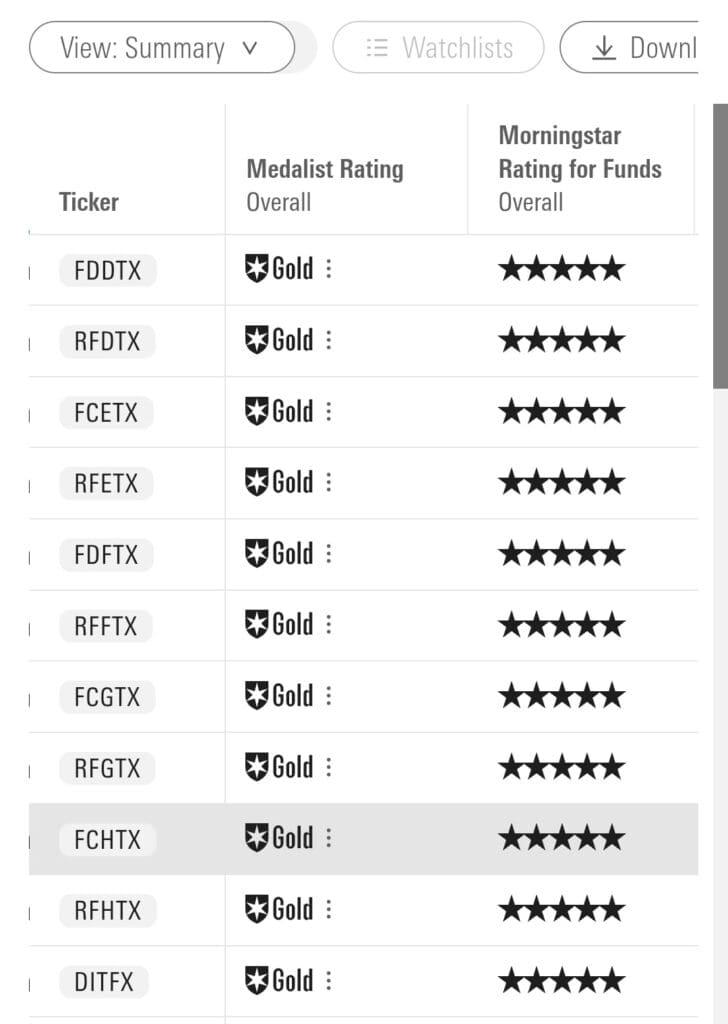

ETF, Bonds & Fund Analysis Tools

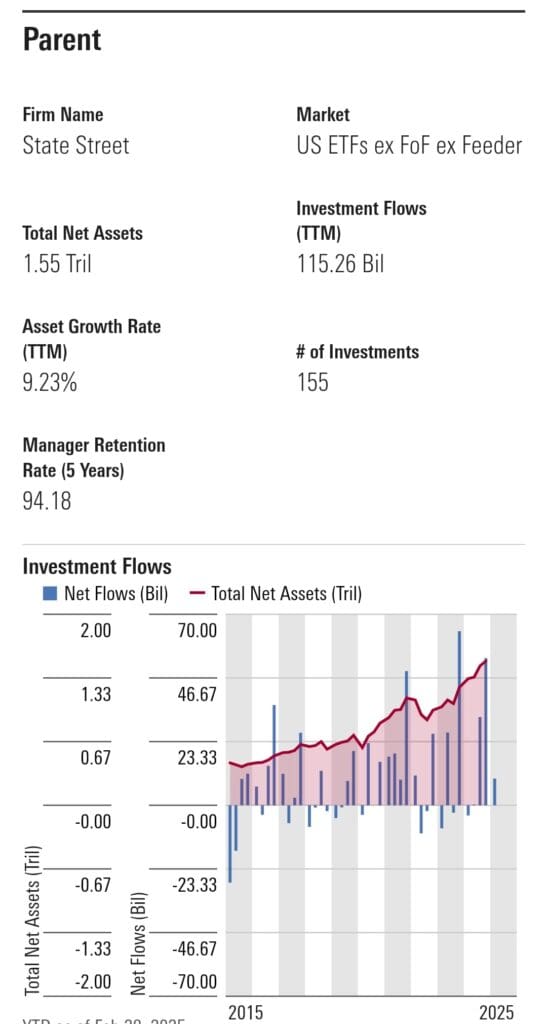

Morningstar Investor provides in-depth analysis for ETFs and mutual funds, including ratings based on performance, fees, and fund manager track records.

Morningstar Investor has one of the top mutual fund Screeners, which is excellent for fund-focused investors.

MarketBeat All Access provides an ETF screener as well, but its focus is more on individual stocks, and its ETF research is not as extensive as Morningstar’s.

-

Our Winner

Morningstar Investor excels in ETF and fund analysis with more comprehensive tools.

Which Investor Types May Prefer MarketBeat All Access?

MarketBeat All Access is tailored to active traders and investors who prioritize real-time data and quick decision-making. Here are the types of investors who may find it beneficial:

Active Traders: MarketBeat offers real-time alerts, technical analysis tools, and momentum signals, essential for those who trade frequently.

Swing Traders: The Trending Stocks and Idea Engine™ help identify short-term opportunities based on momentum and market sentiment.

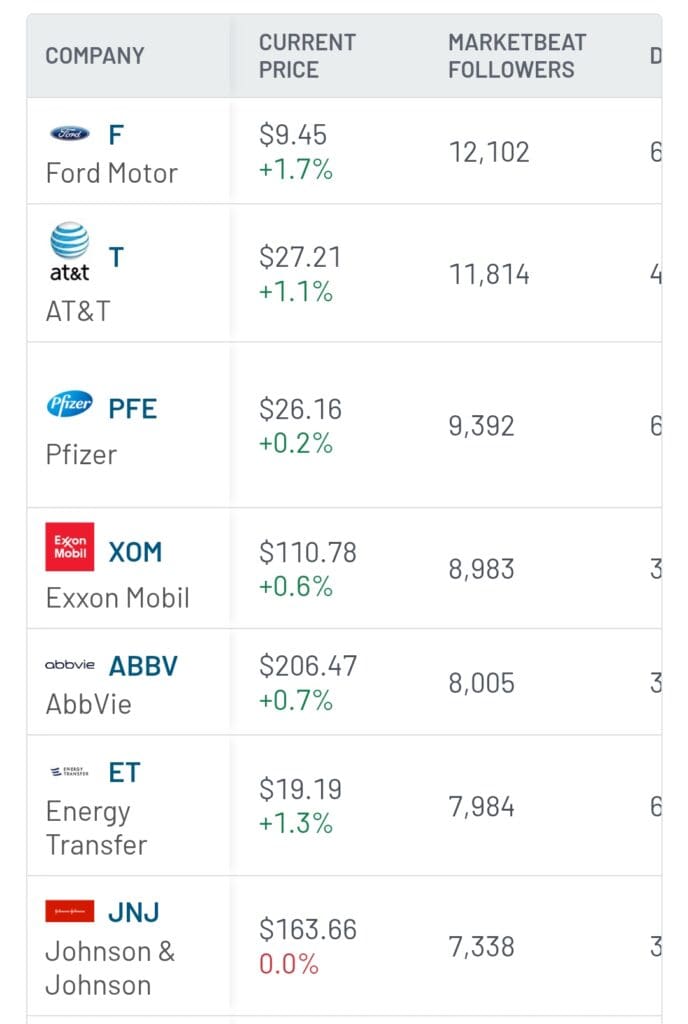

Dividend Investors: MarketBeat is ideal for income investors who want to track dividend stocks and payout ratios.

Analyst-Focused Investors: MarketBeat’s top-rated analyst stock picks and performance ratings are valuable for investors relying on expert opinions.

Which Investor Types May Prefer Morningstar Investor?

Morningstar Investor is designed for long-term investors focusing on fundamental research, portfolio management, and comprehensive fund analysis. Here are the types of investors who may find it a good fit:

Long-Term Stock Investors: Morningstar helps evaluate long-term investment potential with its fair value estimates, economic moat ratings, and independent analyst reports.

ETF & Mutual Fund Investors: Morningstar offers in-depth analysis of mutual funds and ETFs, ideal for those building diversified portfolios.

Dividend Investors: Tools for dividend yield analysis and payout ratios are useful for income-focused investors looking for stable returns.

Retirement Planners: The platform’s retirement and target-date fund analysis makes it a valuable resource for those planning for long-term retirement goals.

Plan | Annual Subscription | Promotion |

|---|---|---|

Morningstar Investor | $249 ($20.75 / month) | 7-Day free trial |

Bottom Line

MarketBeat All Access excels in providing real-time data, technical analysis, and expert stock recommendations, making it ideal for active traders.

Morningstar Investor, on the other hand, is perfect for long-term investors who prioritize in-depth research, fundamental analysis, and fund evaluation, offering powerful tools for managing diversified portfolios.