Table Of Content

What Is Tether?

Tether (USDT) is a stablecoin designed to maintain a fixed value by being pegged to a traditional currency – the U.S. dollar.

It was created to offer the benefits of cryptocurrency, such as speed and global access, without the high volatility associated with coins like Bitcoin.

As a result, Tether is widely used for trading, payments, and transferring funds between exchanges without needing to convert back into fiat.

According to Tether’s transparency page, each USDT token is backed by reserves, though the composition of those reserves has faced scrutiny.

How Does Tether Work & What Investors Need To Know?

Tether works by combining the reliability of fiat currencies with the flexibility of blockchain technology.

-

Fiat-Collateralized Reserves

Tether is primarily backed by a combination of cash, cash equivalents, and other assets to maintain its $1 peg.

Backing Structure: Assets like Treasury bills and cash equivalents are held to support issued USDT.

Transparency Reports: Tether publishes regular assurance reports but has faced criticism about the depth of audits.

Partial Reserve Concerns: In the past, reports showed not all USDT was backed purely by cash, leading to regulatory inquiries.

Therefore, while Tether aims to offer stability, understanding its backing system is important for assessing risk.

Let's see how Tether compares to other Stablecoins:

Feature | Tether (USDT) | USD Coin (USDC) | Binance USD (BUSD) |

|---|---|---|---|

Issuer | Tether Limited | Circle | Binance + Paxos |

Main Backing Asset | Cash, equivalents | Cash, short-term debt | Cash, equivalents |

Audit Status | Limited assurance | Monthly attestations | Monthly attestations |

Regulation Focus | Moderate scrutiny | High compliance | High compliance |

-

Pegged 1:1 to the U.S. Dollar

Each Tether token is designed to maintain a constant value equivalent to $1 USD.

Easy Conversion: Traders can convert USDT to fiat currencies without major price swings.

Trading Pairs: USDT pairs are widely available across crypto exchanges for easy trading.

Price Stability: In normal market conditions, Tether fluctuates only slightly around $1.

Because of this 1:1 relationship, Tether acts as a reliable store of value in the volatile crypto market.

-

Blockchain-Based Transactions

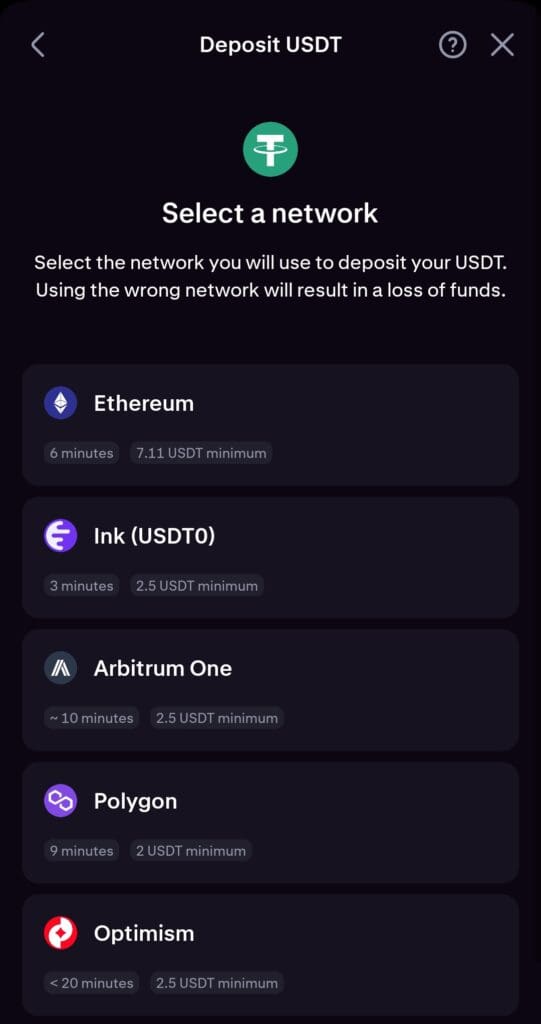

Tether operates on several major blockchains, such as Ethereum, Tron, and Solana.

Ethereum (ERC-20): Allows users to transfer USDT quickly using popular Ethereum wallets.

Tron (TRC-20): Offers faster and cheaper Tether transactions compared to Ethereum.

Multi-Network Flexibility: Users can choose the network that fits their needs based on speed and fees.

As a result, Tether provides high flexibility for different transaction preferences across decentralized and centralized platforms.

-

Widely Used for Crypto Trading

Tether serves as a common base currency for trading other cryptocurrencies.

Liquidity Provider: USDT offers liquidity for thousands of crypto trading pairs.

Safe Haven Asset: Traders often move assets into Tether during times of high volatility.

Arbitrage Opportunities: USDT enables arbitrage trading across different exchanges.

Because of its widespread acceptance, Tether is an essential tool for maintaining trading efficiency and reducing exposure to price swings.

-

Regulatory Scrutiny and Legal Settlements

Tether has been under investigation by regulatory authorities due to questions about its reserves and transparency.

Regulatory Actions: The company settled with the New York Attorney General’s Office in 2021 without admitting wrongdoing.

Operational Changes: Tether agreed to provide greater transparency on reserve composition.

Investor Caution: These regulatory issues have led to calls for careful due diligence before using Tether.

Therefore, while Tether remains popular, users should stay informed about ongoing regulatory developments to manage their exposure effectively.

Tether Benefits & Risks

Tether offers a practical solution for stability in the crypto market, but it also brings certain risks investors must carefully consider.

Benefits | Risks |

|---|---|

Stability Against Volatility | Reserve Transparency Issues |

Easy Conversion to Fiat | Regulatory Pressures |

Enhanced Liquidity | Counterparty Risk |

Faster Transactions | Network Congestion and Fees |

Multi-Blockchain Access | Potential Depegging Events |

- Stability Against Volatility

Tether maintains a stable value, allowing investors to avoid the price swings seen with Bitcoin, Ethereum, and other cryptocurrencies.

- Easy Conversion to Fiat

Because USDT is pegged to the U.S. dollar, it can be quickly converted into traditional currency without major price impacts.

- Enhanced Liquidity

Tether is widely used to provide liquidity across exchanges, making it easier for investors to buy, sell, and trade crypto assets.

- Faster Transactions Across Borders

Using Tether can enable quicker and often cheaper international transfers compared to traditional banking systems.

- Access to Multiple Blockchain Networks

Tether operates on networks like Ethereum, Tron, and Solana, giving users flexibility to select faster or cheaper transaction options.

- Reserve Transparency Issues

Tether has faced scrutiny over whether it has enough reserves to fully back all issued tokens, raising questions about its true stability.

- Regulatory Pressures

Legal settlements, such as with the New York Attorney General, highlight ongoing regulatory challenges and potential future restrictions on Tether.

- Counterparty Risk

Since Tether is issued by a private company, investors rely on the issuer’s financial practices and reporting integrity.

- Network Congestion and Fees

During peak periods, networks like Ethereum can experience high congestion, leading to costly delays for Tether transactions.

- Potential Depegging Events

Extreme market stress or legal action could cause Tether to temporarily lose its 1:1 dollar peg, impacting its use as a safe asset.

Where You Can Buy Tether

Tether (USDT) is available on almost every major cryptocurrency exchange, offering easy access for investors and traders worldwide.

Binance: Offers USDT pairs with hundreds of cryptocurrencies, including Bitcoin, Ethereum, and altcoins.

Coinbase: Supports buying USDT directly with fiat currencies like USD, ideal for beginners.

Kraken: Known for high liquidity and regulatory compliance, Kraken offers multiple USDT trading pairs.

KuCoin: Provides access to a broad selection of altcoins paired with USDT for more advanced traders.

Crypto.com: Allows easy purchase and storage of Tether through its app and Visa card integration.

Each platform offers different benefits in terms of fees, security, and available trading pairs, so it's smart to compare based on your needs.

FAQ

Tether is pegged to the dollar to maintain a stable value, while Bitcoin’s price fluctuates based on market supply and demand.

No, while Tether reduces price volatility, it carries risks like regulatory challenges, reserve transparency concerns, and possible depegging events.

Yes, some merchants and payment platforms accept Tether for purchases, especially in regions with unstable local currencies.

Tether itself does not pay interest, but some exchanges offer yield programs where you can earn a return by lending USDT.

Yes, transactions on public blockchains like Ethereum or Tron are transparent and can be traced through blockchain explorers.

It depends on your goals. Tether is faster for crypto trading, but cash in a traditional bank may offer stronger regulatory protections.

While Tether aims for stability, risks like loss of peg or exchange hacks could result in losses under extreme circumstances.

Tether is often recommended for beginners because it offers a stable value while allowing easy entry into cryptocurrency markets.

Tether Limited mints new USDT when investors deposit dollars and burns USDT when tokens are redeemed back for fiat.