Table Of Content

What is Micro Investing?

Micro-investing refers to the practice of investing small amounts of money regularly into financial instruments such as stocks, bonds, exchange-traded funds (ETFs), or mutual funds.

This approach allows individuals to start investing with minimal capital, often leveraging technology and automation to facilitate the process. Micro-investing platforms typically offer low or no minimum investment requirements and may allow users to purchase fractional shares, enabling them to invest even with limited funds.

Micro-investing aims to gradually build wealth over time by consistently allocating small amounts of money towards investment opportunities, making investing more accessible to a broader range of people.

Micro Investing Pros & Cons

Let's explore some of the key pros and cons of micro-investing.

Pros | Cons |

|---|---|

Accessibility | Limited Investment Options |

Diversification | Risk of Market Volatility

|

Low Or No Fees | Lack of Personalization |

Automation |

- Accessibility

Micro-investing platforms make investing accessible to individuals with limited funds, allowing them to start investing with small amounts of money.

- Diversification

With fractional shares and low minimum investments, micro-investing enables investors to diversify their portfolios across multiple assets, reducing overall risk.

- Low Or No Fees

Micro-investing platforms often have low fees and may offer commission-free trades, making it affordable for investors to participate in the market without significant upfront costs.

- Automation

Many micro-investing platforms offer automated investing features, allowing users to set up recurring deposits or “round-up” transactions, making investing a passive and convenient process.

- Limited Investment Options

Micro-investing platforms may offer a limited selection of investment options compared to traditional brokerage accounts, potentially restricting investment choices.

- Risk of Market Volatility

Investing in the stock market, even with small amounts of money, carries inherent risks, including the potential for loss due to market volatility.

- Lack of Personalization

Automated investing features may lack the personalized touch of human financial advisors, potentially leading to investment strategies that don't align perfectly with individual goals or risk tolerance.

Micro-Investing for Beginners: How To Get Started?

Let's explore how beginners can get started with micro-investing, including preparations, options available, factors to consider, and selecting a micro-investing platform.

-

1. Understand the Basics And Set Financial Goals

Before diving into micro-investing, it's essential to grasp the fundamentals. Understand what micro-investing is, how it works, and its potential benefits and limitations.

Take time to educate yourself about investment principles, risk tolerance, and financial goals. Here's what you need to do:

- Know your risk tolerance: Are you comfortable with potential fluctuations, or do you prefer stability? This will guide your investment choices.

- Define your goals: Are you saving for retirement, a down payment, or a vacation? Knowing your goal helps determine your investment timeline and risk appetite.

- Do your research: Learn about different investment options (stocks, ETFs, mutual funds) and their risks and rewards. Resources like financial blogs, educational platforms, and even your local library can be valuable.

- Calculate your starting budget: Analyze your income and expenses to see how much you can comfortably invest regularly.

-

2. Explore the Options: Choosing Your Micro-Investing Platform

Now, let's pick your investment vehicle! Popular micro-investing platforms offer various features and benefits:

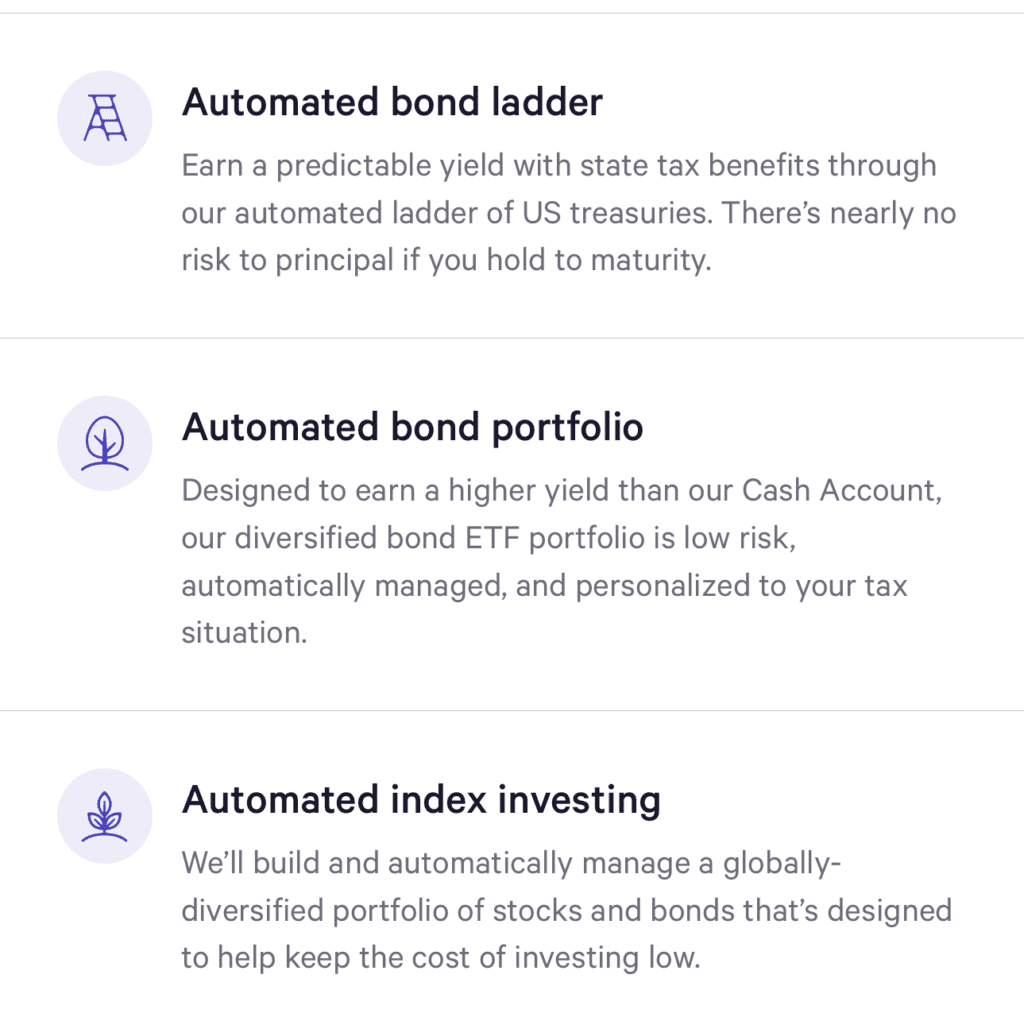

- Robo-advisors: These platforms like Betterment or Wealthfront use algorithms to manage your investments based on your goals and risk tolerance. They often have low fees and minimal investment requirements.

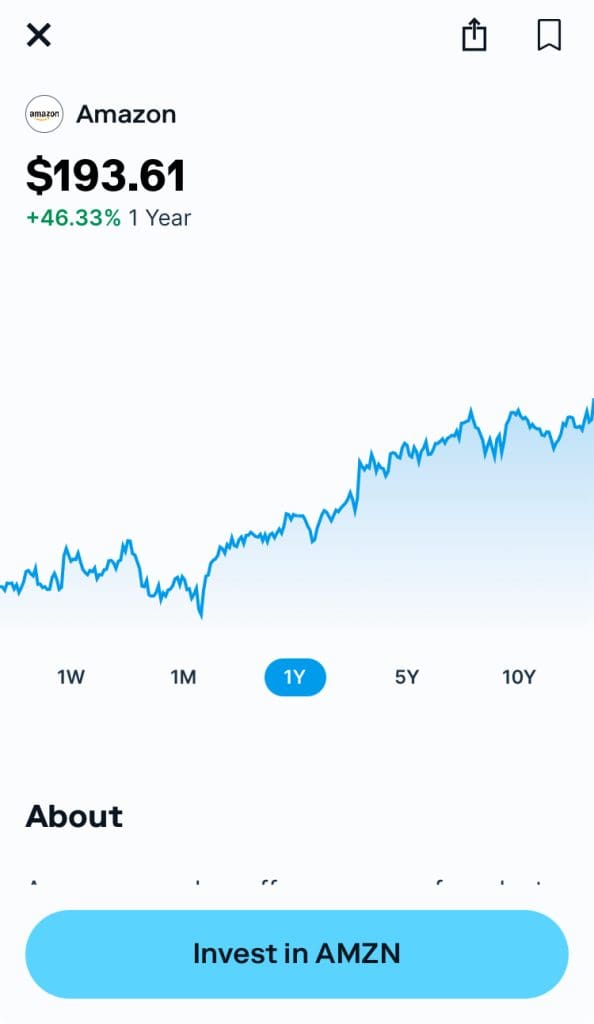

- Fractional share investing platforms: These platforms, like Stash or Acorns, allow you to buy portions of expensive stocks like Tesla or Amazon, making them more accessible.

- Round-up apps: Apps like Qapital or Digit round up your spare change from everyday purchases and invest it automatically, making micro-investing effortless.

- Traditional brokers: Platforms like Robinhood or Charles Schwab offer more control over your investments but require more research and potentially higher fees.

-

3. Consider the Factors: Choosing Wisely

When selecting a platform, consider these factors:

- Fees: Compare management fees, transaction fees, and inactivity fees to find the most cost-effective option.

- Investment options: Does the platform offer the asset types you're interested in? Do they align with your risk tolerance and goals?

- Minimum investment: Consider your starting budget and choose a platform with a low minimum investment requirement.

- User interface: Is the platform easy to navigate and understand? Does it offer educational resources and support?

-

4. Select Your Investment Strategy

Decide on an investment strategy that suits your risk tolerance and objectives.

If you're comfortable with a more hands-on approach, you might opt for actively managing your portfolio by selecting individual stocks or ETFs that align with your research and analysis.

Alternatively, if you prefer a passive strategy, you can utilize automated investing features offered by micro-investing platforms to create a diversified portfolio of low-cost index funds or ETFs.

Assess different asset classes such as stocks, bonds, and real estate investment trusts (REITs), and allocate your investments accordingly to achieve a balanced and diversified portfolio.

-

5. Start Investing and Monitor Your Progress

Once you've selected your micro-investing platform and devised your investment strategy, it's time to initiate your investments.

Begin by allocating a small amount of money towards your chosen assets, ensuring that it aligns with your risk tolerance and financial goals.

Regularly monitor the performance of your investments, keeping an eye on market trends and any changes in your personal circumstances.

Evaluate your progress periodically, comparing it against your established goals and objectives.

Adjust your investment strategy as needed, considering factors such as market conditions, your risk appetite, and any shifts in your financial priorities.

By staying vigilant and proactive, you can optimize your micro-investing journey and work towards achieving your long-term financial aspirations.

Micro-Investing Techniques

Micro-investing has become a popular strategy for beginners and seasoned investors alike.

Here are 4 recommended techniques to supercharge your savings and master the art of micro-investing:

-

Round-Up Magic: Turn Spare Change into Riches

Ever heard of “found money”? Round-up apps like Acorns work by rounding up your everyday purchases to the nearest dollar and investing the difference.

So, that $3.50 latte becomes a $4 investment, automatically funneling your spare change towards your financial goals. It's a painless way to invest and can add up surprisingly quickly

-

Automate Your Way to Wealth: Set It and Forget It

Investing shouldn't feel like a chore. Many platforms, including robo-advisors like Betterment and Wealthfront, offer automatic investing options.

Simply set a regular contribution amount and schedule it to transfer from your bank account directly into your investment portfolio. Consistency is key, and automation makes it effortless!

-

Invest Your "Leftover" Cash

We all have those moments where we end up with an awkward amount of cash – maybe $20 after paying bills or a $10 gift card you can't quite spend.

Instead of letting it languish, micro-investing platforms like Stash and Acorns allow you to instantly invest these “spare pockets” of cash, ensuring every penny works for you.

-

Leverage Fractional Shares: Own a Piece of the Pie

Ever dreamt of owning a piece of Apple or Tesla? Fractional share investing platforms make it possible. They allow you to buy portions of expensive stocks instead of needing the full amount, democratizing access to traditionally out-of-reach investments.

This opens up a wider range of options for your portfolio and lets you diversify even with smaller contributions.

Popular Micro Investing Popular App

Several micro-investing apps have gained popularity for their user-friendly interfaces, low fees, and diverse investment options. Here are some of the most popular ones:

- Acorns: Acorns is a micro-investing app that rounds up users' everyday purchases to the nearest dollar and invests the spare change into diversified portfolios. It offers features like automatic recurring investments, Found Money partnerships, and educational content.

- Robinhood: Robinhood gained popularity for its commission-free trading of stocks, ETFs, options, and cryptocurrencies. It offers a simple and intuitive interface, fractional shares, and a cash management feature.

- Stash: Stash allows users to invest in fractional shares of stocks and ETFs based on their interests, beliefs, and financial goals. It offers educational content, automated investing features, and retirement account options.

- M1 Finance: M1 Finance combines automated investing with customizable portfolios, allowing users to create their own investment pies or choose from pre-built ones. It offers fractional shares, dynamic rebalancing, and a borrowing feature.

- SoFi Invest: SoFi Invest offers commission-free trading of stocks, ETFs, and cryptocurrencies, along with automated investing options and retirement accounts. It provides features like financial planning tools and member benefits.

These apps have attracted a large user base by providing accessible and affordable investment opportunities, along with various features and services to cater to the needs of micro-investors.

Micro-Investing Tips

Here are five key tips to enhance your micro-investing journey and maximize your chances of financial success.

- Start Early and Consistently: Begin micro-investing as soon as possible and contribute regularly, even if it's a small amount. The power of compounding can significantly amplify returns over time.

- Diversify Your Portfolio: Spread your investments across different asset classes, industries, and geographic regions to reduce risk. Diversification helps mitigate the impact of market fluctuations on your overall portfolio.

- Keep Fees Low: Choose micro-investing platforms with low fees and expenses to maximize your returns. High fees can eat into your profits, so compare fee structures and select platforms that offer cost-effective options.

- Educate Yourself: Take the time to learn about investing basics, market trends, and different investment strategies. Building financial literacy empowers you to make informed decisions and navigate the complexities of investing more effectively.

- Stay Patient and Stay the Course: Investing is a long-term endeavor, and it's essential to remain patient and disciplined, especially during market downturns. Avoid emotional reactions to short-term fluctuations and stick to your investment plan to achieve your financial goals.

FAQs

Micro-investing appeals to millennials due to its low barrier to entry, allowing them to start investing with small amounts of money that fit within their budgets and lifestyles, fostering a habit of saving and investing for the future.

Fractional shares enable micro-investors to purchase fractions of expensive stocks or ETFs, making it possible to diversify their portfolios even with limited funds, maximizing their investment opportunities and spreading risk.

Robo-advisors streamline the investment process for micro-investors by providing automated portfolio management, personalized investment strategies, and low-cost options, offering accessibility, convenience, and tailored guidance without the need for extensive financial expertise.

Like other investmentys, tax considerations in micro-investing include understanding the tax implications of different investment vehicles.

For example, capital gains taxes on profits from selling investments, dividend taxes, and the potential benefits of tax-advantaged accounts like IRAs or 401(k)s to minimize tax liabilities and optimize returns over the long term.